Summary:

- Dividend Aristocrats and Dividend Kings are surging, with KO appreciating more than 20% year to date.

- KO’s valuation is aggressive, trading above 25x earnings and a historically low dividend yield.

- KO has increased the dividend for more than six decades, averaging nearly 5% annual growth over the past decade.

- Despite KO’s established business, the company is priced aggressively and faces considerable risk stemming from a looming tax decision.

Eoneren

Dividend Stocks Are Hot!

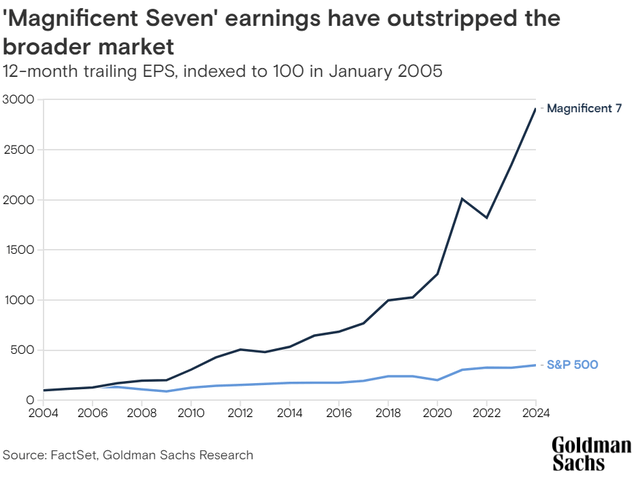

Over the past twelve months, we have published a variety of articles focusing on the dominance of the technology sector and the corresponding concentration of the S&P 500. In the post pandemic era, growth has trounced value year after year. However, as we discussed in this recent article, the market dominance has largely been isolated to some of the largest companies in the world. As it turns out, the Magnificent Seven stocks have led the market, largely on account of their earnings growth over the past two decades. As illustrated below, the growth over the past two years alone has been extraordinary.

However, the market has recognized this strength and these seven companies have accounted for an uncomfortably large portion of the index’s total return…until now.

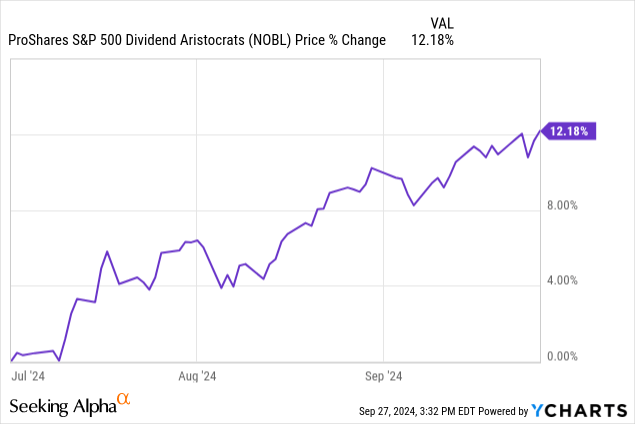

Following several years of lagging performance, dividend stocks have begun to surge. Some of the largest and most established dividend paying companies, such as the Dividend Aristocrats, have begun to make a run. For the initiated, Dividend Aristocrats are S&P 500 companies than have increased their dividends for more than 25 consecutive years. These qualifiers earn a company the title of Aristocrat and join a club that earns the attention of dividend investors. There are even a variety of ETFs that track investments based on these track records, such as the ProShares S&P 500 Dividend Aristocrats ETF (NOBL).

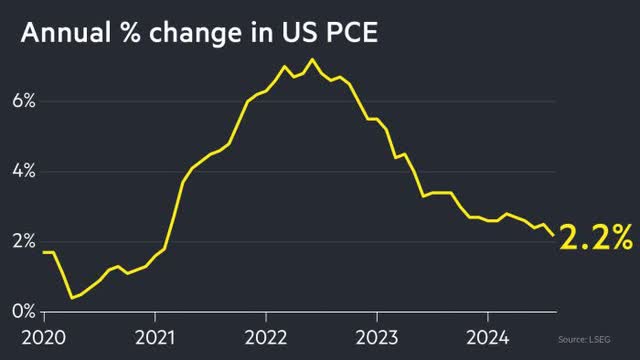

Since the beginning of July, NOBL has appreciated by nearly 13%, spurred largely by shifting sentiment around interest rates. The Federal Reserve recently made good on promises to cut interest rates and current inflation data is increasingly encouraging.

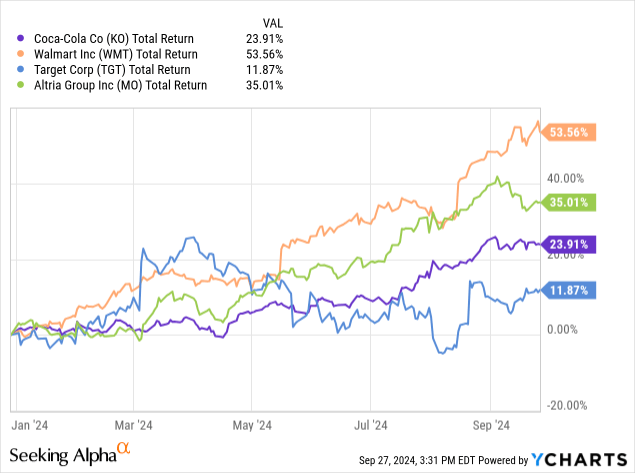

Based on NOBL’s portfolio, there are 68 companies in the S&P 500 which have met the criteria to become a Dividend Aristocrat. However, the purpose of today’s discussion is to touch on a more exclusive and impressive category of dividend paying companies, Dividend Kings. While Aristocrats have raised their dividends for 25 years, companies must reach 50 years to be crowned a king. This narrows the list considerably to a shorter list of recognizable names including Target (TGT), Walmart (WMT), Altria Group (MO), and Coca-Cola (NYSE:KO). These four names have performed similarly well, each charging forward to double digit year to date returns. However, the year to date performance has stretched valuations and set lofty expectations for future earnings growth.

Today, we will focus on KO, exploring the company’s current valuation, dividend yield, and current risk factors.

A Brief History

KO is one of the world’s oldest operating beverage manufacturers, with a rich history that dates back to Atlanta, Georgia. Fast forward and Coca-Cola is one of the largest beverage companies in the world. The company now offers more than 500 unique brands in more than 200 countries. While the flagship Coca-Cola product line remains the foundation of its global business, the company has diversified significantly across water, tea, and even alcohol. An important aspect of KO’s business is their use of partner enterprises such as bottlers, distributors, and wholesalers. One of the largest bottling partners is Reyes Coca-Cola Bottling which operates more than 50 facilities, bottling more than 325 million cases annually.

The company operates the following product lines.

The company sells its products under the Coca-Cola, Diet Coke/Coca-Cola Light, Coca-Cola Zero Sugar, caffeine free Diet Coke, Cherry Coke, Fanta Orange, Fanta Zero Orange, Fanta Zero Sugar, Fanta Apple, Sprite, Sprite Zero Sugar, Simply Orange, Simply Apple, Simply Grapefruit, Fresca, Schweppes, Thums Up, Aquarius, Ayataka, BODYARMOR, Ciel, Costa, Dasani, dogadan, FUZE TEA, Georgia, glacéau smartwater, glacéau vitaminwater, Gold Peak, Ice Dew, I LOHAS, Powerade, Topo Chico, AdeS, Del Valle, fairlife, innocent, Minute Maid, and Minute Maid Pulpy brands.

The company has grown to become one of the most ubiquitous food and beverage brands on the planet.

Current Valuation

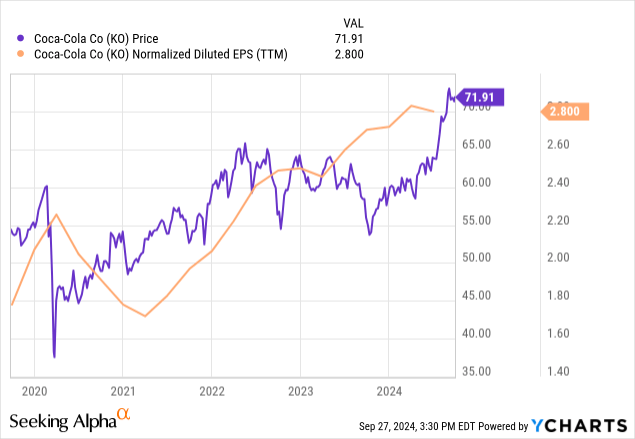

Year to date, shares of KO have appreciated by more than 22%, marking one of the strongest years of price performance in recent history. The run has been fueled by two primary factors, earnings growth and expansion of KO’s earnings multiple.

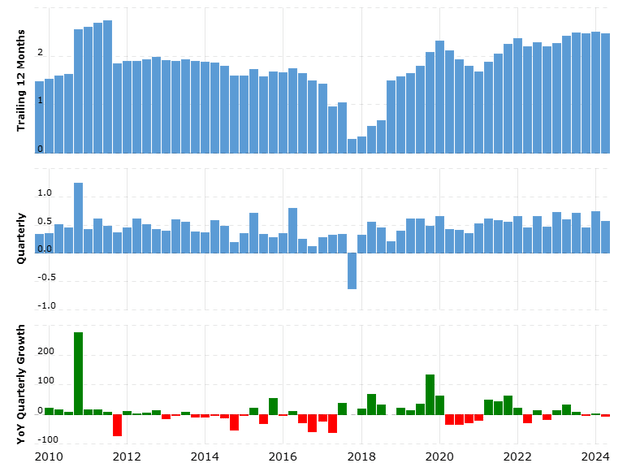

Frist let’s explore KO’s earnings growth. In 2023, KO reported earnings per share of $2.47, a 13% increase over reported earnings from 2022 and a 10% increase over 2021. Over a period of ten years, KO grew earnings consistently. In 2014, KO reported earnings per share of $1.60, corresponding to an increase of 54% over the course of the past decade or a compound annual growth rate of 4.4%.

Earnings growth has been a critical piece of the puzzle for KO, supporting the long term growth of the company’s dividend. Historically, earnings growth has outpaced inflation and the growth of the company’s dividend, both of which are important markers for long term growth and sustainability.

KO’s earnings growth over the past twelve months has been nearly triple the average over the past decade. This growth has fueled a substantial run in shares of KO over the past twelve months, appreciating more than 20% during the period. KO’s price appreciation has exceeded their TTM earnings per share growth, by a factor of two.

Forward earnings growth is expected to be strong and continue outpacing historical numbers. Consensus estimates put 2024 earnings per share at $2.85 an increase of 15% over the prior year. Estimates for 2025 put earnings per share at a $3.05 per share, another increase of 7% over next year’s earnings.

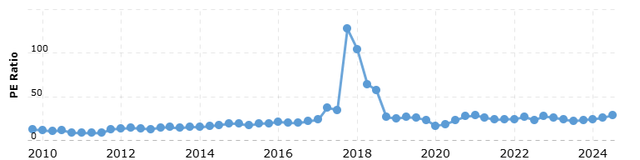

As price appreciation blows past earnings per share growth, it has caused KO’s price earnings multiple to balloon. Today, KO is trading above 25x earnings, the highest price earnings multiple in several years. Based on 2024 and 2025 forecasted earnings, KO’s price earnings multiple is 25x and 23x, respectively. To put this in perspective, the price earnings multiple based on 2025 consensus earnings is above the average multiple of the past five years. This means if shares remain flat and KO delivers on earnings estimates, the company’s price earnings multiple will return to the mean.

As shares continue to surge past $70 per share, KO has set lofty earnings expectations that leave little room for upside. With earnings expected to surge past historical averages over the past five years, anything short of this goal could disappoint investors. Based on the current multiple above 25x, KO could fall significantly. If KO shares were to revert to a price earnings multiple of 20x based on forward earnings estimates, shares would decline by more than 20% dipping below $60 per share.

Dividend Analysis

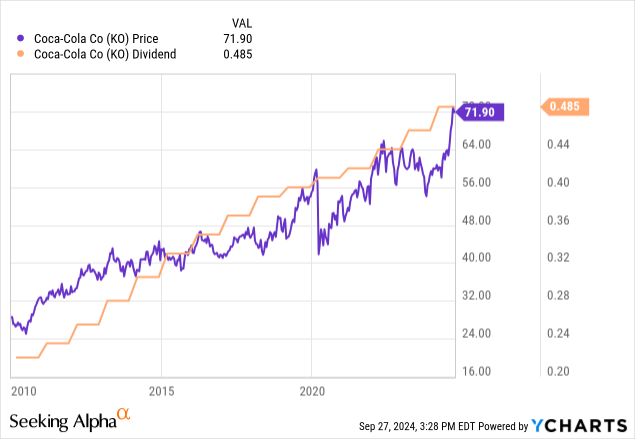

KO is one of the market’s quintessential dividend stocks. This Dividend King has increased the quarterly dividend for more than six decades, becoming one of the most impressive and prolific dividend increasers. The company’s dividend has also played an essential role in long term performance providing a buoy for the company’s share price. Consistency has been a hallmark of KO’s dividend, not just in terms of payment, but consistency of increases to the dividend.

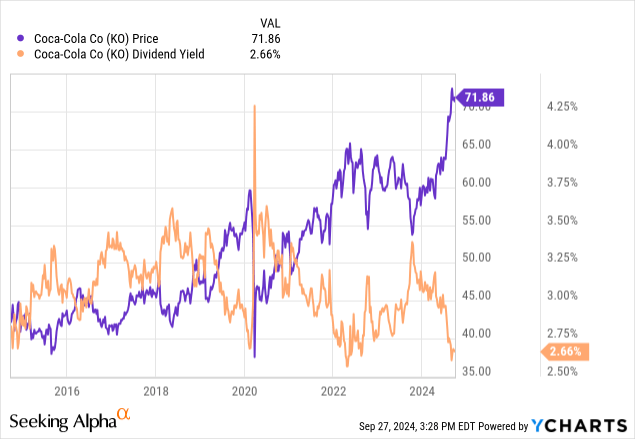

With few exceptions, KO’s dividend yield has remained within a range of 100 basis points fluctuating from 2.5% to 3.5% based on current share prices. Over the past decade, this range has held without failure, save one period during the depths of the pandemic when KO yielded over 4%. Putting aside extraordinary circumstances, the consistency of KO’s yield has been recognizable.

However, when overlayed against KO’s share price, we see a divergence. Shares have increased by more than 66% over the past ten years, but the company’s dividend yield has remained flat. The explanation is growth. Over the past decade, KO’s dividend has grown by nearly 5% annually. As the dividend grows and yield remains locked within a range, shares of KO must appreciate alongside the dividend. Connect KO’s 4.8% dividend growth rate to the company’s ten year earnings growth rate of 4.4%. The similarity corroborates the assertion that KO’s share price increases alongside earnings growth and dividend growth.

The connection between earnings growth and dividend growth also brings up the issue of sustainability. After increasing the dividend for more than six decades, KO’s dividend looks like a runaway freight train. Sustainability is generally measured by the dividend payout ratio, calculated by taking the dividend as a percentage of net income. KO currently distributed around 67% of net income as a dividend to shareholders. Compared to other Dividend Kings, such as MO who pays 80% of net income, KO’s dividend is conservative. This leaves flexibility for future dividend funding in the face of uncertainty.

Based on current share prices, KO is yielding 2.72%, towards the bottom of the historical yield range. The current dividend of $0.485 per share has been paid for the first three quarters of 2024. Given KO has a relatively obvious cadence of dividend increases, the final dividend of the year is likely to remain at $0.485 per share. The first quarter of 2025 should mark another dividend increase for KO. Based on the historical payout ratio of ~70% and consensus estimate for 2024 earnings of $2.85 per share, I believe KO’s dividend for 2025 will be set at $0.50 per share, achieving an important milestone of the $2.00 annual dividend.

This forecasted increase to the dividend would still leave KO with a forward yield of less than 3%, below KO’s longer term historical average. Additionally, as outlined above, forward earnings estimates still leave KO trading near the top of its historical multiple range. From each angle, KO is looking expensive.

Risk Factor

KO is still facing significant trouble over a looming tax issue which has been in locked up in court. Recently, KO announced that it could be liable for $6 billion in back taxes and interest to the IRS following the final decision in a case dating back almost two decades. The IRS believes KO owed unpaid taxes and interest dating back to 2007-2009. KO recently released a press release with more details about the case.

The U.S. Tax Court today completed the next step in the legal process by entering a decision in the ongoing tax case between The Coca-Cola Company and the U.S. Internal Revenue Service. The decision reflects a liability of approximately $2.7 billion. With applicable interest, the total amount is anticipated to be approximately $6.0 billion.

Coca-Cola strongly believes the IRS and the Tax Court misinterpreted and misapplied the applicable regulations involved in the case and will vigorously defend its position on appeal. The company has 90 days to file a notice of appeal to the U.S. Court of Appeals for the Eleventh Circuit. The company looks forward to the opportunity to begin the appellate process and, as part of that process, will pay the agreed-upon liability and interest to the IRS.

On Sept. 17, 2015, the company received a notice from the IRS seeking approximately $3.3 billion of additional federal income tax for years 2007 through 2009. In the notice, the IRS stated its intent to reallocate over $9 billion of income to the U.S. parent company from certain of its foreign affiliates retroactively, rejecting a previously agreed upon methodology without prior notice to the company.

KO intends to enter the appeal process to fight the decision of the court. KO’s management and legal team expects that they will recover “some or all” of the $6 billion in taxes and interest that the company owes to the IRS.

Even though KO is one of the largest companies in the world, $6 billion is no laughing matter. In fact, $6 billion would account for the majority of KO’s $10 billion in net income from 2023. If KO were to owe this amount and split the payments over the span of a decade, it would still amount to a significant headwind against future earnings. With KO currently priced to perfection, this leaves little room for error. The current price multiple certainly does not imply that this risk factor could materialize.

Investor Takeaways

There are companies around the world which have established themselves as some of the most reliable, consistent, and downright impressive businesses. KO is one such company, having raised the dividend for longer than I have been alive. KO seems all but unstoppable in this scenario as one of the most powerful global brands. However, a powerful value proposition does not negate near term financial risks or overpricing by an exuberant market. In the case of KO, both risk factors exist. Based on current share prices above $70, KO is priced aggressively with an earnings multiple above 25x and a dividend yield below 3%. At these prices, KO offers limited upside, earning a Hold rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.