Summary:

- Comcast is a telecommunications giant trading at a severe discount because of industry weakness.

- Comcast is seeing success in the streaming war through its Peacock streaming service.

- Comcast remains confident that its current broadband offering can deliver the same functionality as fiber customers.

- Comcast is projected to grow revenue at low single digits, while growing EPS by double digits.

- Comcast pays a solid dividend and continues to buy back its shares after announcing a new $20 billion share buyback program.

Justin Sullivan

Comcast (NASDAQ:CMCSA) is an American telecommunications conglomerate that is headquartered in Philadelphia. The company is the second largest broadcasting and cable television provider in the world by revenue, only behind AT&T (T). Comcast is a company with a significant moat and this makes them a very strong value play in a difficult macro economy. Despite this, the shares are down by over 30% YTD because of weakness in the entertainment sector with Netflix and Disney also down significantly. Comcast hasn’t had the brightest outlook in its history, with a broadband and cable TV market being challenged by wireless connections and streaming options.

Comcast is acting on this through the launch of its own streaming service, Peacock. Peacock has been growing its paid subscriber numbers by close to 70% YTD and is gaining market share. This is also thanks to its free ad-supported subscription. Comcast does continue to believe in its broadband business as they think this can offer the same functionality as fiber competition.

The question remains whether this company will be able to be worth the investment and generate solid returns for investors. In this article, I will try to see whether Comcast is worth the current share price by taking a deep dive into the company and its growth opportunities.

Company Background

Comcast is an American telecommunications conglomerate and is headquartered in Philadelphia. The company is the second largest broadcasting and cable television provider in the world by revenue, only behind AT&T. In addition, it is the largest pay-TV company, the largest cable TV company, the largest home internet provider in the U.S., and the third largest home telephone service provider. This might give you some idea of just how big this company really is. It delivers its services to U.S. customers in 40 states. Comcast is also a producer of feature films through its ownership of international media company NBCUniversal.

Comcast operates and owns the Xfinity cable communications subsidiary and over-the-air national broadcast network channels, including NBC and Telemundo. It also operates multiple cable-only channels, including MSNBC and CNBC. And this is not even where the company ends as it is also active in the movie production business through Universal Pictures and streaming through streaming service Peacock. Finally, the company owns Universal Parks & Resorts, owns ad-tech company FreeWheel (acquired in 2014), and since 2018 is the parent company of Sky Group.

Comcast is an incredibly broad and well-diversified company operating across multiple industries, but all connected by telecommunications and TV entertainment. Yet, being this big and offering TV and connection services, it does come with its fair share of controversy. Comcast saw the lowest customer satisfaction ratings for many years, it violated net neutrality practices, and has seen its fair share of antitrust worries. The last one does not really come as a surprise when talking about such a big and dominant company with not a lot of competition thanks to the high entry barriers. This would have resulted in unfair negotiating power. Also, its ownership of both content production and distribution raised some antitrust concerns.

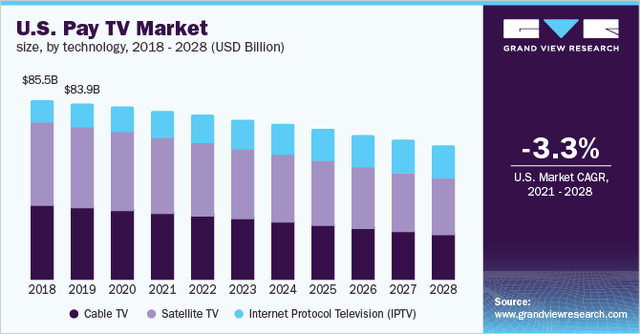

A lot of these concerns continue to dissipate as global video and TV consumption is making a shift towards CTV. More and more people are using streaming services and fewer people are still watching cable TV. But don’t get me wrong here, the cable TV industry is still huge, but is losing ground to streaming services. Lots of streaming services also include TV shows nowadays because it becomes increasingly less popular to watch programs at set times as people are getting used to being able to watch at the moment they prefer. The global broadcasting and cable TV market size was valued at $305 billion in 2019 and is expected to grow at a slow 3.4% CAGR until 2027. In addition to this, the global pay TV market size totaled a massive $230 billion in 2020 and is expected to only grow at a 1.7% CAGR until 2027, while pay TV in the U.S. is already expected to decrease at a 3.3% CAGR over the same time frame.

At the same time, it is the video streaming market that is seeing explosive growth. This market is expected to grow at a 21.3% CAGR from 2022 until 2030 while taking an increasing piece of the market away from pay TV. Obviously, for Comcast, this is not the best news as their primary markets are losing ground. Of course, Comcast acted on this in an earlier stage by launching the streaming service Peacock, which continues to see explosive growth in paid subscriber numbers. At the same time, these trends do relieve Comcast of some of the antitrust pressure it has been seeing over the last decade or so.

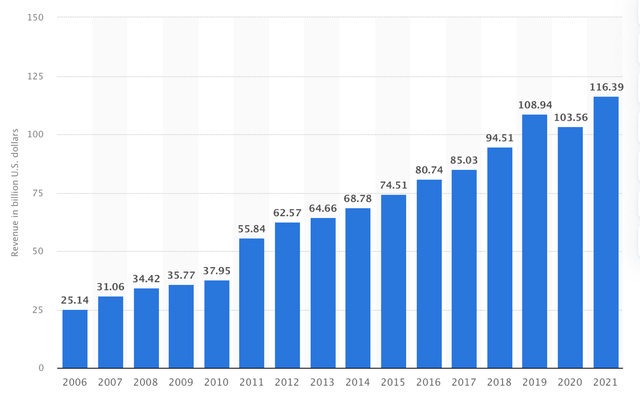

Despite headwinds for Comcast over the last decade, and most notably the last couple of years, the company has continued to solidly increase its revenue to reach over $116 billion by FY21.

Comcast Revenue growth (Statista)

Comcast stock is a real value play. We should not expect incredible revenue growth going forward. At the same time, the company does offer a very solid dividend yield and repurchases loads of shares with the cash flow generated. Is Comcast then really only a dividend income investment? No, the company is still projecting solid growth going forward, despite deteriorating conditions in its largest segments. Also, the company is trying to adapt to industry shifts as it did with the launch of its streaming service. Comcast does remain to believe that its traditional cable services are still the way to go forward.

Analysts currently expect Comcast to grow revenue by low single digits over the next four years. At the same time, EPS is expected to grow double digits through increasing share repurchases and increasing profitability. The question now is: What are the future revenue growth drivers for Comcast?

Peacock

An incredibly important part of future growth for Comcast will be its streaming service, Peacock. We are still very far away from a cable-less world, but the future seems to be the streaming business. The service primarily features films and series content from NBCUniversal studios and other licensed content. The platform also includes television series, news, and sports programming. Where Peacock distinguishes itself from the competition, is through a free ad-supported version with limited content. Premium tiers include more exclusive content and access to additional NBC sports and WWE Network content. As of Oct. 3, Peacock had a total of 15 million paid subscribers and 30 million active users. This is what management has said about Peacock:

Peacock is a natural extension of our existing video businesses with two revenue streams, which encourages cross-promotion, and advertising. Peacock builds audiences and extends our reach, and should enable video to be a long term growth driver for NBCUniversal.

Peacock launched in 2020 and is seeing massive growth. In the latest quarter paid subscribers grew by a massive 70% YTD, making Peacock the fastest-growing streaming service. Management acknowledges the opportunity that Peacock has to be a long-term growth driver by growing its audience. Currently, Comcast earns about $10 per Peacock user including advertising. Peacock was one of the first streaming businesses to start offering an ad-based subscription form which is completely free. Thanks to its already existing expertise in managing the ad business through its cable TV, it was easier to implement effectively for Comcast.

Comcast seems to be doing well through NBCUniversal and Peacock, and future growth seems certain, yet Comcast will need to act on current trends and beat a lot of competitors since the streaming business has many players involved with very large piles of money to spend – including Amazon (AMZN), Apple (AAPL), and Disney (DIS). Comcast plans to spend $3 billion this year on content creation and wants to increase this to $5 billion over the next couple of years. Right now, Disney Plus is still not profitable and is a serious drag on Disney’s financials. This needs to be a warning sign to Comcast to act carefully.

Peacock will continue to grow at a strong pace going forward. At the same time, revenue generation is not significant on total revenue of $116 billion. Therefore, I do not expect this to have a significant impact on revenue anytime soon, and does not justify any investment as it will not significantly impact the growth outlook. It could well be in a couple of years.

Broadband Expansion

Comcast already is one of the largest players in the broadband business, but the company remains committed to expanding this service to more regions and being able to bring the service to more consumers. Comcast wants to expand its broadband service even in regions where it competes with superior fiber or fixed wireless players. This also brings us to the problem of broadband, as it is less reliable and gets you slower internet speeds when compared to fiber. As a result, growth for broadband customers is not as rosy.

I expect Comcast to keep expanding its broadband availability and customer numbers to increase slightly which might allow for low single-digit growth. The long-term outlook, as outlined in this article, is not the best. I do not expect betting on broadband to be a long-term winner. Comcast remains of the opinion that it does not need to overbuild itself with fiber as they believe it will be able to deliver the same services through its current offering. This will save every one of the over 60 million homes from having to dig up their front lawn for the installation of fiber. I hope Comcast is right as it could be a valuable decision going forward.

Multiple Expansion and Shareholder Returns

The growth opportunities above point to low to midsingle-digit revenue growth going forward. As I pointed out before, the stock is not a growth stock but a very strong value play. The company reaches approximately 51% of Americans through its services and this creates an incredible moat. I believe this company will suit a certain type of investor, but would not be misplaced in any portfolio as a safe haven. While I do not see many opportunities for the company, the moat and slow growth do make it a very interesting investment. What makes it even more interesting is the current valuation and EPS growth forecast, which are the most important aspects for investors.

While the company might not look like quite the value play so far this year as the stock is down by 30% YTD, it surely is. The reason for the YTD drop is the general weakness of the entertainment industry in combination with the first-ever quarter of no growth in broadband subscribers in the second quarter. This might seem like a huge problem, but it is expected to be because of macro concerns and no longer-term issue.

As a result of this drop, the current share price is very low. The stock price is the exact same as it was five years ago while revenue and EPS have grown. This means the company is now valued at just a forward P/E of 9.83, which is 38% below both its five-year average and sector median. Of course, the growth outlook is not as strong as it has been over the last five years, so a return to its average P/E of 15 seems unlikely. But when taking into account the solid growth outlook, EPS growth, and moat, a 12/13x P/E seems more than reasonable. This allows for significant multiple expansion and therefore creates solid returns for shareholders. The stock is still very attractively valued at the current share price.

Analysts are projecting EPS growth of 12% this year, slower growth of just 5% in 2023, and pick up faster growth again in the years after with 11.5% and 13% growth in 2024 and 2025, respectively. Double-digit EPS growth gets me very enthusiastic as a shareholder when considering the moat of the business. EPS growth will be driven by strong share buyback programs as well as increasing margins through cost savings.

Double-digit EPS growth at just 10x forward P/E is not expensive at all.

Q3 Financial Results

To get a better look at the current financial performance, we will take a look at the most recent quarterly results. On Oct. 27, Comcast reported its Q3 2022 results. Revenue decreased by 1.5% YoY and came in at $29.84 billion. This means that Comcast’s revenue so for the first nine months totaled $90.87 billion, a 5.9% increase YoY. Despite the top line decrease adjusted net income did increase by 4.5% to $4.22 billion. EBITDA grew by 5.9% to $9.48 billion and adjusted EPS grew 10.3% to $0.96. This all resulted in a free cash flow of $3.39 billion with free cash flow for the first 9 months totaling $11.3 billion, growing 14.9% YoY.

Comcast registered total cable customers of 34.4 million and broadband customers of 32.3 million, which was consistent with the prior quarter and grew 0.9% and 1.9%, respectively. This shows very little growth in customer numbers. If we zoom in on revenue numbers, we can see broadband saw strong growth of 5.7% and wireless grew by 30.8%. Cable communications saw strong growth across the board with some setbacks in voice and video. So far this year, total customer relations grew by 145,000, while total broadband connections grew by 227,000. YTD, growth remained strong for Comcast.

NBCUniversal adj. EBITDA grew by 24.6% to $1.7 billion and included losses from the Peacock streaming service. Peacock paid subscribers did pass the 15 million mark and increased close to 70% YTD. Studios also saw strong growth to $537 million driven by successful new releases. Theme parks saw 88.6% growth to $819 million in EBITDA. This was a record quarter for theme parks as these are rebounding from the COVID-19 pandemic.

Growth continued to be strong for Comcast as cable communications growth was supported by strength in wireless and broadband but was partially offset by weakness in video and voice. With broadband accounting for the largest amount of revenue in the cable communications segment, it is good to see this segment growing although growth was stronger in the past. Strength in broadband will remain to be crucial for Comcast and it will be interesting to see this develop. NBCUniversal’s growth of close to 25% was a strong addition to revenue and growth is expected to remain strong for this segment.

During Q3 2022, Comcast returned $4.7 billion to shareholders by returning $1.2 billion in dividends and $3.5 billion in share repurchases. Total cash returned was higher than free cash flow for the quarter which is not ideal. Comcast recently announced a new share buyback program amounting to a massive $20 billion, which started on Sept. 13th. At the end of the second quarter, this share buyback still totaled $19.5 billion. So far this year Comcast has returned $9.5 billion to its shareholders through share buybacks and paid $3.6 billion in dividends. This brings the total to $13.1 billion, compared to just $5.4 billion in 2021. It is good to see management acting as the share price is near its lows and increasing its share buybacks.

Balance Sheet and Dividend

According to Yahoo Finance, Comcast currently has $5.7 billion in total cash and total debt of $97.65 billion. The huge debt burden of Comcast is not something positive, but also no remarkable thing in this industry. I would appreciate Comcast to either increase its cash position or lower its debt over the next couple of years to give the company a better financial position going forward. Comcast does generate very strong cash flows, and therefore I see no immediate issues with its current debt. If the debt burden would continue to build up it would become more of an issue in the future.

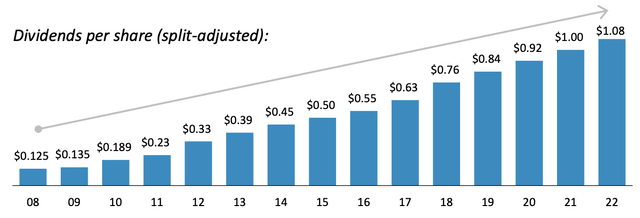

Comcast pays a strong dividend with a forward yield of 3.03%, while keeping the payout ratio low at just 30%. Of course, Comcast uses most of the additional cash generated for share repurchases. The dividend yield receives a C from Seeking Alpha Quant ratings, as well as a B for dividend safety. Comcast started paying its dividend again during the financial crisis in 2008 and has been paying, and growing, its dividend ever since. Dividend growth has been strong at close to a 12% CAGR over the last five years, but has slowed down over recent years with the three-year CAGR coming in at just 9%. I still think that if Comcast would be able to grow its dividend by close to a 10% CAGR, this would be a strong dividend stock starting with a strong yield.

Comcast dividend growth (Comcast)

Conclusion

I will repeat what I have said before as I think the growth opportunities mentioned in this article point to low to midsingle-digit revenue growth and double-digit EPS growth. As I also pointed out before, the stock definitely is not a growth stock, but rather a very strong value play. The company reaches approximately 51% of Americans through its services and this creates an incredible moat. Comcast pays a strong dividend yield and dividend growth looks strong as the payout ratio is still only at a low 30%, giving it plenty of upside potential. The new $20 billion share buyback gives Comcast plenty of room to buy back shares at cheap prices. This will increase value for shareholders and supports double-digit EPS growth over the next few years. The low current price metrics allow for some expansion as weakness from the entertainment sector disappears. When the stock returns closer to fair value, this would represent probably close to a 20/30% upside from the current share price.

We should not forget that the stock is not without weaknesses as the company needs to make sure to keep innovating and adapting and not get stuck in the past. This might sound easy, but it sure isn’t when a company is as big and complicated as Comcast is. This is something to keep a close eye on as it could mean Comcast loses its dominant position.

For now, I like Comcast as I believe the strength and position of the company are worth a lot in the current environment. Industry weakness has led to a significant decrease in share price and offers a nice buying opportunity. Share price returns may have been close to zero over the last five years, but the current price offers a significant upside for the next couple of years. Even if the company does not grow its revenues significantly, the strong dividend payments in combination with the decreasing number of shares outstanding should give you some strong returns.

I rate Comcast stock a buy, but would also recommend taking a look at Deutsche Telekom (OTCQX:DTEGF) as the latter appears to be better positioned for future growth.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.