Summary:

- Rate cuts are closer than ever, it’s time to buy what will benefit your income stream when they do.

- AGNC Investment Corp.’s portfolio filled with MBS will be a key winner.

- AGNC is counter-cyclical, benefitting when the economy is hurting.

Richard Drury

Co-authored by Treading Softly.

The story is told of a man who was building a large boat for decades, worrying that it was going to rain and flood. He would tell others about how this rain was coming, but they would scoff at him because it had never rained before. So, here is a man building a massive vessel for an event that had never occurred historically in the realm of the story. If you don’t know the story, I will spoil it for you: It started raining and poured for 40 days. The only people who survived in the story were those who were on the vessel.

When it comes to the market, there’s very little that occurs that has never occurred before. It seems to be a frequent refrain that we are living in unprecedented times or having once-in-a-lifetime events occurring at a rapid clip. Those of us who live in the current era may feel exhausted from hearing that because we realize that very rarely does something happen that has never happened before. So, being prepared for rate cuts, which we expect to happen this month, it’s not new. This isn’t a change. This is just a natural part of the market cycle.

I feel like I have been a broken record telling people that they should be building up their fixed income allocation. I’ve been telling people that they should invest in assets that will benefit when rates fall, so that way, they’re positioned as best as possible for that occurrence. Well, now that the Federal Reserve has signaled greater than ever that rate cuts are coming soon, I want to once again highlight a wonderful company that invests in assets that will massively benefit when rates are cut.

Let’s dive in!

Buying MBS Before More Cuts Arrive

AGNC Investment Corp. (NASDAQ:AGNC), yielding 14.2%, is a mortgage REIT that invests in agency MBS (mortgage-backed securities). Agency MBS is a unique asset class where the “agency,” Fannie Mae or Freddie Mac, guarantees the principal of the MBS. If a borrower defaults on a mortgage, the agency will buy it back at par value. As a result, agency MBS is considered second only to U.S. government debt in terms of credit safety.

The risk that AGNC takes on is primarily interest rate risk. Agency MBS has a unique relationship with US Treasuries. The two assets tend to have a strong correlation since they both carry zero credit risk. However, correlation does not mean that the prices move in perfect lock-step.

Treasury prices fell in response to the Federal Reserve hiking rates. MBS prices experienced a double-whammy as they were impacted by rate changes and the Federal Reserve significantly cutting back on its MBS purchases. Since the GFC, the Federal Reserve has been the largest buyer of agency MBS. It cut back its buying while prices were falling, and many others also stopped buying. Even mortgage REITs like AGNC significantly slowed down.

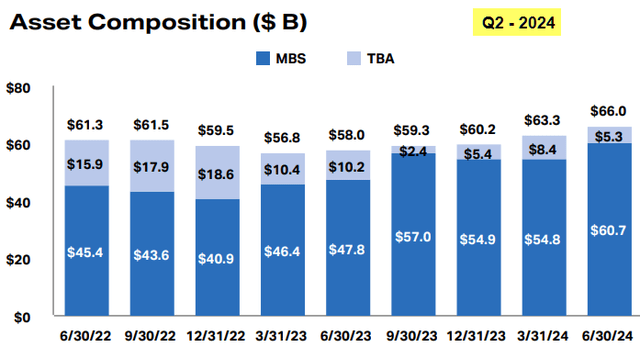

AGNC allowed its MBS portfolio to bottom out at $40.9 billion. Source.

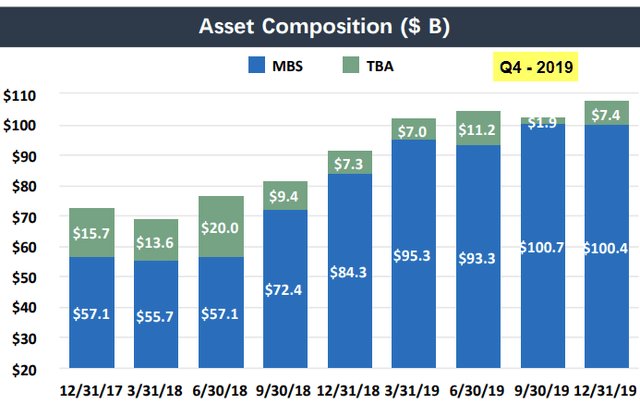

This compares to over $100 billion in Q4 2019: Source.

Since COVID-19, AGNC was reluctant to be a significant buyer of MBS as prices were nosebleed high following the COVID panic and through 2021. Then prices were falling off a cliff from 2022-2023 and AGNC opted not to try to catch the falling knife. Instead, it allowed its portfolio to repay and generally decline.

Through 2023, we saw AGNC start getting more aggressive, but it has not yet fully stepped on the gas as the Federal Reserve delayed rate cuts much longer than the market was anticipating last year.

As we can see from the experience in 2018-2019, AGNC is capable of building up its portfolio rapidly when management believes the opportunity is clear.

Looking at MBS prices, we can see the opportunity that AGNC thought it had in late 2018/early 2019. At that time, MBS prices were in a good dip relative to where they were from 2015-2017: Source.

That “dip” couldn’t hold a candle to the crash we saw in 2022 and 2023. What we are seeing in agency MBS today is a rare buying opportunity. The concern for AGNC is interest rate volatility. AGNC is operating at 7.4x leverage. In the agency MBS business, this is quite low. The reason they’ve been cautious is that there has been ample speculation about when the Fed might start cutting, but every time we approach the predicted date of the cut, the can has been kicked down the road. As a result, we’ve seen interest rates moving quite a bit as they try to guess when the Fed will cut.

At Q2 earnings, CEO Peter Federico suggested that they would consider leveraging back up when they become confident that prices have stabilized:

“We certainly have the capacity, as you point out, when you look at our cash and unencumbered position that Bernie mentioned at 65% of our equity, that would indicate that we have a lot of capacity to take leverage higher if we so chose. And obviously, our outlook for mortgage spread volatility is really important in that equation. And both Chris and I mentioned that in our prepared remarks, is an important development. It’s an important development for our business because of just that point that you’re making, which is — when you go back and you look at how mortgage spreads have behaved, we went through a very difficult repricing period from 2022 to 2023 to find this new range.”

As it becomes more certain when the Fed will start cutting and that interest rates will not go higher, the MBS market will be more stable, allowing AGNC to be more aggressive. What does this mean for AGNC investors?

- A larger portfolio produces higher returns. AGNC has managed to maintain cash flow well exceeding the dividend thanks to interest rate swaps reducing their cost of borrowing, allowing them to get a higher return from a smaller portfolio. That is fading as swaps mature. While they still have a couple of years of runway, it will be essential to grow the portfolio to support the current or higher dividend.

- MBS prices are likely close to a multi-decade low. As interest rates decline, MBS prices will go up. That is a fairly direct cause and effect. If prices are going up, a larger portfolio will help book value recover more quickly. In a leveraged investment, you want to have lower leverage as prices fall, and higher leverage as they rise.

- The cost of borrowing before hedging is currently over 5%. AGNC borrows using the repo market, these are short-term lending agreements that typically mature in 60–90 days and are strongly tied to the Federal Reserve’s Target Rate. A rate cut from the Fed will immediately reduce the cost of borrowing, which will reduce the headwind being caused by interest rate swaps maturing. It will also allow AGNC to consider operating with fewer hedges. By definition, the value of hedges should move in the opposite direction of your core portfolio. So if MBS prices are going up, the price on their hedges should be going down. If interest rates are clearly heading down and there is little risk of them going up, AGNC can operate with a lower percentage of hedges. As interest rates were rising, we saw AGNC operating with a peak hedge level of 126%. Today they are at 98% and declining.

Agency mortgage REITs have seen the prices of MBS decline more and faster than they have since the 1980s. AGNC was wise to allow its portfolio to shrink, essentially sitting on the sidelines while it waited for stability to return. Over the past year, AGNC has slowly been buying more MBS. It has a lot of room to buy more. It is becoming increasingly apparent that the bottom for MBS prices was in October 2023. With the Fed poised to start its next cutting cycle, the downside risks are declining, and the upside prospects are coming into view. AGNC issued a lot of equity in Q2 2024, and we expect that it is issuing more equity right now. It’s trading above book value and MBS is still very cheap. Issuing equity and buying more MBS at bottom prices is precisely what it should be doing.

Conclusion

The benefit to MBS is only starting to be seen and will become more prominently realized as rate cuts occur. I don’t expect we will see only one rate cut in this cycle. I expect the Fed to make a couple of rate cuts over a period of time to test the waters and see how the economy and inflation react to the changes. As I’ve highlighted previously, rate cuts do not have an immediate impact on the numbers because it takes time for the effects to show in the economy, often over a year. As the Federal Reserve makes the changes and observes its effects, the risk is that they cut too much too soon or too little too late; either way, causing a negative impact on the economy and your wallet. However, for the intelligent income investor who maintains healthy allocations in the right places in the market and builds a rate-agnostic portfolio like we’ve been highlighting, you will be filling your pockets with income over the long run.

When it comes to your retirement, you shouldn’t have to worry about gaming the market with every change. However, you should be aware of what is going on so that when you add new positions to your portfolio, they can benefit in the near term while ensuring income over the long run. This way, you’re never without the money you need to pay for the kind of life you want to live.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Treading Softly, Beyond Saving, Philip Mause, and Hidden Opportunities, all are supporting contributors for High Dividend Opportunities. Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.