Summary:

- Coca-Cola has hiked its dividend for 62 consecutive years, which is one of the lengthiest dividend growth track records.

- The company topped analysts’ expectations for net revenue and non-GAAP EPS in the third quarter.

- Coca-Cola’s net debt leverage ratio of 1.7 remains below its targeted range of 2x to 2.5x.

- Shares appear to be trading at an 8% discount to fair value.

- Coca-Cola could be set up for 10% annual total returns through 2026.

A Coca-Cola truck driving down a rural two lane highway. Jean-Luc Ichard/iStock Editorial via Getty Images

As a dividend growth investor, my goal is simple: I aim to own businesses that are reliable dividend payers. This is because I plan to ultimately live off dividends one day. The only way I can do so is if they are predictable, sustainable, and growing.

Well, there aren’t many dividend payers that are more trusted and revered than Coca-Cola (NYSE:KO) (NEOE:COLA:CA). The company has raised its payout to shareholders each year since the Kennedy administration. When I last covered Coca-Cola with a hold rating in July, I appreciated this dividend growth streak. I also liked Coca-Cola’s growth profile and A-rated balance sheet. The valuation was my only concern, with high-single-digit annual total returns seeming likely at the time.

Today, I’m reiterating my hold rating. Coca-Cola’s third-quarter results reinforced my optimism for the future. The company’s leverage ratio remained well-positioned. Coca-Cola is priced at a better valuation than it was several months ago, but I’d like to see a bit more of a dip before upgrading back to a buy rating.

Coca-Cola Can Sustain Its Momentum Beyond Q3

Coca-Cola Q3 2024 Earnings Press Release

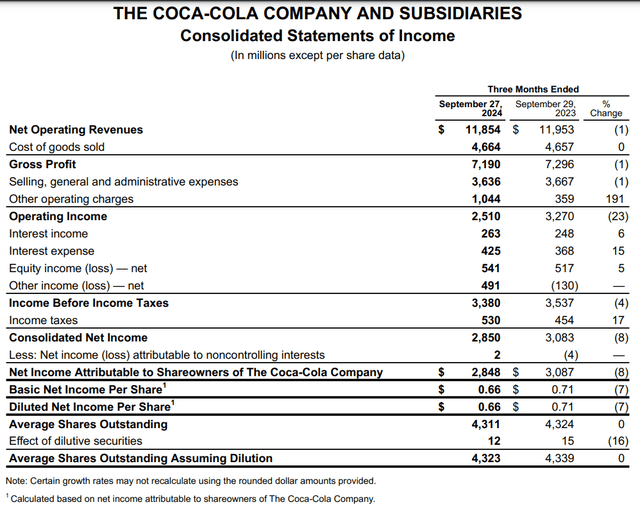

On October 23rd, Coca-Cola reported third-quarter earnings that, I thought, were solid. The company’s net revenue fell by 0.8% year-over-year to $11.9 billion during the quarter. For context, this was $290 million better than Seeking Alpha’s analyst consensus for the quarter.

On the surface, a decline in net revenue would seem to be disappointing. Digging deeper, though, Coca-Cola’s results were better than they appeared. Organic revenue surged 9% higher in the quarter.

The company experienced a 5% drag on net revenue due to unfavorable foreign currency translation stemming from its global presence. Additionally, the refranchising of bottling operations in India, Bangladesh, and the Philippines earlier in the calendar year 2024 weighed on the topline to the tune of 4%. Coca-Cola also experienced a 1% decline in unit case volumes, which was the result of a poor July per President and CFO John Murphy’s remarks during the Q3 2024 Earnings Call. Of note, volumes did improve sequentially as the quarter progressed.

These headwinds were largely offset by a 10% growth rate in Coca-Cola’s price and mix. That was fueled by an approximately 7% lift to the topline via pricing hikes. The remaining 3% net revenue tailwind was thanks to stronger growth in key developed markets versus developing and emerging markets per Murphy.

Coca-Cola’s non-GAAP EPS increased by 4.1% over the year-ago period to $0.77 during the third quarter. That exceeded the analyst consensus by $0.02. Disciplined cost management led the company’s non-GAAP net profit margin to expand by 140 basis points year-over-year to 28.2%. That’s how non-GAAP EPS edged higher as net revenue slightly dipped.

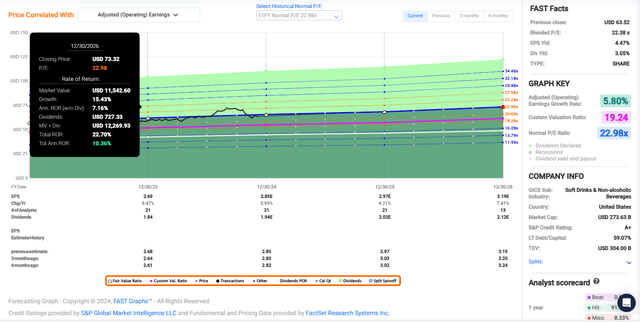

These strong results led Coca-Cola to indicate it now expects non-GAAP EPS to grow at the top end of its 5% to 6% range for 2024. Working off the 2023 base of $2.69, this implies non-GAAP EPS of between $2.82 and $2.85. The FAST Graphs analyst consensus of $2.85 is consistent with this guidance and would be 6% growth.

Looking beyond this year, Coca-Cola has catalysts to keep this level of growth going. Recent limited edition products like Coca-Cola Zero Sugar Oreo and its first-ever global Halloween activation offering in almost 50 markets called Fanta Beetlejuice are examples of products that can generate short-term buzz. This keeps the company’s brand portfolio relevant.

Coca-Cola also plans to debut its Bacardi Mix ready-to-drink pre-mixed cocktail in the calendar year 2025. Alongside Bacardi Limited, the company’s initial launch is planned for select European markets and Mexico.

As my colleague The Dividend Collectuh mentioned in an article from last month, Coca-Cola is demonstrating its social media savviness with recent moves. That includes the company’s presence at the Rock In Rio music festival earlier this year. The event was viewed by more than 70 million people and resulted in Coca-Cola being the most mentioned brand on TikTok.

For these reasons, the FAST Graphs analyst consensus is that non-GAAP EPS will grow by another 4.2% in 2025 to $2.97. An additional 7.4% jump in non-GAAP EPS to $3.19 is expected for 2026.

Coca-Cola Q3 2024 Earnings Press Release

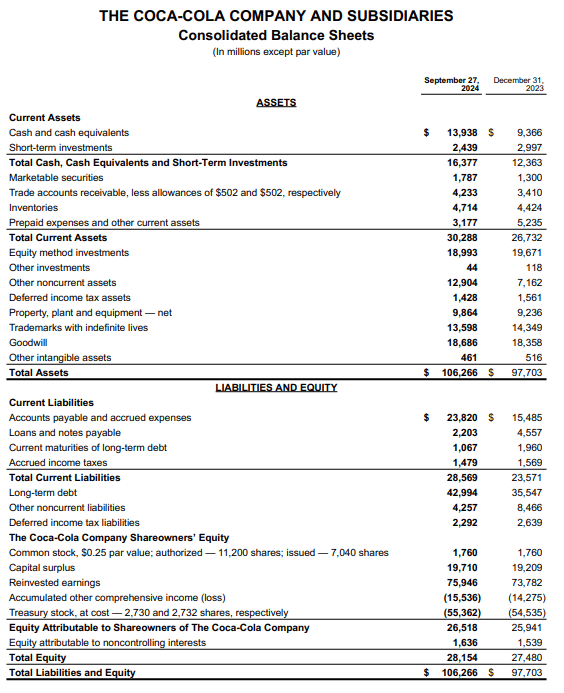

On the balance sheet side of the equation, Coca-Cola is also financially sound. The company’s net leverage ratio as of September 27th, 2024, was 1.7 times EBITDA. That’s less than the targeted range of between 2x and 2.5x. Including the $6.1 billion milestone payment to ultra-filtered milk company Fairlife expected in the first half of 2025, the net leverage ratio would be on the lower end of its target range. That’s why Coca-Cola enjoys an A+ credit rating from S&P on a stable outlook (unless otherwise sourced or hyperlinked, all details in this subhead were according to Coca-Cola’s Q3 2024 Earnings Press Release).

Fair Value Could Be Close To $70 A Share

Since my previous article, Coca-Cola’s total returns have been -3% as the S&P 500 index (SP500) has gained 12% over that time. The valuation is slightly more appealing now than it was during my last article, but it’s not quite enough for me yet.

Coca-Cola’s forward P/E ratio of 21.1 is a bit below the 11-year average P/E ratio of 23 per FAST Graphs. The company’s 5.8% annual forward non-GAAP EPS growth consensus is better than its average growth rate of nearly 4% in that time. In my view, that offsets the fact that interest rates are likely to remain somewhat higher than they have been in the last decade.

The calendar year 2024 is roughly 92% complete, which means another 8% of 2024 and 92% of 2025 is ahead in the next 12 months. That is how I get a forward 12-month non-GAAP EPS input of $2.96 for Coca-Cola.

Plugging this in with my fair value multiple of 23, I compute a fair value of $68 a share. That implies shares of Coca-Cola are priced at an 8% discount to fair value from the current $63 share price (as of December 4th, 2024). If the company matches the growth consensus and returns to fair value, it could post a cumulative total return of 23% by the end of 2026.

Dividend Growth Won’t Be Fizzling Out Anytime Soon

The Dividend Kings’ Zen Research Terminal

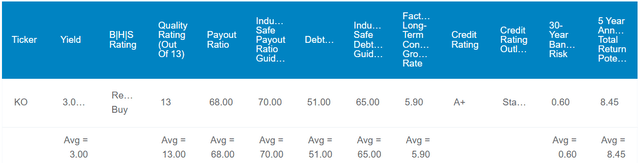

Coca-Cola’s 3.1% forward dividend yield is marginally above the consumer staples sector median forward yield of 3%. This is why Seeking Alpha’s Quant System awards respective C+ and C- grades for forward dividend yield and overall dividend yield.

As I alluded to at the outset, Coca-Cola truly shines in the dividend growth category. The company’s 62-year dividend growth streak is leaps and bounds more established than the sector median of 2 years. That’s enough for an A+ grade from the Quant System for overall dividend consistency.

This dividend growth should also continue in the years to come. That’s because Coca-Cola’s non-GAAP EPS payout ratio is poised to register in the high 60% range in 2024. This is marginally better than the 70% EPS payout ratio that rating agencies like to see from the industry, per The Dividend Kings’ Zen Research Terminal. That explains the B grade from the Quant System for overall dividend safety.

Thanks to its improving growth prospects and manageable payout ratio, Coca-Cola’s dividend growth is expected to be better than the sector median. The Quant System anticipates 4.8% annual forward dividend growth, versus the sector median of 4.3%. This is sufficient for a B- grade from the Quant System for forward dividend growth.

Risks To Consider

Coca-Cola is an operationally healthy business, but there are still risks to the investment thesis.

One such risk is the increasing adoption of the GLP-1 drug class. To my knowledge, there have been no studies directly addressing the impact these drugs have on beverage consumption. But if reduced satiety and food intake are any indication, it may not be a leap to conclude the drug class could have a modest impact on beverage consumption. Depending on the extent to which these drugs are embraced, this could be a headwind for Coca-Cola. In the meantime, the high list prices for these drugs are going to be a barrier to widespread adoption for at least some time, in my opinion.

Another risk to Coca-Cola is its continued tax dispute with the IRS, which I have referenced in prior articles. President and CFO John Murphy noted in his opening remarks during the Q3 2024 Earnings Call that the company made a $6 billion deposit with the IRS related to this dispute during the quarter. Murphy emphasized that Coca-Cola will continue to defend its position and believes it will prevail. If the company doesn’t win in court, however, that could push its leverage ratio to the top end of its targeted range.

Lastly, Coca-Cola will have to keep providing consumers with the products that they desire. If the company can’t do so, competitors could undercut it and swipe away market share. That could weigh on Coca-Cola’s growth potential.

Summary: My Buy Range Is Within Striking Distance

Coca-Cola is a storied Dividend King. The company’s growth profile is respectable for a company of its dependability as well. Even if it loses the IRS tax dispute, Coca-Cola would still possess a very robust balance sheet. The annual total return potential from the current share price could be right around 10%. However, I’d like to see a bigger margin of safety. That’s why I’m maintaining my hold rating until a pullback into the high $50 range or until the fair value of shares rises further.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.