Summary:

- I cautioned investors about buying further into Coca-Cola stock in January 2023 as its valuation and price action were no longer attractive. My downgrade has panned out accordingly.

- Astute investors correctly anticipated the late 2022 bottom in the S&P 500 as they rotated from the crowded risk-off trades to the unloved risk-on ones.

- As a defensive stock, KO has suffered as the market’s doom and gloom fears dissipated, and rightly so. KO was overvalued in late 2022 and early this year.

- However, KO is no longer overvalued, suggesting value-conscious buyers could return to help stem the recent selloff.

- I argue why investors who resisted the urge to buy heavily into KO earlier this year should look closely at KO at the current levels. Upgrade to Buy.

Justin Sullivan

I last updated investors on The Coca-Cola Company (NYSE:KO) in early January as I downgraded the stock following its recovery from its October 2022 lows. I reminded investors that its price action and valuation were no longer attractive.

As such, the rotation into risk-on stocks has led to significant underperformance in KO and its consumer staples (XLP) peers. However, I wasn’t caught napping by the rotation. I updated investors in a Consumer Discretionary Select Sector SPDR ETF (XLY) article in early December 2022 to prepare for a rotation back into risk-on stocks.

I highlighted to investors that the time to board the XLY train was timely, given the market bottom in October 2022. Therefore, astute market operators who correctly anticipated the bottom in the S&P 500 (SPX) (SPY) in late 2022 would have expected to seize opportunities in risk-on sectors like the XLY and abstain from adding to crowded defensive sectors like the XLP.

I even emphasized:

The XLY has consistently outperformed its XLP peers out of previous bear market/deep market pullbacks since the Great Financial Crisis. Notably, as seen in the XLY/XLP’s long-term chart, it bottomed in November 2008, well before the market bottom in spring 2009. – XLY: Un-loved sectors bottoming out – Part 2 by JR Research

As such, I’m glad to see the underperformance of KO, even though Coca-Cola posted a solid second-quarter or FQ2 earnings release in late July 2023. Why? Because it shows that the market is functioning according to how it should be, risk-off to risk-on, as the doom and gloom dissipates, rotating from crowded trades to the previously un-loved ones. Investors who hopped on the defensive train in late 2022 as the XLP topped out should consider this a valuable lesson in assessing investor psychology to help improve their risk/reward profile.

Accordingly, KO fell further from its July 2023 earnings release, revisiting lows last seen in February 2023, likely compelling weak holders to exit quickly. As such, the risk-off trade is getting swiftly unwinded, even though I gleaned that the opportunity to turn more constructive on KO is opportune. Makes sense? Recall the adage, “Buy when there’s blood in the street.” Blood is undoubtedly spilling now among KO investors, allowing us another opportunity to assess the appeal of the current levels.

Analysts’ estimates suggest business as usual for wide-moat Coca-Cola. Accordingly, Coca-Cola is estimated to post a 7% CAGR in its adjusted EPS from FY22-25, indicating a solid franchise. Its ability to deliver highly robust pricing action in Q2 underscores its competitive advantage and market leadership. Management’s growth diversification into growth product categories and higher-growth geographical regions demonstrates its commitment to driving sustainable shareholder value. Coca-Cola also invests wisely in innovation and revenue growth management to lift operating leverage.

Hence, KO’s fundamentals have remained robust, notwithstanding its market underperformance. Despite that, it’s critical to remember that no matter how solid the company is, KO was overvalued in late 2022. However, the downward de-rating has normalized its overvaluation, taking the heat off as weak holders departed.

Accordingly, KO last traded at a forward EBITDA multiple of 18.5x, slightly below its 10Y average of 19x. It took us back to valuation levels last seen in late 2021 before KO outperformed its risk-on peers as we fell into a bear market. In other words, KO is assessed to be within the fair value zone.

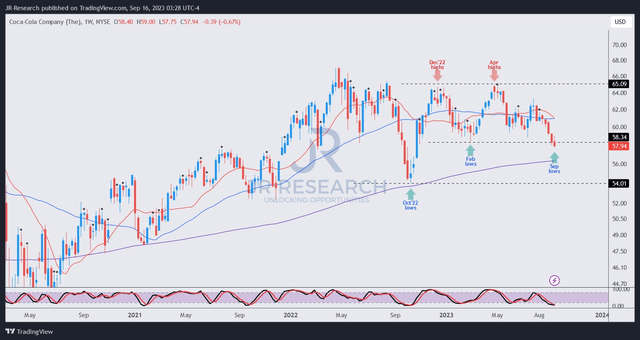

KO price chart (weekly) (TradingView)

To be clear, I have not gleaned a validated bullish reversal in KO’s price action, suggesting buying sentiments have improved significantly. In other words, investors considering a buying opportunity now must be prepared to average down.

I assessed that KO buyers need to hold the $58 level firmly over the next four weeks to ascertain the robustness of the support zone. Failing this, I expect it to consolidate above its previous October 2022 lows, and thus, I am not expecting it to drop back to those levels.

While it’s still too early to ascertain where its next drop zone could occur, I believe it makes sense for investors to concur that KO’s risk/reward profile looks much more attractive after the steep decline from its December 2022 highs.

Rating: Upgraded to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!