Summary:

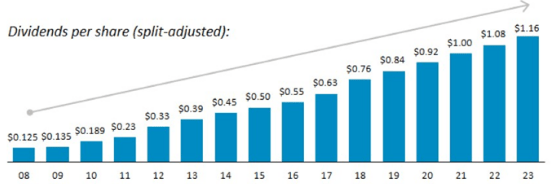

- Comcast has a strong 15-year record of dividend payments and positive dividend growth.

- Comcast continues to trade at discounted historical valuations and at a discount to its respective industries and sector.

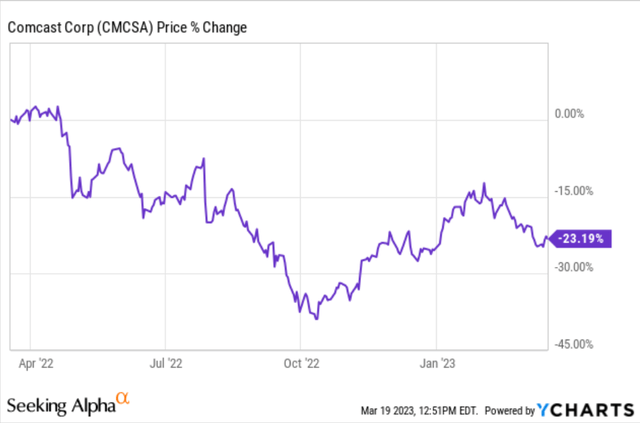

- Down over 20% on a 1-year timeframe, it might be an ideal time to take a stab at Comcast stock.

- Utilizing a relative comps valuation analysis and a modified DCF, I will show Comcast’s undervaluation relative to its peers.

- Some interesting developments in NBCUniversal; including the opening of SUPER NINTENDO WORLD™ in Hollywood, California in early 2023.

Jeff Fusco/Getty Images Entertainment

Comcast’s 1-Year Price Action

Investment Thesis:

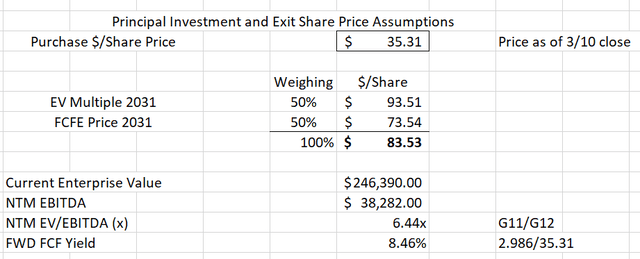

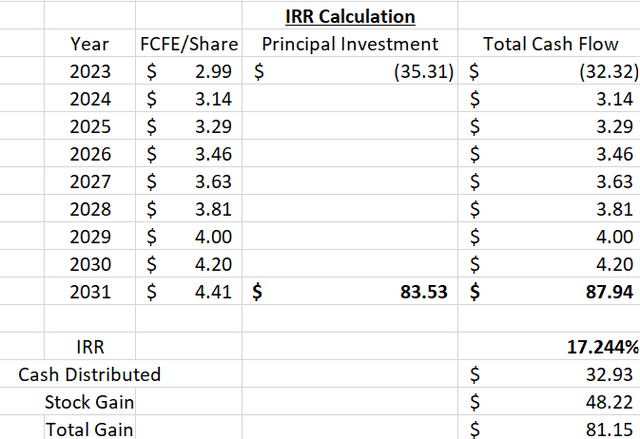

Comcast Corporation (NASDAQ:CMCSA) is being rated as a buy and overweight relative to its cable/satellite industry peers. Steady growth, paired with consistent and reliable share buybacks and dividends, make CMCSA an attractive investment going into its FY 2023. I have placed a price target of $83.53, 8 years out, using a DCF model.

Strong Q4 and FY 2022 Dividend Results and Return of Capital

- Raising dividend by $0.08 to $1.16/share in 2023 – Translates to a 7.4% year-over-year in 2023.

- This increase makes it Comcast’s 15th consecutive annual dividend increase.

- Return of capital – Record high of $17.7B with $13.0B in share repurchases and $4.7B in dividends.

Significant Streaming and International Growth

- Peacock domestic paid subscribers more than doubled, surpassing 20 million by year-end.

- Peacock revenue nearly tripled to $2.1 billion – AEBITDA loss of $978 million, which was in line with the FY ’22 outlook provided in 2021.

- Strong customer relationship increases due to the expansion of Sky in the U.K., Germany, and Italy.

Strong Xfinity Performance and Margin Expansion

- Total customer relationship net additions were 75,000, and total broadband customer net additions were 250,000 in their cable communications segment.

- Ex-severance (FY ’22 results were greatly impacted by increased severance costs in Q4), AEBITDA increased 5.8% YoY.

- Excluding severance, Q4 ’22 AEBITDA margin expanded to a record high of 45.3%.

- Surpassed 5 million customer lines in just 5 years.

Comcast’s Industry Positioning

Although Comcast is in the cable/satellite industry, with its three business segments, Comcast also operates in the media and entertainment, and telecom industries. Comcast Corporation has strongly positioned itself for success through adverse market conditions with brands across the globe, covering several consumer preferences. Its Comcast Cable segment, under the Xfinity brand, NBCUniversal business segment, and Sky Group brand in Europe, allows Comcast to succeed ahead of its competition.

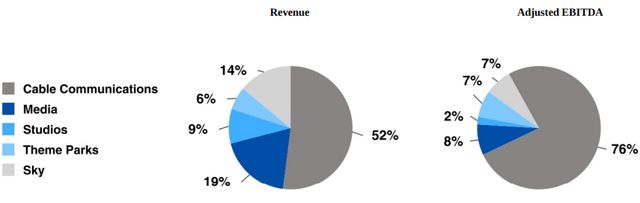

As a conglomerate with industry-leading businesses worldwide, Comcast distinguishes itself from other cable and satellite providers. Although roughly 50% of its revenue and 70% of its EBITDA comes from its cable infrastructure providing voice, phone, and internet, its other business offerings diversify it from the competition. Because of its multi-segment offerings, Comcast has grown even in unfavorable economic conditions and provided investors with a steadily increasing dividend yield higher than the industry averages. Although Comcast isn’t growing its sales and earnings as much as it did in the past few years, the company has been able to stick to its reliable strategy of returning capital to shareholders through quarterly dividend payments and share buyback programs to increase investor ownership.

Comcast Business Segments

- Cable Communications: Cable Communications consist of Comcast Cable, which provides broadband, video, voice, wireless, and other services domestically under the Xfinity brand.

- Media: The media segment primarily consists of NBCUniversal’s television and streaming platforms. These platforms include its cable networks, the NBC and Telemundo broadcast networks, and local broadcast television stations. Peacock and its minority stake in Hulu are also the DTC streaming options offered in the media segment.

- Studios: Studios comprise NBCUniversal’s film and television studio production and distribution operations. DreamWorks studios is also a revenue-generating acquisition under the studios segment.

- Theme Parks: Theme Park revenue consists primarily of Comcasts’ Universal theme parks in Orlando, Hollywood, Japan, and China.

- Sky: The Sky Group is one of Europe’s leading entertainment companies, which includes a DTC business model, providing video, broadband, voice, and wireless phone services. Sky Group comprises the Sky News broadcast and Sky Sports networks.

Comcast Revenue and AEBITDA by Business Segment (Form 10-K)

Figure 1

Industry Dynamics and Growth Forecast

Comcast Corporation’s industries are capitally intensive and saturated with several noteworthy competitors. Across the streaming, broadband, and telecommunication sub-sectors, Comcast has to compete with media giants like Netflix (NASDAQ:NFLX) and broadband providers like Charter Communications (NASDAQ:CHTR) and Lumen Technologies (NASDAQ:LUMN). Verizon (NASDAQ:VZ) and AT&T (NASDAQ:T) are also strong competitors, with Xfinity in the telecom space. Grand View Research expects the broadband market to reach roughly $750 billion by 2030 and grow at a steady 9.7% CAGR from 2023-2030. Increasing online commerce in the retail space and rapidly rising platforms for streaming content are notably augmenting the market growth. Comcast is investing heavily in wireless technology, with its free cash flow holding immense potential in digitizing the world in developing markets. Currently, the market is roughly valued at $420 billion and has several internal drivers to reach that $750B valuation by the end of the decade. Spending on video services and pay TV in the U.S. and internationally is set to continue to decline because of cord-cutting; however, Comcast remains a strong competitor in the space. Luckily, Comcast has been investing aggressively in the streaming space with Peacock and its split ownership of Hulu with Disney, which will help ease the pressures for the drop in engagement in annual spending on video services.

Recent Earnings Call Developments and Internal Catalysts

After listening in on the most recent full-year 2022 and Q4 earnings call from Comcast, there were some very interesting developments noted by Brian Roberts (CEO), Michael Cavanagh (President, ex-CFO), and Jason Armstrong (newly appointed CFO). Early in the call, Brian noted that there was a strong film slate of content out of the NBCUniversal segment. In 2022, NBCUniversal was the 2nd best-performing studio in terms of the worldwide box office. Box office success can be accredited to some releases like Jurassic, Minions, and Puss In Boots. Moreover, these box office successes have had great carry-over success for Peacock, which doubles the results in the box office and on the streaming platform. Peacock’s premium tier now has 60,000+ hours of content as well as access to all of Peacock’s live-streamed sporting events – Price = $4.99 monthly or $49.99 per year, which comes in at a discount compared to its competition (Netflix Basic Monthly – $9.99/Premium – $19.99, Warner Bro’s HBO Max Ad-Tier – $9.99, Disney’s Disney+ Ad-Tier – $7.99).

Peacock Developments

Comcast accrued more than 20 million paid subscribers at the end of 2022 in its DTC platform, Peacock. Subscribership growth was fueled by some of the films stated above and sporting events like the World Cup, NFL, and Premier League. Although some of these events are short-term stimulants, executives expect subscriber cadence to follow the content launches, which will fall heavily in the 2nd half of 2023. Although the company stopped posting recorded ARPU numbers, Jeffrey Shell (NBCUniversal CEO) stated that Peacock’s average revenue per user is approaching $10 per customer, which has grown modestly since its inception and has vitalized revenue growth. On the call, Cavanagh noted that Peacock has consistently seen a positive drive upwards in domestic ARPU. Media-adjusted EBITDA drastically cratered by nearly 82% because of severance increases and considerable losses in Peacock. These losses are accredited to content investment and the rollout of the premium next-day access to current NBC and Bravo shows in late 2022. Some NBC shows that will have next-day access are the Law & Order series and The Tonight Show Starring Jimmy Fallon. NBCU just announced a seven-year deal to air Big Ten Saturday Night football games starting in 2023 – with Peacock streaming an extra eight games per season. The CFO stated that Peacock’s losses of more than $2B in 2022 will be shy of Peacock’s losses in 2023, guiding toward ($3.0B), which is expected to be the peak net loss for Peacock.

Theme Parks

Florida’s park in Orlando and California’s location in Hollywood led the parks segment. COVID greatly impacted attendance at the park in Beijing in the first few quarters of 2022 with strict lockdown instruction, but there has been great progress in the last quarter. There were higher theme park attendance and guest spending in the U.S. and in Osaka, Japan parks for fiscal year ’22, which is a good sign, even though several other competitor parks saw a decline in spending from macroeconomic headwinds. Some significant developments in the future for Universal Parks will be the Super Nintendo World theme park opening in February 2023 in Hollywood, potentially driving consumer demand and recognition. Additionally, NBCUniversal CEO, Jeffrey Shell, stated that Epic Universe, the newest planned theme park in Orlando, is scheduled to open in the summer of 2025. Planning and construction of this park started in 2019 but were delayed due to COVID; however, the highly awaited park, projected to finish in 2025, will bring tons of new fans.

Comcast Cable & Xfinity

Fiscal Year 2022 and Q4 revenues came in at +0.7% in Q4 YoY and +4.3% for the full-year 2022 YoY. Adjusted EBITDA quarterly results include severance expenses of 638 million in Q4, which was 548 million higher than the previous year’s Q4. Severance expenses were one-time outlier expenses in this quarter’s report, so a lot of the significant data was skewed. As a result, most of the benchmark results talked about in the call included severance expense and also ex-severance results. The Cable Communications segment also includes Hurricane Ian’s impacts, which occurred in Southwest Florida. The Hurricane caused damage to thousands of homes that Comcast serves in the southern region of the U.S. As a result, Comcast noted that customer relationship losses in Cable Communications were inflated by about 35,000 people in Q4, and Broadband customer churn was inflated by about 30,000 people. Broadband revenue increased by 5.4% due to an increase in organic ARPU growth. Comcast is starting to transfer to ARPU rather than subscriber growth/churn when looking at the success in its cable segment due to the slow growth in the segment. The average revenue per user growth was accredited to optimizing customer relationships and providing the best broadband consumer experience.

Capital Allocation Priorities

FCF generation of $12.6B in FY 2022 allowed for a record return of capital of $17.7B in 2022. Investors received $4.7B in dividends and saw ownership increase due to a generous share buyback program of $13.0B.

Comcast continues to stand by its capital allocation philosophy of:

- Investing organically to drive long-term profitable growth

- Maintaining a strong balance sheet

- Returning capital to shareholders

CMCSA Dividends/Share 2008-2023 (FY 2022 Investor Presentation)

Figure 2

Significant Comcast Internal/External Risk Factors

Competitive Pressures and Saturated Markets

As noted in the company 10-K filing, all business segments of Comcast are highly saturated and competitive. Comcast faces fierce competition in several of its business segments, particularly in the telecommunications and media industries. Other competitors with large cash reserves, like AT&T and Verizon, pose a significant threat to Comcast’s market share. In addition, the rise of streaming services like HBO Max, Netflix, and Disney+ has disrupted the traditional media industry. Linear TV viewership is declining, and the cord-cutting wave is in full swing. Comcast’s NBCUniversal subsidiary faces increasing competition from these streaming giants. Once its Hulu split ownership is bought out by Disney (around 2024), Comcast will have to rely entirely on Peacock to offset its inevitable cable TV subscribership churn.

Economic Conditions

Because Comcast is a multinational conglomerate, it has a diversified business portfolio; however, some of its operations are sensitive to economic conditions more than others. For example, many analysts forecast a recession coming up, and with this will come changes in consumer spending. A downturn in the economy could result in reduced revenue and profitability for the company. For example, during the COVID-19 pandemic, many consumers have cut back on spending, which has impacted Comcast’s theme park and film studio businesses.

Threat of COVID-19

COVID-19 has shown adverse impacts on some of Comcast’s business segments and will potentially continue to impact Comcast’s performance moving forward. An example of Comcast’s business being hindered by COVID-19 was in its NBCUniversal segment and, more specifically, its Beijing, China, theme park. Throughout the first few quarters of 2022, COVID restrictions remained tight in Asia compared to domestic policy, ultimately leading to sparse sales and earnings in the China location. In the past couple of years, NBCUniversal and Sky’s operations were adversely affected by the pandemic through strict governmental policy and theme park closures. Capacity restrictions/reduced attendance, operating hours, and increased costs to update health & sanitation procedures all have had negative impacts on Comcast’s theme parks.

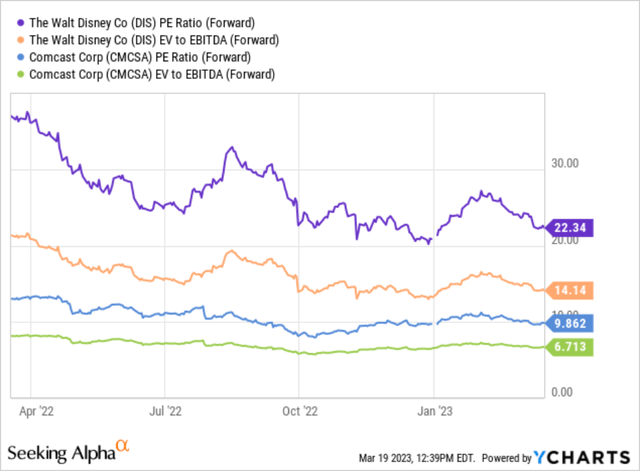

Why Comcast and not Disney?

Many investors might ask the question, Why Comcast stock and not Disney? Given that Comcast operates in many of the same segments that Disney does, investors frequently have to choose between the two when assessing which one to buy. Both of these companies have a significant presence in the media and theme park industries; however, it is important to note that Disney’s parks account for nearly half of its revenues, while Universal Parks only accounted for roughly 2% of Comcast’s Q4 top-line. Comcast has recognized its user losses in cable and strategically transformed its streaming business model to compete with giants like and Disney’s Disney+, Hulu, and ESPN+. Disney’s streaming space offers a much more extensive content library; however, this comes at a much greater price than Comcast’s rapidly growing Peacock service.

Comcast has a larger business segmentation and spans its business model more widely than Disney. Although the company is paying a strong dividend and focusing on controlling the share count, management is also taking strategic steps in investing in streaming and other areas of market expansion. High-speed internet and cable communications is something that Comcast has that Disney does not, and it has proven to work even in times of economic instability. The valuation Comcast trades at is also much more attractive on an investment standpoint when being compared to Disney.

Comcast vs. Disney Valuation Metrics (YCharts)

Valuation

Relative Valuation

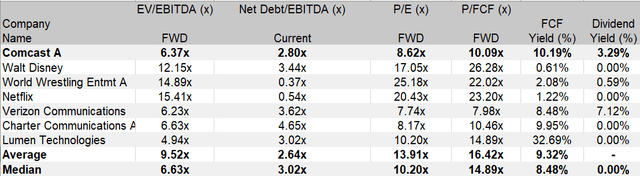

Shown below in figure 3 are relevant comparable multiples in the communication services sector and the media/entertainment and cable/satellite respective industries. As you can see below, on an NTM basis, Comcast is relatively undervalued for its P/E and P/FCF metrics when looking at the average and median for the selected peers. In terms of EV/EBITDA and Net Debt/EBITDA, Comcast is anywhere from slightly undervalued to in-line with its competitors’ multiples. Comcast Corporation also offers a sturdy free cash flow yield and a strong dividend yield in a space where dividends aren’t popular.

Relative Ratio Comps (FactSet)

Figure 3: Data from FactSet

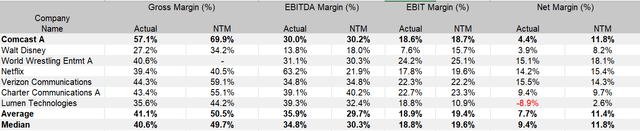

Below in figure 4, out of its competitors, Comcast has the strongest gross margin (57.1%) currently and in the next twelve months (69.9%) relative to its peers and industries in which it competes, making the corporation more profitable. Comcast is in line with peer averages and medians for EBITDA margin (30.0% vs. 35.9%), EBIT margin (18.6% vs. 18.9%), and slightly underperforming in terms of net margins (4.4% vs. 7.7%).

Relative Margin Comps (FactSet)

Figure 4: Data from FactSet

The DCF Modeling for CMCSA is shown in the link below:

CommunicationServices_CMCSA_Canno.xlsx

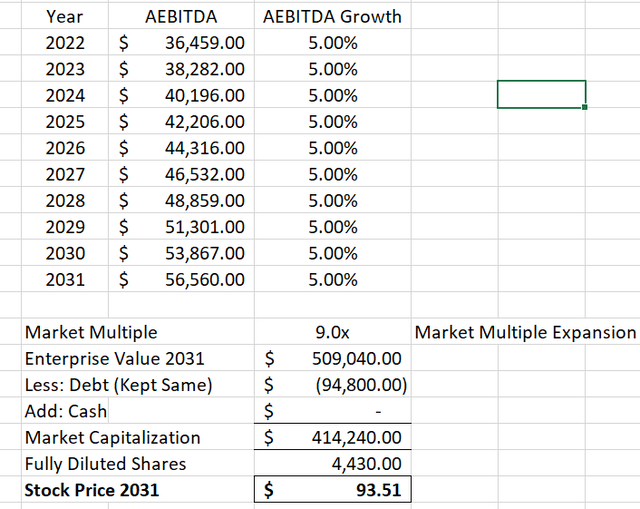

If the link doesn’t work, there are screenshots below of the excel DCF file.

Image 1: AEBITDA

AEBITDA Assumptions (Data From FactSet)

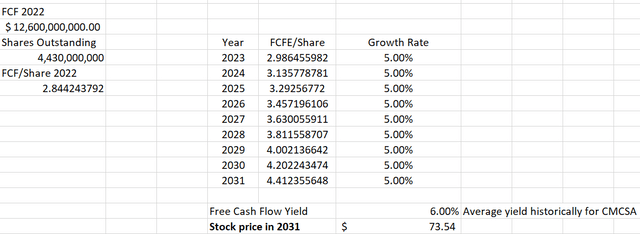

Image 2: FCF

FCF Assumptions (Data From FactSet)

Image 3: Price Assumptions

Price Weights and Assumptions (Data From FactSet)

Image 4: IRR

IRR Calculation (Data From FactSet)

Concluding Remarks

Comcast’s multi-pronged approach has demonstrated sustained performance and growth from a top and bottom-line standpoint. Comcast continues to strategically balance its dividend and share repurchase program with its reinvestment into growth opportunities to not only provide shareholders with increased ownership but also with attractive growth prospects. Management continues to project strong returns in its broadband business, and media segments, both domestically and internationally. Because of its attractive valuation relative to its comparables and industry medians, as well as its extensive conglomerate offerings, I believe CMCSA stock is poised to succeed as a long-term investment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CMCSA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is purely my opinion, and prospective investors should conduct further research to make a conclusive decision.