Summary:

- The cable-cutting trend is definitely not Comcast’s friend.

- However, bears are missing how Comcast’s competitive advantages provide both a wide moat and solid free cash flow generation.

- And don’t let their roar drown out the potential value of the agreement between Disney and Comcast that requires the former company to buy Hulu from CMCSA.

DNY59/E+ via Getty Images

This article was coproduced with Chuck Walston.

The primary bear arguments against Comcast (NASDAQ:CMCSA) are that the company will grow slowly, if at all, and that cord-cutting represents a fierce headwind.

I will opine that bears are missing how Comcast’s competitive advantages provide both a wide moat and solid free cash flow generation. Add an attractive valuation and a rapidly growing, safe dividend to the mix, and you could have a solid investment.

Furthermore, CMCSA is investing capex into initiatives that will likely bear fruit over the midterm.

I should add that there is one more important consideration: Disney (DIS) and Comcast have an agreement that requires the former company to buy Hulu from CMCSA. How that plays into evaluating CMCSA as a prospective investment is well worth considering.

Hear The Bears Roar

The cord-cutting trend is definitely not Comcast’s friend. In the last quarter of 2022 alone, another 1.4 million Americans ditched their cable subscriptions.

Xfinity, Comcast’s cable business, led the way with 614,000 customers opting out of the service in Q1. The company’s U.S. cable subs now stand at 15.5 million, down from 17.7 million at the end of Q1 2022, and there appears to be no end in sight to the cable cutting trend.

A study by PwC entitled “Entertainment & Media Outlook 2022‑2026” predicts that the number of homes in the U.S. subscribing to pay TV will drop from 64 million in 2022 to just under 50 million by 2027.

However, despite the continued loss of cable subs, there was a period when investors appeared to be mollified by Comcast’s growth in broadband customers. For example, CMCSA added 300,000 new broadband subs in Q3 of 2021 alone. Unfortunately, that favorable trend came to a screeching halt. Last quarter, the company added a measly 3,000 new broadband customers.

In part, that is because demand for broadband in the U.S. is largely satiated. The Internet & Television Association estimates 84% of U.S. homes already have access to broadband. Simply put, there is no more room for significant growth, at least not in terms of additional subscribers.

Another negative is that as is the case with many streaming services, Peacock, despite adding millions of new customers, is hemorrhaging money: Peacock lost $7 million a day in Q1, and the losses are projected to reach nearly $3 billion for the full fiscal year.

Watch The Bulls Charge

An important consideration when evaluating Comcast as a potential investment is the depth and width of the company’s moat.

In concert with Charter (CHTR), CMCSA operates as a duopoly within the U.S. Furthermore, a sound argument can be made that both are monopolies within their geographic spheres: the two firm’s divide the U.S. in twain, with fewer than one percent of consumers having access to the services of both companies.

That is particularly true in terms of Americans’ access to broadband service. A report by The Institute For Local Self-Reliance reveals that the two cable providers hold “an absolute monopoly” over 47 million people. Additionally, CMCSA is the sole provider of broadband for 30 million customers, and an additional 33 million customers’ only alternatives to the cable companies are markedly slower and less reliable providers.

In most cases, CMCSA also provides superior broadband service. Ookla and U.S. News both rate Comcast’s Xfinity as the fastest broadband service, and studies show downloads speeds for broadband are two-and-a-half times faster than those of wireless, while broadband’s upload speed advantage is even greater.

To place this in context, more than 85% of Comcast’s customers receive 100 megabits/second service. This compares to AT&T (T), Verizon (VZ), and T-Mobile (TMUS) with speeds that rarely exceed 20 megabits/second. And it is important to note that to match Comcast’s performance, wireless providers would require enormous capex.

While the growth in Comcast’s broadband subs has been stymied of late, a new initiative by the company is likely to both cement its position among consumers and lead to average revenue per user (‘ARPU’) growth.

The current gold standard in terms of internet speeds is provided by cable modems. The fastest services available today use technology known as DOCSIS 3.0 and DOCSIS 3.1. DOCSIS 3.1 provides a maximum downstream capacity of 10 Gbps along with a maximum upstream capacity of 1-2 Gbps.

Comcast recently completed a field trial of DOCSIS 4.0. DOCSIS 4.0 provides downstream capacity of 10 Gbps but boosts upstream capacity to 6 Gbps. The increased upstream capacity will cater to consumers interested in live streaming, content creation, and other upload centered activities. Simply put, wireless providers will be left in the dust by this development.

Comcast intends to bring DOCSIS 4.0 to market in late 2023 and projects the service will be available to 50 million customers by the end of 2025. It is important to note that the new technology will not require the installation of new connections to consumers’ homes. Once DOCSIS 4.0 is in place, I project Comcast’s ARPU will experience a significant upswing.

Along with DOCSIS 4.0, there is another development that should drive revenues.

While investors, particularly bears, tend to focus on Comcasts’ cable TV, broadband and related businesses, the firm garnered 29% of its revenues in 2022 from theme parks.

The company’s theme parks in Florida are generally considered second rate in comparison to Disney’s (DIS) operations; however, that may change in the not-too-distant future.

CMCSA is building a new, fourth theme park, Universal’s Epic Universe, that will double the size of the original theme park at Universal Orlando Resort.

Back in July of 2020, the COVID crisis shut down construction of the new facility. However, work resumed in March 2021, and the new park is expected to open to the public by the summer of 2025.

Below is Comcasts’ rendering of the new park.

goodhousekeeping.com/life/travel/a41123517/universals-epic-universe-orlando-florida/ (Source: Good Housekeeping)

Encompassing 750 acres, Epic Universe will double the size of Universal.

Epic Universe is expected to introduce, as the name suggests, epic rides and attractions, using the latest and greatest immersive technology. Water rides, a gigantic dual roller coaster, a Super Nintendo World and a Donkey Kong mine cart coaster, as well as Harry Potter related rides, are just a sampling of the attractions Epic Universe will offer. Two 750-room and a 500-room hotel are also being built on the property.

With $1 billion in construction costs, this is capex spent today to boost revenues in 2025 and beyond.

A third consideration that lies on the horizon is the agreement CMCSA has with Disney to sell the former company’s 33% stake in Hulu. In 2019, the two firms reached an agreement that permits either company to force the sale of Comcast’s investment in Hulu to Disney starting in January 2024.

The agreement values Hulu at a minimum of $27.5 billion, meaning Comcast’s investment is worth a minimum of $9 billion plus.

Analysts at Wolfe Research’s estimate Comcast’s share of Hulu is worth $9 billion to $13 billion, and, Macquarie analyst Tim Nollen values the deal at $10 billion or more, and opined that Disney CEO Iger’s “interest in owning Hulu outright will remain strong.”

For a while, there was speculation that Disney would pass on the opportunity, but during Disney’s last earnings call, Hulu was mentioned eighteen times, and CEO Iger provided this revealing comment:

So we’re very bullish about leaning into digital advertising. We’re bullish about how we’re positioned there. We’re bullish about Disney+ and Hulu and that combination, by the way. We think that by making Hulu available as a one-app experience will increase our engagement and increase our opportunity in terms of serving digital ads and growing our advertising business.

At this juncture, it appears as if Disney’s acquisition of Comcast’s remaining 33% share of Hulu is a foregone conclusion. All that remains is how much and when.

Should the deal go for one-third of the $27.5 billion minimum price guaranteed by the agreement between the two companies, then Comcast would garner about $6.5 billion in after-tax proceeds.

During the last earnings call, when CMCSA Chairman and CEO Brain Roberts was questioned regarding the sale of the Hulu stake, he provided this response:

So first of all, you want to invest in your growth businesses with new initiatives. That’s been one of the hallmarks of our company, whether it’s investing in broadband, now trying to get to 10G investing in that wireless relationship. Parks just talked about we built more hotels than maybe anybody in North America, which is part of how parks have been so successful.

So are there investment opportunities?

Dividend, return of capital via dividend. Some investors really value that. Other investors want buyback. We’ve kind of said we think we can do both. So we’ve increased our dividend for 15 years in a row. And we’re hopeful that that can continue.

And then buybacks. Last year we bought $13 billion of stock back and paid a $5 billion dividend. This year, we continued the dividend, increased it, and we bought $3 billion in the first quarter. So we’ll just have to wait and see. Hopefully your number is very low and it will be more than that. But I think, I look at it all driving to what’s the stock and we look at it over a long period of time.

Debt, Dividend, And Valuation

Comcast’s credit is rated on the lowest A rung with a stable outlook.

CMCSA has a yield of 2.85%, a payout ratio a bit below 30%, and a 5-year dividend growth rate of 10.67%.

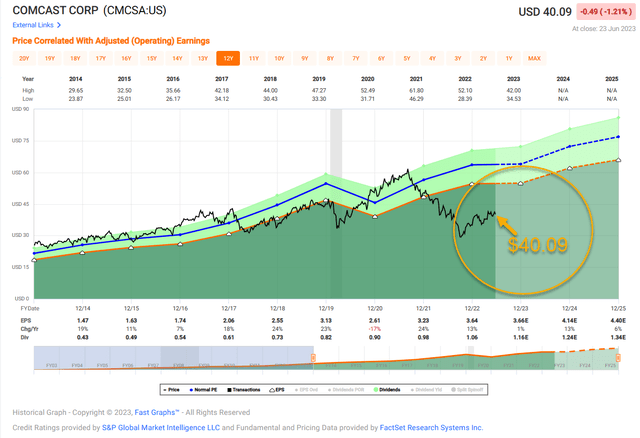

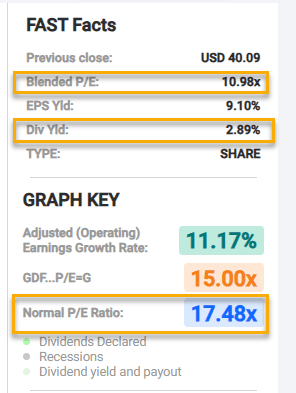

The stock trades for $40.09 a share. Analysts’ average one year price target is $45.21. The price target of the 10 analysts that rated the stock following the most recent earnings report is $50.20.

FAST Graphs

CMCSA currently trades with a forward P/E of 11.9x, well below the stock’s average P/E over the last 5 years of 17.17x.

The current 5-year PEG of 0.82x is also well below the 5-year average PEG of 1.25x for CMCSA.

The company repurchased $13 billion of its stock and in 2022, equal to 7% of the shares outstanding, and $2 billion in 1Q23.

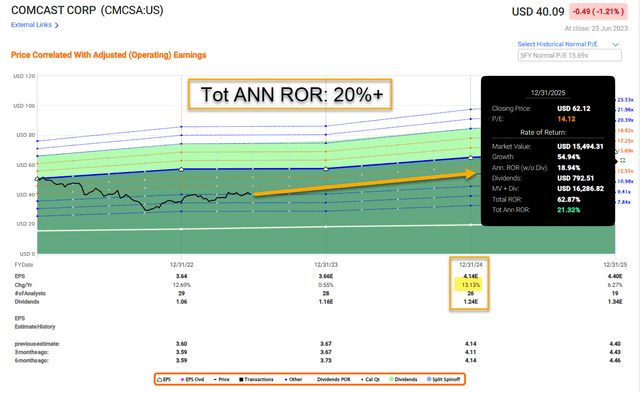

FAST Graphs

Is CMCSA A Buy, Sell, Or Hold?

For years, bears have claimed cable cutting would sink CMCSA.

A decade ago 80% of U.S. households subscribed to cable, and the share of Americans subscribing to cable has dropped precipitously since then. Even so, Comcast has still grown revenue, FCF, and EBITDA at a marked rate.

I posit that the initiatives outlined in this piece will likely lead to further growth for Comcast, albeit over a mid-term horizon. Meanwhile, the stock trades at a rather low valuation.

I contend that for the patient investor seeking a solid dividend growth stock, CMCSA is a sound investment.

I contend that the bears are setting a trap for themselves. One that will prevent them from taking part in an investment with a formidable moat, well-funded and rapidly growing dividend, and reasonable growth prospects.

I rate CMCSA as a BUY.

I added to my position while conducting research for this article.

FAST Graphs

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMCSA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.