Summary:

- Decent FY22 results, yet the company is trading at around 10x, which got me intrigued as to why.

- The company isn’t feeling the love because of the lack of a catalyst for revenue growth.

- I argue that the company doesn’t need any catalysts because it is generating great free cash flow.

- Furthermore, if the company can keep improving on margins, the company doesn’t need revenue growth.

- A simple DCF model of the company with conservative estimates still suggests the company is trading at a discount.

Cindy Ord

Investment Thesis

With upcoming quarterly results this month, I wanted to take a closer look at Comcast Corporation (NASDAQ:CMCSA) to see why the company has been trading at a P/E Ratio of around 10x while also being down over 18% over the last year. While sifting through information on the company and modeling its financials, I cannot see why the company would be trading at such a multiple. I give the company a buy rating because it is generating very good free cash flow even if its revenue growth is minimal. I do agree the company is a great stock to hold during a downturn, however, I would wait a little while longer before initiating a position due to upcoming volatility in the economy and quarterly reporting.

In this article, I will briefly look at what is the potential of expanding margins but will mostly focus on the company’s financial situation and provide a 10-year DCF model with some reasonable assumptions, that still will lean towards a more optimistic outlook for the company.

Outlook

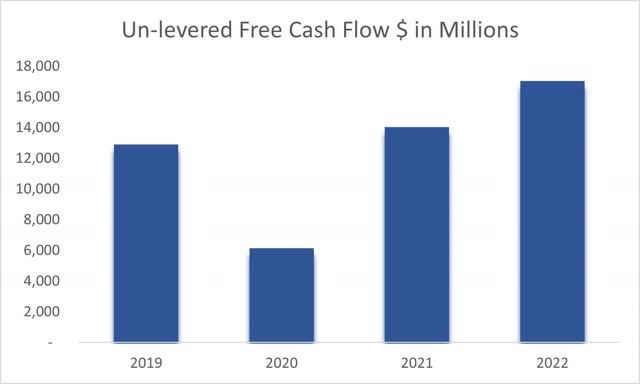

FY22 results were decent, beating analysts’ estimates. Total revenue was up 4% y-o-y, and net income was down around 60% though, mainly due to the company’s goodwill and long-lived asset impairments which are one-off charges. The company is chugging along just fine while maintaining a very strong un-levered free cash flow position over the years and this year was no exception.

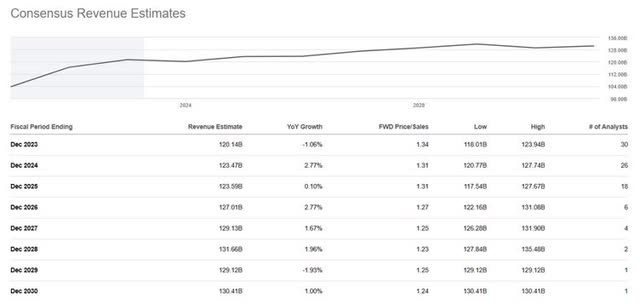

The company managed to improve the EBITDA margins by around 110bps, which is pretty good for a company this size. When going through financial statements and earnings calls, I always like to see how a company that doesn’t grow very strongly in terms of revenues will improve profitability. The company knows that its revenues will not grow very fast going forward without an amazing catalyst in play, and analysts agree, with consensus estimates showing very little revenue growth. The opening of new theme parks will give it a slight boost; however, the segment is very small compared to other revenue segments.

Consensus Revenue Estimates (Seeking Alpha)

So, the only other way the company can increase its profitability is through margin expansions. I do not see any catalysts that would improve profitability substantially as Peacock does seem promising, however, it is still losing a lot of money. Its revenues grew 3-fold year over year to around $2.1B while costs doubled to around 4.5B, so they are still deep in the hole according to FY22 annual report. The management is not giving up on the streaming service and is very pleased with how the service is performing. If management is going to keep throwing money at it, it will start to become profitable eventually, however, it is still very early to tell.

With the upcoming economic headwinds, everyone is a lot more pessimistic about the short-term outlook. I am one of those people also. There will be volatile moments in the stock markets that will unjustifiably bring down share prices of solid companies like CMCSA, however, this should be praised as an opportunity to enter at an even better price and reap better returns over the long run.

So, as I can see there aren’t many catalysts that could improve margins substantially or revenue growth for now. I will be interested in hearing what the management will say in the upcoming quarterly report.

Financials

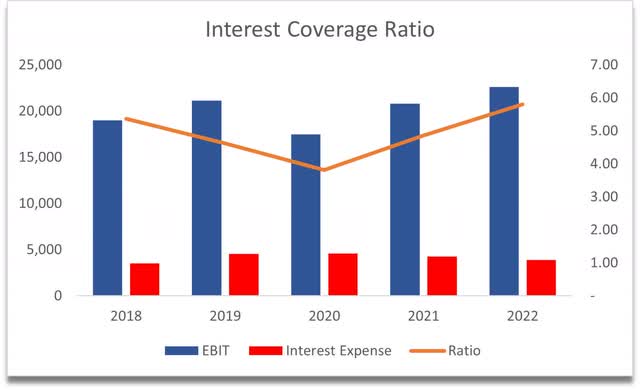

The company’s cash position is not as good as it was last year. It was cut in half basically to $4.8B. The total debt outstanding is massive. As of Dec 31st, 2022, it was sitting at $93B. The company is slowly paying it off. Is this going to be a problem for the company, and is this why the share price is underperforming because a lot of investors just don’t like that amount of debt? Maybe, but I don’t think it’s a problem necessarily. The company has been generating very good EBIT for at least the last 5 years, which can cover the interest expense around 5 times over. The ratio was 5.81x at the end of ’22. If the company continues to pay down debt steadily, this won’t ever be a problem. A ratio over 2 is considered acceptable and over 3 is good.

Interest Coverage Ratio (Own Calculations)

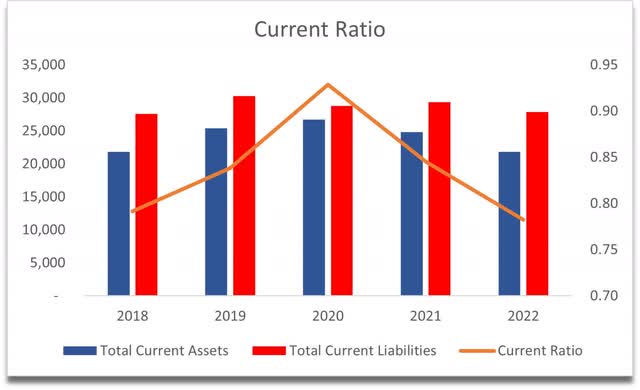

The company’s current ratio, however, is lacking. It has not been over 1.0, which is the bare minimum for any company to have, in at least the last 5 years. If the company manages to keep more cash on hand, it will be over that minimum threshold in no time but so far it has not been able to achieve that.

Current Ratio (Own Calculations)

It doesn’t seem to be affecting the performance and liquidity of the company as even during the pandemic it managed to pay off its short-term obligations with ease.

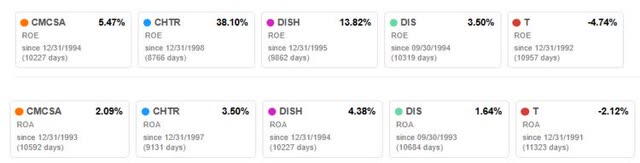

In terms of profitability and efficiency, the company seems to be sitting somewhere in the middle of the competition. ROA and ROE, if looking at just the company itself, aren’t generating very high returns in my opinion, but if we compare them to the competition, these are acceptable in that regard.

ROE and ROA vs Competition (Seeking Alpha)

Same story for return on invested capital. It is not very high if we look at the company individually, but when considering the competition, it seems to have somewhat of a moat and a competitive advantage.

ROTC vs Competition (Seeking Alpha)

As I mentioned earlier, the company can generate very good un-levered free cash flow and if the company continues this trajectory, it is not going to have any liquidity problems in the future.

Overall, a bit of a mixed bag in terms of the company’s balance sheet but relatively strong due to the company’s ability to generate a lot of UFCF which will keep the company liquid while it is slowly paying off the debt.

Valuation

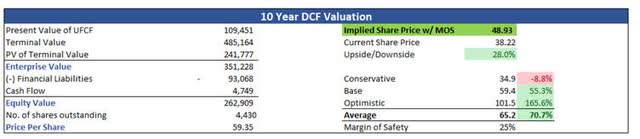

For the DCF model, I decided to keep it quite simple. For ’23 and ’24 I will take the consensus estimates as I’ve shown at the beginning of the article, and from then on, I will linearly grow the revenue growth from 5% in ’25 to 2.5% by ’32 for the base case scenario. To get a range, I will decrease every period from the base case by 200bps for the conservative case and vice versa for the optimistic case.

For margins, I wanted to be a little optimistic. I assume for the base case that over the next decade, the company will manage to return to slightly better margins than it had at the end of ’21 mainly because the one-off impairment charge in FY22 decreased net margins by around 800bps which I assume will come back up the next year and over the next decade the company manages to become more cost-efficient. So, net margins will improve by around 250bps from FY21 net margins.

Seeing how good the company is at generating UFCF which makes the company very liquid and quite safe even if liquidity ratios aren’t very good, I will give the company a 25% margin of safety on the final intrinsic value calculation. With that said, the company’s intrinsic value is $48.93, which implies a 28% upside from current valuations.

10-Year DCF Valuation (Own Calculations)

Conclusion

I believe the company isn’t getting much love because of the health of its balance sheet, which looks like it is way overleveraged at first glance, but once you dig deeper into the leverage, you can see that it is still very much sustainable. The company’s ability to generate fantastic UFCF minimizes the risk that the company is overleveraged. Another reason I think why it isn’t getting much love is because there aren’t many growth catalysts in the future, but the company doesn’t need any when it can generate such free cash flow, and if it manages to improve its margins further, the company is a safe bet in the long-run and even in during an economic downturn that we may experience shortly.

I will wait for the next earnings report to come out before deciding if I want to open a position because I would like to hear if the management is going to give their thoughts on how the economy is going to develop in the near future, and also if the company reports worse numbers than estimated, then the long-term investor may be able to get in at an even better entry point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.