Summary:

- Nike is a highly successful company with a market cap of $160 billion and a strong track record of returns.

- The company’s commitment to innovation, brand recognition, and efficient operations contributes to its success.

- Despite challenges such as subdued consumer sentiment and elevated inflation, Nike has demonstrated resilience and adaptability in its financial performance.

ROSLAN RAHMAN/AFP via Getty Images

Introduction

It’s time to discuss a company I have never discussed before. That company is NIKE, Inc. (NYSE:NKE).

Although I like its shoes, I’m not necessarily a fan of the industry it operates in. The footwear & accessories industry is highly competitive and often relies on a company’s ability to promote its products.

As most of my readers know, I like to buy companies that go further up the supply chain to avoid some of these risks.

That said, NKE is a beast.

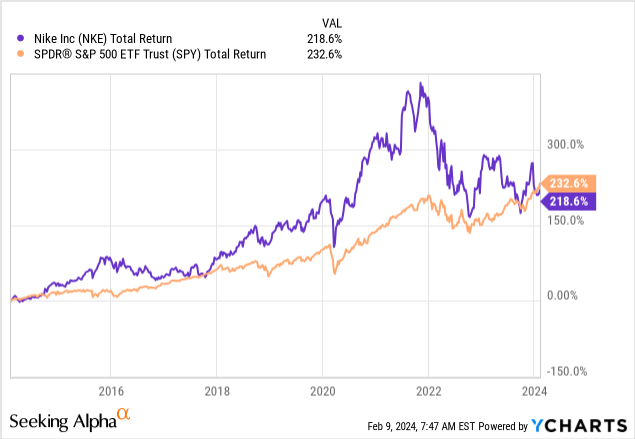

With a market cap of roughly $160 billion, the stock has returned 14.9% per year since 2003, which makes it one of the best sources of wealth.

However, going back ten years, NKE has returned 219%. While that is not a bad performance, the S&P 500 has returned 233%.

This underperformance is unusual and a result of two major issues:

- After the pandemic, NKE’s stock soared higher, supported by eager consumer spending. This priced in a lot of growth, negatively impacting the valuation.

- Due to higher inflation after 2021, consumer sentiment plummeted, hurting the company’s sales.

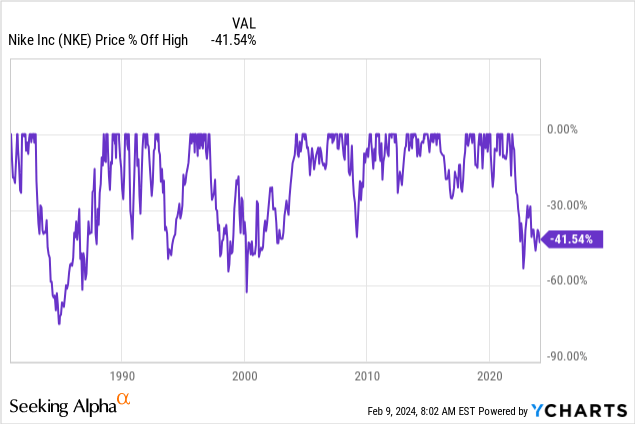

That said, the chart below shows the correlation between University of Michigan consumer sentiment (the red line) and the distance (in %) Nike is trading below its all-time high.

TradingView (University of Michigan Confidence, NKE)

As we can see, while consumer sentiment is attempting to start a recovery, Nike shares remain roughly 40% below their all-time high, making it one of the worst sell-offs in its history.

With that in mind, although I believe that prolonged above-average inflation and an unfavorable rate environment could keep consumer sentiment subdued on a prolonged basis, I’m consistently looking to buy high-quality consumer dividend growth stocks, which is an area significantly underrepresented in my portfolio.

In this article, we’ll dive into Nike’s financial performance, its dividend, and risk/reward.

So, let’s get to it!

A Dividend Stock With A Terrific Track Record

One of the company’s biggest strengths is (I’m paraphrasing the company here) its relentless commitment to innovation in product development.

The company invests heavily in research and development, continuously pushing the boundaries of design and technology to create cutting-edge footwear, apparel, and equipment.

Its innovation lab focuses on enhancing athletic performance, improving comfort, and reducing environmental impact.

While this sounds like a sales pitch, its products are actually very good. I know a few people who have felt tremendous benefits after using Nike footwear for heavy-duty tasks like running marathons.

They also look very cool, I think.

On top of that, the company has one major advantage: brand recognition.

According to the company, its iconic Swoosh logo and slogan, “Just Do It,” embody the brand’s ethos of empowerment, athleticism, and excellence.

Essentially, the company believes that its “brand equity” translates into a loyal customer base and provides it with pricing power and resilience against competitors.

It also has one of the best-performing global footprints, consisting of NIKE-owned retail stores, online sales, partnerships with retail accounts, and distributors.

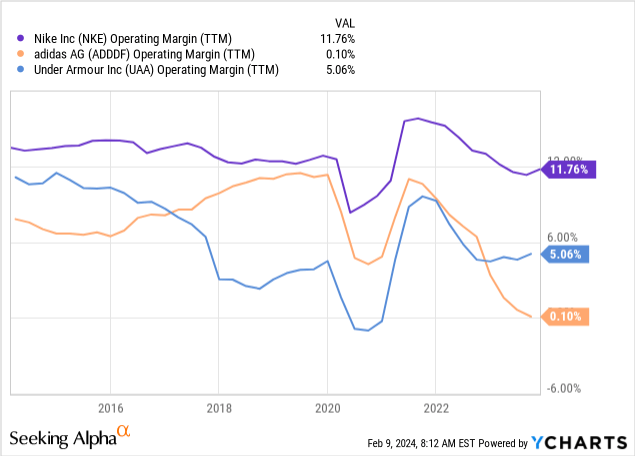

Looking at the chart below, we see that the company is also more efficient than its peers, with consistently higher operating margins.

Even from a dividend (growth) point-of-view, the company is attractive.

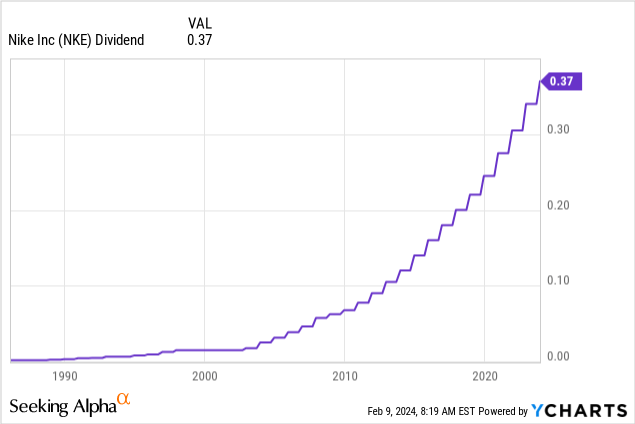

After hiking its dividend by 8.8% on November 15, Nike currently pays $0.37 per share per quarter. This translates to a yield of 1.4%.

This dividend is protected by a payout ratio in the low 40% range and comes with a five-year CAGR of 11.1%.

The dividend is also protected by a stellar balance sheet. In 2025, net debt is expected to be less than $300 million, which is barely 0.04x EBITDA.

It has an AA- credit rating, which is one of the best ratings in the world.

Moreover, although the company is no Dividend Aristocrat, it has a history of very consistent dividend growth.

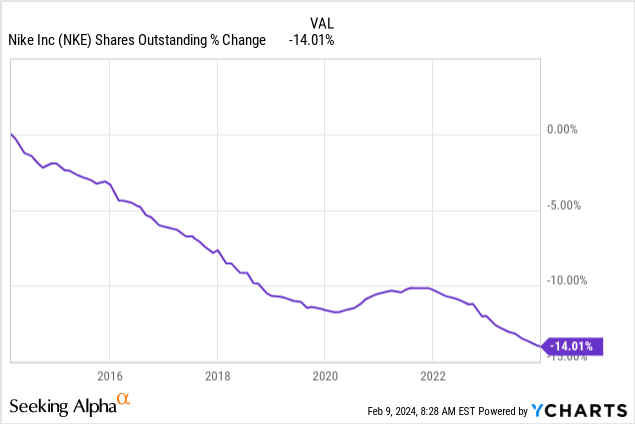

The company is also buying back stock. Over the past ten years, it has bought back 14% of its shares, which contributed to its strong stock price performance.

So far, so good.

Now, the question is how the company is doing in an environment of subdued consumer sentiment, sticky inflation, and elevated rates.

As we can see below, the mix of these factors has resulted in rapidly deteriorating credit quality. At first, it was just a post-pandemic normalization. Now, it’s worse.

Twitter/X (@KobeissiLetter)

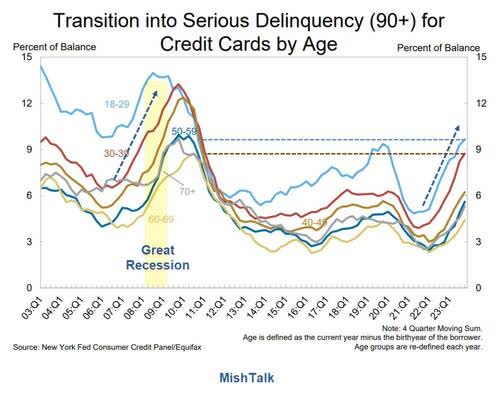

Especially, younger people are seeing elevated delinquency rates, as the chart below shows.

New York Fed Consumer Credit Panel

The good news is that Nike is doing quite well despite these issues.

Nike Remains In A Good Spot

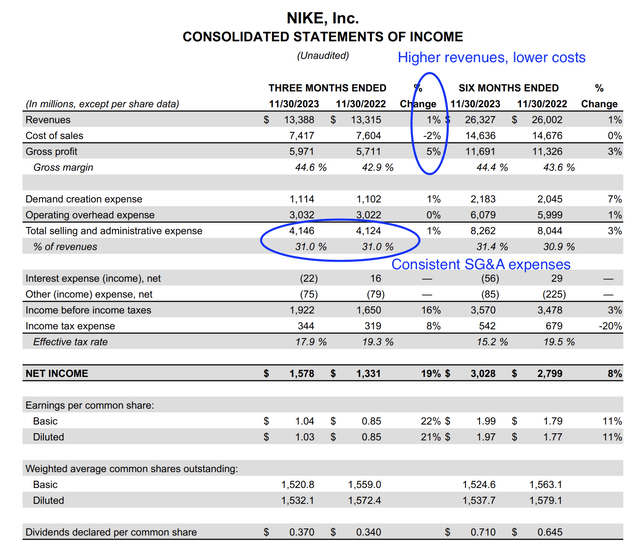

In December of last year, the company reported its 2Q24 earnings.

In the second quarter, the company reported a 1% increase in revenue compared to the previous year. This growth was attributed to proactive marketplace management and disciplined execution despite facing a highly promotional (read: challenging) environment.

Gross margins expanded by 170 basis points to 44.6%, driven by strategic pricing actions, lower ocean freight rates, and improved supply chain efficiency.

Meanwhile, earnings per share surged by 21% year-over-year to $1.03, reflecting the company’s focus on profitability and cost management.

NIKE Direct revenue grew by 4%, with stores up 9% and digital up 1%, while wholesale declined by 3%.

In other words, despite challenges, the company’s financial performance demonstrated resilience and adaptability in navigating market dynamics.

With that in mind, the company noted that consumer behavior showed resilience in higher-priced products, particularly footwear models priced at $100 or above.

Furthermore, Nike’s brand strength was evident during key shopping moments such as Double 11 in Greater China and the Black Friday-Cyber Week period.

However, softer demand outside these moments and increased promotional activity across the marketplace prompted adjustments in channel growth plans, which makes sense, given macroeconomic developments.

The good news is that despite challenges, Nike maintained lower markdown rates than many competitors and saw encouraging signs from recent consumer activations around new innovations.

Furthermore, with regard to my earlier comments on product innovation, Nike is somewhat sacrificing short-term revenue growth for longer-term earnings growth, as it intends to reduce the marketplace supply of key franchises to channel resources toward new products.

While this strategy may initially impact revenue growth, Nike aims to capitalize on consumer interest in new innovations and maintain its competitive edge.

But wait, there’s more!

The company also announced plans to identify opportunities for cost savings, aiming for up to $2 billion in cumulative savings over the next three years.

This includes initiatives such as simplifying product assortment, improving supply chain efficiency, leveraging scale, increasing automation, streamlining organizational structure, and enhancing procurement capabilities.

And as we look to drive greater efficiency and productivity, we will reallocate and invest the majority of these savings to deliver the greatest consumer impact on our largest growth opportunities. Ultimately, we believe that building a faster and more efficient NIKE will accelerate future growth and innovation and deliver long-term profitability, creating value for years to come. We will continue sharing updates over the coming quarters. – NKE 2Q24 Earnings Call

On top of that, the company is focusing on growth in the women’s segment and is working on expanding its Jordan brand to become the 2nd-largest shoe brand in the United States.

So, what does this mean for the valuation?

Valuation

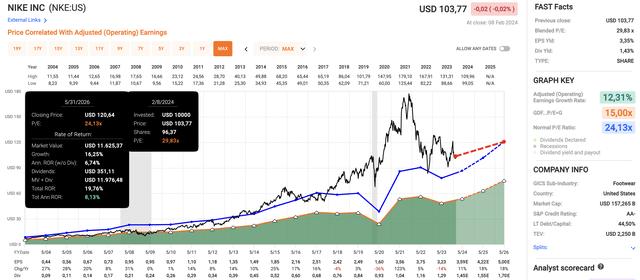

Using the data in the chart below:

- Analysts expect 2024 to see 11% EPS growth, which would be a significant improvement after a 14% contraction in 2023.

- Both 2025 and 2026 are expected to see 18% EPS growth.

- Currently, NKE trades at a blended P/E ratio of 29.8x, which is well above its long-term normalized P/E multiple of 24.1x. Especially after the pandemic, the stock diverged from its “normal” valuation.

- When combining its dividend with expected P/E growth and a fair P/E multiple of 24.1x, the stock has an implied annual return of 8%.

It’s worth noting that the company’s 10-year normalized P/E ratio stands at 30x, which suggests that the stock has an annual return potential of about 17%.

Currently, the consensus price target for the stock is $123, which is 19% higher than its current price. This price target is consistent with my own estimate of an 8% annual return, assuming a conservative outlook for the company’s future.

That being said, if inflation decreases at a faster rate and the Fed achieves a soft landing, the company may perform even better, likely benefiting from a higher P/E multiple over an extended period.

However, the biggest risk to the company’s long-term returns is prolonged inflation, which could keep returns somewhat subdued compared to historical levels.

Overall, I rate the stock as bullish, although I’m not in a hurry to invest in NKE.

In the next few weeks, I don’t expect the stock to gain momentum, which could give me some time to consider how to restructure the consumer segment in my dividend portfolio, as I would very much like to make NKE a big part of that.

Once consumer sentiment gains more upside, I expect NKE’s stock to run hot again, which is the coiled spring I’m looking for.

Takeaway

Nike presents a compelling case despite recent challenges, as its focus on innovation, brand strength, and efficient operations positions it well for long-term success.

Despite a subdued consumer sentiment and elevated inflation, Nike’s resilience and adaptability shine through in its recent financial performance.

While its current valuation may seem somewhat stretched (in light of macroeconomic challenges), potential EPS growth and a strong dividend make it an attractive prospect for investors with a long-term view.

However, monitoring macroeconomic factors like inflation remains crucial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.