Summary:

- Within this analysis, you will find a rationale for KO’s attractiveness supported by a series of comparisons between the Enterprise and some of its competitors (incl. PEP and KDP).

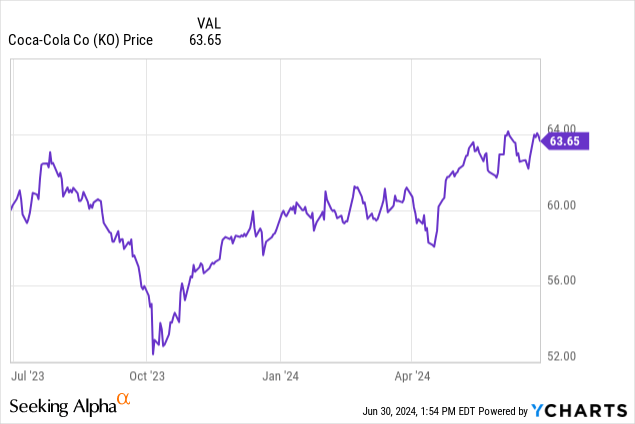

- Coca-Cola’s stock price has increased ~21.5% since its crash in the second half of 2023. Its EV/EBITDA multiple is significantly higher than its competitors.

- However, I believe the Company has deserved its valuation.

- Despite 0% organic volume growth in NA, KO improved its market position when compared to PEP or KDP, which saw their volumes decline.

- KO’s sales growth in North America segment by ~7% in Q1 2024 shows improvement in market position compared to competitors. Its profitability remains outstanding.

Fotoatelie

Investment thesis

For transparency, let me start with this statement – I own a certain stake in Coca-Cola (NYSE:KO), I don’t see a reason to sell it, and I consider adding more. Some investors may be concerned that Coca-Cola’s valuation multiples are significantly higher than those of some of its competitors. However, I believe that the business is fairly valued with no reason to drop in value, but there is still some room for potential multiple appreciation.

Considering the:

- leadership position with a top-tier, globally recognizable brand portfolio

- improving market position through organic volume and organic growth (while outperforming the competition)

- outstanding profitability exceeding 60% in terms of gross margin and 30% in terms of Operating Income and EBITDA margins

- Dividend King status with dividends being well-covered and growing at an attractive pace

- potential turnaround regarding the FX fluctuations given the upcoming shift in FED policy

I believe KO is an attractive opportunity for stability-seeking investors, especially those who are income-oriented. I am bullish on KO.

Quick Introduction

KO is one of these stocks that doesn’t require extensive introduction into its business. The products under its globally recognizable brands (including Fanta, Sprite, Schweppes, and, of course, Coca-Cola) are sold in over 200 markets. Apart from its soft drink brands, the Company is also engaged in the juice, water, coffee, tea, and ready-to-drink alcohol segments. KO’s stock price has increased ~21.5% since its crash in the second half of 2023.

As an M&A advisor, I usually rely on a multiple valuation method, which is a leading tool in transaction processes. This method allows for accessible and market-driven benchmarking. Numerous metrics are available for valuing a company, with EV/EBITDA being a rule of thumb for most sectors, especially mature ones. However, it’s crucial to understand the business metrics that can possibly impact a given multiple – only then may we know whether the market sentiment is reasonable.

With that said, the forward-looking EV/EBITDA multiple stood at:

Just by looking at these numbers, some could consider KO overvalued when compared to some of its peers, however, I don’t believe that to be the case – here’s why. Enjoy the read!

Coca-Cola’s Valuation Is Justified

#1 KO further improves its leadership position

The Company distinguishes six business segments:

- Europe, Middle East & Africa

- Latin America

- North America

- Asia Pacific

- Global Ventures

- Bottling Investments

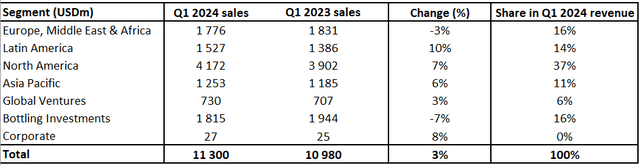

It managed to grow its sales within the most important segment (North America contributing to 37% of total sales) by ~7% in Q1 2024 compared to Q1 2023. KO didn’t record sales growth within each of its business segments in Q1 2024; however, given their share in KO’s total revenue, the Company delivered a 3% sales growth compared to the same period of the previous year. For details, please refer to the table below.

Own compilation based on KO’s SEC filings

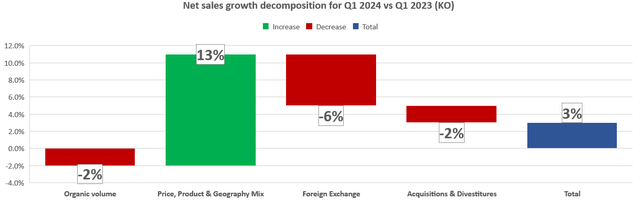

Looking at the big picture, the 3% sales growth was achieved through the (overall) positive effect of KO’s pricing power, product & geography mix, which was partially offset by divestitures, negative foreign exchange fluctuations, and organic volume decline. For details, please refer to the chart below.

Own compilation based on KO’s SEC filings

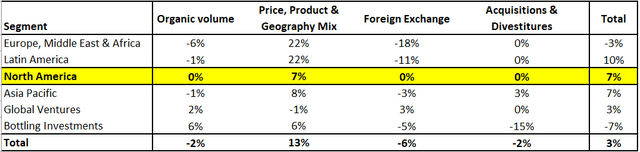

While there have been some unfavourable instances (e.g., a noticeable organic volume decline in the Europe, Middle East & Africa segment, as well as significant FX fluctuations from the above and the Latin America segments), I would like to bring your attention to the most important market for both KO and its competitors like PEP or KDP – North America. For details regarding the net sales growth recomposition by business segment, please refer to the table below.

Own compilation based on KO’s SEC filings

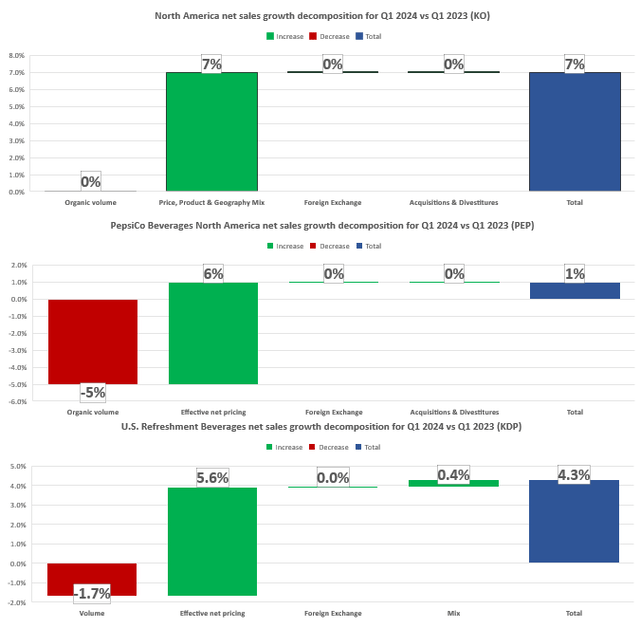

As presented above, sales realised within the North American segment grew by ~7%, which was derived from the price, product, and geography mix. While reviewing KO’s financial performance, I’ve been pleased to see a 0% change in organic volume. As no growth in terms of organic volume seems to be nothing to be happy about, let me clarify:

- During 2023, organic volume for this segment declined by 1% compared to 2022, so Q1 2024 brought some improvement in this area

- Some of its competitors (PEP and KDP) found Q1 2024 more challenging in terms of organic volume as each of the above entities recorded volume declines within the comparable segments (PepsiCo Beverages North America for PEP and U.S. Refreshment Beverages for KDP)

For details, please review the charts below.

Own compilation based on KO’s, PEP’s, and KDP’s SEC filings

Given the declining volumes of PEP (by 5%) and KDP (by 1.7%), we may presume, on the big picture level, that KO further improved the market position of its core business segment when compared to PEP and KDP by simply upholding its volumes. Also, with the highest net impact of other factors (7% vs 6% vs 6%), KO delivered the highest growth of the comparable business segment across the analyzed entities (7% vs 1% vs 4.3%).

Interestingly, when we unpack the 7% of price and mix of KO, we will find that the sole pricing effect of the Company was around 5%, as the Company’s CEO, James Quincey explained during the Q1 2024 Earnings Call:

As it relates to pricing, of the seven points in the first quarter, approximately two of those are mix or timing related. The rest is pricing, and we expect that to moderate as the year goes on, and we expect the 2024 to be a much more normal year in terms of pricing.

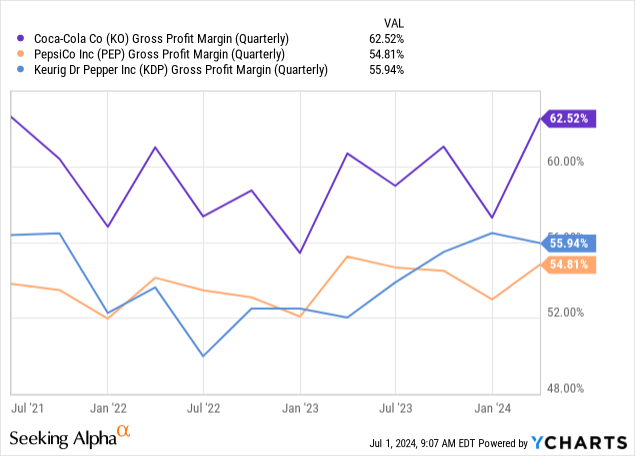

#2 Outstanding profitability

Starting from the top and looking at the gross margin, Coca-Cola has generated significantly higher gross margins than PEP and KDP during the last three years. During Q1 2024, the Company marked a ~62.5% gross margin – once again noticeably higher than its competitors (54.8% for PEP and 55.9% for KDP). It’s also an improvement of 1.8 percentage points to Q1 2023 when KO had a gross margin of 60.7%. The improvement was a result of the pricing power KO holds, which was partially offset by the increase in commodity prices, as well as unfavourable FX fluctuations.

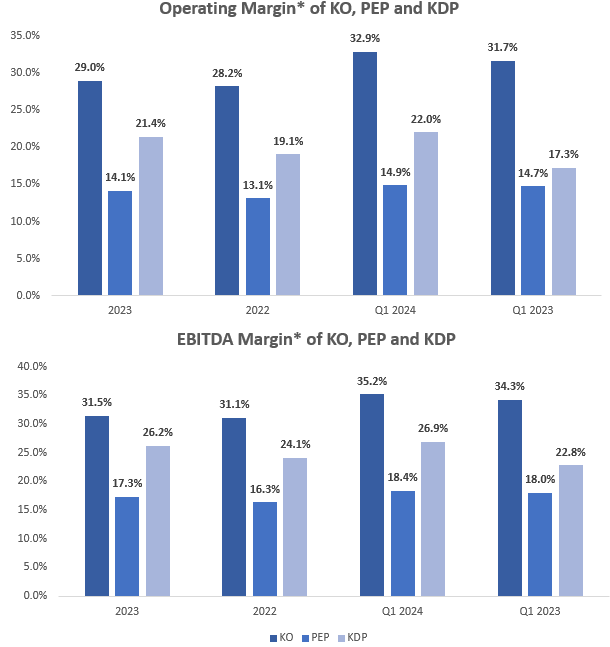

Further, KO maintains a significant advantage over PEP and KDP in terms of Operating Income* and EBITDA* margins. Please note that I’ve included Net revenues, Cost of goods sold, and SG&A expenses in the Operating Income calculation, then adjusted for depreciation and authorisation costs to get EBITDA. As presented in the charts below, each entity improved its margins in 2023 vs. 2022 and Q1 2024 vs. Q1 2023. Similarly to the gross profit margin, KO significantly outperformed its competitors in terms of profitability measured at the Operating Income* and EBITDA* margins.

Own compilation based on KO’s, PEP’s, and KDP’s SEC filings

#3 Dividend King

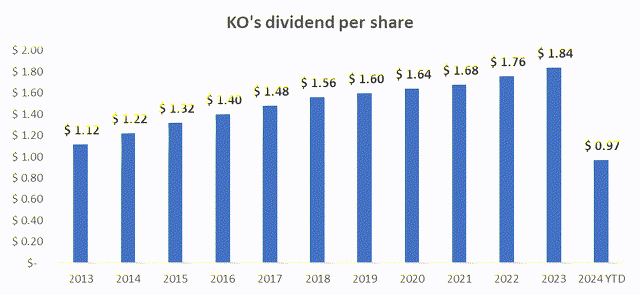

Coca-Cola is the Dividend King, with a reasonable and well-covered dividend yield of ~3%. This means that KO provided its shareholders with over 50 consecutive dividend increases (62 to be exact). That should be an especially attractive factor for income-oriented investors. KO’s DPS marked a solid CAGR of 5.1% during the 2014 – 2023 period (with 2013 as a base year). The CAGR for the last five years (the 2019 – 2023 period) was lower and amounted to 3.4% due to the relatively modest dividend increases in 2019 and 2020. However, the DPS growth has picked up its pace in recent years, growing by 4.8% and 4.5% in 2022 and 2023, respectively (on a year-over-year basis). Moreover, assuming KO upholds its quarterly dividend through 2024, that would mean a 5.4% DPS growth year-over-year. For details regarding KO’s DPS development during the 2013 – 2024 YTD period, please review the chart below.

Own compilation based on KO’s website

The dividends remain well-covered as the Company has outstanding profitability and a strong balance sheet characterized by a below-target net debt to EBITDA of 1.6x (with the targeted range from 2.0x to 2.5x).

Risk Factors

The Company’s industry is highly competitive and subject to a regulatory environment. As health awareness grows globally, some negative long-term trends accompany the market. The strengthening of such trends and KO’s failure to adapt could endanger its long-term performance.

The inability to uphold and further grow its market share could worsen KO’s financial performance. The Company’s competitive edge lies in brand awareness, marketing efforts, and brand vision. Should consumers’ perception of its key brands shift negatively, the Company’s leading position could be endangered, leading to higher stock price volatility.

Any other material adverse changes could result in worse financial performance and higher stock price volatility.

Valuation Outlook & Key Takeaways

As indicated earlier, the forward-looking EV/EBITDA multiple stood at:

- ~20.1x for KO

- ~14.8x for PepsiCo

- ~13.6x for Keurig Dr Pepper

I don’t see a reason why KO’s multiple should be considered “too high”, given the competitive advantages over its competitors. Considering the:

- leadership position with a top-tier, globally recognizable brand portfolio

- improving market position in terms of organic volume and organic growth

- outstanding profitability

- Dividend King status with dividends being well-covered and growing at an attractive pace

- long track record of successfully navigating shifts in the ever-changing market environment, consumer behaviour, and business standards

- potential turnaround regarding the FX fluctuations given the upcoming shift in FED policy

I remain bullish on KO. While I don’t believe it will provide outstanding total returns, I consider the risk-to-reward ratio to be attractive. In terms of valuation, the EV/EBITDA multiple should remain within the 20.0x-21.0x range given the current state of the business.

I’ve held my shares for quite some time. I don’t intend to sell them and I’m certainly looking forward to adding more. Long KO!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.