Summary:

- Comcast has successfully transformed itself from just a cable TV provider to one that has revenues coming from many sources including broadband, theme parks, movies, and streaming.

- The investments in Peacock are starting to pay off and the path to profitability is showing through increased revenue from paid subscribers.

- To think that CMCSA is a failing business because of “cord-cutters” or Peacock as just another streaming service will be underestimating the combined strengths of all the business segments.

Sundry Photography

Introduction

What comes to mind when most people think about Comcast (NYSE: NASDAQ:CMCSA)?

Could it be CMCSA’s products and services delight their customers? The following statement from the President of Comcast Corporation Michael Cavanagh at the Q1 2023 earnings call certainly got me fired up.

… our position as a scaled leader in very large and profitable markets with tens of millions of customers paying us over a $100 per month…

“People must love the Comcast experience to pay so much for it,” was my first thought.

That may not be the case.

Now, if customers have no real alternatives for getting their broadband other than through CMCSA or a few other broadband and cable TV providers because these companies operate in an oligopoly, then the “$100 per month” fees that these “tens of millions of customers” are paying CMCSA are out of a lack of choice rather than a case of them liking CMCSA over other competitors.

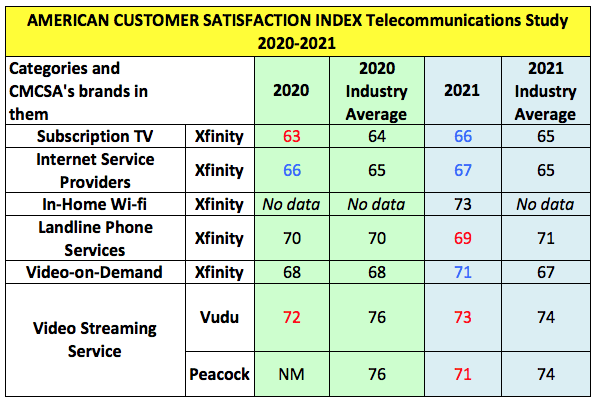

Other than the high costs of its services, the quality of service is also in question too. The American Customer Satisfaction Index Telecommunications Study (ACSI), a trusted “national indicator of the quality of economic output for goods and services as experienced by consumers of that output”, conducted a study of the different telecommunications companies in the United States for the years 2020 and 2021. CMCSA did not exactly impress.

Data Compiled from ACSI Study

CMCSA has the dubious honor of having received the highest share of negative response to their customer service. A check on Trustpilot reveals CMCSA’s dismal score.

Could those be the reasons why what comes to mind could be the term “cord cutters”? Many may think that CMCSA is a dying cable business because millennials are not interested in Cable TV anymore; the high prices and poor service certainly did not help retain customers. As of April 2023, the number of customers in the United States willing to pay for cable TV fell below 50% of its residential customers.

CMCSA has also been embroiled in multiple lawsuits. Now, I get it that big companies get sued all the time. However, when a huge number of these cases got to do with allegations of fraud or misrepresentation of facts, the very integrity of the company becomes undermined. And when a company’s business practices are being doubted, it can make trusting certain information that the company presents a tough one to swallow.

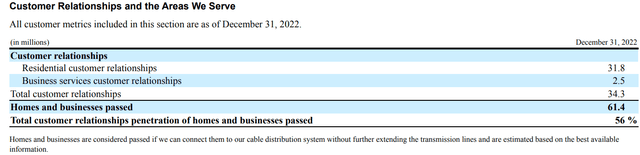

Take for example the following information that is presented on page 2 of the 2022 annual report, informing readers of the areas that CMCSA serves.

If that information can be trusted, it will mean that the “total customer relationships penetration of homes and businesses passed” of 56% in 2022 is a better result than that of 10 years ago at 53.8%. But when CMCSA admits to giving the wrong broadband map to the (Federal Communications Commission) FCC, with implications on getting federal grants for expanding broadband connectivity, to blocking rivals from getting the same grant, this is serious on many levels.

With the above as the backdrop, let’s study the business.

The Business

According to the 2022 Annual Report, Comcast (NASDAQ: CMCSA) describes itself as

… a global media and technology company with three primary businesses: Comcast Cable, NBCUniversal and Sky. We were incorporated under the laws of Pennsylvania in December 2001. Through our predecessors, we have developed, managed, and operated cable systems since 1963. Through transactions in 2011 and 2013, we acquired NBCUniversal, and in 2018, we acquired Sky. We present our operations in five reportable business segments:

(1) Comcast Cable in one reportable business segment, referred to as Cable Communications;

(2) NBCUniversal in three reportable business segments: Media, Studios, and Theme Parks (collectively, the “NBCUniversal segments”); and

(3) Sky in one reportable business segment.

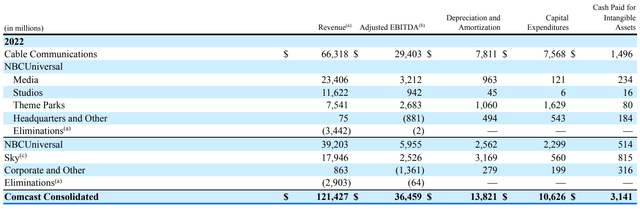

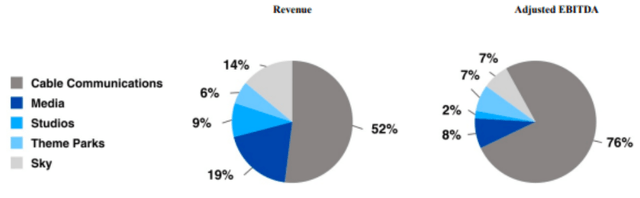

The results for 2022 are presented below. The largest segment is the Cable Communications Segment, at 52% of the full-year consolidated revenue.

Investors new to CMCSA may not know but back in 2010, this segment was responsible for 95% of CMCSA’s revenue. Out of the full-year 2010 revenue of $37.9 billion, the Cable Segment was responsible for $35.8 billion of that. Since then, management has been diversifying the revenue stream to bring that figure down. By 2013, 64.6% of the full-year revenue ($41.8 billion out of $64.7 billion) came from the Cable Communications Segment (page 2). And by 2022, just 52% of the revenue is generated by the Cable Communications Segment.

How Did Comcast Get Here

To more fully understand where Comcast Corporation (NASDAQ: CMCSA) is headed requires an appreciation that this is a company that has undergone multiple transformations in the past 15 years to get here.

In the 2008 annual report, CMCSA described itself as

… the nation’s leading provider of cable services, offering a variety of entertainment, information and communications services to residential and commercial customers. As of December 31, 2008, our cable systems served approximately 24.2 million video customers, 14.9 million high-speed Internet customers and 6.5 million phone customers and passed over 50.6 million homes in 39 states and the District of Columbia. We report the results of these operations as our Cable segment, which generates approximately 95% of our consolidated revenue… Our other reportable segment, Programming, consists primarily of our national programming networks, including E!, Golf Channel, VERSUS, G4 and Style.

CMCSA’s main competitors back in 2008 were other direct broadcast satellite (“DBS”) operators and phone companies. The operating margins for the Cable segment were 40.6% (page 27 of 10K). The competitors then were mainly AT&T (NYSE: T) and Verizon (NYSE: VZ).

The Great Financial Crisis provided an opportunity for CMCSA to diversify its revenue stream into the entertainment industry by buying out NBCUniversal from General Electric (NYSE: GE). This naturally means CMCSA now competes with entertainment giants like Disney (NYSE: DIS) and its Marvel and Star Wars franchise, Warner Bros Discovery (NASDAQ: WBD) and its DC Universe with even more superhero-genre, Netflix (NASDAQ: NFLX) with its original content expertise, Apple (NASDAQ: AAPL) with its billions invested in Apple TV+; and more recently we have Amazon (NASDAQ: AMZN) throwing itself into the fray with its MGM acquisition in 2022.

CMCSA is no slouch. Its multi-year evolution in the media and entertainment business only started with the NBCU acquisition which came with it not just content but also the world-renowned theme park Universal Studios (Disney is the only other company above that has something like that) and film production capabilities with Universal Pictures. That was followed by DreamWorks Animation in 2016, Sky in 2018 to offer streaming services to Europe, before launching the Peacock streaming service in the United States in 2020. The $0 tier that Peacock offered (discontinued in 2023) definitely helped to boost its subscription numbers. Even so, at $5 a month for the full Peacock library, it remains one of the most affordable streaming services out there, a key consideration when many are tightening their purse strings.

Streaming and TV content from NBC Universal

In 2015, Alan Wurtzel, NBCUniversal’s audience research chief, spoke to New York Post in an interview about the change in millennials’ content consumption behavior, expressing his shock at the double-digit increase in usage of streaming and smartphones, so I doubt management underwent the transformation they did because they had the foresight a decade ago to address the issue of cord-cutting. However, when CMCSA decided to shift to streaming, which is apparently the right move, they moved fast.

Peacock Will Lead The Way

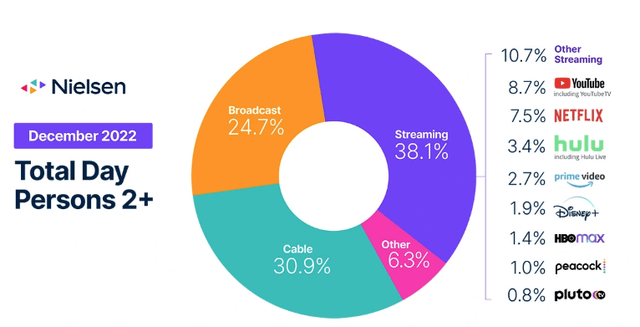

According to this August 2022 research from Nielsen,

Amid the slowdown of new content on traditional television and reduced sports programming, streaming claimed the largest share of U.S. TV viewing in July—a first after four consecutive months of hitting new viewership highs. Streaming viewership in a given month has exceeded broadcast viewing before, but this is the first time it has also surpassed cable viewing.

Even the start of the football season in October 2022 which boosted television viewership by 12.4% from the low in August 2022 was insufficient to shake streaming’s leadership. And Peacock, despite its late start in the streaming business when compared to established peers, managed to capture 1% of the total streaming viewership in December 2022, it, according to data by Nielson.

Streaming services remain most popular destination for TV viewing in December

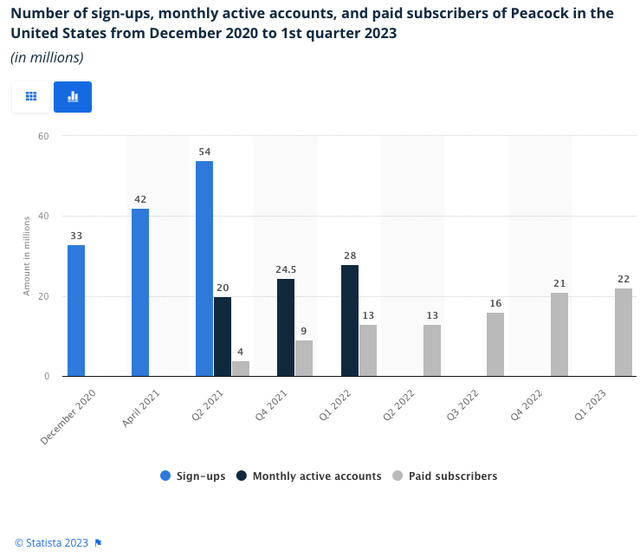

The growth is not just in the number of sign-ups, which many did when the service was first launched with a free tier option. The important metric is the number of paid subscribers, which increased more than 5-fold in 7-quarters from 4 million in Q2 2021 to 22 million in Q1 2023.

Paid subscribers of Peacock in the United States from December 2020 to 1st quarter 2023

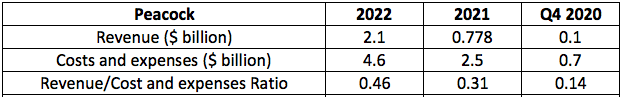

The ratio of revenue to costs and expenses in Q4 2020 was a very low 0.14 but by the end of 2022, that ratio has improved to 0.46 meaning the cost of acquiring each paid subscriber has come down. Once the ratio exceeds 1, the segment will be profitable.

Author’s compilation and calculation

Comcast President Mike Cavanagh shared his views about Peacock at the Q1 2023 earnings call,

Premium content with a dual revenue stream, both advertising and subscription fees, and we’re encouraged by our results so far, growing paid subscribers and engagement levels to roughly 20 hours per subscriber per month fueling strong growth in advertising revenues. We’re investing, but the results we are seeing give us confidence that we are on the right path for Peacock to break even and grow from there.

Before anyone gets too excited about the demonstrated growth of the streaming business, let’s put the $2.1 billion of revenue from Peacock into context.

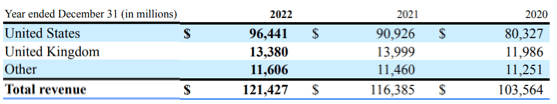

2022 10K

CMCSA generates more than $100 billion in revenue every year from 2020 to 2022. $2.1 billion is just 1.73% of CMCSA’s total revenue for 2022. To be sure, since Peacock’s share of the total revenue in 2021 was even smaller at 0.67%, bulls can say that the revenue at Peacock had increased 2.5 times in just one year, which is remarkable but in the bigger scheme of things, Peacock by itself is not going to move the needle much. But that is not the point of Peacock, at least not yet. To think about Peacock just from a paid-subscriber point of view will be mistaken. Comcast’s President explains the strategy for Peacock,

Premium content with a dual revenue stream, both advertising and subscription fees, and we’re encouraged by our results so far, growing paid subscribers and engagement levels to roughly 20 hours per subscriber per month fueling strong growth in advertising revenues.

The way I understand Peacock is it is both a linchpin as well as a gateway if you will. Peacock is a lynchpin that ties different revenue generators – movies, original content, TV shows – together as a whole, and it provides a gateway to CMCSA’s viewers from different content consumers on CMCSA’s multiple platforms. Not every CMCSA’s viewer will like sports, cartoons, or news, and that is fine because Peacock has all of these and more. If someone is watching the news on NBC, that person may hop over to the financial news on MSNBC, before going to E! to get some laughs from Celebrity Prank Wars or watch the latest drama in the lives of the Kardashians. Having Peacock makes it enticing for clients looking to advertise through CMCSA. Jeff Shell, CEO of NBCUniversal, explained it this way in the Q3 2022 earnings call,

As far as Peacock our long-term aspirations on Peacock is for it to be — to balance out our overall Media business. I think we’ve said all along that we — our strategy in streaming is different than some of the premium SVOD players like Netflix and Disney+. We view it as a part of our business. We manage it as one. We make decisions on programming as one. We sell advertising across the business as one. And as viewership shifts to — from linear to Peacock we want Peacock to get to a level and a scale that causes our business to be balanced as consumer sentiments and advertiser sentiments change.

And so if you want to — if you have a great content business the way you maximize your returns is having platforms where you can have the flexibility to put your content on your own platforms and move it around to give your content the best chance of success. And we’ve had that over the years.

So, when you look at Peacock what is the definition of success? It’s really two things. One is taking that ecosystem that I just talked about and giving yourself an addition to your platform, which allows you more flexibility to maximize the return of your content both in terms of allowing it — a show to have a better chance of being a hit or a movie to have a better return when you can move it around, and have the right platform for the right piece of content. So, we want to get Peacock to a scale where we’re fairly indifferent between content going on linear and content going on Peacock and having the best platform out there. And we think we’re well on our way to that

And by having the latitude to move in-house content around the different channels, there is a greater chance of finding the right audience that will make a show or a movie a hit.

With so much at stake and the billions spent on Peacock, eyes will be on the profitability and growth of this segment as its success is not a done deal. This is not a segment that has a moat, in my opinion. Despite Peacock’s impressive library of content and it has unique shows, it is pitted against content giants like Disney (NYSE: DIS), Warner Bros Discovery (NASDAQ: WBD), Netflix (NASDAQ: NFLX), Apple (NASDAQ: AAPL), and Amazon (NASDAQ: AMZN). There will come a point when subscribers have to give up something.

CMCSA is definitely not betting the farm on Peacock alone, and that is heartening to know.

Other Growth Areas

Four growth areas were outlined at the conference call.

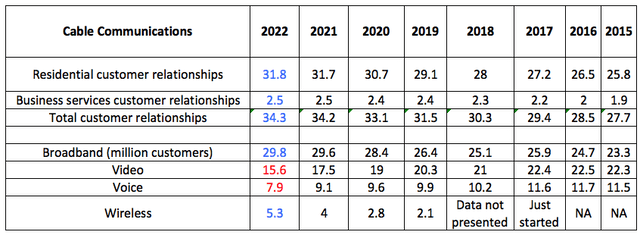

The first is in the Cable Communications segment. The increase in the number of customers for both the residential and business side have been increasing over the years.

Data on Customer Numbers Compiled from 10Ks from 2015 to 2022

In the hyper-connected world today, people are consuming more content, at home, work, and even when they are on the go. That story is supported by the growth in the numbers of broadband and wireless customer. Growth in these areas is able to mitigate the decline in video and voice customers.

The second area of growth comes from high-margin (almost 60%) Business Services. CMCSA’s 2.5 million domestic business customers are more than any of its competitors, giving it a headstart in this segment. Its advanced network infrastructure is more suitable for serving commercial and government locations compared to the competitors offering legacy wireline and fixed wireless services.

The third area of growth maximizing CMCSA’s own slate of intellectual property – including special IP that is licensed like Harry Potter or Nintendo’s characters like Mario – to create experiences that can delight customers in its theme parks. There are 4 more theme parks to come – Donkey Kong, Epic, a horror-themed park, and one for younger children – coming online in the next two years and providing even more revenue streams to cover a wider range of audiences.

The fourth area of growth is content and streaming (Peacock). CMCSA has well-loved brands/characters like Jurassic, Minions, Halloween, Puss in Boots, Megan, and now Super Mario Bros. Scoring movie hits is not a given but the beauty of having such a breadth of content is CMCSA does not have to depend on hits to bring in new customers and retain existing ones. Having a roster of famous characters that can be refreshed in sequels (think of all the never-ending Marvel and Star Wars movies that have benefited Disney) will do the trick.

Risks and Concerns

Intense competition has been raised in this article so we shall not repeat that again.

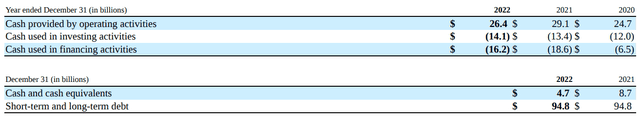

Investors should keep an eye on the debt situation. CMCSA is (at the point of writing) a $173 billion market cap company with $94.8 billion in debt.

At the same time, CMCSA businesses generate a lot of cash flows from operating activities. In 2022, CMCSA managed $26.4 billion in operating cash flow which is 27% of the total debt. So long as CMCSA can continue to grow that cash flow – and the four growth drivers outline above seem plausible – the company should be able to continue to handle all the current and long-term debt.

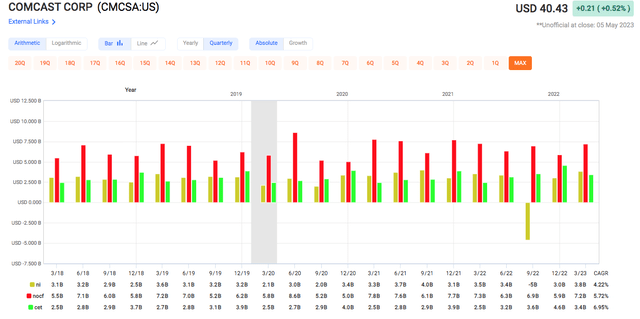

The other concern would be the massive decline in net income in Q3 of 2022.

Fast Graph CMCSA Net Income, Operating Cash Flow, and Capital Expenditure for Q3 2022

In the Q3 2022 earnings call, the CEO said,

Switching gears, the UK and other European markets have been adversely affected by the Ukraine conflict as we all know higher energy costs, higher interest rates, higher overall inflation, and currency headwinds. This quarter we took a non-cash charge as a result of all of this at Sky based on this environment which Mike will talk a bit more about.

The new CFO Mike Cavanagh explained,

Challenging economic conditions in the UK and other European markets have resulted in a significant increase in discount rates used in the annual impairment analysis and reduced estimated future cash flows at Sky…

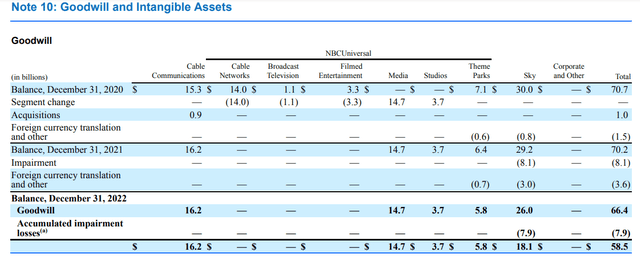

As a result, we have taken an impairment charge related to Sky goodwill and intangible assets totaling $8.6 billion.

More details are found on pages 40 and 90 of the 2022 10K.

According to Note 10,

The decline in fair value primarily resulted from an increased discount rate and reduced estimated future cash flows as a result of macroeconomic conditions in the Sky territories.

Huge as it is, this impairment is not reflective of the CMCSA business. Companies are required by the SEC to do an annual impairment exercise, and this can affect the net income on the income statement. This impairment does not reflect the company’s revenue and cash flow-generating abilities.

Lastly, revenue from Sky has fallen from $32 billion in 2021 to $19 billion in 2022 (page 74) in part due to the Ukrainian conflict and the resulting inflationary pressure that it puts on people’s wallets. This is an external-driven event that hopefully when resolved will also relieve the same pressure on spending.

Valuation

The forecasts for earnings and sales have been coming down over the past 6 months for FY 2023, 2024, and 2025 (analysts might not have updated the latest earnings results yet).

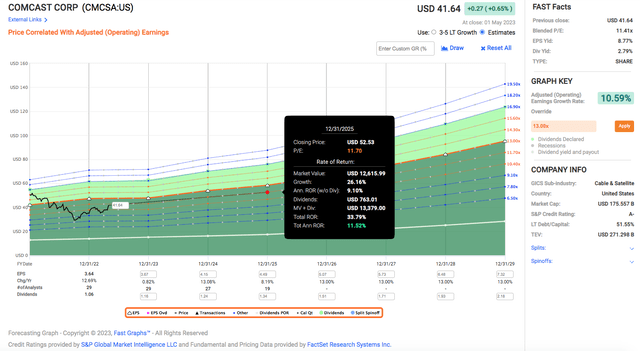

Zach’s valued CMCSA at $40 which if true does not provide a margin of safety at the price that concluded on 28 April 2023. The Morningstar analyst is more bullish, valuing CMCSA at $60, which is possible if the stars align, CMCSA hits its milestones, and it can trade back up to a P/E of 15. For context, the normal P/E for the past 10 years is between 17-18. To establish a margin of safety, we assume that CMCSA trades at around the current blended P/E of 11.7. And assuming analysts’ growth forecast of 10.59% pans out and the company manages to grow the adjusted earnings per share at that rate, CMCSA is able to potentially provide a total annualized rate of return of 11.52% by 2025.

Conclusion

How should one think about Comcast (NYSE: CMCSA)?

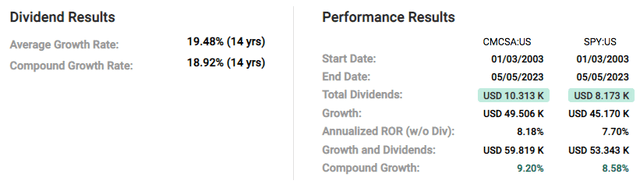

As an investor, I see CMCSA as an A- rated company that has a proven history of returning to shareholders. A $10k investment in CMCSA would have been better than a similar one in SPY over the past 20 years.

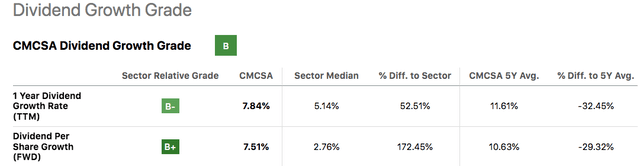

CMCSA has also been a dividend compounder. To be fair, the rate at which CMCSA has been increasing the dividends has come down to the high single-digits in the past three years and according to Seeking Alpha, the expected dividend growth rate is expected to fall further. And with the dividend payout ratio at around 30%, the dividend looks pretty safe to me with plenty of room to grow.

Seeking Alpha Dividend Growth Page

CMCSA has diversified its revenue sources and among the very successful ones are the theme parks and studio businesses, and the venture with Peacock shows positive results and improved profitability within just 3 years of its launch.

Users of its various services may view CMCSA very differently and less positively. The 1-star rating on Trustpilot does not lend confidence, nor do the many lawsuits. And if there are credible and better alternatives that users of CMCSA’s services can turn to, I can see CMCSA in trouble. However, when CMCSA operates in an oligopoly among other service providers with customer satisfaction ratings just as terrible, I see customers having little choice but to ventilate about their unhappiness online while sticking with CMCSA.

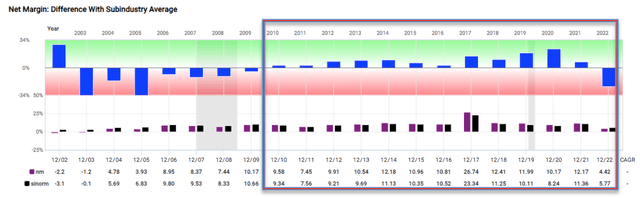

Over the years, the company has managed to improve its operating earnings every single year (with the exception of 2020), all while undergoing a vast transformation in terms of how the company brings in revenues. Love it or hate it, it is hard to argue that CMCSA is a well-run business with above-industry net operating margins ever since its evolution that began with the acquisition of NBCUniversal and DreamWorks.

Fast Graph Fiscal Fitness Check

Anyone who continues to think of CMCSA as just a mere cable TV provider bleeding revenue thanks to cord-cutters is not wrong but they are also not grasping the full narrative of the evolving CMCSA story.

Since the low of $28.39 that it reached in November 2022, CMCSA has staged a remarkable price recovery, gaining 42.4% in just 6 months while SPY gained 18.5%, the QQQ gained 24%, and competitor Verizon (NYSE: VZ) remained flat in a similar time period. Yet, it is still undervalued, and with it possibly undervalued by as much as 33%, according to Morningstar’s valuation of $60 per share, CMCSA is a buy for the dividend growth investor looking to hold an A- credit-graded company with a solid balance sheet, good cash flow, growth prospects, and one that operates in an oligopoly where even providing the poorest service is not enough to turn away its customers.

Wait no more to fully participate in the growth of this company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMCSA, GOOGL, AMZN, AAPL, DIS, WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.