Comcast: Broadband Concerns Overblown, Still Bullish On Future Of Xfinity Mobile

Summary:

- Xfinity Mobile added 6.59 million wireless lines and saw a 19% increase in wireless revenue in FY23.

- Comcast experienced a net loss of broadband customers but sustained broadband revenue growth through price increases.

- Comcast’s broadband business remains in a strong position due to its dominant market share and ability to expand network capacity at a lower cost than competitors.

- Wireless growth has more than compensated for losses associated with linear TV.

- Given Comcast’s dominance across its entire network footprint and the significant undervaluation of CMCSA shares, I am reiterating my initial ‘Buy’ rating.

SOPA Images/LightRocket via Getty Images

Introduction

In October, I published an article titled “ 4 Reasons Why Comcast’s Deal with T-Mobile Is A Great Move,” primarily focusing on the financial prospects of Comcast’s (NASDAQ:CMCSA) wireless service, Xfinity Mobile, and its potential role as a customer funnel for their broadband internet service. In this article, I will revisit my initial thesis on Comcast’s broadband and wireless segments in light of the recently released FY23 results.

Ultimately, I will elucidate why, based on these insights, I maintain my belief that Comcast represents a compelling addition to the portfolios of value investors seeking both growth potential and reliable dividend income.

It’s important to note that my investment horizon spans at least five years. Therefore, this article serves as a reassessment of my initial investment thesis on Comcast, providing updates and insights to determine whether any adjustments to my stance on the company are warranted.

Xfinity Mobile Adds Lines and Grows Wireless Revenue in FY23

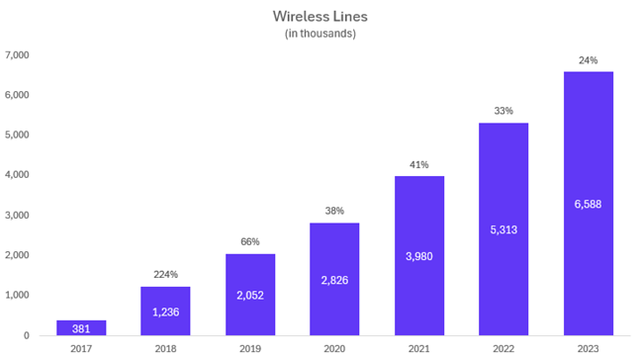

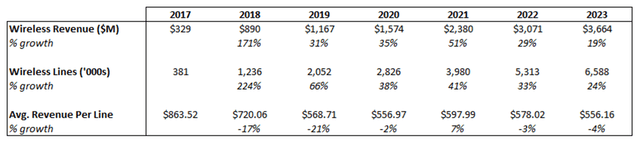

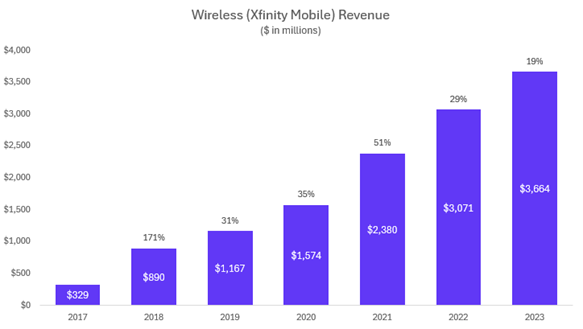

A cornerstone of my initial investment thesis for Comcast centered on the sustained growth trajectory of Xfinity Mobile since its inception in 2017. In 2023, Comcast realized a net addition of 1.275 million wireless lines, marking a solid 24% increase compared to the prior year and elevating the total number of wireless lines to 6.59 million.

The surge in wireless lines translated into equally strong revenue gains, with wireless revenue climbing by $593 million to reach $3.66 billion in 2023, reflecting a year-over-year growth rate of 19%.

CMCSA 10-K filings

The consistent expansion of wireless lines at an annual rate of over 20% coupled with parallel growth in wireless revenues lends to the validation of my initial thesis regarding Xfinity Mobile’s market penetration and revenue generation capabilities.

The second part of my initial thesis posited that Comcast’s exclusive offering of Xfinity Mobile to existing broadband customers could serve as a compelling incentive for non-broadband customers to switch to Xfinity internet, lured by the potential savings on wireless services. I anticipated that by gaining broadband subscribers through the Xfinity Mobile incentives, the company would become less reliant on price hikes to fuel broadband revenue growth.

As we delve into the 2023 performance of Comcast’s broadband business, we’ll assess the extent to which these strategic maneuvers have materialized and evaluate their impact on Comcast’s overall financial landscape.

Comcast Experiences Annual Net Loss of Broadband Customers for First Time in Over 10 Years but Broadband Revenue Continues Marginal Growth

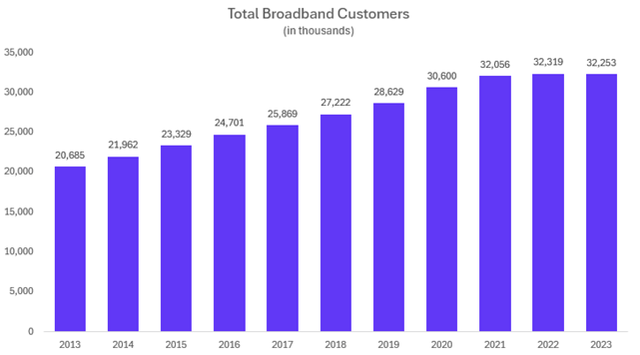

In a departure from its historical trajectory, Comcast encountered a net loss in broadband internet customers in FY23, marking the first instance in over a decade. The net loss, totaling approximately 66,000 customers, represents a mere 0.2% decline from its 2022 broadband customer base of 32.32 million accounts.

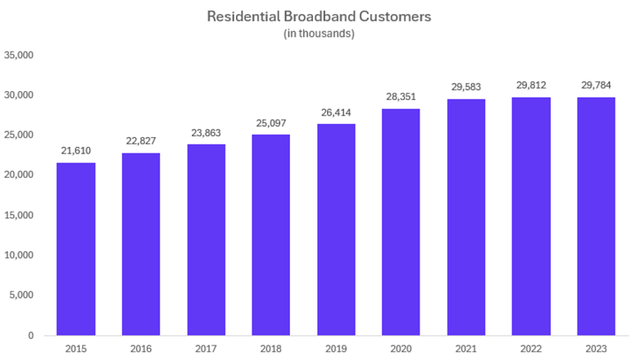

Notably, the net loss of residential broadband customers—those most likely to benefit from the incentives of Xfinity Mobile—constituted less than half of the total net losses.

Comcast registered a net loss of roughly 28,000 residential broadband customers, accounting for less than 0.1% of its residential broadband base and less than 0.09% of total broadband customers.

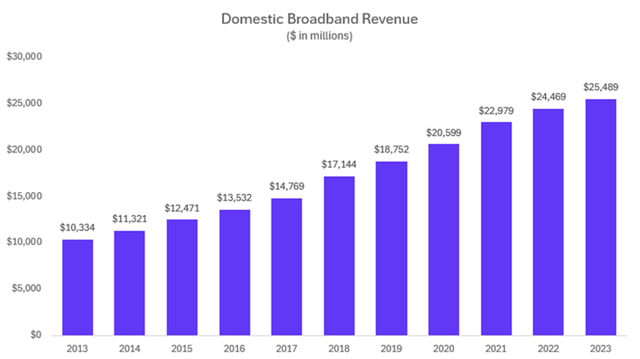

Despite the contraction in broadband customers, Comcast sustained broadband revenue growth of 4.2% year-over-year through price increases.

So, it is safe to say that the anticipated marginal growth in Comcast’s residential broadband customer base, driven by consumers seeking wireless savings, has not materialized in 2023. While not immediately panic-inducing, it does warrant scrutiny going forward considering the price increases that allowed Comcast to grow revenue despite losing customers is likely a primary contributor to customer churn in the first place.

Why I’m Not Worried About Comcast’s Broadband Internet Business

While recent developments in Comcast’s broadband business instill a bit of uncertainty regarding this segment, I believe the company still remains in a strong position. It is estimated that Comcast has grown its broadband market share in the areas it serves from 50% to about 65% over the last 10 years. Furthermore, due to their network architectures, cable networks like Comcast benefit from the ability to steadily increase network capacity at modest incremental cost, allowing them to consistently upgrade and build out their networks without significantly reducing margins. This is compared to the large phone companies who usually cannot increase network speeds widely across their networks without significant investments in bringing fiber closer to customers.

To put this comparison into context, AT&T (T) has the largest fiber network among phone companies with 26 million homes and businesses passed. These expansion efforts have seen AT&T spend roughly $48 billion over the past two years to expand homes and businesses passed by about 3 million per year, and they are expected to spend an additional $40+ billion to achieve 30 million homes and businesses by EOY 2025. These values imply that it costs AT&T roughly $8,000 per each additional home/business passed. On the other hand, Comcast has spent a total of around $21.5 billion over the past five years to increase homes and businesses passed by 5.5 million, implying an average cost per additional home/business of roughly $3,900, less than half the costs for AT&T.

Due to the heavy time and capital investments required to expand fiber networks, it is unlikely that large portions of Comcast’s footprint will see significant competition from fiber in the immediate future. Couple this with Comcast’s dominance in the areas that it serves and it’s clear that the downside for their broadband business is relatively limited. For these reasons, I believe that despite the recent broadband customer churn, Comcast’s broadband business is still in a solid position to continue growing at low-to-mid single digits per year.

Where Comcast’s Wireless Opportunity Sits Today

In my original article, I demonstrated how Xfinity Mobile represented a $30.5 billion opportunity and over the last year, that opportunity has actually increased by roughly $130 million despite experiencing a net loss in broadband customers. This is because during 2023, Comcast increased homes and businesses passed by 1.5 million, bringing the total to 62.5 million and increasing the number of homes and businesses that can access Comcast’s internet, thereby increasing the potential number of wireless lines.

Comcast has historically maintained a residential broadband penetration rate of approximately 48%, meaning that Comcast has captured roughly 48% of total homes and businesses passed as residential broadband customers. With current homes and businesses passed sitting at 62.5 million, this implies a reasonable residential broadband customer base of 30 million.

We can then multiply the 30 million residential broadband customers by the 2.5 individuals per U.S. household (using 2 to be more conservative) to get 60 million total wireless lines. By multiplying the 60 million total wireless lines by $571.57, the average annual wireless revenue per line that Comcast has generated since becoming relatively stable in 2020, to get an annual wireless revenue opportunity of $34.3 billion. We can then subtract Comcast’s FY23 wireless revenue of $3.664 billion to reach the total untapped wireless revenue opportunity of $30.63 billion. Using this theoretical wireless revenue and the company’s FY23 wireless revenue, we can infer that Comcast has only captured 10.7% of their wireless market opportunity.

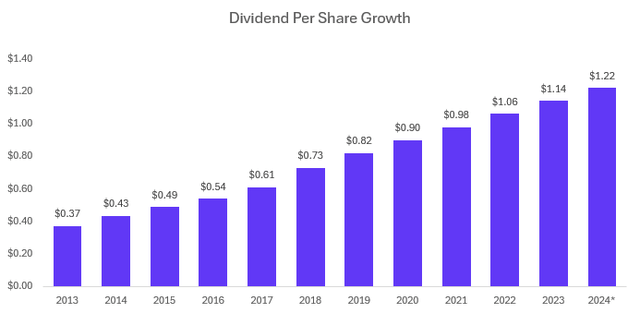

Comcast Is a Solid Choice for Income Investors

Comcast has had a solid history of growing their dividend distributions to shareholders. Adjusting for a 2:1 stock split in 2017, the company has grown their dividend payout for 12 consecutive years and has compounded its dividend per share at 8.8% annually over the last five years. Comcast also has a payout ratio (TTM) of 31%, leaving plenty of capital to reinvest back into the company.

Additionally, Comcast returned $11 billion to shareholders in 2023 through their share repurchase program. In January 2024, the board of directors approved a new share repurchase program authorization of $15 billion, further increasing Comcast’s capacity to continue returning value to shareholders.

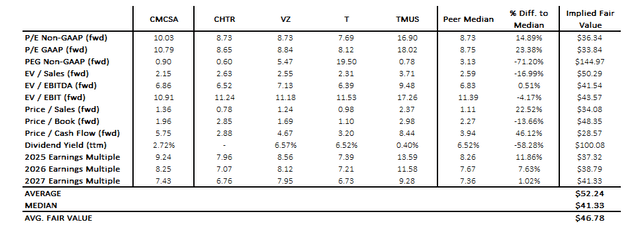

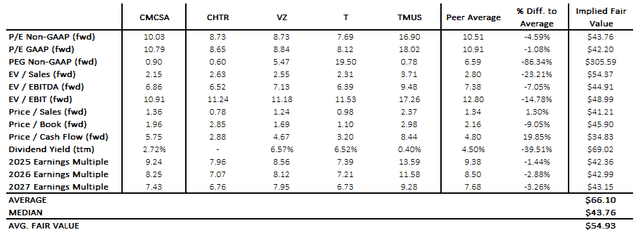

CMCSA Shares Remain Undervalued

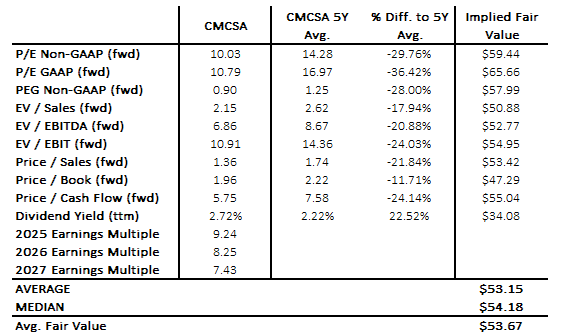

CMCSA shares are currently undervalued on a relative basis and a DCF basis. When comparing Comcast’s current forward-looking valuation ratios to its own 5-year averages, we can see that the implied fair value of CMCSA shares currently sits at $53.67, which suggests a 28.6% upside.

Seeking Alpha

When comparing CMCSA’s valuation ratios to median values of its peers, we get an implied share price of $46.78, suggesting a current undervaluation of 10.76%.

Finally, when comparing Comcast’s ratios to the average values of its peers, we get a fair value of $54.93 per CMCSA share, representing an implied upside of 31.6%.

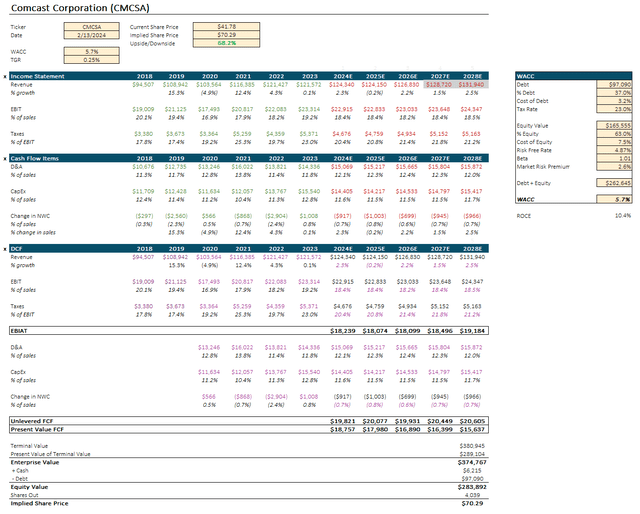

Our DCF model suggested that CMCSA shares are even further undervalued.

For the years 2018-2023, I obtained key financial data from Comcast’s 10-K filings. Sales and EBIT percentages were calculated based on this data. Revenue estimates were sourced from Seeking Alpha. Please note that estimates highlighted in gray may be less reliable due to limited analyst coverage. However, given Comcast’s history as a public company and analyst coverage, these estimates are considered adequate for this DCF analysis.

For non-revenue line items, I calculated averages of the historical percentages to estimate future values. Given Comcast’s stability, this method is considered valid for projecting the future.

I then calculated EBIAT (earnings before interest after taxes) by subtracting the tax expense from the EBIT estimate for each future year.

Next, the weighted average cost of capital (WACC) was computed. The risk-free rate was determined from the current yields on AAA-rated corporate bonds (4.87%). The market risk premium was calculated by subtracting the risk-free rate from the S&P 500 average annual return since 1950 of 7.5%, resulting in a 2.6% premium.

After calculating Comcast’s WACC, I computed unlevered free cash flows using the formula:

EBIAT + Depreciation & Amortization – Capital Expenditures – Change in Net Working Capital

I then used these unlevered FCF values to calculate the terminal value and its present value, which, in turn, led to the enterprise value. I opted for a conservative terminal growth rate (TGR) of 0.25% to account for further pay-TV and broadband internet headwinds.

To find the equity value, I added cash & cash equivalents to the enterprise value and subtracted total debt. Dividing this by the weighted average diluted shares outstanding yielded an intrinsic value of $70.29 per share.

An intrinsic value of $70.29 per share represents a substantial 68.2% upside to the current share price of $41.78, indicating that Comcast’s shares are significantly undervalued. The combination of Comcast reporting a net loss in broadband customers and the news of Disney (DIS), Fox Corp. (FOX), and Warner Bros. (WBD) teaming up to offer a sports streaming service has resulted in a 10% drop in share price. In my opinion, the market has largely overblown these events, driving CMCSA shares down to an even more attractive level.

The Biggest Challenge to the Initial Xfinity Mobile Thesis

One of the key hurdles facing my original thesis for Xfinity Mobile revolves around its wireless revenue growth and the average annual revenue per line (ARPU). From 2019 to 2021, Comcast witnessed accelerating growth in wireless revenue, reaching a peak of 51% in 2021. However, the years 2022 and 2023 saw a significant deceleration in wireless revenue growth, dropping to 29% and 19%, respectively.

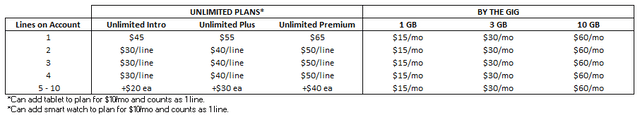

The growth in wireless lines has consistently outpaced revenue growth, leading to consistent declines in ARPU. This trend may be largely attributed to a notable portion of wireless lines added each year opting for Xfinity’s data-capped ‘By-the-Gig’ wireless plans, particularly the 1GB and 3GB plans, rather than unlimited data plans.

In contrast to unlimited data plans, where the monthly fee is determined by the plan tier and the number of lines on the account, data-capped plans charge flat monthly fees based solely on the allotted data amount, with additional fees charged for every GB used beyond the plan’s cap.

The cost structure of data-capped plans means the company does not generate additional revenue with every additional line on the plan, presenting a potential challenge for Xfinity Mobile moving forward. If an increasing portion of total wireless lines opts for data-capped plans, it would signify a growing segment of lines are not contributing additional revenue, potentially constraining the overall success of the wireless business.

In the upcoming quarters, I will closely monitor this trend and assess its impact on the potential of Comcast’s wireless business. If it appears that this pattern will significantly restrict Comcast’s ability to maximize its wireless opportunity, I may need to reconsider my initial thesis for Xfinity Mobile.

Key Takeaways

In 2023, Comcast’s Connectivity & Platforms business experienced notable developments. The company sustained robust growth in wireless lines at over 20%, while wireless revenue increased by just under 20%. Concurrently, Comcast faced a net loss of broadband customers in 2023 but managed to increase broadband revenue by 4%, primarily through price increases. Despite the decline in broadband customers, I remain optimistic about Comcast’s broadband internet business.

Comcast’s broadband internet service dominates the areas it serves, maintaining an estimated market share of 65% throughout its network footprint. Additionally, the company’s network infrastructure enables it to expand its reach and increase capacity at a fraction of the cost incurred by large phone companies deploying fiber networks to compete. Given the substantial time and capital investments required by many competitors to expand their networks, significant competition from fiber in Comcast’s broadband footprint seems unlikely in the next five years, consolidating Comcast’s dominance in its operational areas.

Expanding its broadband network reach over the past year, Comcast augmented its wireless TAM by approximately $130 million despite losing broadband customers. As Comcast continues to expand its network and deploy advanced technologies for enhanced performance and capacity across its broadband footprint, I anticipate a return to broadband customer growth, supporting the upward trajectory of its wireless lines.

While I expect Comcast to sustain strong growth in wireless lines, the trend of new wireless customers opting for data-capped plans appears to limit revenue generation from a portion of the wireless lines. This constraint hampers Comcast’s ability to fully leverage its wireless opportunity and will be a focal point for my ongoing analysis of the company.

Presently, I maintain my initial thesis that Comcast’s wireless business will sustain solid growth, more than offsetting losses from linear TV. However, my confidence in the notion that wireless savings will funnel customers to broadband is waning. As a long-term investor, I will monitor this aspect further before making adjustments to my perspective. Overall, I remain bullish on Comcast’s future prospects, and with its consistent dividend growth and substantial undervaluation, I believe CMCSA is an attractive buy option for income and value investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMCSA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.