Summary:

- Comcast offers a valuable alternative to telecom stocks with its strong infrastructure and faster-growing dividend.

- The company has multiple growth avenues, a robust balance sheet, and an attractive dividend with a 5-year CAGR of 10.7%.

- Comcast’s current valuation is in deep value territory, with potential for significant total returns for investors.

MarsBars

It’s easy to pick up a cheap dividend-paying telecom stock these days, with AT&T (T) and Verizon (VZ) now sporting yields north of 7%. However, one should understand that those businesses are slower growing and operate in a competitive landscape.

That’s why cable companies with valuable fiber assets may be a good alternative for those investors seeking an infrastructure company with a lower but faster growing dividend.

This brings me to Comcast (NASDAQ:CMCSA), which I last covered here back in March, highlighting its well below average valuation. Since then, the stock has given a 6.6% total return, beating the 5.4% rise in the S&P 500 (SPY), despite the latter’s tech-fueled rally in recent months.

In this article, I discuss recent developments and why it remains an excellent value for those seeking a moat-worthy business that’s fundamentally strong and pays an appealing yield.

Why CMCSA?

Comcast is a media and communications giant whose businesses reach hundreds of millions of customers and viewers worldwide. Its assets include Xfinity, Comcast Business, NBCUniversal, Sky, Telemundo, and Peacock streaming. Over the trailing 12 months, it generated $120 billion in total revenue.

Comcast has a little bit of something for everyone, as it has a traditional media business that generates strong advertising revenue, valuable real estate through its theme parks, and economically-essential infrastructure assets through its vast fiber footprint, as one of two cable giants in the U.S., with Charter Communications (CHTR).

While the scent of CMCSA being a conglomerate may scare some investors away, its assets actually complement each other unlike that of industrial conglomerate GE (GE) which has failed to realize synergies from its empire-building days. For example, CMCSA’s theme park assets complement the media assets by reinforcing the brands, and the cable business can also complement the streaming side by offering bundled services.

Meanwhile, CMCSA is executing well, with adjusted EBITDA growing by 3% YoY and adjusted EPS growing by 7% YoY during the first quarter. It also generated robust free cash flow of $3.8 billion over the same time period, which amply covered the $1.2 billion in dividend payments, equating to a 32% FCF payout ratio. While CMCSA’s dividend yield is just 3%, it’s has a compelling 5-year CAGR of 10.7%.

In addition, management returned capital to shareholders in a tax efficient manner through $2.0 billion worth of share repurchases, leaving $600 million in retained capital. CMCSA has repurchased 7.8% of the outstanding float over the past 5 years, with most of the buybacks happening over the past 18 months with the share price trading at discounted levels.

As such, it appears that management has a “value” mindset when it comes to being opportunistic with share buybacks. It also doesn’t hurt that management’s interests are aligned with that of shareholders, considering that the current CEO is the son of the founder, and who owns a significant 20.6 million shares in the company.

CMCSA Shares Outstanding (Seeking Alpha)

Potential headwinds to Comcast include its slowing broadband customer growth, which netted just 5,000 additional customers during Q1. This could be due to large telecoms like Verizon, AT&T, and T-Mobile (TMUS) capturing market share through fixed wireless and fiber offerings. Nonetheless, the broadband business remains highly profitable for CMCSA, as it saw solid ARPU (average revenue per user) growth of 4.5% YoY.

There is also potentially strong upside in the wireless business, as Comcast enjoys a good relationship with Verizon through a wholesale agreement, and this business is still in the early innings. Management also sees incremental opportunities in Business Services, as noted during the recent conference call:

Our second major growth opportunity, business services, which is approaching $10 billion in annual revenue, is growing at mid-single digits with newly reported margins just shy of 60% and delivering adjusted EBITDA growth in the high single digit range. Here too our advanced and adaptable network infrastructure is much better suited to serving commercial and government locations compared to the legacy wire line and wireless providers.

Management is also currently eyeing the sale of its stake in the Hulu streaming service to Disney (DIS) and other tech buyers. CMCSA’s CEO recently highlighted the value of its stake in Hulu, and that there is contractual certainty that Hulu can be sold for more than what Comcast paid into it.

Importantly in this higher interest rate environment, CMCSA maintains a strong A- rated balance sheet with a net debt to TTM EBITDA of 2.6x, which is reasonable for an infrastructure company. Plus the leverage ratio could be pushed down with CMCSA’s aforementioned material free cash flow after paying the dividend and/or with the sale of its stake in Hulu.

Lastly, CMCSA remains in deep value territory at the current price of $39.79 with a forward PE of 10.8, sitting far below its normal PE of 17.5. This is also considering robust analyst estimates of 8% to 12% annual EPS growth in the 2024–2025 timeframe. Analysts have a conservative price target of $45.34, which still represents a potential 17% total return over the next 12 months.

FAST Graphs

Investor Takeaway

Comcast has several avenues of growth, a solid balance sheet, and pays an attractive dividend that’s growing at a faster rate than that of the leading telecom stocks. It remains in deep value territory at its current price, with analysts forecasting high single to low double-digit EPS growth over the next couple of years. Its valuation could also benefit from any monetization of its Hulu stake and from its continued share repurchases at bargain valuations. As such, total returns investors searching for value may benefit from CMCSA at its currently discounted levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMCSA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

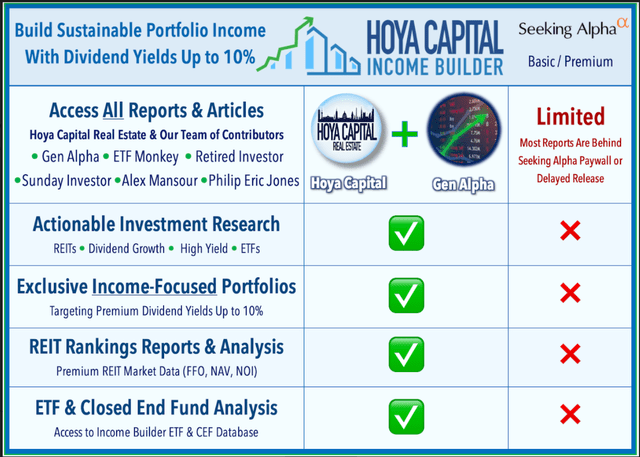

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!