Summary:

- Coca-Cola has high brand value, allowing it to generate profits by simply selling its trademark to beverage manufacturers.

- The company maintains a stable market share in North America, its largest market, and continues to generate profits.

- KO has a history of rising dividend payouts and a strong financial position, making it a favorable investment option.

Justin Sullivan

Thesis

Coca-Cola (NYSE:KO) is a multinational beverage corporation headquartered in Atlanta, Georgia. Established in 1886, it is renowned for its flagship product, Coca-Cola, a carbonated soft drink. The company has grown to offer a diverse portfolio of beverages, including various sodas, juices, teas, and energy drinks. The company’s size and reach make it one of the largest and most recognizable beverage companies worldwide. Coca-Cola’s presence extends across a wide range of markets, and its products are distributed through an extensive network of bottlers, retailers, and vending machines.

In spite of having experienced a major dip in its sales in 2020 – the pandemic year – the beverage giant still managed to generate profits, highlighting its ability to weather shocks and improve its productive efficiency. The company’s financial position is strong across all parameters – it is the largest firm in its largest geographical market (by revenue), lending it sufficient market power.

In addition, it also earns a large margin due to its business model of selling its trademark to beverage manufacturers and it has been paying out handsome dividends to its shareholders. All these factors point towards a bright prospect for the company in the financial arena.

High Margins

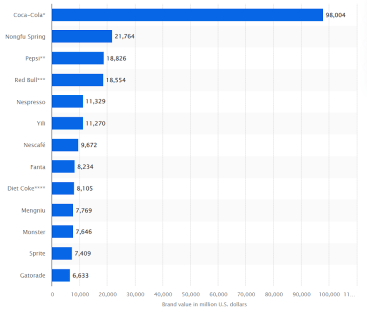

One of the factors strongly in favor of the Coca-Cola company is its brand presence. The graph below shows the brand value of Coca-Cola compared to other beverage companies. It has a huge lead compared to other beverage companies like PepsiCo and Nescafe. This is one of the strongest advantages of the beverage giant.

Statista

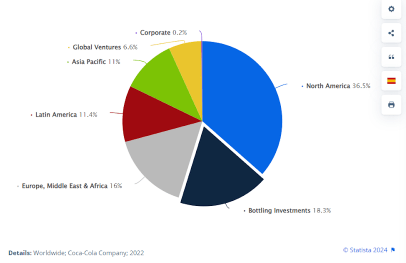

This particular factor of high brand value has allowed Coca-Cola to establish its trademark among consumers in the beverage market. The result is that Coca-Cola is able to extract sufficient profits by simply branding and selling its trademark. This means that many of the beverages that have the branding of Coca-Cola are neither manufactured, nor bottled by Coca-Cola. The only contribution of Coca-Cola is its trademark. The graph below shows the percentage of revenue that comes from bottling investments. It is only a fraction of the larger chunk of revenue that comes to Coca-Cola.

Statista

One of the primary advantages of this business model is that this allows Coca-Cola to gain a high margin on every unit of sales because it incurs almost no expense in the per-unit production of beverages. Therefore, it is to be noted that this high-margin business model allows Coca-Cola to generate sufficient cash and profits to expand into other business territories and also provide handsome dividends for their shareholders, which I will expand on later in this article.

Stable Market Share in Largest Market

Statista

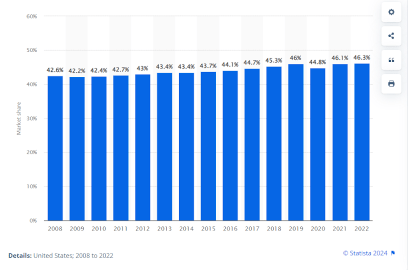

Another factor to note from the above figure is that a major chunk of revenue for Coca-Cola comes from North America. It is therefore imperative for Coca-Cola to maintain a stable market share in its largest market by sales figure. The figure below gives the market share of Coca-Cola in the space of non-alcoholic beverages across time.

Statista

The graph shows a clear picture where we can see that the market share of Coca-Cola has remained mostly stable and well above 40% (even during the shock of the pandemic) in the United States. Moreover, there is also an upward trend for Coca-Cola in terms of market share as it has reached its all-time high of 46.3% in FY22. Therefore, even when looking at the biggest market of Coca-Cola, we can safely say that the beverage giant is the single biggest player in the non-alcoholic beverage space in its biggest market and will continue to generate profits.

Rising Dividend Payouts

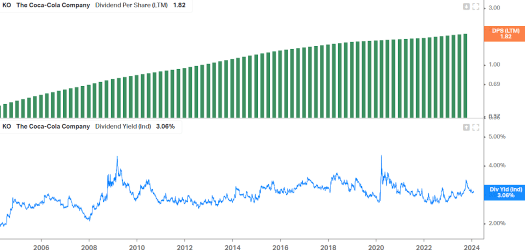

Koyfin

The graph above shows the dividend payout per share and also the dividend yield. We can clearly see that the dividend payment has been on the rise. Therefore, Coca-Cola is a great investment, especially for long-term investors. There have been sudden spikes in the middle for dividend yield which could primarily be explained by the two economic recessions around the same time (the 2008 financial crisis and the 2020 covid crisis). However, the yield has mostly been around 3%. However, a keener look also shows us that there has been a slight upward trend in the dividend yield. So there is a high chance that the dividend yield will also keep on rising along with the dividend payout.

Financials

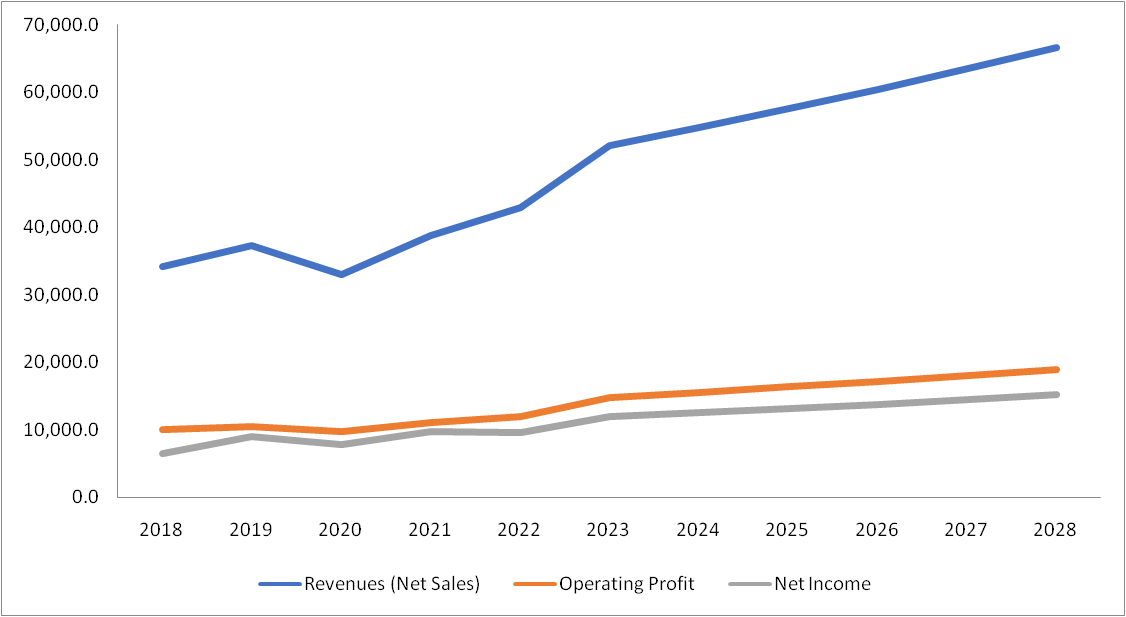

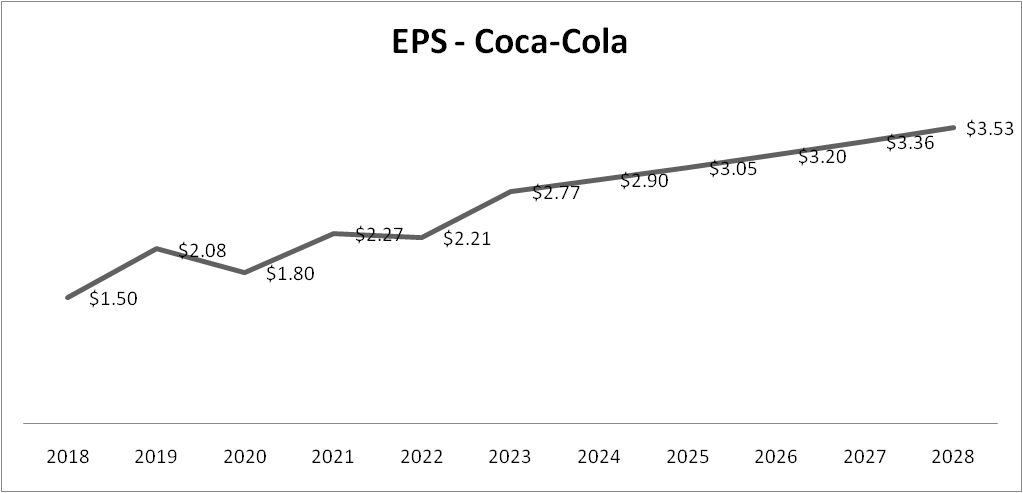

Below are the trends of net sales, operating profit, and net income. As we can see, the revenue and profits have been following an alternating cyclical pattern. However, if we remove the cyclicity, we notice a clear upward trend emerging from revenue, profit, and EPS. Therefore, it becomes clear that the profits are expected to increase further and therefore. An interesting pattern to note is that the sales dipped significantly in FY20 and reached the lowest point in that very year. However, the net profit (and the EPS) in FY20 was more than that of FY18. The explanation for this is that the cost structure for Coca-Cola has improved over time which has allowed it to weather the shock of the pandemic. This indicates that as Coca-Cola is positioned to improve its sales from the pandemic, it will reach higher levels of profitability due to more efficient production capacity.

Author’s Material Author’s Material Author’s Material

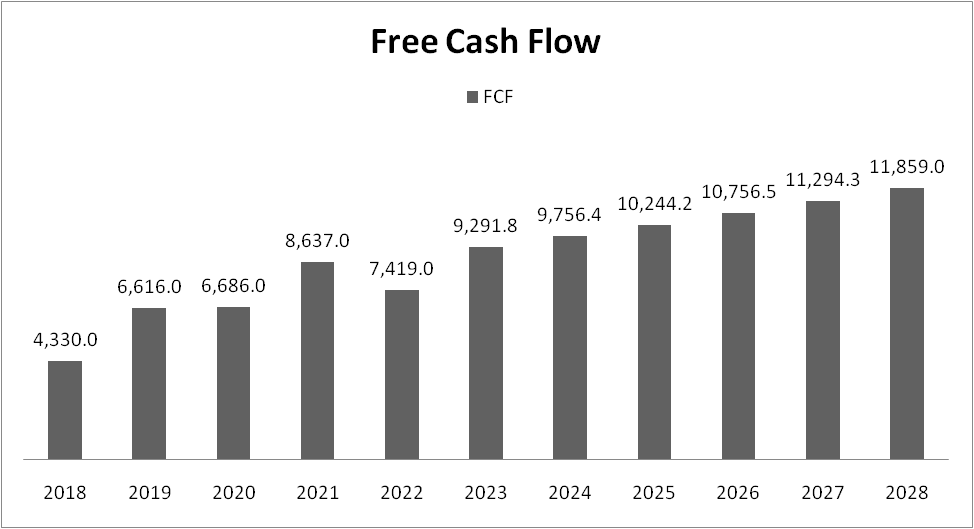

When we look at the free cash flow, we notice that there is also a cyclical pattern here where there is a dip in every even year (FY20, FY22). Based on this pattern, the inference is that there will be a dip in cash flow in FY24 as well. However, I believe that this is not a cause for worry because after every dip the rebound has been even greater. Therefore, because of this, there has been an upward trend in the level of free cash flows. Moreover, this has also been propelled by the improved profitability of Coca-Cola. Therefore, when looking at it from a longer-term perspective, I believe that Coca-Cola will be a favorable stock to bet upon.

Valuation

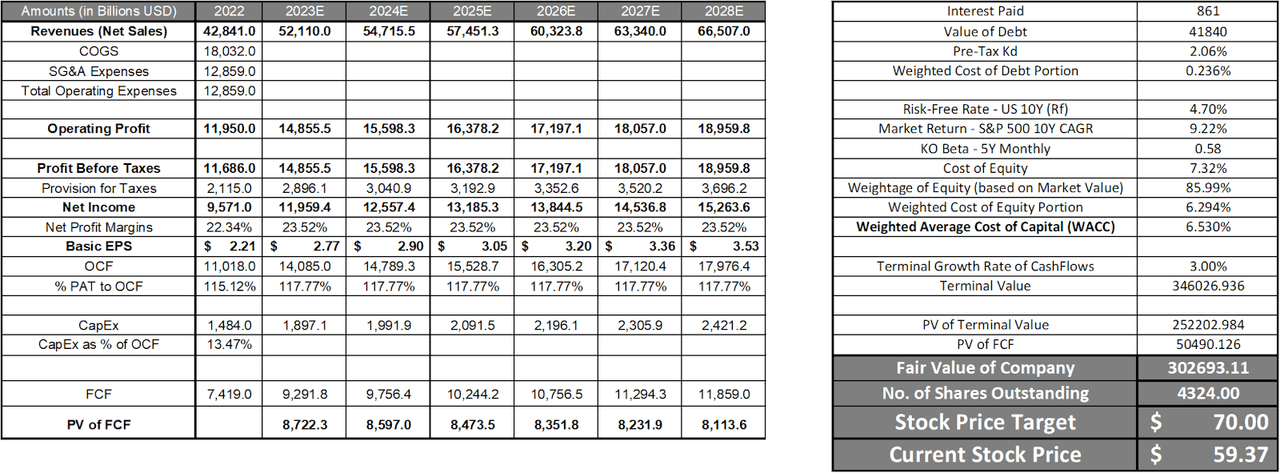

To assess the valuation of Coca-Cola, I have undertaken a DCF Valuation. Below is an image of a DCF Valuation performed on KO. I have assumed 5.0% revenue growth from 2024 to 2029 because the primary market is the USA which is a slow-growing economy. However, I have kept the estimates slightly high because Coca-Cola has a significant presence in India and China.

I assumed that KO’s net profit margins will remain at 23.52% in 2024 and beyond. Ultimately, we get a Fair Value/ Price Target of $70.00 in the base case scenario. The DCF analysis gives us a value that has an upside of 17.91%.

Risk of Consumers Moving Towards Healthier Drinks

One potential concern for prospective investors eyeing Coca-Cola stems from the evolving landscape of consumer preferences, particularly the rising demand for healthier and more natural product options.

In recent times, a noticeable shift in consumer consciousness has emerged, with Coca-Cola, historically associated with sugary and less nutritious beverages, facing a critical juncture. This has been due to studies revealing the adverse effects of sugary beverages. The era when soda dominated the beverage market seems to be receding, opening the door for alternative options that could potentially challenge Coca-Cola’s market share. The contemporary beverage scene witnesses a growing inclination toward alternatives such as flavored teas, coffees, and notably, energy drinks. While this transformation is most evident in the American market, its influence extends to other regions.

For Coca-Cola, a brand deeply entrenched in the world of traditional sodas, navigating this shift poses a significant challenge. The evolving preference for beverages aligning with health-conscious values may pose a threat to Coca-Cola’s established product lineup. However, amid this challenge, there is a glimmer of optimism. Coca-Cola, known for its ability to adapt to changing consumer preferences, has strategically invested in segments aligning with the health-conscious movement.

Two noteworthy examples within Coca-Cola’s portfolio are AHA and Topo Chico, acquisitions aimed at expanding the brand’s offerings to cater to evolving consumer demands. These ventures signify a proactive approach by Coca-Cola to stay relevant and capture a portion of the market driven by health-conscious consumers. While the transition away from traditional sodas presents a potential hurdle, Coca-Cola’s demonstrated adaptability to market trends offers hope that the company can successfully pivot to meet the changing preferences of consumers.

Conclusion

Overall, the stock is providing a relatively optimistic picture. A close look at some of the financial and operational aspects provides a bright picture as it signals rising profit margins, increasing dividend payouts, a dominant player in the US market, etc. This is further strengthened by the valuation which gives us an upside of 17.91%. So, overall, my recommendation for the stock would be a BUY.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.