Summary:

- Coca-Cola stock is trading close to its historical 3% yield level.

- Coca-Cola recently reported strong organic sales growth, with an average of 7% per year over the last 5 years.

- The company has shown increased guidance and pricing power amidst continuing food inflation.

- Stock remains a “buy on weakness” story.

Anne Czichos

In my recent article on The Coca-Cola Company (NYSE:KO), I had highlighted three reasons the stock was a Buy despite weak price action YTD. The three reasons being:

- 3% yield

- PepsiCo’s (PEP)’s then just announced earnings and

- Technical signs

Since then, Coca-Cola has performed better than the market, losing about 0.50% compared to the market’s 1.50%. However, since that article, a few key developments have taken place, which warrants this follow-up article with three more reasons why I am re-iterating my “Buy” rating. Let us get into the details

Strong Organic Sales But Some Worries Remain

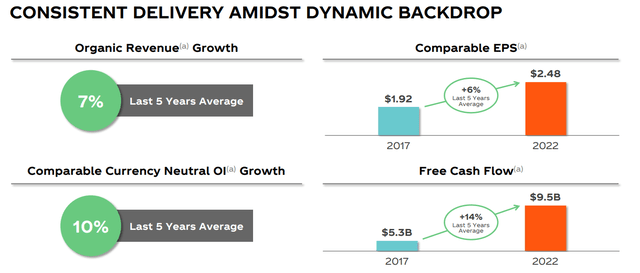

In the recently reported quarter, Coca-Cola smashed organic revenue expectations, which propelled the company to beat EPS by 6 cents and revenue by $250 million. As the company proudly reported in its Q2 investor presentation, over the last 5 years, it has reported:

- 7%/yr average organic revenue growth

- 6%/yr average EPS growth

- 10%/yr average operating income (assuming neutral currency)

- and most importantly for me, 14%/yr average growth in Free Cash Flow [FCF]

As I wrote in my Q2 preview article linked above, FCF was one of the items I was paying attention to since the payout ratio was getting a little concerning. Coca-Cola reported H1 (first two quarters) FCF of $4 billion, which just about barely covers the company’s half-yearly dividend commitment of $3.978 billion. However, Coca-Cola has alleviated my concerns a little bit with its full-year FCF guidance of $9.5 billion, which if met, places the payout ratio at nearly 84%.

Coca-Cola Delivery (investors.coca-colacompany.com)

While none of these numbers scream “high-growth” or a “double-bagger”, the company highlighted that it was able to accomplish the above under largely unforeseen combination of events in the last 5 years, including but not limited to COVID, war, political and trade tensions, and extreme economic policies (too soft to too hard in a span of months).

Coke Challenges (/investors.coca-colacompany.com)

It is the company’s ability to operate reliably through almost any situation that gives me the most confidence in sticking with Coca-Cola for the foreseeable future. As an example of this, Coca-Cola was earning 71 cents per share in 1998, a quarter of a century ago. Since then, the World in general and the stock market in particular have been through the following:

- Dot-com bubble

- Dot-com crash

- Financial crisis of 2008

- Extremely dovish Fed

- COVID crash

- Extremely hawkish Fed

But Coca-Cola’s EPS has tripled in this 25-year span, all the while paying increasing dividends to investors. That may not be seem enough when you see stocks go up 200% to 300% in a year (or even less) but many of those stocks cratered in 2022 (or other bearish years) and have not returned to their former glory. For example, Buy Now Pay Later stocks were all the rage in 2021 and Affirm Holdings, Inc. (AFRM) breached $170s back then. The stock is now trading at $14, having reached as low as $8 in the last 52 weeks. Coca-Cola, the company and by extension its stock, is designed to last for decades more, if not centuries. The company is unlikely to ever be the flavor of the month but has enough flavors to last a lifetime.

Increased Guidance And Higher Base

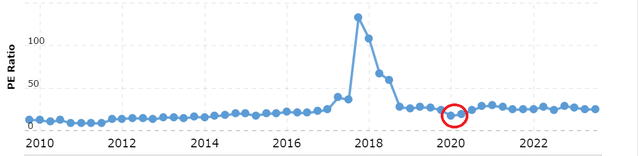

As part of its strong Q2 results, Coca-Cola also increased its full-year EPS and revenue guidance. While the company guided for ~$2.62/share, analysts now expect $2.64/share for the full-year. That means, the stock is trading at a forward multiple of 22.70 as of this writing.

This is significant because of two reasons:

- In the last 5 years, except the COVID dip highlighted below where the stock traded at a multiple of high-teens, Coca-Cola stock has never been as cheap as right now.

- As I’ve written in the past, proven dividend growth stocks like Coca-Cola have an unwritten “base-yield”, as the market tends to bid up the price of the stock to match the “usual” yield. For Coca-Cola, that base-yield is around the 3% mark as I explained here. Based on the current annual dividend of $1.84/share, the 3% price is $61.33 and the stock is trading ~1% below this price and I believe this may not last long. I mean, it took a COVID type event for the stock’s PE to lag in high teens and yield to cross 4%.

CO PE (mactrotrends.net)

Pricing Power Amidst Continuing Food Inflation, With Marketing Savvy

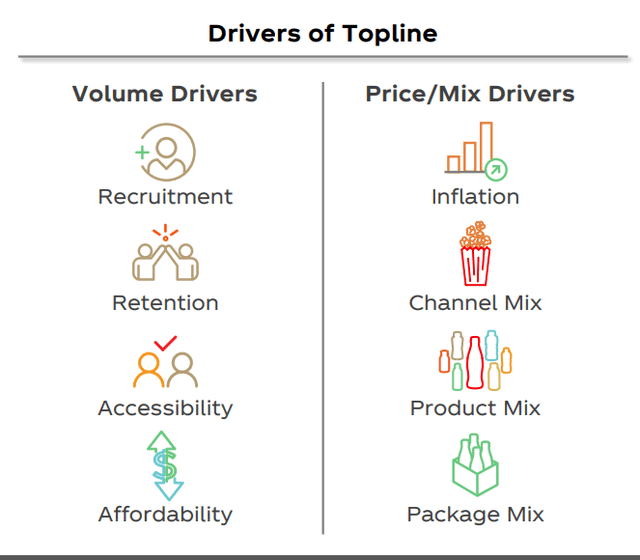

Food prices are still high, despite generally slowing inflation. As reported here by Seeking Alpha, this should benefit consumer based companies with pricing power. Not many companies can compete with Coca-Cola when it comes to pricing power and brand value. I find it interesting that Coca-Cola also recently highlighted dynamic pricing strategies (2nd image below) as part of its revenue growth management. Long time investors may recall that Coca-Cola tried and largely failed at implementing dynamic pricing at Vending Machines. It will be interesting to see if the company learns from its mistakes in the past where it basically conveyed profit was the primary reason behind the strategy. For example, when temperature soared, the heat-sensor in the vending machines would alert the price to be jacked up.

Since then, I believe Coca-Cola has gotten a lot smarter, sensitive, and inclusive in their marketing, which makes me believe the Hybrid pricing will not focus solely on profits this time. For example, the “Small World Machines” campaign at the height of political tension between India and Pakistan showed the company’s global awareness while acknowledging that it needed to expand its presence in Pakistan especially. Similarly, the “Share a Coke” campaign personalized the Coke experience.

But pricing power is just one of the many avenues the company uses to increase its topline as it focuses on other tangible aspects like accessibility/availability of its products along with hiring and retaining the best possible talent. In short, Coca-Cola undoubtedly has the pricing power but it needs to be careful in leveraging it while not exploiting it.

Topline Drivers (investors.coca-colacompany.com)

KO Dynamic Pricing (investors.coca-colacompany.com)

Risks

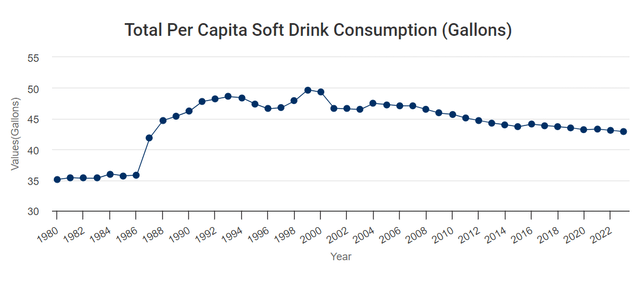

- Like Tobacco, Soft Drinks tend to be under constant attack. However, unlike Tobacco, Soft Drinks consumption is not declining as rapidly. But, the risk remains in that Coca-Cola should continue their efforts to diversify into other categories including juice, sports drink, and energy drink.

Per Capita (ibisworld.com)

- As much as Coca-Cola is a staple, it is still heavily reliant on a healthy consumer spending habits. While a general consumer weakness is bad for any company, soda sales did perform better than pricier drinks during the last full-recession (post-2008).

- Being a global giant is mostly an advantage but can be a disadvantage at times, like now. With the US dollar so strong against almost any currency, Coca-Cola faces strong currency headwinds as it reported in its recent quarter. For full-year 2023, Coca-Cola expects as much as 4% hit on revenue due to currency headwind.

Conclusion

I had rated the stock a “Buy” ahead of the Q2 earnings and the results have reinforced my faith in the company. There are a few red spots like the pressure on FCF but this company has shown it can navigate through the best and worst of environments. I remain invested with Coca-Cola and rate the stock a moderate buy between $60 and $63. Anything in the very high $50s would be a gift to back up the truck.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.