Summary:

- The Coca-Cola Company stock has fallen almost 20%, presenting a rare buying opportunity with its lowest P/E in 3 years.

- Despite concerns about weight loss drugs impacting soda demand, Coke’s volumes are expected to grow steadily, driven by emerging market per capita consumption growth.

- Coke offers a safe dividend yield of 3.4% and has a strong growth outlook, particularly in developing markets and rapidly growing non-soda products.

- Long-term 6.2% growth is now expected, and combined with the best valuation in 3 years, you can match the market’s returns for the next decade owning this A+ rated 61-year dividend streak legend.

- Coke is arguably Warren Buffett’s favorite aristocrat. He drinks 5 cans of Cherry Coke per day, and over the last 40 years, has spent almost $100,000 drinking7,000 gallons of Coke.

gradyreese

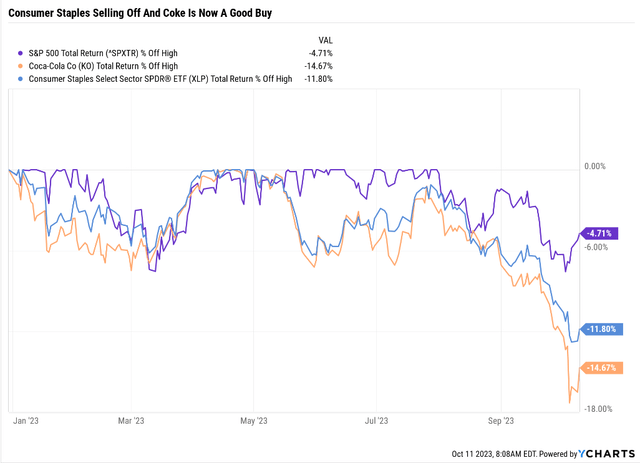

It’s raining blue-chip bargains, with stocks in general selling off a bit and some world-beaters taking a bigger tumble.

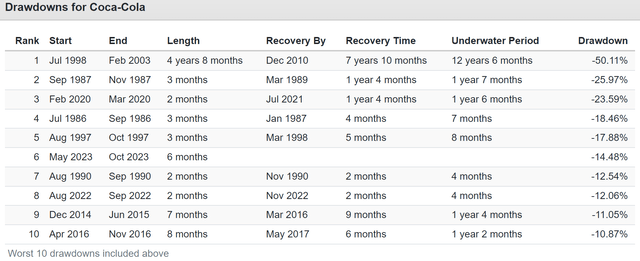

The Coca-Cola Company (NYSE:KO) falling almost 20% is pretty rare. In fact, the recent decline hit an intra-day low so deep it was the 4th biggest decline in Coke’s price since 1985.

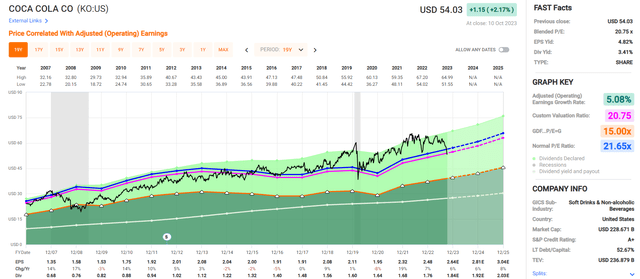

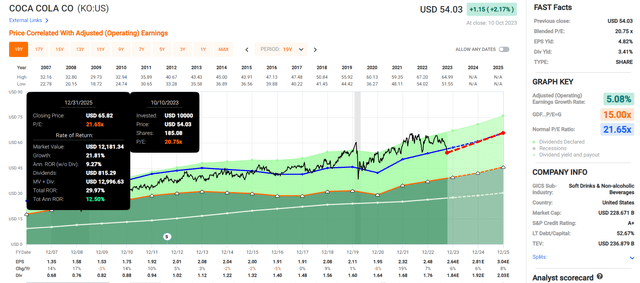

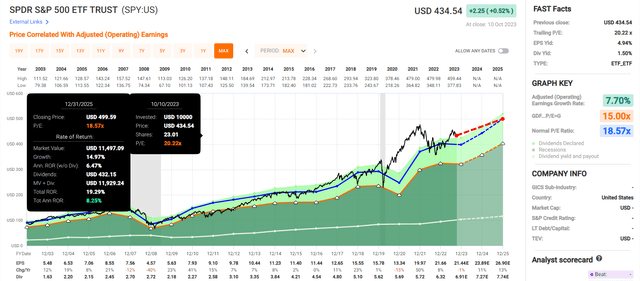

More exciting for me is that Coke’s P/E fell to the lowest level in 3 years.

The Lowest P/E In 3 Years! If You Love Coke And You’re Not Buying Now, What Are You Doing With Your Life?;)

Coke tends to spring back quickly from these kinds of valuations, hitting a new record high within 4 to 8 months.

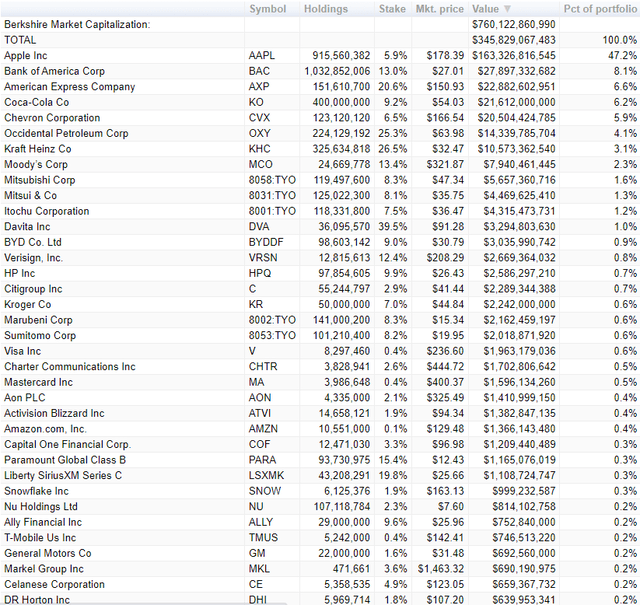

Of course, we can’t forget the endorsement of Warren Buffett, who owns $22 billion worth of Coke. It’s 6% of Berkshire’s portfolio and one of just a handful of companies his company owns shares in.

So, we have one of Buffett’s favorite companies.

If you gave me $100 billion and said take away the soft drink leadership of Coca-Cola in the world, I’d give it back to you and say it can’t be done.” – Warren Buffett.

How much does Buffett love Coke? He drinks five cans daily and has done so for about 40 years.

- 73,000 cans of coke

- 6,844 gallons.

How much Cherry Coke Buffett has drunk in the last 40 years

Despite drinking 11 million calories of Coke (an average of 750 calories per day or 30% of daily calories) costing about $91,000, over the last 40 years, containing 6,760 lbs of sugar, Buffett has managed to maintain good health and is still enjoying being CEO of Berkshire at the age of 93.

Should you and I love Coke as much as Buffett? No, you should not drink five cans of Coke daily, no matter how many shares of the stock you own.

- Buffett has gotten lucky

- 210 grams per day of sugar from Coke would cause most people to die of obesity long before they reach 93

- some people smoke three packs a day for 50 years and don’t get lung cancer

- but it doesn’t mean you should.

But should we love Coke as a company and dividend growth stock? It’s a dividend king with a 61-year dividend growth streak, an A+ stable credit rating, and a very safe yield of 3.4%.

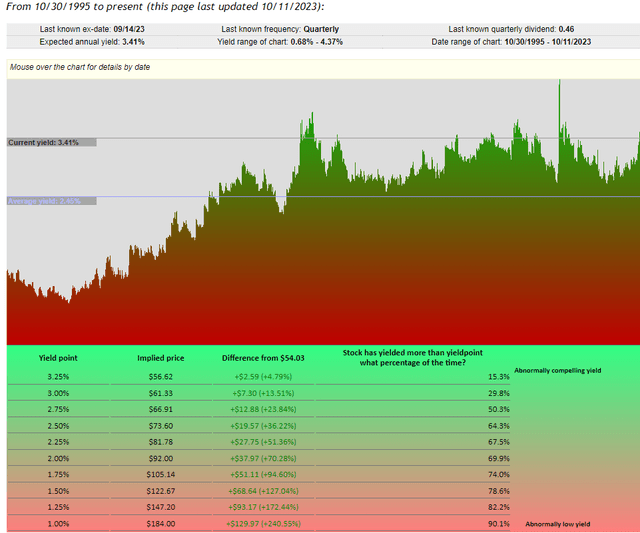

How often does Coke offer a 3.4% or higher yield? In the last 25 years, just 6.6% of the time.

Of course, a falling stock is either a good buying opportunity or a value trap.

Let me show you the three reasons why it’s the best time in 3 years to buy one of Buffett’s favorite dividend kings.

Why The Market Hates Coke Right Now Is Silly

There are two main reasons that people are saying Coke is falling.

- Narrative always follows the price.

The first is the fear of Ozempic and other weight loss drugs like Wegovy.

The latest blow took the form of comments from Walmart, which said it’s already impacting shopping demand from people taking Ozempic, Wegovy, and other appetite-suppressing medications. That sent shares of food and beverage companies sliding, some to multiyear lows.” – Fortune.

This sounds like a fun story, but if weight loss drugs were crushing food demand, why did Pepsi report 7% sales growth and its 7th consecutive quarter of double-digit price increases?

Yes, Pepsi’s volumes declined 2.5% YOY, but do dividends get paid out of cans or free cash flow?

Cigarette volumes fell for over 50 consecutive years before increasing slightly during the Pandemic and then resuming their steady fall.

And over this time, tobacco stocks were the best-performing investments.

FactSet Research Terminal FactSet Research Terminal

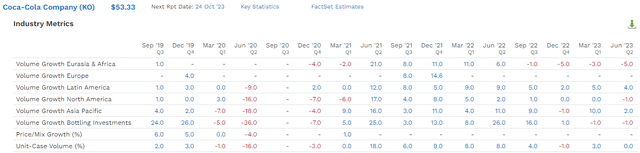

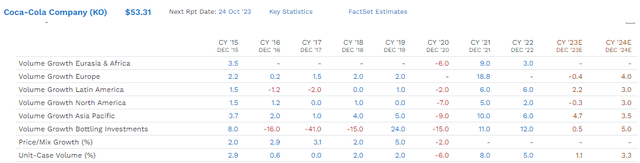

KO’s volumes are fine and expected to grow slowly but steadily despite the huge headwind in soda volumes.

For the industry, Statista thinks Soda volumes will fall 1.9% next year, but revenue for the industry will grow from $328 billion in 2023 to $368 billion.

By 2027, Americans will still be drinking 62 billion liters of Soda.

- 390 million oil barrels worth per day

- over 1 million bpd worth of soda!

Imagine if Exxon (XOM) produced soda instead of oil. That’s the kind of volume we’re talking about.

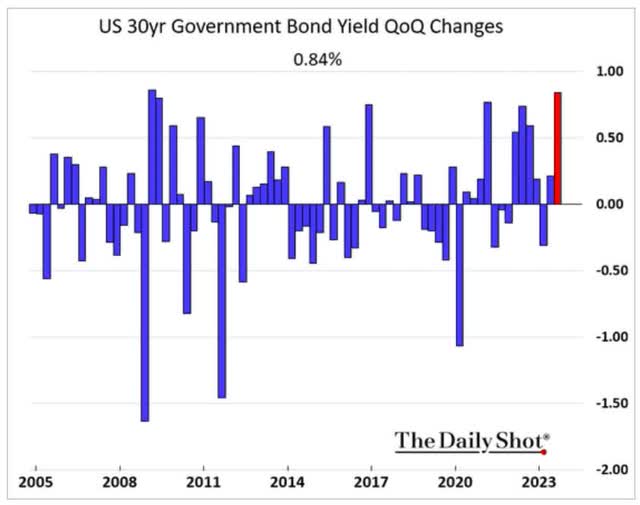

And the other reason Coke has sold off?

I must say, “Coke is not a bond alternative, never was and never will be.”

Bonds don’t grow their income or offset inflation, and long-term Coke is likely to run circles around almost any bond you can buy.

Coke’s Growth Prospects Are Solid

Morningstar is bullish on Coke because while just 31% of sales, the non-soda part of the business is thriving. Coke keeps buying popular, fast-growing brands, like Vitamin Water and, most recently, Costa and Bodyarmor.

- I drink about 10 to 15 zero-calorie Watermelon Strawberry vitamin waters per week (5 g of fiber each! No calories)

- not up to Buffett’s levels…yet;)

- Five vitamin fiber waters = 25 g of fiber per day!

- Maybe we should start a BRK shareholder petition to ask Buffett to switch to this;)

And let’s not forget the big growth avenue for Coke, which is just increasing sales in developing markets.

- North America: $1100 per capita drink sales (about three cans per day of soda)

- Latin America: $190

- Asia-Pacific $144.

Coke will clean up if steadily richer people in developing markets drink more.

We expect Coke to blend global best practices in brand and research investment with local culture and taste preferences to accelerate growth in these regions.” – Morningstar.

I know what you’re thinking. Sounds great, but how fast can a giant like Coke grow?

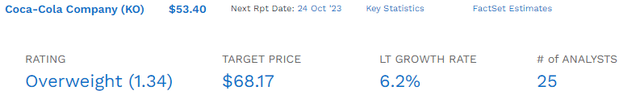

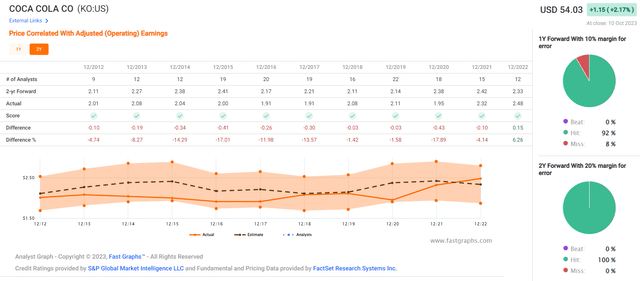

Ok 6% growth is pretty good for Coke.

Analysts are usually within 15% of its actual growth rates.

So with a very safe 3.4% yield, courtesy of a recession-resistant business model (you’ll pry that vitamin water out of my cold, dead hands!;), A+ balance sheet, and a 60-year dividend growth streak, there is a lot to love with Coke.

And now that includes the valuation.

Coke: A Buffett Wonderful Company at A Fair Price

Coke Fundamental Summary

- yield: 3.4%

- dividend safety: 100% very safe (1.00% dividend cut risk)

- overall quality: 98% low-risk

- credit rating: A+ stable (0.6% 30-year bankruptcy risk)

- long-term growth consensus: 6.2%

- long-term total return potential: 15.2% vs 10.2% S&P 500

- current: $53.16

- fair value: $59.96

- discount to fair value: 11% discount (good buy) vs 5% overvaluation on S&P

- 10-year valuation boost: 1.2% annually

- 10-year consensus total return potential: 3.4% yield + 6.2% growth + 1.2% valuation boost = 10.8%%

- 10-year consensus total return potential: = 179% vs 160% S&P 500.

How would you like twice the market’s yield and a much safer yield? And then imagine you can keep up with the market with less valuation risk and with a third of your returns paid in cash. That’s what Coke is offering.

FAST Graphs, FactSet FAST Graphs, FactSet

Risk Profile: Why Coke Isn’t For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

Coca-Cola Risk Summary

We assign a Low Uncertainty Rating to Coca-Cola. We view strong bottler relationships as crucial to its business model and return profile, but in periods of high inflation, these relationships could come under pressure as the bottlers tend to bear the brunt of cost increases. This is less of an issue in the U.S. where local bottlers are small and have limited bargaining power, but in emerging markets-which hold the key to healthy volume growth-Coca-Cola faces much larger bottlers, such as Arca Continental and Coke Femsa, that are likely in a better position to negotiate.

Although nonalcoholic beverage demand tends to be resilient through economic cycles, Coke has high exposure to international markets (over two thirds of both revenue and profits) that leads to stepped up volatility within its operations-resulting from shifting macroeconomic and regulatory landscapes, currency fluctuation, and geopolitical risks-compared with domestically-focused peers. The international experience of management combined with bottler collaboration globally can help the firm tackle these challenges. With the ubiquity of smartphones and social media, food and beverage brands are constantly under consumer scrutiny. Any marketing message or business practice that is perceived to be inconsistent with the company’s positioning could be brought under the limelight, and without timely and appropriate response, result in temporary or long-term brand damage. That said, we don’t see environmental, social, or governance risks to materially affect Coke’s operations or investment returns.

As consumers become increasingly health conscious, Coke faces the challenge of reducing the health impact of its beverages without compromising on the distinct taste that sits at the core of brand loyalty. Although reformulation and revised recipes have helped slow the exodus of consumers from its sparkling drinks, the secular headwinds remain a risk that Coca-Cola will have to contend with in the coming years.” – Morningstar.

KO’s Risk Profile Includes

- regulatory risk (globally, including soda taxes)

- litigation risk (tobacco-style class action over soda’s link to obesity)

- M&A execution risk: Coke is an M&A machine, always buying new brands and transitioning to a healthy future

- supply chain disruption risk

- labor market risk (tightest job market in over 50 years globally)

- currency risk.

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

DK uses S&P Global’s global long-term risk-management ratings for our risk rating.

- S&P has spent over 20 years perfecting its risk model

- which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

- 50% of metrics are industry-specific

- this risk rating has been included in every credit rating for decades.

The DK risk rating is based on the global percentile of a company’s risk management compared to 8,000 S&P-rated companies covering 90% of the world’s market cap.

KO Scores 68th Percentile On Global Long-Term Risk Management

S&P’s risk management scores factor in things like:

- supply chain management

- crisis management

- cyber-security

- privacy protection

- efficiency

- R&D efficiency

- innovation management

- labor relations

- talent retention

- worker training/skills improvement

- occupational health & safety

- customer relationship management

- business ethics

- climate strategy adaptation

- sustainable agricultural practices

- corporate governance

- brand management.

KO’s Long-Term Risk Management Is The 225th Best Risk Manager In The Master List (55th Percentile In The Master List)

| Classification | S&P LT Risk-Management Global Percentile |

Risk-Management Interpretation |

Risk-Management Rating |

| BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

| Strong ESG Stocks | 86 |

Very Good |

Very Low Risk |

| Foreign Dividend Stocks | 77 |

Good, Bordering On Very Good |

Low Risk |

| Ultra SWANs | 74 | Good | Low Risk |

| Coca-Cola | 68 | Above-Average (Bordering On Good) | Low Risk |

| Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

| Low Volatility Stocks | 65 | Above-Average | Low Risk |

| Master List average | 61 | Above-Average | Low Risk |

| Dividend Kings | 60 | Above-Average | Low Risk |

| Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

| Dividend Champions | 55 | Average | Medium Risk |

| Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal.)

KO’s risk-management consensus is in the top 45% of the world’s best blue-chips, on par with the likes of:

- Realty Income: Ultra SWAN dividend aristocrat

- Hormel Foods: Ultra SWAN dividend king

- Enterprise Products Partners (uses K-1 tax form): Ultra SWAN dividend champion

- Procter & Gamble: Ultra SWAN dividend king

- Nike: Ultra SWAN.

The bottom line is that all companies have risks, and KO is above-average, bordering on good at managing theirs, according to S&P.

How We Monitor KO’s Risk Profile

- 25 analysts

- three credit rating agencies

- 28 experts who collectively know this business better than anyone other than management

- and the bond market for real-time fundamental risk-assessment

When the facts change, I change my mind. What do you do, sir?” – John Maynard Keynes.

There are no sacred cows here. Wherever the fundamentals lead, we always follow. That’s the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: It’s The Best Time In 3 Years To Buy One Of Buffett’s Favorite Dividend Aristocrats

While I strongly disagree with Buffett’s 30% Coke diet, I can’t fault his love of Coke as a company.

For the first time in three years, Coke is now a good buy, as long as you understand that this is not a growth stock and that, long term, beating the market will be difficult.

However, for the next decade, Coke is likely to keep up with the market while offering one of the safest dividends on earth.

From an A+ rated company with a wide moat, brilliant management, and a very solid growth outlook courtesy of healthier beverages and rising per capita drink consumption in emerging markets.

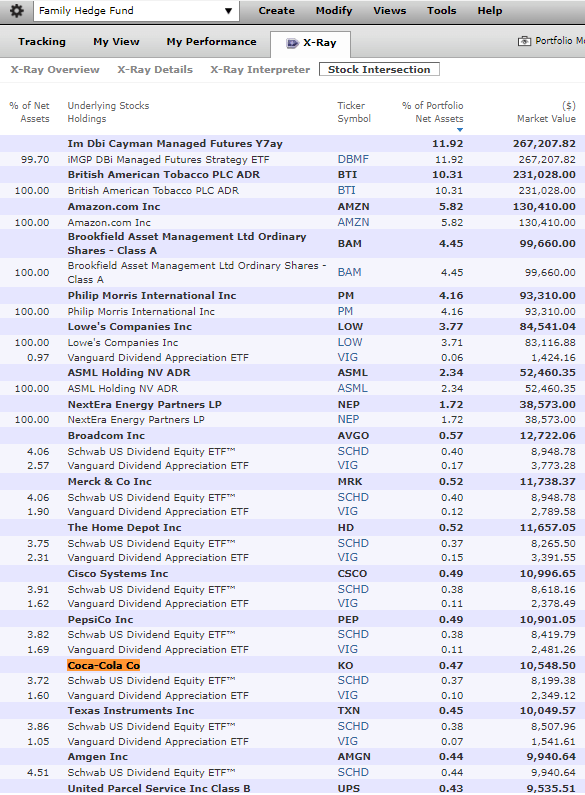

I own $10,500 worth of Coke

Morningstar

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own KO via ETFs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and more.

Membership also includes

-

Access to our 13 model portfolios (all of which are beating the market in this correction)

-

my family’s $2.5 million charity hedge fund

-

50% discount to iREIT (our REIT-focused sister service)

-

real-time chatroom support

-

real-time email notifications of all my retirement portfolio buys

-

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.