Summary:

- The Coca-Cola Company easily beat consensus estimates during Q2 2023.

- The beverage giant forecasts growth slowing to a more normalized 5% to 6% range after organic growth hit 11% during Q2 on price hikes linked to inflation.

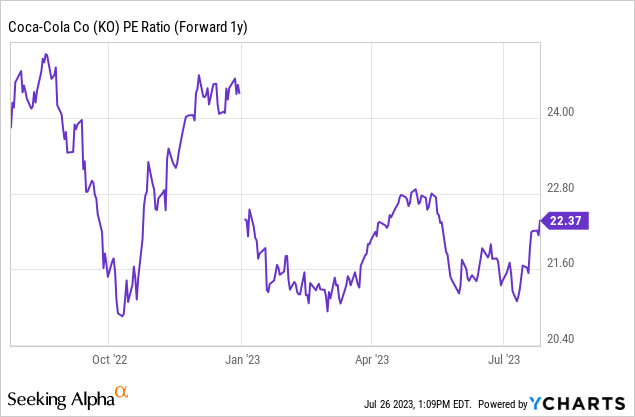

- KO stock should continue underperforming the market to an elevated ’24 P/E multiple of 22x.

nicoletaionescu/iStock via Getty Images

The Coca-Cola Company (NYSE:KO) reported another solid quarter in Q2, but the stock isn’t moving much due to an elevated valuation multiple from investors willingly overpaying for safety. The beverage company continues to benefit from inflationary pressures pushing revenues up, while higher costs cut into any ability to produce excessive profit growth. My investment thesis is Neutral on the stock due to the likelihood for moderating revenue growth combined with the elevated valuation.

Coca-Cola Reports Moderated Growth For Q2

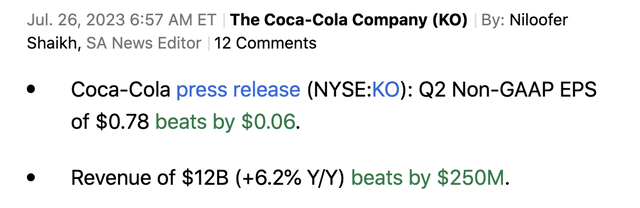

The beverage leader reported Q2’23 results as follows:

By most metrics, Coca-Cola had a strong quarter. Organic revenue defined by management grew 11% and EPS grew a similar amount to reach $0.78.

The key is that Coca-Cola had to smash analyst estimates to generate the majority of that growth. The consensus estimates were for EPS growth of only $0.02 above the $0.70 earned last Q2.

A common theme of the earnings call was a plan for moderating growth with pricing no longer growing at an aggressive clip. The CEO made the following comment on the Q2 ’23 earnings call:

Across the sector, consumers are increasingly cost conscious. They’re looking for value and stocking up on items on sale. In these markets, our pricing is largely in place and is expected to moderate as we cycle pricing initiatives from the prior year.

Coca-Cola ultimately has a goal for 5% to 6% growth via an equal mix of pricing and volume. The 2H guidance suggests organic revenue growth falls closer to those levels due to the moderating pricing growth led by inflation over the past year.

Remember, Coca-Cola is facing an issue where cost conscious consumers are looking to trade down to value brands, especially if the company takes more price hikes. The beverage giant hasn’t been taking price hikes due to strength in the business with unit case volumes in the U.S. market down.

Ultimately, management guided to 5% to 6% EPS growth for the year above the $2.48 earned in 2022. The consensus analyst estimates are for the EPS to grow ~5% to reach $2.61.

KO Stock – Stretched Valuation

Coca-Cola remains a legendary company able to grow revenues and earnings in excess of 5% annually while revenues already top $12 billion on a quarterly basis. The problem is that the stock already factors in such growth and many years ahead due to the safety inherent in that growth.

Based on the current estimates, the stock trades at ~22x 2024 EPS targets of $2.81. Analysts are actually forecasting nearly 8% growth next year to reach that EPS target.

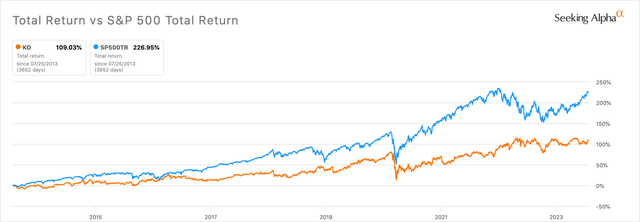

While investors might happily pay up for the reliable growth of Coca-Cola, the stock returns are predictably disappointing due to the willingness of investors to overpay for the stock. Over the last decade, Coca-Cola has produced a total return of 109% while the S&P 500 (SP500TR) has soared 227%.

Even with analysts forecasting EPS growth of 7% annually, Coca-Cola should have a forward P/E multiple no higher than 2x the growth rate. In this case, a 15x multiple would warrant a stock price of no more than $42.

A stock trading at 3x the forecasted growth rates will predictably fail to match the total returns of the market. Just YTD only, Coca-Cola has a slightly negative return while the S&P 500 has produced a 20% total return.

The stock offers a 3% dividend yield with consistent growth. These tasty looking dividend yields are a primary reason investors are likely overpay for a stock that constantly fails to keep up with market gains.

Takeaway

The key investor takeaway is that The Coca-Cola Company either has to smash current estimates or the stock will further underperform over the next decade. On any major dips, similar to what happened during Covid, investors could smartly buy Coca-Cola for the solid growth story. Otherwise, investors should just buy the S&P 500 to generate the additional returns versus overpaying for the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.