Summary:

- Comcast Corporation has a current dividend yield of 3.2% and is well covered considering the payout ratio sits at 28%.

- The business has seen decreases in customer count across many segments. However, the wireless lines and streaming segments have offset these losses.

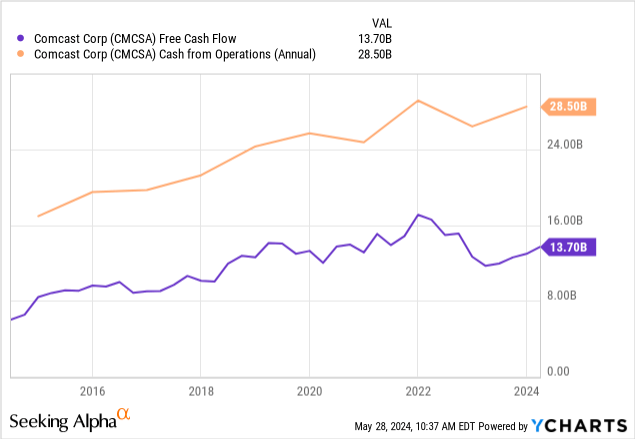

- Liquidity remains strong, with free cash flow and cash from operations both increasing.

- Interest rates have likely affected the growth prospects and once rates are cut, growth initiatives may become more relevant and affordable.

jetcityimage/iStock Editorial via Getty Images

Overview

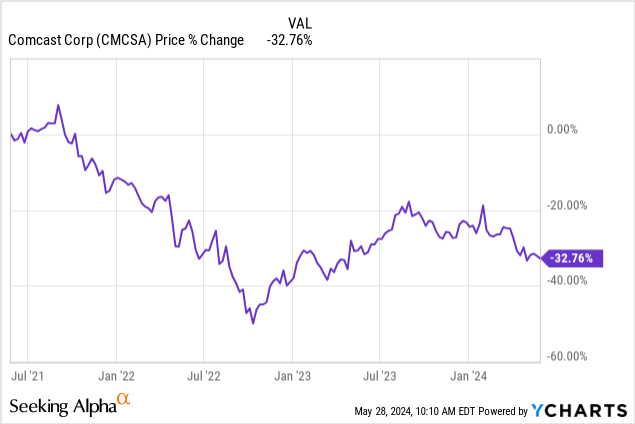

Growing up, I mostly associated Comcast Corporation (NASDAQ:CMCSA) with the cable they provided. However, that part of the business has been effectively dead for a long period of time and the bulk of their business comes from telecommunications in the form of Xfinity as well as media and entertainment through various channels, with the most notable being the Peacock streaming service. Comcast has caught my attention recently as I noticed that the price has been heavily suppressed for a few years now and has struggled to gain any upside momentum. The price is now down over 32% over the last three-year period.

The business now operates with two main segments, including connectivity platforms and content experiences. Financials in these segments have a bit of a mixed outlook, as some of the larger segments have failed to capture any meaningful growth recently. However, the growth of Peacock is something that we have to consider as subscriber counts have risen and revenues increased by over 50%. Peacock is becoming a more sizeable payer within the streaming market that can begin to compete against the more popular competitors in the space.

Additionally, the current dividend yield of CMCSA sits at 3.2% since the price has come down, which is above its normal average range. While this isn’t a large dividend yield by any means, Comcast has a pretty solid dividend growth record over the last decade, with increases averaging in the double digits. While the company doesn’t normally maintain a reputation as a dividend growth stock, I believe there is long-term income potential that can be captured here while also gaining exposure to a diverse range of products and sales channels. First, let’s take a look into the financials and review the latest earnings report.

Financials

Comcast reported their Q1 earnings at the end of April and the results were a bit mixed, contributing to the recent price decline. The financials itself remained solid, represented by a 1.2% rise in revenues to $30.1B,s accompanied by adjusted earnings per share growth of 13.9% over the prior year’s Q1. While adjusted EBITDA did not grow, it maintained a flat performance, coming in to match the same as the prior year’s total at $9.4B for the quarter. Earnings per share landed at $1.04, beating estimated by $0.05. Total return to shareholders increased due to $2.4B in share repurchases implemented as a way to grow investor confidence.

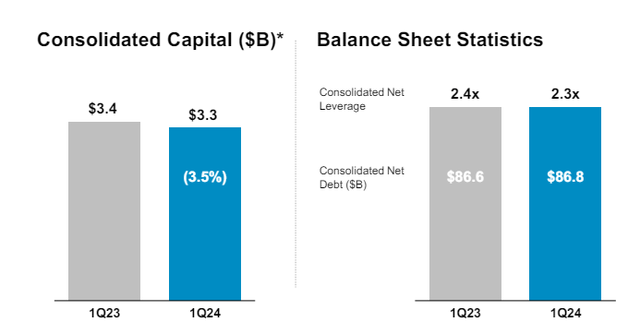

Free cash flow and balance sheet metrics also remain healthy as the net leverage ratio has slightly decreased down to 2.3x. Liquidity still sits strong with consolidated capital amounting to $3.3B, which includes all different channels of cash that can be accessed between debt capital and other forms of financing to help get through any potential headwinds. CMCSA still prioritizes investing for organic growth, and this is reinforced by the fact that free cash flow increased by nearly 25%. We can see that free cash flow has increased to $13.7B, while cash from operations now totals $28.5B.

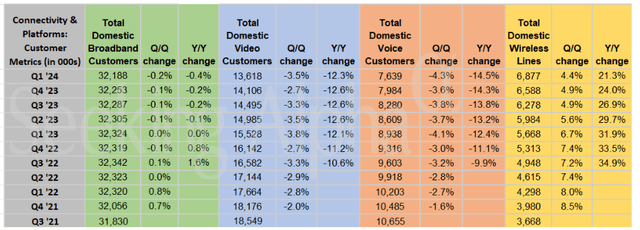

They’ve been able to increase free cash flow with incremental price increases across all channels, but I worry about the sustainability here and likely so are most investors, judging from the price decline. It would be one thing if the company was also growing their subscriber and customer counts, but we can see that the number of customers across most segments within connectivity and platforms have decreased year over year for several years in a row now. The total domestic broadband customer count has been remaining mostly flat since the end of 2021 while total domestic customers have been decreasing at double-digit rates year over year now. This broadband channel is focused on providing high-speed interest services, so I believe this can be offset with some creative price offerings or perhaps bundling strategies to boost customer counts here.

Similarly, total domestic voice customers now sit below the 10,000 count, as this area has also seen double-digit decreases on a year-to-year basis. Total domestic video customers are also down 12.3% on a year-over-year basis due to lower demand within the Xfinity platforms. The only exception to this would be the growth experienced within the total domestic wireless lines segment. Growth in this segment has offset a lot of the decreases experienced, as it has consistently provided double-digit growth on a year-to-year basis. In the latest Q1 earnings, we saw total customers grow to nearly 7,000 and increase at a 4.4% growth over last quarter.

As a whole, the connectivity and platforms segment remained flat with a slight 0.1% decrease in revenue totaling $20.3B. Residential connectivity revenue is where the bulk of this segment’s profitability lies, but they saw a slight decrease in revenue of 0.8%, totaling $17.8B. This decrease was offset by an increase in the business services connectivity channel, which saw growth of 5.4%, totaling revenue of $2.4B. In the content and experiences segment, we saw a slight increase in revenues of 1.1% totaling $10.4B.

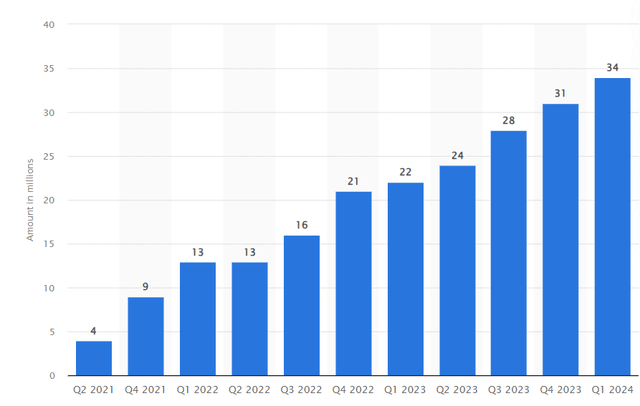

The media channel had the largest impact, with total revenues growing by 3.6% to a total of $6.3B. This growth can be attributed to the streaming revenue growth of Peacock. Peacock revenues increased by 54% to $1.1B and the subscriber count increased by 55% year over year to 34M. In fact, we can see the strength and consistent growth in subscribers of Peacock throughout the years as they increase the amount of original series and day one movie releases on the platform.

They are making active strides in the streaming department by actively cooperating with competitors to implement bundling strategies. For example, the latest StreamSaver packing includes a combination of Peacock, Netflix (NFLX), and AppleTV (AAPL) for a low price of $15 per month. As the focus on streaming grows, this can become a larger source of revenue for Comcast and ultimately shift the tides more favorable with continued investment and strategies. For example, we received the following confirmation over the last earnings call.

By providing the tens of millions of traditional paid TV subscribers as well as streamers with choice in how they engage with us, we continue to generate significant audience for our programming: big events like the Olympics, Sunday Night Football, Big 10, top entertainment shows like Saturday Night Live and Law and Order. With strong consumer demand for our content, we’re well positioned to evolve with the changing market. – Mike Cavanagh, President

Dividend

As of the latest declared quarterly dividend of $0.31 per share, the current dividend yield sits at 3.2%. The current dividend yield sits above its four-year average dividend yield of only 2.36%, which may be an indication of undervaluation. Even though the yield has risen due to the drop in share price, the dividend remains well-covered with a large margin of safety. The current dividend payout ratio sits at 28.85%, which remains below CMCSA’s five-year average of 30.47% as well as below the sector median payout ratio of 36.47%.

CMCSA isn’t typically known as a dividend growth stock, but the results say otherwise! Taking a look at the growth history, the dividend has increased at a CAGR (compound annual growth rate) of 11.29% over the last ten-year period. Even on a smaller time frame of only 5 years, the dividend has increased at an average CAGR of 8.63%. This is supported by EBITDA growth that has averaged 5% as well as free cash flow per share growth of 6.1% per year.

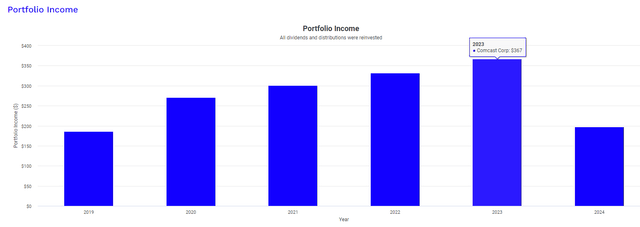

We can put a visualization to how quickly the dividend has increased by using Portfolio Visualizer. This calculation assumes an original investment of $10,000 at the start of 2019 and assumes that no additional capital was ever deployed after this. However, this does include the reinvestment of dividends received every quarter. In 2019, your dividend income would have totaled only $186. However, fast-forward to the full year of 2023 and this would have doubled in 4 short years to $367.

Valuation

Seeking Alpha’s Quant current gives Comcast a strong buy rating of 4.6 and this is due to the high profitability metrics as well as the attractive valuation signals. For instance, CMCSA sits at a price to earnings ratio of 10.22x, which significantly undercuts the sector median price to earnings ratio of 18.41x. Additionally, Comcast’s five-year average P/E ratio sits above 19.3x, which further reinforces how much of a discount shares currently trade at. The price to book ratio has averaged 2.19x over the last five-year period, but it currently sits at 1.78x.

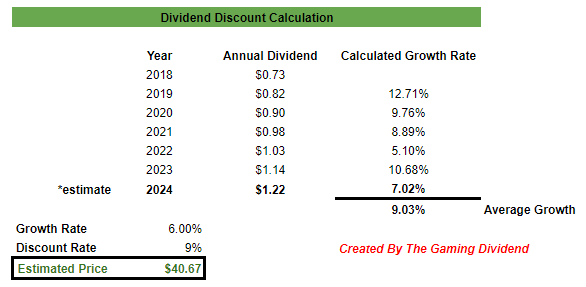

The average Wall St. price target is $48 per share, which indicates a potential price upside of 24.5% from the current levels. The highest price target is at $56 per share, while the lowest price target sits at $40 per share. To get another point of reference for valuation, I decided to run a dividend discount calculation for an estimated fair price.

I started by compiling the annual dividend payouts for each year dating back to 2018. We can see that the dividend has increased at a CAGR of 9.03% since then, but this includes the estimated annual payout of $1.22 per share for 2024. For an estimated growth rate, I thought 6% was fair since EBITDA has increased at a 5% average over the last 5 years and revenue growth year over year has averaged 6%. EPS is estimated to grow at a CAGR of 9.25% over the next 3 to 5-year period, but I wanted to stay on the conservative side of my estimate.

Author Created

With these inputs, I get an estimated fair value of $40.67 per share. This aligns with the bottom end of the Wall St. price target range and represents a potential upside of a modest 3.5% from the current level. However, I want to emphasize that this outlook is using the currently conditions of the business and macro environment. There’s a chance that growth prospects improve as new strategies are implementing to address the segments that have seen decreases in revenue.

Vulnerabilities & Risk

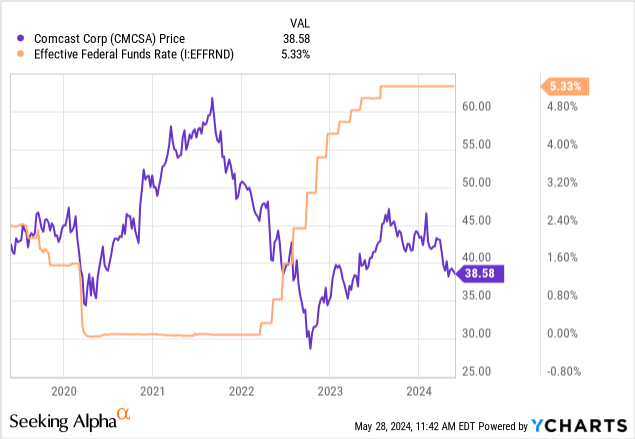

I believe that Comcast remains highly sensitive to the higher interest rate environment that we are in. However, we’ve observed that that pricing, cash flow, and balance sheet still remain strong, so I am not talking about a vulnerable to rates in terms of profitability. What I mean is that the higher interest rates have caused the slowdown on different growth initiatives for Comcast. While rates rise, so does the cost of obtaining debt capital and maintaining potential higher interest payments. It’s no coincidence that the price of CMCSA started to take off as rates were cut to near zero levels. Conversely, the price started to sharply fall as rates were increased rapidly at the mid-point of 2022.

As the cost of capital increases, the planned investments, growth initiatives, or research development projects may get halted or delayed. We are currently in an environment that doesn’t support growth or risk taking, therefore CMCSA are only taking measured risks where the costs are low, such as with the streaming segment of the business.

Additionally, the combination of higher interest rates with higher than anticipated levels of inflation causes consumer spend to tighten. Perhaps this is a contributing factor to the loss of customers throughout the different segments. Consumers are likely cutting back on expenses wherever possible and switching to cheaper alternatives as a result. Interest rates are expected to get cut by the end of the year, and this could potentially improve growth prospects.

Takeaway

Comcast’s business has been able to efficiently maintain its balance sheet and financial strength through price increases and strong growth within the wireless and streaming segments. However, the business has suffered by decreasing customer counts throughout most other segments. As we remain in a higher interest rate and higher inflation environment, we may still have some runway of sideways movement to go. Dividend growth has remained strong and sits well-supported by the low payout ratio and growing free cash flow. Additionally, the current earnings, revenue, and EPS growth suggest a modest upside to my price target of only $40 per share. This modest upside under current conditions isn’t yet appealing enough, so I will remain on the sidelines and likely revisit once interest rates are cut to see how the business improves.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.