Summary:

- Coke posted a stellar 2022, with revenues up 11% year over year.

- Growth into 2023, however, seems less secure.

- We are excited about the company’s new venture into the alcoholic beverage market.

Georgiy Datsenko

Dividend Royalty

In the world of corporate household names, Coca-Cola (NYSE:KO) stands apart. From its universally recognized logo and products, to management’s successful efforts to expand the company’s holdings into energy drinks and water, to Warren Buffett’s famous adulation of the brand, Coke seems to occupy a league of its own in many ways. For a sense of Coke’s scale, 2.2 billion of the company’s beverage products are consumed daily.

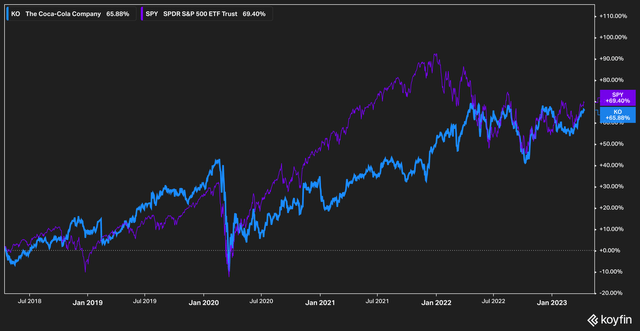

Incredibly, despite having a beta of only .55 (beta being a measurement of how volatile a stock moves in comparison with the broader market, with a measurement of 1 being equal to the market), Coke’s stock has largely kept pace with the S&P 500 (SPY) on a total return basis over the past five years.

Of course, past returns are not indicative of future performance, and the question that has dogged Coke for some time is, what’s next? How can a brand with such deep market penetration consistently grow? In this article we’ll dive in and see if the company today still represents an attractive investment.

Let’s dive in.

Overview & Valuations

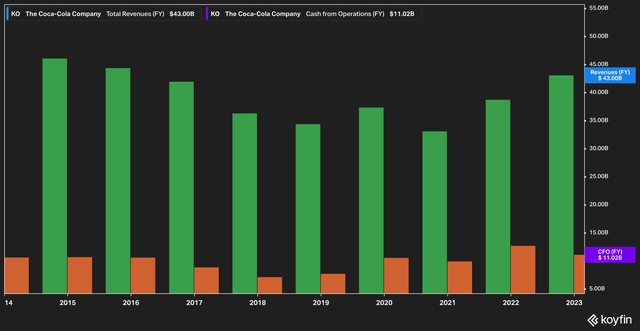

Gargantuan reach aside, Coke posted a very successful 2022, clocking in a roughly 11% increase in overall revenue.

While much of this growth was driven by passing on rising input costs to customers, management has a solid outlook for 2023. In the most recent conference call, they stated that shareholders should look for currency-neutral earnings per share of 7-9% versus 2022’s results, and organic revenue growth year-over-year of 7-8%.

Coke segments its business primarily by geography, but also categorizes product sales as either concentrate or finished product operations. Concentrate operations are largely meant for commercial end-users for resale to the public, while finished product operations are meant for vending machines, retailers, et cetera.

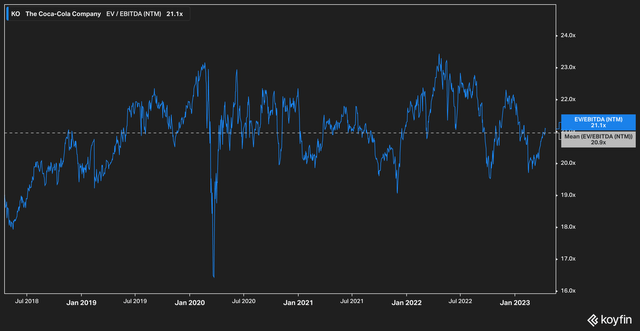

From a valuation perspective, Coke doesn’t seem like a major bargain at first glance.

On a forward EV/EBITDA basis, Coke currently trades hands at a multiple of 21 (competitor PepsiCo (PEP), for reference, trades at 17.8x). We generally prefer EV/EBITDA for valuation versus price to earnings because EV/EBITDA better reflects the math and assumptions an actual buyer of the company would utilize. For most companies, needing 21 years to pay back an investment sounds quite steep–but if the company you were buying were Coke, perhaps you would find the steep cost worth it.

At any rate, the valuation is pretty much in line with the historical average forward EV/EBITDA of 20.9x, which tells us that the stock is more than likely trading at a fair valuation.

What Have You Done For Me Lately?

Of course, Coke isn’t going to stay on top of the world simply by doing business as usual. So what does Coke have up its sleeve to continue to grow its already sizable market share?

Coke has proved flexible over the years, branching away from pure soda to incorporate bottled water and energy drinks (such as Monster and Powerade). One of the most obvious beverage categories that Coca-Cola has been absent from (as a manufacturer, anyway) is alcoholic drinks. That, it seems, may be changing.

The company announced recently that it would be venturing into the alcoholic arena, starting with a pre-mix version of the ever-popular Jack & Coke in partnership with Jack Daniels Distillery. The company trial launched this product in Mexico in early 2023 and reported better than expected results. The product starting appearing on U.S. shelves in March, 2023.

To be sure, the whiskey and Coke combination is a fairly ubiquitous drink–but is it enough to make a difference for a company the size of Coca-Cola?

Coke executives recently spoke at the CAGNY conference in New York, where CEO James Quincey gave some good insight into Coke’s strategy and mindset behind the launch. Here is his response when asked how the company thought about incorporating alcoholic beverage sales into the company. (The answer is a bit long, but we think worth the read.)

The way we think it is, of course, we only want to do this if in the long run, it can be material to the Coca-Cola company. We don’t need extra hobbies we need extra things that are material at scale. And so getting there, what we are setting ourselves is milestones. If I can get to X, then I believe it’s worth doing the next stage. If I can get to Y then it might make sense to go to Z or whatever, that’s on the road to something material in 2030 or whatever.

And so at the moment, we’re just in the very experimental stage. But what’s emerging as something that seems to function in the marketplace because it’s a very fragmented and somewhat chaotic sector, the kind of the ready-to-drink alcohol sector. But if you can see in the marketplace an idea of premixed cocktails of which Jack and Coke should be the tip of the spear. If that works, then you can argue there’s a premixed cocktail space.

You can argue there’s a hard sell space, although it tends to be concentrated in the U.S. And you can argue there’s a spiked version. Simply spiked all the kind of lemonade spiked version. If between all these experiments, we can see 3 clusters emerging that can be put together into something that makes sense for the consumers and the retailers then maybe there’s, we can get to the next milestone. We do want to be disciplined.

We want to have a lot of experimentation, but it got to turn into disciplined achievement of milestones, all in the service of demonstrating to ourselves that there’s a material endpoint. And we’re just at the beginning.

We think this response provides the kind of insight into the mind of the top-level executive that investors should want to see. It shows us that the process for developing these drinks is not simply some throwaway idea, but is part of a much larger strategic framework. It also shows us that the company has a more-than-passing level of commitment to this idea–should the Jack & Coke pre-mix drink fail to take off, the company will remain committed to finding a better idea that fits the space.

The Bottom Line

Coke is a world-class company with a solid management team that is bent on sustaining both the company’s brand position and securing its future growth. The company also appears to be fairly valued on a forward EV/EBITDA basis, which insinuates that long-term investors may find current prices attractive.

Risks to our thesis are a major failure by the company to make any headway into the alcoholic beverage market. Major disruptions to the Chinese economy or global geopolitical tensions resulting in boycotts of Western brands also poses a threat.

Investors looking to begin a position in Coca-Cola should consider these risks, of course, but we believe investors with a long time horizon may find KO stock attractive at this price point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.