Summary:

- Seeing Comcast’s move to spin off cable as just a name change and a sign the company wants out of cable networks is wrong.

- A history of smart moves by Comcast vs. bad ones favors the odds for a very possible coup in the cable space.

- The deal could set the sector free from the paralysis of thinking by peers.

Above: The Xfinity switch was both a smart offensive and defensive move.

- Initial negative takes by some analysts on Comcast’s cable assets spinoff, who see no solution to inherited sector problems, are wrong.

- The key lies in the spinoff’s flexibility to add and reshape the business, unencumbered by corporate goals on remaining segments.

- Disney, Paramount, and WBD are not sellers at the moment, but this move is a game changer as a test. (Comcast is already fishing with Peacock). The new “Spinco” will set the agenda for the entire sector ahead.

The annual revenue of Comcast (NASDAQ:CMCSA) hit $121b in 2023. The proposed spinoff of its cable group represents $7b in revenue, or 8.47% of its 2023 total. Revenue in Q3 is tracking 6.5% ahead of 2023, though most metrics YoY were slightly down. For a peer-to-peer comparison, Disney (DIS) revenue in 2023 was $88b. The difference is in CMCSA’s command of a massive position in its communications/digital segment (boasting 32m subscribers), which is currently enmeshed in cord-cutting, including NBCUniversal.

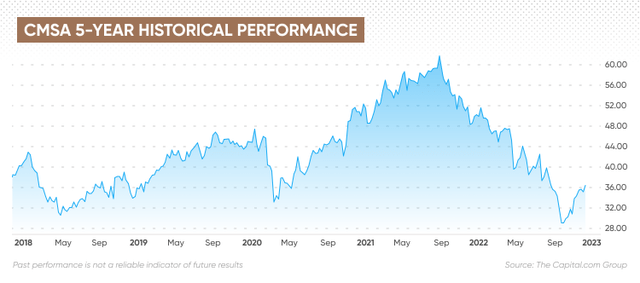

Above: Mr. Market is not yet a believer. But the spin-off shows that management isn’t fast asleep as are many peers.

All of these trends generated $43b in revenue last year. This cushion, in our view, makes Comcast far more flexible in moving assets than any competitors. The loss of $7b in revenue to its spinoff move — even though its holders will get first crack — and its CEO-designate (Mark Lazarus, 48) who currently runs NBCUniversal, means Comcast will graft its management culture onto the spinoff. He has a long history in media, including a turn at Turner before joining Comcast. His strength has been dominant in sports TV, and that is one area I expect him to target for the spinoff. The TV sports sector is expensive and crowded, mainly due to the gluttonous demands of the leagues at renewal time, as per the latest NBA deal. It’s already labelled as a loss-leader for ESPN and Amazon.

But aside from game and playoff rights, there is a thriving business in the sports programming business of panel shows, analysis, and a particularly potent possibility in actually creating a cable sports show centered entirely on sports gambling. Ad money would be plentiful from the platforms. And above all, so would betting audiences — now estimated at 37m daily.

The spinoff would include: NBCUniversal, USA, CNBC, MSNBC, Oxygen, E!, Syfy, Golf Channel, Fandango, Rotten Tomatoes, and marginal others, amounting to a total audience of over 70m.

Google

Above: The age of the entertainment conglomerate is passing. As of now, Comcast appears to be acting as a first-mover unlocking assets in a negative overall trend.

There clearly is no expectation that the spinoff could reverse the cord-cutting. But my sense from industry associates is that the eye on the prize in this move is, to some extent, refreshed revenue initiatives under CEO Lazarus. But the liberation of a $7b starting gun business, tightly focused, free of corporate overhead drags can be viable fast. The key question investors need to muse on is this: Will this group of networks have enough staying power from their core audiences to hold their base revenue streams fast? And further, will partnership moves like the one up front like Peacock be just the beginning of a wider plan to build the best and possibly sell off the marginal or loser sites to make for a better EBITDA performer?

Benchmark analysts got the opinions trend negative, I believe, because of a sense that a name change alone with a few promises here and there does not constitute an attractive incentive for investors. Understandably, their focus lies in making a coherent case for a possible spinoff company to produce accretive earnings gains over time. Where I disagree is in seeing the value of the spinoff in freeing the cable business to literally become something of a first-mover souk by a process of consolidations and further spinoffs, sales, or mergers that could unlock considerable investor value for those who can see beyond a simple spin-off. Remember, Comcast has proven itself as a crafty operator, grown to its size by a preponderance of smart moves over their history in building out from a straightforward communications company.

An example is its marketing thrust of switching customers to Xfinity. The deal to consumers is simple, fast, and unburdened by excess transfer clicks. The value proposition is clear to customers who want both broadband services and affordable subs before they click. This comes from Comcast’s knowledge of the consumer mindset. With the expiration of the ACP, Comcast noted, they would not have lost 82,000 subscribers in broadband, but actually gained 2%. My point here is that the company is so well-tuned into the consumer’s thinking that it has great flexibility in managing assets against trends.

I think the deal will lead to a huge, long-awaited shake-up in the cable network business. Right now, industry leaders appear to be just observers of the melting ice cube of the sector, seemingly bereft of ideas to move as has Comcast done here. We have talked to several investment bankers we have worked on deals in the past, for something of an insight into the plan’s impact on its current share price of $43 or a projected valuation of the cable spin-off. One banker we talked to with long experience valuing the sector said:

I don’t expect big time moves in Comcast stock leading to a possible deal next year. I also think these guys are real savvy about investor response. So my expectation is that the valuation of the spin off will be very inviting. Some people we spoke to dismissed the move, telling me the deal represents a clear signal that Comcast doesn’t want to be in the cable network business long term. That’s not it. The clearest signal I see at this early stage is to open up the movement of presumably failing assets to a new perspective. Its to find value that few believe in now. It could well surprise.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.