Summary:

- CMCSA remains a Buy for value/ dividend-oriented investors, attributed to its overly discounted valuations and expanded forward yields.

- Peacock, its D2C segment, has recorded narrowing losses and increasing paid subscribers, with the subscription price hikes likely to accelerate the top/ bottom line growth over the next few quarters.

- CMCSA’s bundled services have also triggered lower churn rates and improved customer lifetime value, in both broadband/ mobile segment and streaming bundling.

- Combined with the healthier balance sheet and potential $15B in Hulu payout, we expect the management to continue investing in its growth opportunities ahead.

- Based on the stock’s bullish support at the $37s, we believe that CMCSA continues to offer an attractive risk/ reward ratio at current levels, triggering our reiterated Buy rating.

ymgerman/iStock via Getty Images

We previously covered Comcast (NASDAQ:CMCSA) in January 2024, discussing why we had maintained our Buy rating, thanks to its moderating debt to EBITDA ratio, excellent shareholder returns, and its extremely discounted valuations.

Its other segments continued to be highly profitable on a YoY basis, implying its ability to weather the slow but inevitable cord cutting and unprofitable streaming in the intermediate term, before things eventually normalize.

Since then, CMCSA had further retraced by -9% well underperforming the wider market at +10%. Despite so, we are doubling down on our Buy rating, with the stock still offering a highly attractive investment thesis across dividend incomes and capital appreciation prospects.

This is on top of its improved monetization across the connectivity and media segments, as its ARPU grows and subscribers grow, respectively, triggering the expansion of its adj EBITDA margins and healthier balance sheet.

Combined with the potential $15B in Hulu payout, we expect the management to continue investing in its growth opportunities ahead, triggering in our reiterated Buy rating.

The CMCSA Investment Thesis Remains Robust Ahead, Further Aided By The Recent Pullback

For now, CMCSA has reported a mixed FQ1’24 earnings call, with overall revenues of $30.05B (-3.8% QoQ/ +1.2% YoY), adj EBITDA of $9.35B (+16.7% QoQ/ -0.6% YoY), and adj EPS of $1.04 (+23.8% QoQ/ +13% YoY).

Part of the top/ bottom line tailwinds are attributed to the Connectivity & Platforms segment, with growing revenues of $20.27B (-0.7% QoQ/ +0.5% YoY) and adj EBITDA of $8.21B (+8.4% QoQ/ +1.4% YoY).

This is despite the moderating Total Connectivity/ Platforms Customer Relationships to 51.97M (-0.16M QoQ/ -0.53M YoY) and the Total Domestic Broadband Customers to 32.18M (-0.07M QoQ/ -0.14M YoY), implying higher ARPUs and improved monetization across its existing loyal consumers.

At the same time, CMCSA’s D2C segment, Peacock, has reported narrowing operating margins of -54.5% in FQ1’24 (+8.5 points QoQ/ +49.8 YoY), with growing paying subscribers of 34M (+3M QoQ/ +12M YoY).

While the management does not break out its linear TV revenues and opting to combine them together with Peacock, we can already see its overall numbers impress at Media Segment revenues of $6.37B (-8.7% QoQ/ +3.5% YoY) albeit with moderating adj EBITDA margins of 12.9% (+11.4 points QoQ/ -1.4 YoY/ -15.4 from FQ1’19 levels of 28.3%).

At the same time, we believe that the upcoming subscription fee hike for Peacock may help, with the current ad-supported tier to be priced at $7.99 monthly (+$2)/ $79.99 annually (+$20) and the mostly ad-free Peacock Premium Plus at $13.99 monthly (+$2)/ $139.99 annually (+$20) from July 2024 onwards.

Based on the minimal churn observed since the first fee hike in August 2023, with 24M of subscribers in Q2’23 and 28M in Q3’23, we may see CMCSA’s Peacock report improved top lines while narrowing its losses over the next few quarters, well balancing the decline observed in the secular linear TV segment in general.

This is further aided by the company’s recent launch of streaming bundle, including Peacock, Netflix (NFLX), and Apple TV (AAPL) available to all of its existing broadband and TV customers, with the “deep discount” likely to attract new subscribers while potentially reducing churn, well negating Peacock’s second fee hike.

It is apparent that bundled services have triggered lower churn rates, as similarly reported by CMCSA for the broadband and mobile segment, with it already “improving customer lifetime value.”

At the same time, we expect this bundle to increasingly push the ad-supported tier to consumers, since advertising makes up $2.02B (inline YoY) of its FQ1’24 revenues domestically – one that is typically directly accretive to bottom lines.

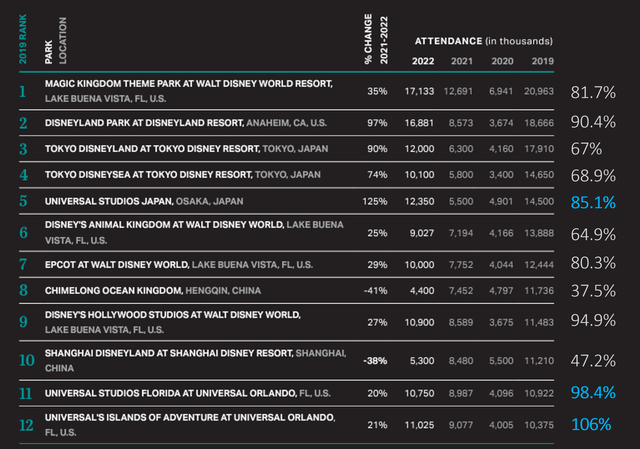

Theme Park Rankings

Themed Entertainment Association and AECOM

Lastly, CMCSA’s Theme Park business cannot be ignored, since it recorded robust revenues of $1.97B (+1.5% YoY) and adj EBITDA margins of 31.9% (-1.8 YoY/ -7.1 from FQ1’19 levels of 39%).

This is especially since three of its theme parks continue to report robust attendance in 2022, with relatively higher attendance ratio to 2019 levels compared to its direct competitor, Disney (DIS), based on the latest data from Themed Entertainment Association and AECOM released in June 2023.

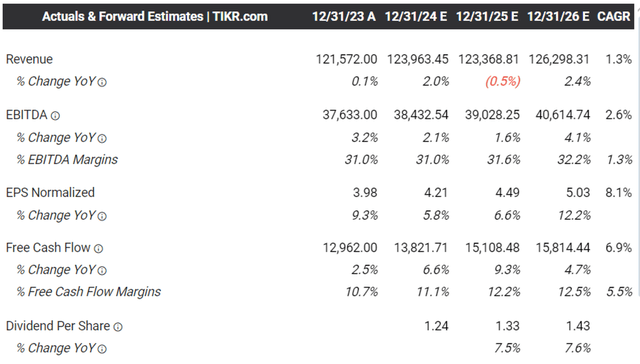

The Consensus Forward Estimates

Perhaps this is why the consensus has priced in stable adj EBITDA margins and Free Cash Flow margins ahead, further underscoring CMCSA’s robust overall profitability despite the unprofitable D2C segment and the secular decline in linear TV.

At the same time, with a moderating net debts of $90.06B (compared to $88.87B in FQ4’23, $95.17B in FQ1’23, and $100.28B in FY2019) and relatively stable net-debt-to-EBITDA ratio of 2.4x in FQ1’24 (compared to 2.36x in FQ4’23, 2.02x in FQ1’23, and 2.94x in FY2019), it is apparent that CMCSA remains reasonably leveraged thus far.

This is compared to its connectivity peers, such as AT&T (T) at 3.05x/ Verizon (VZ) at 3.12x, and its media/ streaming/ theme park peers, such as DIS at 2.77x/ Warner Bros. Discovery (WBD) at 5.27x.

Readers must also note that CMCSA is set to receive a lump sum Hulu payout ahead, ranging between the original sum of $8.6B and our bullish estimate of $15B as discussed here.

This will allow the management to opportunistically deleverage its balance sheet while investing in its growth drivers, including those highlighted in the FQ1’24 earnings call, such as the expansion of its broadband network, scaling of its streaming business, and construction of its Epic Universe theme park ahead of the 2025 opening.

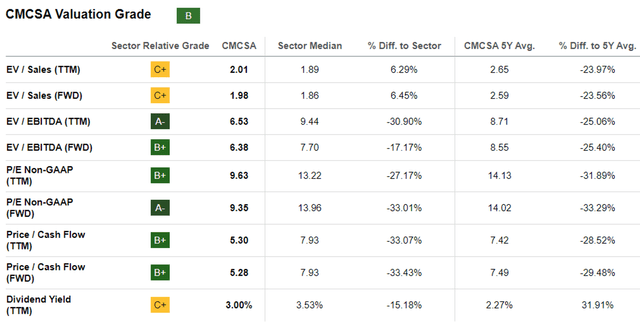

CMCSA Valuations

This is also why CMCSA continues to appear discounted at FWD EV/ EBITDA of 6.38x and FWD P/E of 9.35x, compared to its 1Y mean of 7.07x/ 10.62x and 3Y pre-pandemic mean of 8.18x/ 15.67x, respectively.

The same can also be observed in comparison to its peers, such as T at 6.47x/ 7.86x, VZ at 7.15x/ 8.76x, DIS at 13.15x/ 21.75x, and WBD at 6.24x/ NA, respectively, with the market seemingly giving away CMCSA’s highly profitable connectivity and theme park businesses away.

So, Is CMCSA Stock A Buy, Sell, Or Hold?

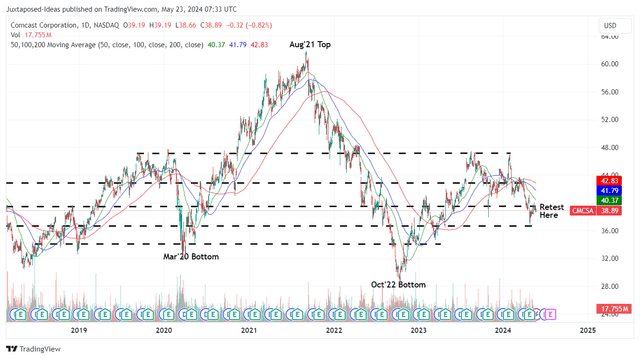

CMCSA 5Y Stock Price

For now, CMCSA has lost much of its 2024 gains while trading way below its 50/ 100/ 200 day moving averages.

Based on its LTM adj EPS of $4.09 and the discounted FWD P/E valuations of 9.35x, the stock is trading near to our fair value estimates of $38.20.

Based on the consensus FY2026 adj EPS estimates of $5.03, there seems to be a decent upside potential of +20% to our base-case long-term price target of $47.

Readers must also its inherently discounted valuations compared to its 3Y pre-pandemic P/E mean of 15.67x, with it potentially triggering a bull-case long-term price target of $78.80.

This is on top of CMCSA’s expanded forward dividend yields of 3.16%, compared to the 4Y average of 2.35% and the sector median of 3.67%.

Combined with the stock’s bullish support at the $37s, we believe that it continues to offer an attractive risk/ reward ratio at current levels, triggering our reiterated Buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.