Summary:

- Comcast stock has underperformed the market this year, down 11% compared to S&P 500’s 14% gain.

- Despite challenges in the cable industry, Comcast’s strategic partnerships and diversified portfolio position it for sustained business strength.

- Even considering potential earnings pressure over the next few quarters, Comcast should still be able to generate about $15 billion of earnings before taxes.

- From a fundamental perspective, I see CMCSA shares as significantly undervalued, calculating an implied target price for Comcast stock at $62 per share.

SweetBabeeJay

Comcast (NASDAQ:CMCSA) is not seeing much investor love lately, with the stock significantly under-performing the broader U.S. stock market this year. In fact, since the beginning of the year, CMCSA shares are down by approximately 11%, compared to a gain of about 14% for the S&P 500 (SP500).

The key reason for Comcast’s disappointing performance is likely found in the broader challenges for the cable industry, which faces an ongoing erosion of subscribers, driven by rising infrastructure competition and an ongoing shift towards streaming. On a high level, and taking a long-term perspective, however, Comcast’s commercial momentum is likely stronger than the challenges it faces. Strategic partnerships, robust financial health, technological advancements, and a diversified business portfolio collectively position Comcast for sustained business strength, in my view. And even accounting for some earnings pressure over the next few quarters, Comcast shares are still trading cheap, pointing to an enterprise valuation of 10x projected 2024 operating income. From a fundamental view, I value Comcast stock using a residual earnings model and calculate an implied target price equal to $62 per share.

Why Comcast’s Commercial Momentum is Stronger than its Challenges

Comcast has strategically enhanced its operational footprint through partnerships that expand its service capabilities and market reach. The agreement with Starlink to bolster Enterprise Managed Connectivity offerings exemplifies this strategy. By leveraging Starlink’s satellite network, Comcast can provide enhanced connectivity in underserved regions, thus tapping into new customer bases and improving network redundancy. Furthermore, Comcast’s investment in FreeWheel’s adtech platform is timely and could prove quite valuable. With the Olympics on the horizon (Jul 26, 2024 – Sun, Aug 11), the enhanced live product capabilities of FreeWheel will optimize programmatic ad buying, manage viewing spikes, and improve ad pacing. These improvements are expected to attract a broader range of advertisers, thereby increasing ad revenues and enhancing viewer satisfaction. In fact, the Olympics alone are expected to generate approximately $1.1 – 1.3 billion in incremental ad revenue, while political ad spending could add another $100 – 150 million, according to analyst estimates (Source: Seaport Research, note on CMCSA dated June 24).

While challenges such as cord-cutting and competitive broadband pressures persist, Comcast’s strategic initiatives mitigate these risks. The creation of new value bundles that integrate linear and streaming services directly addresses the cord-cutting trend. For Q2, I project broadband subscriber churn below 200.000, while I estimate around 300K wireless adds for mobile & video subscribers. Additionally, Comcast’s diversified portfolio ensures balanced revenue streams across various sectors. The mix of media, broadband, and theme park businesses provides a buffer against sector-specific headwinds.

Comcast’s strategic focus on high-potential content and theme park ventures offers another vertical for potential upside. In Q2 and Q3, the release of blockbuster films such as “Despicable Me 4” and “Wicked Part 1” is projected to generate $200-300 million in box office revenue. On that note, investors should acknowledge that these releases are not speculative ventures, but are backed by proven franchises with established fan bases, which should support a solid market reception.

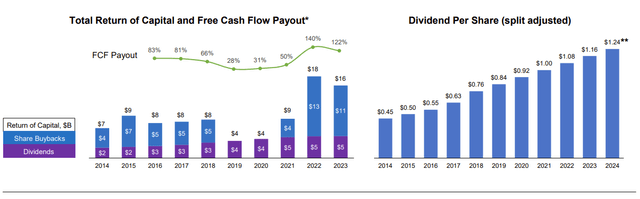

Solid Shareholder Returns

This should offer the company a strong backdrop to execute on shareholder distributions. Specifically, I point out that management has already shared the decision to undertake $15 billion in stock buybacks, of which about $10 billion is still outstanding (equals to about 6-7% of Comcast’s market cap). Meanwhile, Comcast remains committed to a sustainable (increasing) annual dividend of $1.24 per share, adding about 3.2% to the total shareholder yield (I am looking for a cumulative ~10% payout in 2024).

Valuation Update: Raise TP To $62/ Share

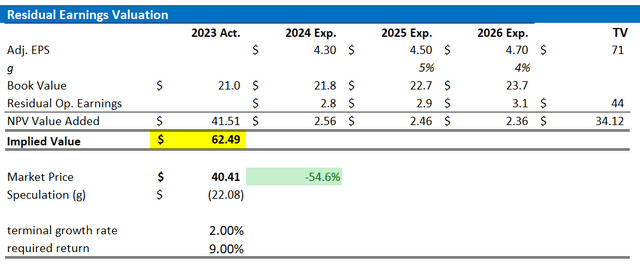

After about one and a half years since my last CMCSA valuation, I am revising my valuation assumptions for Comcast stock. Based on analyst consensus estimates, with adjustments of +/- 10%, I now project Comcast’s earnings per share for FY 2024 to range between $4.2 and $4.4 (non-GAAP). Additionally, I forecast these earnings will rise to $4.5 in FY 2025 and $4.7 in FY 2026. Beyond FY 2026, I anticipate a compound annual growth rate in earnings of approximately 2%, which is approximately in line with global nominal GDP, and thus likely conservative. I am maintaining my cost of equity assumption at 9%. With these updates, I now assess the fair value of Comcast stock at $62, reflecting a slight increase from my previous estimate of $61, but still well above Comcast’s current market trading price.

For context, the value “Speculation” is just the difference to fair implied value. A positive value implies a premium; or in other words, markets are speculating to price more fundamental upside compared to my estimates.

Company Financials; Bloomberg & Author’s EPS Estimates; Author’s Calculation

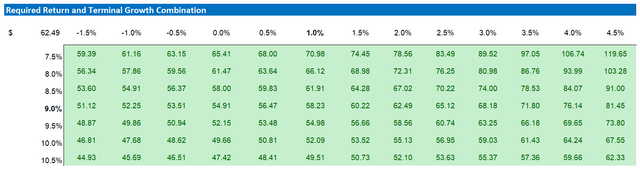

Below also the updated sensitivity table.

Company Financials; Bloomberg & Author’s EPS Estimates; Author’s Calculation

Investor Takeaway

In conclusion, Comcast’s commercial momentum looks stronger than the challenges it faces. Strategic partnerships, robust financial health, and a diversified business portfolio collectively position Comcast for sustained business strength, in my view. Even considering potential earnings pressure over the next few quarters, Comcast should still be able to generate about $15 billion of earnings before taxes, which opens room for a strong equity yield compared to the company’s $150 billion market cap. From a fundamental perspective, I see CMCSA shares as significantly undervalued, calculating an implied target price for Comcast stock at $62 per share. “Buy”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.