Summary:

- Coca-Cola is targeting Generation Z, who are digitally savvy and document their lives on social media, as a key demographic for growth.

- The company has implemented strategies such as Studio X, a digital ecosystem, and marketing campaigns that resonate with Gen Z, resulting in increased brand value and strong recruitment of Gen Z drinkers.

- Despite economic challenges, Coca-Cola has seen strong financial performance, with earnings and organic revenue growth, improved gross margins, and increased penetration in key markets. The company’s dividend safety is also not a concern, with growing free cash flow to cover the dividend.

- Although FCF is expected to come in lower in 2024 than the prior year, I expect the company to repurchase a significant amount of shares this year, which should alleviate pressure on the dividend safety.

- I suggest those looking to invest in KO wait for a pullback near the $55 level, where I think the stock offers a margin of safety.

Riska

Introduction

Looking at the picture above, I think this is a perfect representation of Generation Z, snapping pictures of everything they do in life and documenting it on social media. So, what does this have to do with The Cola-Cola Company (NYSE:KO) you ask? Well, the Dividend King has been targeting Gen Z in its products and for good reason. And this generation, in my opinion, will be a huge part of the company’s growth going forward. In this article I discuss why the Dividend King has this generation in its sights and how it should impact their growth positively over the long-term.

Previous Thesis

I last covered KO roughly 6 months ago in an article you can read here where I rated the stock a buy. Then the stock was trading near $56 a share where I think it offered a decent margin of safety for investors. Since then, the stock has gone on to post their Q4 earnings closing out the year strong with some impressive growth we’ll discuss later.

They also awarded investors with a 6% upside for those bought during that time. In it I discussed the company’s total returns, 10-year dividend growth, and organic growth which made them the perfect stabilizer for a dividend-focused portfolio. Fast-forward 6 months later and we discuss the company’s financials, dividend safety, and why I think they are still a great stock to buy and hold at the right price.

Who Is Gen Z And Why Is KO Targeting Them?

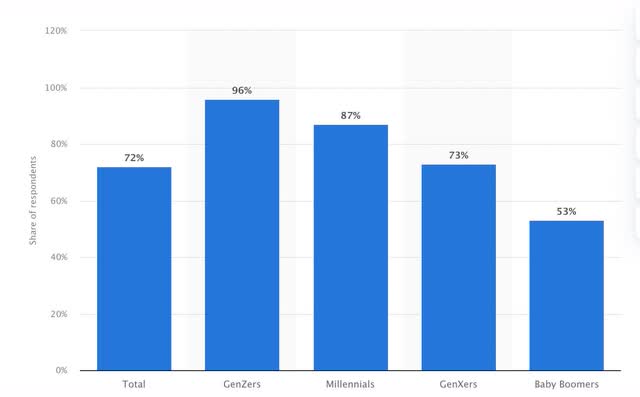

For those unfamiliar with Generation Z, they are the generation after Millennials, those born in the early 80’s to mid-1990’s. Generation Z are those born in the mid-1990’s to early 2010’s. In short, they are probably your nieces, nephews, children, or grandchildren depending on your age.

They are the age group more in tune with the digital world like AI, cellphones, and social media. The ones taking pictures documenting every step of their life. The ones never knowing a world without internet.

So why do I think KO is targeting them? One reason is that they are growing up. And this means they will likely be a big part of the labor force going forward. But the biggest reason is they document everything on social media and will likely define AI adoption.

Because they shape the culture through the internet, this is all promotion for Coca-Cola. And they are also huge consumers. They love to travel and enjoy experiences, which can translate to large spending. And like any business, without consumers KO cannot grow efficiently. So, they have to adopt new metrics to change with the population, and those changing consumer habits.

One way to do this is by targeting a certain group of people. To me it’s no different than businesses like Starbucks (SBUX), Realty Income (O), Visa (V), or Apple (AAPL) targeting growth initiatives in countries like India, China, Europe, or Latin America.

And KO has been making smart business moves as such. In 2023 they stood up Studio X, the digital ecosystem to recruit their next generation of drinkers. Their marketing has shifted from a TV centric model to a digital first organization that balances local intimacy, scale, & flexibility. In the US, Sprite was named as the #1 one beverage brand by Gen Z drinkers. In fact, it’s the drink my son always orders when we go out.

And their Studio X is driving tangible results. Coke studio taps into consumers’ passion for music as the campaign uses digital portals to access real experiences, and this has generated more than 1.2 billion YouTube views. And who do you think uses the YouTube platform the most?

You guessed it. Gen Z, resulting in strong recruitment which caused the Coca-Cola brand value to increase to $8 billion, making the company the 10th most valuable brand in the world.

statista

Financials

This recruitment also resulted in strong growth in the company’s financials in 2023. Earnings grew 8% while KO saw 12% organic revenue growth as well. They saw strong demand in Australia, India, Latin America, Japan, and South Korea despite the challenging economic backdrop.

Furthermore, Coca-Cola managed to increase penetration in Latin America, resulting in volume growth of 4%. Comparable gross margins were also up 140 basis points. They reported EPS of $0.49 during Q4 earnings back in February, nearly 9% higher than the $0.45 in Q4 22.

This brought the total non-GAAP earnings to $2.69, up from $2.48 at the end of 2022. And this was despite currency headwinds of 13%, which was impressive in my opinion. As consumers become most cost & value conscious because of inflation and higher interest rates, KO still managed to post some impressive growth year-over-year.

Total revenues also grew more than 6% to $45.7 billion, up from $43 billion year-over-year. Another thing that impressed me is how the company managed to improve its balance sheet lowering their leverage to just 1.7x EBIDTA, below their targeted range of 2x – 2.5x. This also declined from 1.8x in 2022 and is lower than peer, PepsiCo’s (PEP) leverage level of more than 2x.

Dividend Safety

I know some analysts were worried about KO’s dividend safety with the dividend increase announcement back in February with $0.485, up from $0.46 prior. This represents 61 years of growing the dividend. I’ll admit I too had some concerns with the growth outlook and dividend safety, but the impressive growth they had last year targeting Gen Z drinkers, I think their dividend safety is of no concern.

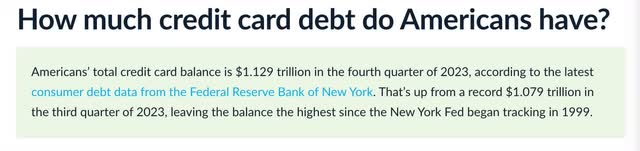

Coca-Cola managed to grow their free cash flow in 2023 by more than 2% despite headwinds. And while 2% might not seem like much, it is impressive considering the economic backdrop that consists of inflation, high interest rates, and surging credit card debt, causing tighter consumer spending.

lendingtree

Free cash flow was up to $9.7 billion and although this is expected to be lower in 2024 due to higher CAPEX, using the company’s shares outstanding according to their 10-K, KO needs roughly $8.4 billion in FCF to cover the dividend.

And even if FCF does decline to $9.2 billion as expected, the dividend will be completely covered. Yes, their FCF payout ratio will be elevated above 90%, but I expect the company will continue with their share repurchases, buying back a sizable amount similar to 2023.

Management addressed this saying they would be flexible in their share repurchases. But I think they will repurchase a decent amount going forward which should alleviate some pressure from the dividend payout ratio. Traditionally, investors prefer companies with lower payout ratios and KO’s has hovered near 80% over the past 5 years and decreasing their share count will allow for a lower payout ratio.

Of course this is all speculation and the economy or company could experience a downturn in the near future that could also affect this. Their healthy balance sheet also gives them financial flexibility as the company has nearly $9.4 billion in cash & cash equivalents with an A-credit rating.

Valuation

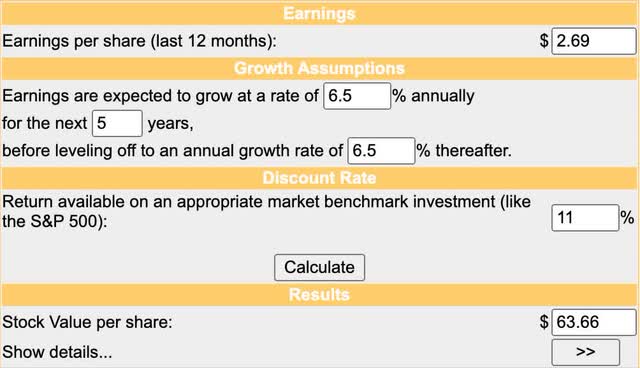

Coca-Cola’s non-GAAP P/E at the time of writing sits at 22.4x, above the sector median’s 18.8x, but below their 5-year average of 24.64x. This means the beverage giant has a fair value of roughly $66 a share, giving investors some upside from the $60 where it currently trades.

This is also similar to Wall Street’s price target of roughly $66 a share. Me personally, I like KO near the $55 level for a margin of safety but if interest rates are cut soon then I can see investor sentiment becoming more positive in the market pushing the stock price near $70.

Seeking Alpha

Using Seeking Alpha’s earnings estimates growth rate of roughly 6.5% for the next 5 years and a ROR of 11%, slightly higher than the S&P’s average of 7% – 10%, I have a price target of roughly $64 a share for KO. With their globally-recognized brand and investor sentiment expected to shift with 3 rate cuts still expected this year, I think an 11% expected rate of return is not out of the realm of possibility.

moneychimp

Risks

One risk KO faces is if the economy falls into a recession. With job losses expected, this could impact the company negatively going forward. Some have been predicting a recession for years now but I wouldn’t be surprised if we got one in the near term as job losses tick up. The economy has been holding strong with job growth recently, but I expect this to slow in the coming months.

Furthermore, with FCF already expected to fall for 2024, this would put more pressure on the dividend coverage if this comes in lower than expected. If so, their share price could also see some volatility leading those who are buying here to some capital losses. That’s one reason I prefer the stock near $55 a share, but this is all dependent on how the economy fares in the coming months. However, this is something investors should be aware of going forward.

Investor Takeaway

Coca-Cola is a globally-recognized brand that has been focusing on growing its brand targeting Gen Z drinkers. With many getting older and the economy shifting to AI and other advanced technologies, this is a smart move on the company as this generation plays a huge part in their marketing.

Furthermore, KO managed to post some impressive growth year-over-year, resonating well Gen Z despite headwinds. They also increased their dividend for the 61st time and expect organic revenue growth of 6% to 7% in 2024.

If the economy does get better with interest rates expected to decline and manage to dodge a recession, then the stock should see some nice upside closer to $70 a share as investor sentiment shifts positively back into the market.

If the economy falls into a recession, the share price could see some volatility, especially if cash flows are suppressed or come in lower than expected. I like the company near the $55 level where I think the stock offers a nice margin of safety therefore leading me to a rating of Hold for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.