Summary:

- Comcast Corporation has shown remarkable growth in both revenue and free cash flow over the past decade, with revenue increasing by 87.80% and free cash flow by 164.80%.

- Despite challenges from direct-to-consumer streaming platforms, CMCSA’s strategic initiatives, including the expansion of its own streaming services like Peacock, position it well for future growth.

- A discounted cash flow analysis suggests that CMCSA is currently undervalued, presenting a potential return of 44.41% compared to its current market price.

Cindy Ord

Intro

Comcast Corporation (NASDAQ:CMCSA) is a global media and technology company with various segments. The Cable Communications segment provides broadband, video, voice, and wireless services under the Xfinity brand. The Media segment operates NBCUniversal’s television and streaming platforms, including cable networks, broadcast networks, and Peacock. The Studios segment handles film and television production and distribution. The Theme Parks segment operates Universal theme parks in different locations. The Sky segment offers direct-to-consumer services and operates entertainment networks, news networks, and sports networks. Additionally, CMCSA owns the Philadelphia Flyers and provides streaming services like Peacock.

In this article, we will conduct a comprehensive analysis of CMCSA’s financial performance and growth prospects. Our evaluation will encompass a thorough examination of the company’s revenue trends, profitability metrics, and its ability to generate free cash flow. By considering these key factors, readers can gain valuable insights into CMCSA’s potential and make well-informed decisions regarding its suitability as an investment opportunity in the current market landscape.

Track Record of Growth

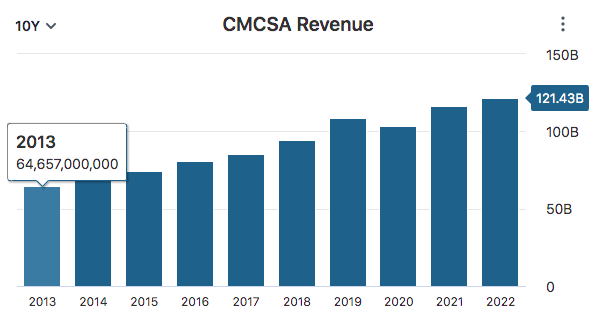

A high growth rate is important as it indicates the company’s competitiveness, financial stability, and potential for future success. CMCSA has demonstrated remarkable growth in both revenue and free cash flow over the years, highlighting its strong financial performance and market position.

In terms of revenue, CMCSA has experienced consistent growth for the past decade. From 2013 to 2022, the company’s revenue increased from $64.66 billion to $121.43 billion, representing an impressive total growth of 87.80%. This sustained growth is a testament to CMCSA’s ability to expand its market presence, attract customers, and capitalize on business opportunities. Furthermore, the compounded annual growth rate (CAGR) of CMCSA’s revenue stands at 6.79%, which is a significant achievement for a company of its size.

Data by Stock Analysis

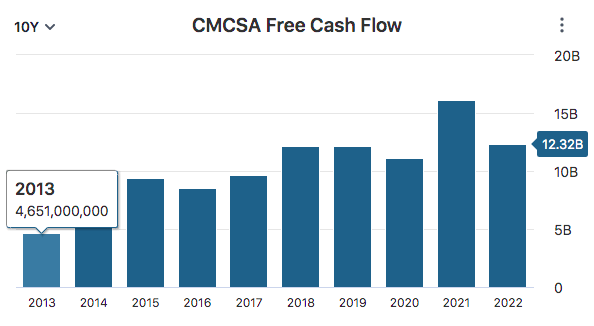

Moving on to free cash flow, CMCSA has also exhibited robust growth in this key financial metric. Over the same period, from 2013 to 2022, CMCSA’s free cash flow increased from $4.65 billion to $12.32 billion, reflecting a remarkable total growth of 164.80%. This growth demonstrates CMCSA’s ability to generate strong cash flows and manage its finances efficiently. With a CAGR of 10.91% in free cash flow, CMCSA has consistently improved its ability to generate cash and create value for its stakeholders. This growth is crucial as it allows the company to invest in research and development, pursue strategic acquisitions, reduce debt, and return value to shareholders through dividends or share repurchases.

Data by Stock Analysis

CMCSA’s remarkable growth in revenue and free cash flow over the past decade can be attributed to several key factors. Firstly, the rise of broadband has played a significant role. As a leader in expanding broadband internet access in the United States, Comcast has experienced substantial revenue growth in this segment. In 2013, 71.4% of the US population used the internet but today 91.8% of Americans are online. The growth of the internet has provided a significant tailwind for CMCSA. This expanding market has fueled CMCSA’s revenue growth, positioning the company for success in the digital age.

In addition to its organic growth, CMCSA has strategically pursued several acquisitions over the past decade, such as NBCUniversal and Sky. These strategic moves have proven instrumental in expanding Comcast’s presence in new markets and driving growth in both revenue and free cash flow. The acquisition of NBCUniversal has allowed CMCSA to diversify its offerings and strengthen its position in the media and entertainment industry, while the acquisition of Sky has expanded its international footprint. Through these acquisitions, CMCSA has not only expanded its customer base but also unlocked synergies and gained access to new revenue streams, solidifying its growth trajectory.

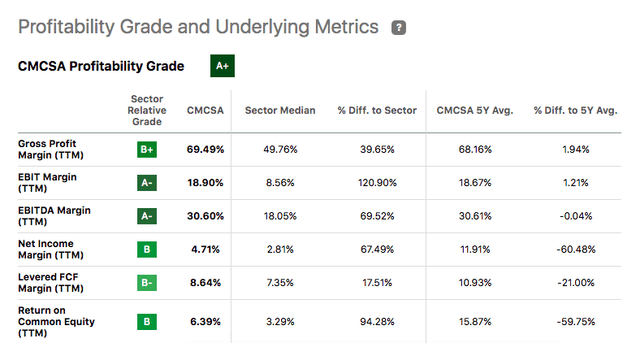

Track Record of Profitability

CMCSA’s remarkable profitability is evident in its strong financial performance and effective management, as demonstrated by consistently robust operating margins that showcase cost control and revenue maximization. The company stands out among its peers in the sector, surpassing them in key profitability metrics such as gross margins, EBIT margins, EBITDA margins, net income margin, FCF margin, and return on equity. This superiority in profitability is of utmost importance as it signifies superior financial performance, enabling reinvestment in growth opportunities and ensuring long-term sustainability and competitiveness in the market.

CMCSA has leveraged its remarkable scale to establish a robust track record of profitability. Under its Xfinity brand the company has 32.2 million broadband subscribers, allowing CMCSA to hold the position of the leading internet service provider in the United States, providing distinct advantages such as economies of scale and enhanced bargaining power with content providers. This expansive scale enables CMCSA to optimize its operations, reduce costs, and negotiate favorable terms, ultimately contributing to the company’s impressive profitability and positioning it as a formidable player in the market.

Additionally, CMCSA brand strength is another driver over its profitability, particularly under the Xfinity brand, has been a significant driver of its success. Xfinity has established itself as a trusted and recognized name in the telecommunications and entertainment industry. The brand is synonymous with reliability, quality, and innovative services. With a wide range of offerings, including cable TV, internet, and home phone services, Xfinity has positioned itself as a one-stop solution for consumers’ connectivity needs. This strong brand reputation not only attracts new customers but also fosters loyalty and retention, contributing to CMCSA’s continued growth and market dominance.

NBCUniversal’s brand strength is a key asset for CMCSA, bolstering its position in the media and entertainment industry. NBCUniversal is renowned for its iconic television networks, including NBC, Bravo, USA Network, and Telemundo, among others, which have a wide viewership and dedicated fan bases. The brand is associated with high-quality programming, engaging content, and award-winning shows and movies. With a diverse portfolio spanning broadcast, cable, film, and digital media, NBCUniversal has established itself as a prominent player in the entertainment landscape, attracting audiences and advertisers alike. This strong brand recognition and reputation contribute to CMCSA’s overall success and enable it to leverage the power of NBCUniversal’s content across various platforms.

Outlook

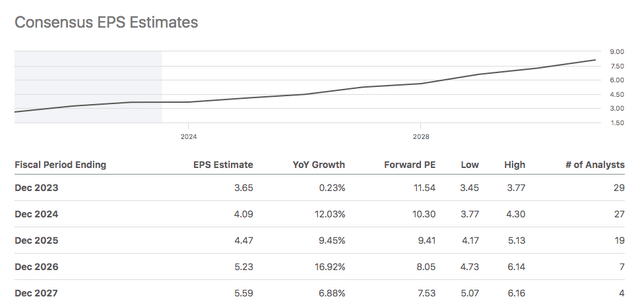

CMCSA’s outlook for the rest of 2023 appears relatively stable, with an estimated EPS of $3.65, reflecting a modest year-over-year growth of 0.23%. While the projected revenue estimate of $120.37 billion indicates a slight decline of -0.87% compared to the previous year, it suggests a relatively resilient performance given the challenges faced by various industries in the current economic climate.

However, CMCSA’s earnings are expected to grow significantly over the next three years with an average growth rate of 12.8%. Therefore with its strong market position, extensive customer base, and strategic initiatives, CMCSA is well-positioned to navigate the current economic climate and continue delivering solid financial results in the coming years.

There are some risks that may affect these earnings projections. The emergence of direct-to-consumer (DTC) streaming platforms has had a significant impact on traditional cable providers like CMCSA. These platforms offer consumers greater flexibility, convenience, and control over their content consumption by allowing them to stream content on-demand, anytime and anywhere. As a result, there has been a shift in consumer preferences, with more individuals opting for DTC streaming services over traditional cable subscriptions.

This has led to a decline in the number of cable subscribers for companies like CMCSA. To adapt to this changing landscape, CMCSA has responded by expanding its own streaming offerings, such as Peacock, to remain competitive in the evolving market and meet the growing demand for online content.

CMCSA focus on the expansion of its streaming services will be a main catalyst for further growth in the years to come. CMCSA’s offerings like Peacock and Xfinity Flex are positioned to capitalize on the increasing trend of content consumption through streaming platforms. By investing in and expanding its streaming services, CMCSA aims to leverage changing consumer preferences and secure a strong foothold in the evolving media landscape.

Peacock’s paid subscriber count continues to grow, reaching 21 million in the first quarter of 2023, reflecting consistent growth compared to previous quarters. In contrast, the streaming service had nine million subscribers in the fourth quarter of 2021. Additionally, CMCSA recently announced price increases for its popular Peacock streaming platform as the company pushes for profitability in this segment. This marks the first time the fees have been raised.

Existing customers will see a $1 increase to $5.99 for the ad-supported Peacock Premium plan and a $2 increase to $11.99 for the mostly ad-free Peacock Premium Plus tier. The price hikes, effective from August 17 for existing users and immediate for new customers, are aimed at offsetting rising content costs and enabling continued investments in user experience and content. The adjustments come as Peacock faces mounting streaming losses and intensifying competition in the market.

Another catalyst for growth for CMCSA will be its commitment to be a leader in animation. Through strategic investments and the collaboration of DreamWorks and Illumination, the company has achieved tremendous success in creating globally recognized and beloved franchises. Iconic movies like Despicable Me, Shrek, Pets, and the recent Super Mario Bros. which has shattered records, including the largest worldwide opening for an animated film. Additionally, the success of Super Mario Bros. opens up the door for many potential sequels that will drive further growth. In our view, this focus on animation further strengthens CMCSA’s position in the industry and paves the way for continued success and expansion.

Valuation

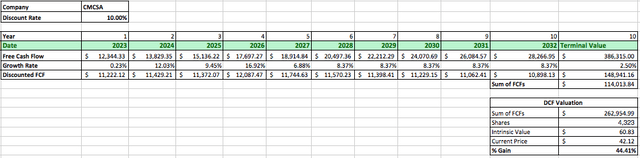

To evaluate CMCSA’s intrinsic value, we will utilize the discounted cash flow (DCF) analysis. By calculating the present value of anticipated future cash flows, we can determine the true worth of the company. Starting with CMCSA’s starting free cash flow of $12.3 billion, we will apply an initial growth rate of 0.23% for 2023, followed by growth rates of 12.03% for 2024, 9.45% for 2025, 16.92% for 2026, and 6.88% for 2027 based on the data from the section above.

For the subsequent period, we will use a growth rate of 8.37% for years 6-10 based on the average compound annual growth rate of CMCSA’s revenue and free cash flow over the last decade. Employing a discount rate of 10%, based on the average return of the S&P 500 with dividends reinvested, and a conservative perpetual growth rate of 2.5%, we determine the intrinsic value of CMCSA to be $60.83. This suggests that CMCSA may be currently undervalued, presenting investors with a potential return of 44.41% compared to the company’s current market price.

Takeaway

CMCSA’s commitment to expanding its streaming services, such as Peacock and Xfinity Flex, positions it well to capitalize on the growing trend of content consumption through streaming platforms. The success of CMCSA’s animation franchises, along with strategic acquisitions and its brand strength, further solidify its growth potential. Despite the challenges posed by the emergence of direct-to-consumer streaming platforms, CMCSA’s resilience, financial stability, and strategic initiatives make it an attractive investment opportunity with a promising outlook for growth in the coming years.

Taking into account CMCSA’s strong market position, diverse business segments, and the analysis of its financial performance and growth prospects, we recommend a buy rating for the company. CMCSA’s low price in relation to its intrinsic value, as determined through a discounted cash flow analysis, suggests that the stock is currently undervalued.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.