Summary:

- The Coca-Cola Company announced its 62nd consecutive annual dividend increase, surprising with a 5.40% increase to 48.50 cents per share.

- The company’s payout ratio based on trailing twelve months of free cash flow has increased to 85.71%, raising concerns.

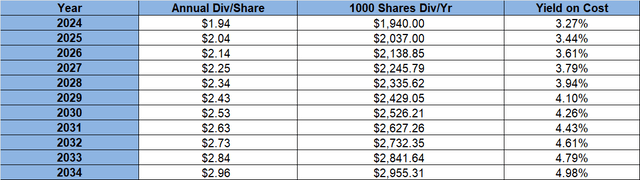

- The projected yield on cost for someone buying Coca-Cola stock today is close to 5%, with expectations of a 5% dividend growth rate for the next 3 years.

- With the increased dividend, I’d be interested in buying more of this stock at $55.

Justin Sullivan

My grandpa was always punctual, sometimes to a fault. I recall him showing up at a few parties before the guests arrived, but he didn’t mind as long as he was on time. “You could set your clock by me,” he used to say proudly. It has been more than two decades since he passed, but the life lessons my family learned from him are for eternity. My grandpa was never much of an investor, although he was a compulsive saver.

Had he invested, I’d go out on a limb and say The Coca-Cola Company (NYSE:KO) would have been one he admired. After all, increasing dividends for 60+ years is commendable by and of itself, but to do so in an extremely predictable manner (both the amount and timing of increase) is truly to be admired.

Coca-Cola has once again announced its dividend increase on the third Thursday of February. To be specific, the company has just announced its 62nd consecutive annual dividend increase as Seeking Alpha has covered here. I recently previewed this expected annual dividend increase and projected a 4.34% dividend increase to 48 cents. But Coca-Cola has surprised on the upside by dishing out a 5.40% increase to 48.50 cents. Not too shabby. As I’ve written in the past, retirees can predict and count on Coke’s annual dividend increases to the day and cent if history and recent numbers are studied carefully.

Let’s see how the numbers look after this increase.

- Current outstanding share count is at 4.307 Billion.

- The new quarterly dividend is 48.50 cents per share.

- That would represent a commitment of $2.088 Billion/quarter towards dividends (4.307 Billion shares times 48.50 cents).

- Coca-Cola’s average quarterly FCF (free cash flow) was $2.436 Billion using the most recent 4 quarters, which would represent a payout ratio of 85.71% ($2.088 B divided by $2.436 B). This number has gone up by nearly three percentage points compared to my 2023 review, when the payout ratio based on trailing twelve months FCF was 83%. An increasing payout ratio is definitely concerning if it is becoming the trend, but how do things look using a five-year average quarterly FCF? Coca-Cola recorded an average quarterly FCF of $2.381 B over the last 5 years, which gives it a payout ratio of nearly 88%. Ouch! But, at least this latter number is better than the 90% at this time last year.

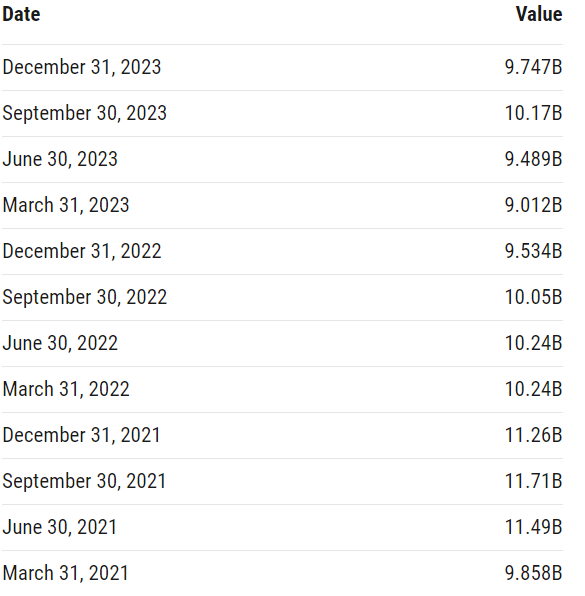

- In my 2023 dividend increase review, I mentioned that the FCF deceleration in 2022 was understandable with the COVID-19 tailwind petering off and that I’d be watching 2023’s FCF to see if the downtrend got reversed. 2023’s FCF came in at $9.747 billion for the year compared to $9.534 billion in 2022. So, a small improvement, but one that I’d take given the ever-increasing dividend.

- Using forward earnings per share projections of $2.81 per share, a new quarterly dividend of 46 cents per share would represent a payout ratio of 69%, two percentage points lower than this time last year. That’s a bit of a relief after how the FCF-based numbers looked above.

- In summary, Coca-Cola once again has proven its reliability by sticking to its annual dividend increase, down to the day. That Coca-Cola has better EPS-based coverage than FCF-based coverage tells me that the company is operating with more discipline. However, I’d still like to once again highlight the fact that FCF has declined noticeably since 2021. Between March 2021 and September 2022 quarters, all but one quarter recorded at least $10 billion in Trailing Twelve Months [TTM] FCF. And since then, only one TTM period out of five has breached the $10 billion mark. This, coupled with the fact that the dividend has gone up from 42 cents/share/quarter to 48.50 cents/share/quarter has pushed the payout ratio to concerning levels.

KO TTM FCF (YCharts.com)

Extrapolation

This section looks at the projected yield on cost for someone buying Coca-Cola today assuming a 5% dividend growth rate per year for the first 3 years and 4% thereafter. The expected yield on cost has inched close to 5% compared to 4.40% during last year’s review. This is down to two reasons: higher than expected dividend increase this year, which gives me a bit of confidence to bump up the next 3 years’ expectations to 5%/yr.

Conclusion

I am surprised (and happy) with The Coca-Cola Company’s greater than 5% dividend increase, but I am not scared to admit that I am more concerned than ever at the payout ratio, especially based on the recent FCF. Does it mean I am willing to bail out of this investment? Not quite, for many reasons including capital gains taxes and a higher yield on cost. But at the same time, I am reluctant to push new funds into this stock right now. I’d be willing to invest new funds into Coca-Cola stock at $55, which should net a beginning yield of 3.50%.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.