Summary:

- Coca-Cola’s strong brand portfolio, leadership position, and Dividend King status reflect its resiliency.

- Despite recent stock price increases, KO is not overvalued, with the multiple valuation method indicating potential upside and justified premium over peers.

- KO’s business model is highly cash-generative, supporting consistent dividend growth and maintaining an attractive risk-to-reward ratio for investors.

- The Company’s long-term track record and adaptability ensure it remains a ‘buy’ in my portfolio.

Urupong

Coca-Cola (NYSE:KO) (NEOE:COLA:CA) doesn’t need much of an introduction. It operates globally through numerous soft drink brands, including Sprite, Fanta, and Coca-Cola. Moreover, the Company also operates within other beverage segments, including tea, water, and coffee.

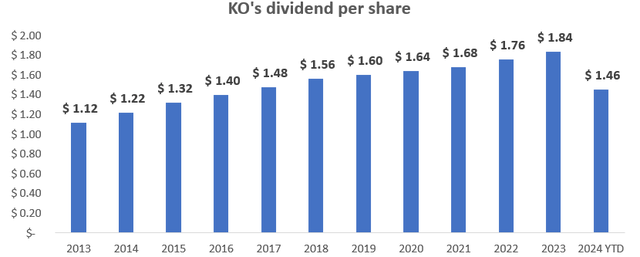

For transparency, Coca-Cola holds a well-deserved place in my portfolio, and as I can imagine, in many investors’ portfolios due to (among other things) its Dividend King status. On July 29, 2024, the Company announced another quarterly dividend of $0.485 per share. Should the dividend be upheld for the following quarter, it would constitute an attractive (given the scale, track record, and maturity of the business) year-over-year DPS growth of 5.4%.

Previous Coverage and Thesis Update

I recently covered KO and indicated it was a ‘buy’ due to its leadership position, outstanding profitability, strong brand portfolio, meaningful shareholder rewards, and attractive risk-to-reward in terms of valuation.

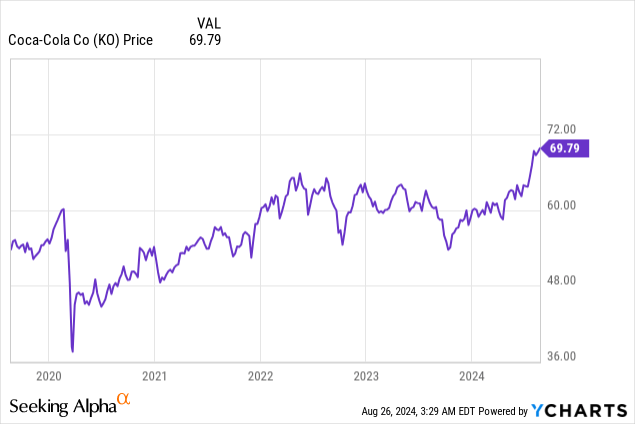

Since then, its stock price has increased by over 10%. Should you be interested to get a better grasp on the development of my views on KO, please refer to the link below:

- The ‘Bargain’ Window Has Closed, But Coca-Cola Still Looks Buyable

I’ve recently noticed some voices raising a possible ‘overvaluation’ of KO, given its relatively dynamic stock price increases over the last months.

Despite the dynamic stock price increases, I don’t consider KO overvalued. As an M&A advisor, I follow a multiple valuation approach as a rule of thumb – a leading tool in transaction processes. This leads me to conclude that, although limited, the upside potential remains.

Moreover, the Company showcases:

- long-term track record

- resilient business model

- substantial shareholder rewards

- high profitability

- top-tier brand portfolio

- leading position in the industry

Based on the above factors (described further in the following sections) I uphold my ‘buy’ rating for KO. I am bullish on Coca-Cola.

Valuation Outlook

The multiple valuation method – leading tool in M&A processes

As an M&A advisor, I usually rely on the multiple valuation method, a leading tool in transactional processes. This method allows for accessible and market-driven benchmarking. Utilizing so-called ‘multiples’ facilitates determining whether a given stock price is justified, as these multiples are a combination of a given ‘value’ metric and a given ‘financial results’ metric. Numerous metrics are available for valuing a company, with EV/EBITDA being a rule of thumb for most sectors.

For example, when we collect NBOs (non-binding offers, which indicate interest to acquire a given company) or bid one, the offer is generally structured as ‘X’ times a given financial metric (usually EBITDA, but that depends on the sector), leading to Enterprise Value, which is later subject to certain adjustments.

Coca-Cola’s historical EV/EBITDA multiple

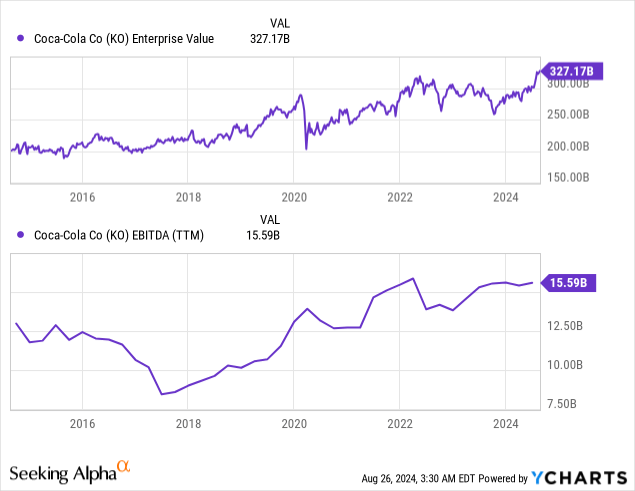

That said, let’s analyze KO’s Enterprise Value and EBITDA for the last ten years, as depicted in the charts below.

As we can observe, both charts look similar to some degree, but the correlation will never be perfect as there are numerous metrics impacting investors’ view of the business, not just its EBITDA. Moreover, stock prices are always subject to Mr. Market’s (yes, I love to reflect on Benjamin Graham’s brilliant metaphor) mood swings.

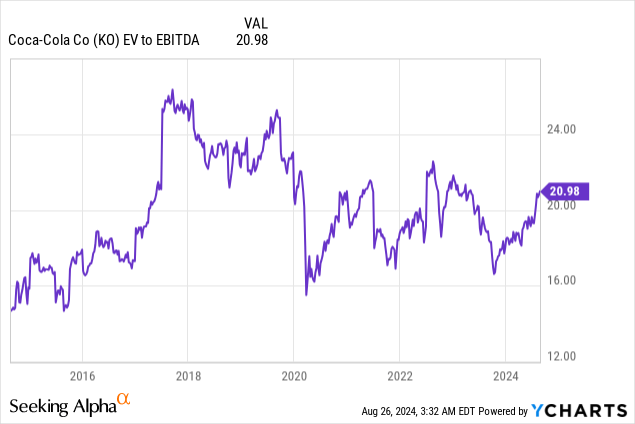

Combining the above metrics leads us to the EV/EBITDA multiple, which should be a starting point of an analysis (not the stock price itself). While I haven’t discussed it in this coverage, one also has to be aware that the multiple valuation method allows us to properly include stock issues or repurchases, which also impacts the stock price.

The above chart implies to me that KO is not overvalued. However, that’s not the point one should stop at. It’s always worth taking a look at some peers of an analyzed entity to build a broader perspective.

Coca-Cola’s valuation compared to some of its peers

The forward-looking EV/EBITDA multiple stood at:

At this point, some could conclude that KO is overvalued due to the significant valuation premium over PEP or KDP. However, as mentioned earlier, investors should consider other factors that may differentiate KO from its peers and justify such a premium, such as (inter alia):

- the position of an industry leader

- better sales growth metrics, such as volume growth

- higher profitability

- Dividend King status with a highly cash-generative business model directly translating into substantial shareholder rewards

The Valuation Is Justified: Q2 2024 Update

The business keeps on growing

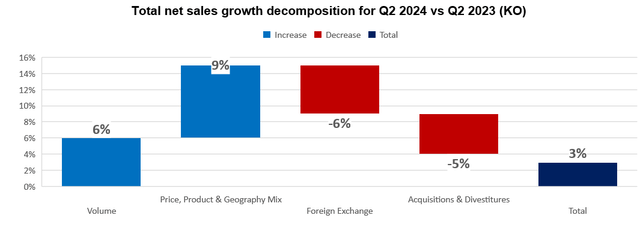

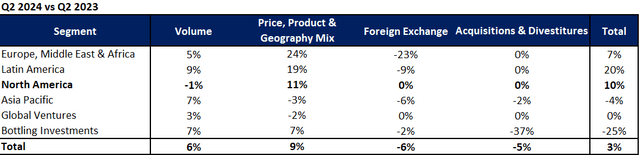

Coca-Cola’s revenue in Q2 2024 increased by ~3% compared to Q2 2023. The growth was attributable to 6% volume growth and 9% positive pricing and mix effects, which were offset by a negative 6% FX effect and a negative 5% acquisitions & divestitures effect. Please review the chart below for details.

Author based on KO’s Q2 2024 10-Q

Such an extensive 9% pricing and mix effect was attributable to:

(…) one, approximately five points of intense inflationary pricing, across a handful of markets to offset significant currency devaluation. And two, an array of pricing and mix actions across our markets. Excluding the impacts from concentrate shipment timing and pricing from markets with intense inflation.

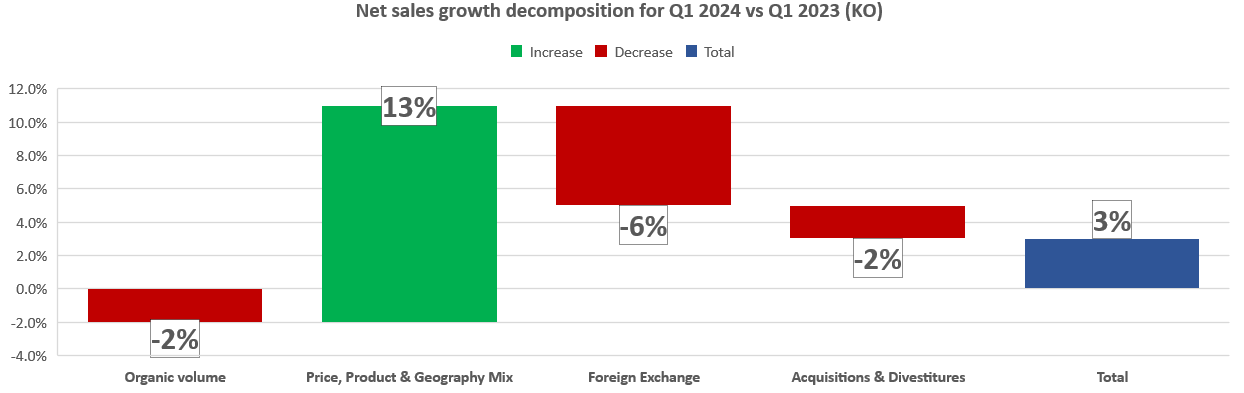

Comparing that to the Q1 2024 performance, we may observe a slight decrease in price, product & geography mix, but a significant improvement on the volume front compared to the previous year’s analogical period.

Author based on KO’s Q1 2024 10-Q

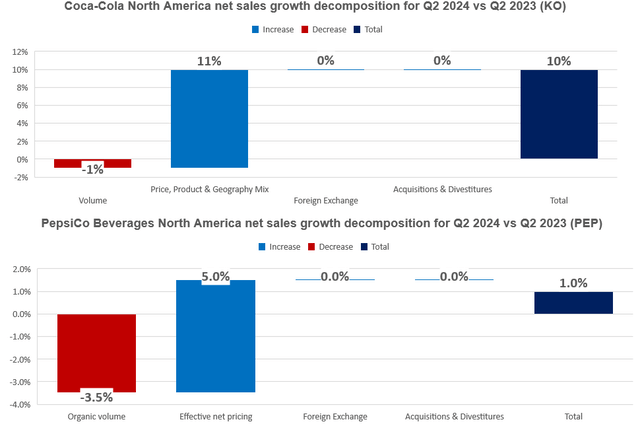

The final result, driven by different factors, was similar, with 3% year-over-year sales growth. It’s also important to note that KO (looking at the big picture) continues to enhance its position in its most important market – North America. The Company delivered a negative volume effect of 1% and a positive pricing & geography effect of 11%, while its close peer – PEP showcased a negative volume effect of 3.5% and a positive net pricing effect of 5%. The end result in this market was 10% growth for KO and just 1% growth for PEP. Please review the charts below for details.

Author based on KO’s and PEP’s Q2 2024 10-Qs

At the same time, KDP recorded 3.3% net sales growth in its U.S. Refreshment Beverages segment.

For more details regarding the performance of the rest of KO’s segments, please review the table below.

Author based on KO’s Q2 2024 10-Q

KO has outstanding profitability, translating into a cash-flow machine

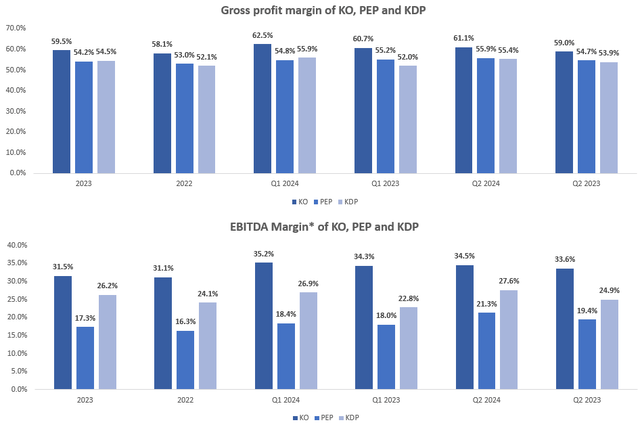

Coca-Cola records noticeably higher gross profit margins than its competitors and significantly higher EBITDA margins. Both metrics usually exceed 30% and 60% for KO, respectively. Please review the charts below for details. Please note that I’ve included Net revenues, Cost of goods sold, and SG&A expenses in the Operating Income calculation, then adjusted for depreciation and authorisation costs to get EBITDA.

Author based on KO, PEP, and KDP

Abstracting from KO’s evident competitive edge over PEP and KDP, each entity improved its profitability in Q2 2024 compared to Q2 2023.

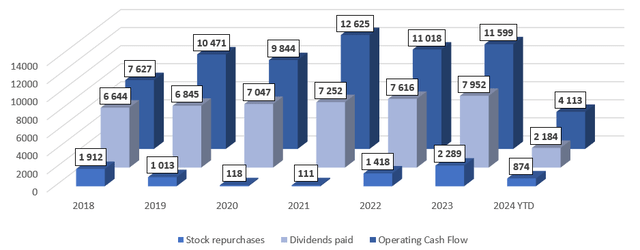

Such high profitability recorded within a mature industry translates into the cash-flow machine characteristic of Coca-Cola, which generated over $67B of cash from operating activities during the 2018 – 2024 YTD period. The Company has a shareholder-friendly approach with significant rewards:

- over $45.5B of dividends paid in the period above

- over $7.7B of stock repurchases in the period above

Please review the chart below ($m) for details.

Risk factors

No stock market investment is risk-free, as both market and company-specific risk factors accompany each business. For instance:

- KO operates in a highly competitive environment that can be considered a ‘red ocean’ market, meaning that the Company has to constantly improve and adapt to the current market trends to uphold and further grow its market share

- Due to the brand factor embedded within its business, KO is highly dependent on brand awareness and perception among consumers

- KO’s business is subject to the regulatory environment

- Long-term consumer trends don’t work in KO’s favour as health awareness keeps on rising, which may lead to worse business performance in the future should the Company fail to adapt

- KO’s pricing power will be upheld only to some extent before it starts to reflect a more negative impact on volume

Summary

Despite the abovementioned risk factors and limited upside potential resulting from the multiple expansion, I consider KO’s risk-to-reward ratio attractive. Investors will benefit not only from the multiple appreciation but also from the growing scale of the business and shareholder rewards.

With the Company showcasing:

- long-term track record

- resilient business model

- substantial shareholder rewards

- high profitability

- top-tier brand portfolio

- leading position in the industry

Coca-Cola remains a ‘buy’ for me. For transparency, I have a stake in KO.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.