Summary:

- CMCSA has started to play coy, with the Hulu option deal brought forward to September 2023 against the original timeline of January 2024.

- The management drummed up Mr. Market’s interest in the deal, by guiding a $30B synergy/ churn benefit on top of Hulu’s intrinsic value.

- Based on our conservative projection, we believe that Hulu may be valued at $45B with an FWD EV/ Revenue valuation of 4x, thanks to its profitable growth trend.

- The additional liquidity may then allow CMCSA to either deleverage its balance sheet and/ or pursue innovation/ growth across its theme parks/ connectivity business.

- The CMCSA stock remains a Buy here, thanks to its dual pronged prospects through capital appreciation and dividend income.

RHJ/iStock via Getty Images

We previously covered Comcast (NASDAQ:CMCSA) in July 2023, discussing its excellent prospects through the year, thanks to the Mario movie’s blockbuster performance, further aided by the Universal theme parks already approaching pre-pandemic attendance levels.

While the elevated interest rate environment might be a temporal headwind, we had rated the stock as a Buy then, thanks to its profitable growth investment thesis.

In this article, we will be discussing CMCSA’s 33% stake in Disney’s (DIS) Hulu. We believe that things are drastically different now, with the former likely holding on to a gold mine, since Hulu may be worth more than the supposed sum previously determined in 2019.

Hulu May Be A Gold Mine For CMCSA

For context, the option for the Hulu deal was previously set for January 2024, which has now been brought forward to September 30, 2023, by both parties. Most importantly, a floor was also determined at $27.5B back in 2019, implying that CMCSA’s 33% stake was valued at $9.07B.

Investors might also want to note that this number implied an embedded growth premium compared to the previous valuation of $15B in April 2019, based on the sale of AT&T’s (T) 9.5% stake for $1.43B.

For now, it appears that DIS may have to shell out a lot more indeed since the D2C market has boomed post-pandemic with many other streaming companies similarly expanding in valuations.

For example, the obvious leader in the global streaming market, Netflix (NFLX), has grown its Market Capitalization by +25.9%, from $141.80B at the end of 2019 to $178.57B at the time of writing.

We also believe that CMCSA’s sale is more likely to happen than not, based on DIS’ intent to “offer a one-app experience domestically that incorporates our Hulu content via Disney+” by the end of 2023.

For now, investors must note that DIS has reported an immense growth in the overall Hulu global subscriber base from 25.2M in March 2019 to 48.3M by June 2023, up by +23.1M over the past four years, expanding at an impressive CAGR of +17.6%.

This is on top of the increased average monthly revenue per paid subscriber for Hulu’s SVOD-only members by -2.6% from $12.73 to $12.39, and Hulu’s Live TV+SVOD by +74.8% from $52.58 to $91.80 over the same time frame.

Based on these numbers, we believe that Hulu has brought an excellent estimated growth in annualized revenues from $4.8B in March 2019 to $11.27B in June 2023 (+4.3% from FY2022 levels of $10.8B), expanding an impressive CAGR of +23.79%.

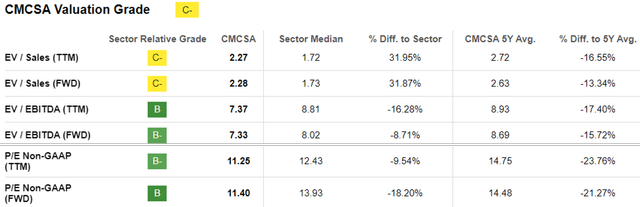

Based on the impressive top-line expansion thus far, we believe that Hulu on its own deserves a growth premium, compared to the sector median FWD EV/ Revenues of 1.71x, CMCSA’s 2.27x, and DIS’ 2.25x.

We posit that Hulu may likely be rated higher than NFLX’s 5.57x, based on the former’s top-line expansion at a CAGR of +23.79%, as discussed above, compared to the latter at +13.7% between FY2019 and FY2022.

Even if we are to be assigned a more conservative FWD EV/ Revenue valuation of 4x, Hulu may potentially be valued at $45B, with CMCSA’s 33% stake coming in at approximately $15B.

Naturally, it remains to be seen how the negotiations may be moving forward, with the price tag potentially immense, based on the CEO of CMCSA, Brian Roberts’ commentary in the recent Goldman Sachs Communacopia + Technology Conference:

“The value of the bundle, we’ve seen Hulu with package with Disney and with ESPN+, you’d be able to stay in that bundle. That reduces churn like half for Disney and others. So that value goes with it. Just that piece of the synergy and the churn benefit could be worth $30 billion. And that’s before you ascribe any value to the actual Hulu.” (Seeking Alpha).

Either way, we believe that the previous $27.5B valuation for Hulu is outdated, with the new number likely to be astounding.

Now what will the CMCSA’s management do with the additional liquidity?

While our $15B projection may be a drop in the bucket, compared to its immense long-term debts of $94.97B in FQ2’23 (inline QoQ/ -1.7% YoY), the sum may still help the management to deleverage part of its balance sheet at these times of elevated interest rates.

For example, CMCSA reported a growing annualized interest expense of $3.99B by FQ2’23 (-1% QoQ/ +3% YoY), thanks to the higher weighted-average interest rates, negating its rich annualized adj. EBITDA generation of $40.96B (+8.8% QoQ/ +4.2% YoY).

Otherwise, the company has the option of pursuing innovation and growth, with the management already planning to expand its theme park footprints in Orlando, Las Vegas, and Texas through 2026.

This is on top of the intensified capex for the Connectivity business, which comprises the bulk of the media company’s top lines at 66.7% (-1 points YoY) and bottom lines at 81.4% (+0.1 points YoY) in the latest quarter.

As a result of its multiple top and bottom line growth drivers, we believe CMCSA remains well poised for outperformance moving forward, significantly aided by the extra liquidity from the Hulu deal.

So, Is CMCSA Stock A Buy, Sell, or Hold?

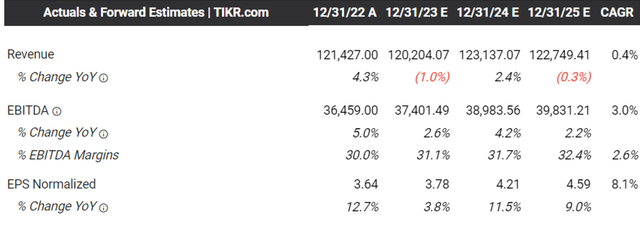

The Consensus Forward Estimates

For now, the consensus estimates that CMCSA may still generate a decent top and bottom line growth at a CAGR of +0.4% and +8.1% through FY2025, though moderate compared to its historical CAGR of +7.1% and +13.1% between FY2016 and FY2022, respectively.

CMCSA Valuations

Perhaps this explains why the CMCSA stock trades an impacted FWD valuation compared to its 5Y mean and the sector median, with the pessimism already baked in.

Then again, we believe that the correction has been overly done since the company is still expected to expand its adj EBITDA margins and EPS despite the stagnant top-line.

The improved profitability has directly contributed to CMCSA’s 5Y Dividend Growth Rate of +9.40%, with its payout likely remaining safe at a stable dividend coverage ratio of 3.26x, compared to the sector median of +2.02% and 2.13x, respectively.

While the CMCSA management does not offer any forward guidance, based on its annualized H1’23 adj EPS of $4.10 (+9.6% YoY) and its FWD P/E of 11.40x, it appears that the stock is trading below its fair value of $46.74.

Depending on individual investor’s conviction and dollar cost averages, they may want to wait for CMCSA’s upcoming FQ3’23 earnings call on October 26, 2023, with the consensus estimating revenues of $29.72B (-2.5% QoQ/ -0.5% YoY) and adj EPS of $0.95 (-15.9% QoQ/ -1% YoY).

Then again, the management has had a long track record of beating consensus estimates for thirteen consecutive earnings calls, with the upcoming call likely to be similar, based on the exemplary H1’23 double beats thus far.

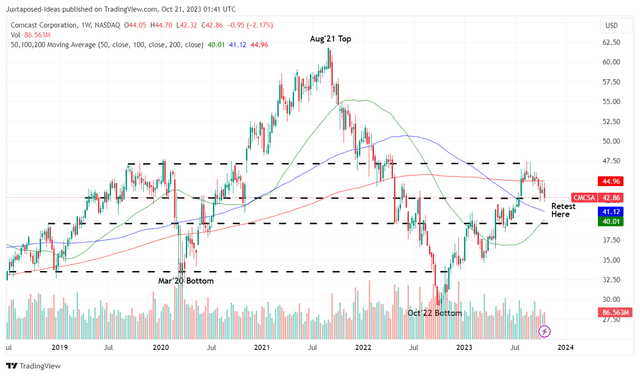

CMCSA 5Y Stock Price

The CMCSA stock’s recent pullback has also triggered an attractive upside potential of +22% from current levels to our long-term price target of $52.32, based on the consensus FY2025 adj EPS estimates of $4.59.

As a result of the attractive dual-pronged prospects through capital appreciation and dividend income, we continue to rate the CMCSA stock as a Buy here.

Do not miss this pullback.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.