Summary:

- Coca-Cola’s phenomenal brand portfolio supports one of the longest dividend growth streaks in the world.

- The company flexed its brand power with price hikes, which helped it to top the analyst consensus for net revenue and comparable EPS.

- The consumer staple’s balance sheet remains sound.

- Coca-Cola’s shares could be trading at a 9% discount to fair value.

- The Dividend King could be poised to deliver 30%+ cumulative total returns through 2026.

Somebody pours cola from a bottle into a glass on a table. Dreamer Company

In dividend investing, brand quality is of the utmost importance. This is especially so when investing in consumer-facing businesses. Why do I make this claim?

Because the more loyal customer base that a product portfolio has, the greater pricing power it is afforded. That tends to convert into steadily increasing sales and earnings, which ultimately supports the rising dividend payments that I am pursuing.

When it comes to consumer-facing businesses, there is arguably nobody that can outdo Coca-Cola (NYSE:KO). When I last covered KO with a buy rating in March, that was one of the reasons that I liked it so much. The A-rated balance sheet also bolstered the investment case. Finally, shares were slightly discounted.

Today, I will be updating my thesis for the first-quarter results that were announced on April 30. The company’s brand power was again reflected in its operating and financial results. Coca-Cola’s growth outlook is fine. The consumer staple remains financially sound. Shares have arguably become more valuable, which makes the discount even greater now.

An Exceptional Brand Portfolio Powered Great Q1 Results

KO Q1 2024 Earning Press Release

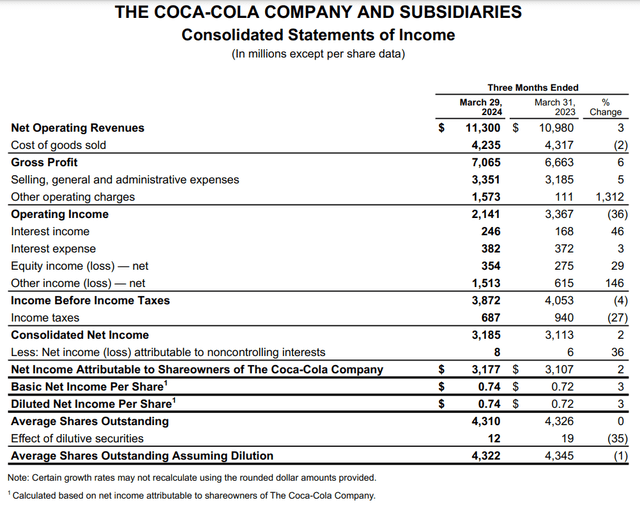

KO’s first-quarter results offered more proof that the company is returning to meaningful growth. The company’s net revenue edged 2.9% higher year-over-year to $11.3 billion in the quarter. For perspective, that came in $330 million better than Seeking Alpha’s analyst consensus.

At a glance, this growth seems uninspiring at best. However, the results were much stronger than total net revenue growth initially suggested. This is because KO’s organic revenue surged 11% higher during the first quarter.

Underpinning these results is the popularity of the company’s portfolio of beverages. More than two billion servings of KO’s products are consumed each day. That means the company’s products are a part of more than a billion people’s routines.

Because KO’s products are viewed by many as cheap and simple pleasures, it has a great deal of pricing power as well. The company leveraged this with 13% price/mix growth for the first quarter. Yet, even with these higher prices, KO’s unit case volume grew by 1% in the quarter.

Due to the company’s substantial international presence, much of these tailwinds were offset by unfavorable foreign currency translation. That weighed on net revenue to the tune of 6% during the first quarter.

Concentrate sales were down by 2% for the first quarter. However, this was attributable to the timing of concentrate shipments and one less day in the quarter.

Finally, divestiture negatively impacted net revenue by 2% during the first quarter. That was because KO decided to refranchise bottling operations in Vietnam in January 2023. Earlier this year (January and February), the company also refranchised some bottling operations in India. In February, KO also refranchised bottling operations in Bangladesh and the Philippines.

The company’s comparable EPS rose by 6.7% over the year-ago period to $0.72 for the first quarter. That was $0.02 ahead of Seeking Alpha’s analyst consensus.

Disciplined cost management helped KO’s non-GAAP net profit margin expand by 80 basis points in the first quarter. Along with a 0.5% reduction in the diluted share count from share buybacks, this is how the company’s comparable EPS growth rate outpaced the net revenue growth during the quarter.

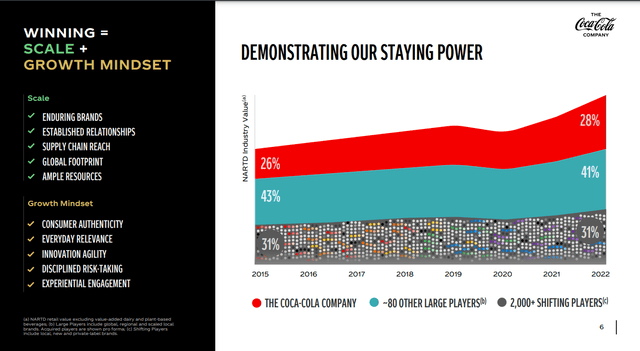

KO 2024 CAGNY Investor Presentation

One thing that can be deceiving about KO is that for its size, it isn’t operating high up in some ivory tower. The company is generally adept at gauging the preferences and perceptions of consumers. That is how KO’s non-alcoholic ready-to-drink market share improved from 26% in 2015 to the high-20% range recently.

In the years ahead, I believe KO’s market share of the NARTD market will remain steady or slightly grow further. This is because of recent moves the company has made to build on its brand relevance.

For instance, KO recently launched K-Wave in Australia, a drink infused with a fruity flavor. This was to celebrate the devotion of fans to their favorite K-Pop artists.

According to Chairman and CEO James Quincey’s opening remarks during the Q1 2024 Earnings Call, this was aimed at warming up Gen Z drinkers to its brands. So, even though this is a limited edition drink, the potential to win over this demographic is what makes it a winning move in my opinion.

KO also began its Minute Maid Zero Sugar global campaign in North America during the quarter. Harnessing the pull of influencers and social media should also be a positive to future growth.

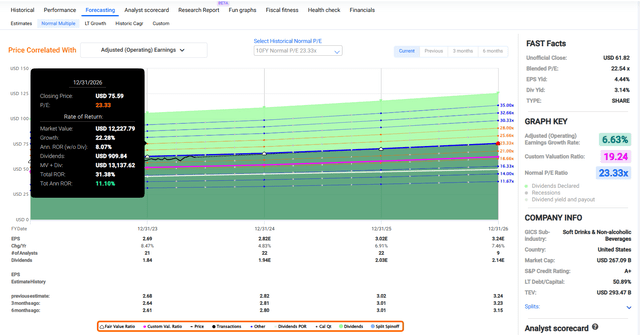

This is why I believe the FAST Graphs comparable EPS forecasts for the next few years are reasonable. In 2024, the consensus is that comparable EPS will increase by 4.8% to $2.82. For 2025, another 6.9% growth to $3.02 is anticipated. In 2026, a 7.5% growth to $3.24 is currently being projected.

KO 2024 CAGNY Investor Presentation

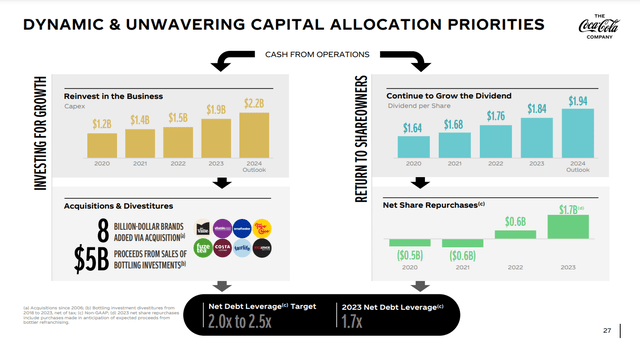

No discussion of KO can be complete without a mention of its remarkable financial strength. The company’s leverage ratio improved sequentially from 1.7x in Q4 2023 to 1.6x in Q1 2024 per CFO John Murphy. That is well under the targeted net debt leverage ratio of between 2x and 2.5x.

This gives the company room to send a final $765 million payment to fairlife in 2025. This is because the ultra-filtered milk company has outperformed expectations, so it was entitled to receive this payment.

More importantly, KO had $15.2 billion in cash and short-term investments on hand as of March 29. That gives the company plenty of resources to challenge the ongoing $3.3 billion case (plus interest) with the United States Internal Revenue Service concerning the tax years 2007 through 2009. Even if KO were to lose its case, it has ample resources to pay this settlement without running into any financial issues (unless otherwise sourced or hyperlinked, all details in this subhead were according to KO’s Q1 2024 Earnings Press Release, KO’s CAGNY 2024 Investor Presentation, and KO’s 10-K Filing).

Fair Value Is Closing In On $70 A Share

Since my previous article, shares of KO have gained 3% to the 2% gains of the S&P 500 index (SP500). Thanks to the company’s solid execution and time passing, I believe shares have become valuable by more than these gains.

Ownership in KO is trading hands at a current-year P/E ratio of 21.7. This is below the 10-year normal P/E ratio of 23.3 per FAST Graphs.

In my view, a reversion to this valuation multiple is very much on the table. Sure, even as interest rates settle lower, they will be greater than the average throughout the past 10 years.

For my money, KO makes up for this through its improved growth prospects. Steps taken in recent years to trim lower conviction brands from the portfolio and go all-in on bigger brands appears to be paying dividends. This has allowed KO’s annual earnings growth to improve from sub-4% to a three-year annual forward growth consensus of 6.6%.

When this week is complete in a few days, 2024 will be 42% finished. That means 58% of the year will remain and 42% of 2025 will lie ahead in the coming 12 months. This is how I’m considering the $2.82 2024 analyst comparable EPS consensus and $3.02 2025 analyst comparable EPS consensus. That provides me with a 12-month forward comparable EPS input of $2.90.

Using this earnings input with my fair value multiple, I get a fair value of $68 a share. That works out to a 9% discount to fair value from the current $62 share price (as of May 29, 2024). If KO grows as expected and returns to fair value, it could post 30%+ cumulative total returns by the end of 2026.

Dividend Growth Is Ramping Up

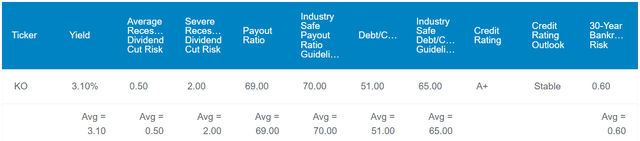

The Dividend Kings’ Zen Research Terminal

KO’s 3.1% forward dividend yield is modestly better than the consumer staples sector median forward yield of 2.8%. Thus, the company earns a B- grade for forward dividend yield from Seeking Alpha’s Quant System.

KO doesn’t just offer market-beating income, either. This is backed up by what will be a 62-year dividend growth streak after this year is complete. That is substantially greater than the consumer staples sector median of 14 years. This is why KO has an A+ grade from Seeking Alpha’s Quant System for dividend consistency.

As I detailed in my previous article, dividend growth is also trending toward acceleration. The company’s most recent 5.4% dividend raise in February was better than the raises in the 4% range in prior years.

KO can maintain faster dividend growth for two key reasons. For one, I noted earlier in this article how the company has improved its earnings growth prospects in recent years. Secondly, KO’s 69% EPS payout ratio is below the 70% EPS payout ratio that rating agencies desire from the industry per the Zen Research Terminal.

The company is anticipated to generate $2.82 in comparable EPS in 2024. Against the $1.94 in dividends per share that are slated to be paid this year, that would be a 68.8% comparable EPS payout ratio. Along with robust financial positioning, this is why I believe dividend growth will be in line with earnings growth moving forward.

Risks To Consider

KO is a company with world-class brands, but there are no bulletproof businesses. There are no new risks noted in the company’s most recent 10-Q Filing, so I’ll reiterate risks from past articles.

As I noted earlier, KO has the resources to settle its tax dispute with the IRS. The risk, however, is that such a settlement could push the net debt leverage ratio from below its target to within its target. That would diminish the strength of the balance sheet from very strong to merely “good” overnight.

As I noted in my previous article, another risk to KO is the potential for it to be hurt in a recession. This is because the company’s business mix is somewhat reliant on away-from-home consumption. If a recession happened, that could pressure KO’s near-term growth prospects.

Another risk to KO is that malicious hackers view it as an attractive target. If the company is successfully breached, valuable proprietary information and customer information could be compromised. That could lead to a less impressive competitive position and lawsuits, which would harm growth as well.

Summary: A Wonderful And Discounted Company

KO is a superb business, which is why I’m glad to have a 0.5% weighting within my portfolio. This isn’t a huge position, but that’s why I would consider upping this to around 1% long-term.

The company’s growth potential is improving. The balance sheet is excellent. Best of all, the valuation is interesting here. That’s why I’m maintaining my buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.