Summary:

- Comcast Corporation’s Q3 results were better than expected – as the company topped analyst consensus with regards to both revenues and EPS.

- Comcast returned to shareholders a total of $4.7 billion, $1.2 billion in the form of dividend payments and $3.5 billion in the form of share repurchases.

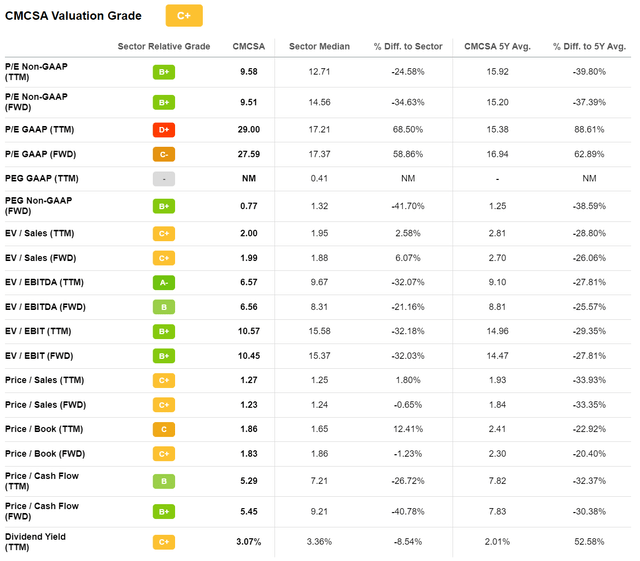

- Valued at x10.5 EV/EBIT, Comcast continues to trade very cheaply and at a discount of approximately 30% to the Media & Communication industry.

- In my opinion, Comcast Corporation stock should be fairly valued at approximately $47.16/share.

Cindy Ord

Thesis

Valued at x10.5 EV/EBIT, Comcast Corporation (NASDAQ:CMCSA) continues to trade very cheaply and at a discount of approximately 30% to the Media & Communication industry. Such a discounted valuation is not justified, in my opinion – especially when considering that Q3 was actually better than expected/ feared.

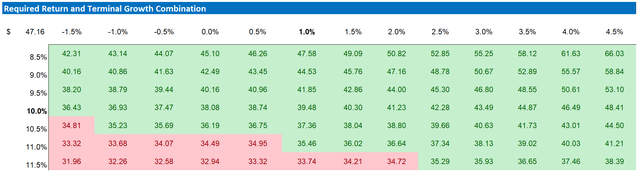

Although I slightly lower my EPS expectations for 2023, as I expect the media and entertainment industry to remain pressured by macro headwinds, I continue to see more than 30% upside for Comcast investors. In my opinion, CMCSA stock should be fairly valued at approximately $47.16/share.

Comcast’s Q3 Tops Expectations

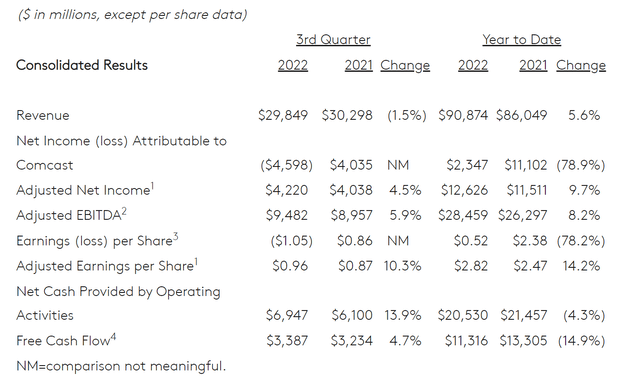

During the period from July to end of September, Comcast managed to generate total group revenues of $29.8 billion. Although revenues are down approximately 1.5% versus the same period one year earlier ($30.3 billion in Q3 2021), Comcast topped analyst consensus estimates by about $200 million ($29.65 billion estimated, according to data compiled by Refinitv).

During Q3, Comcast recorded adjusted EBITDA of $9.5 billion, representing a 5.9% year-over-year growth versus the same period one year earlier. Adjusted net income expanded about 4.5% year-over-year, to $4.2 billion; and EPS came in at 96 cents, which is approximately 6 cents more than what analyst consensus expected.

Reflecting on the better-than-expected Q3 results, Comcast CEO Brian Roberts commented (emphasis added):

I’m proud of the company and our strong financial results this quarter. We delivered solid growth in adjusted EBITDA and adjusted EPS, generated significant free cash flow, invested in our businesses’ future and returned a record amount of capital to our shareholders.

This performance is a testament to our consistent strategic focus on innovation and our team’s ability to execute at the highest level in any environment…

…Together, our company is a leader in very large and profitable markets. Despite the challenges that may lie ahead, we are in an enviable strategic and financial position, and our future remains bright.

Business Highlights

Although revenues at Comcast’s NBCUniversal dropped by about 4% year over year to $9.6 billion, the segment managed to increase EBITDA by approximately 24.6%, as the studios division was boosted by a strong the successful releases of Jurassic World: Dominion as well as Minions: The Rise of Gru. (Studio division revenue shot up by about 31% to $3.2 billion.) Moreover, Peacock paid subscribers count in the U.S increased to 15 million, jumping by almost 70% year to date.

Comcast’s Cable Communication business increased adjusted EBITDA by 5.4%, as the segment’s EBITDA margin increased to the highest level on record, to 45.1% (120 basis points increase versus Q3 2021). By end of the September quarter, the Cable Communication business recorded total broadband customers of 32.2 million. However, while increasing the subscriber base by only 1.5% year-over-year, there are signs that broadband growth is slowing – especially as competition with wireless internet companies is heating up.

Most disappointing was the performance at Sky: the segment’s revenue increased by 14.7%, to $4.3 billion. And the segment also suffered from “noncash impairment charges related to goodwill and intangible assets,” which amounted to $8.6 billion.

Valuation Continues To Be Attractive

Comcast is valued cheaply: priced at a EV/EBIT of approximately x10.5, the company trades at a discount of approximately 30% to the Media & Communication industry.

Moreover, investors should consider that during the Q3 period, Comcast returned to shareholders a total of $4.7 billion, $1.2 billion in form of dividend payments and $3.5 billion in form of share repurchases. Given a $150 billion market cap, (annualized) shareholder distributions topped 12.5% in the September quarter.

Target Price Estimation

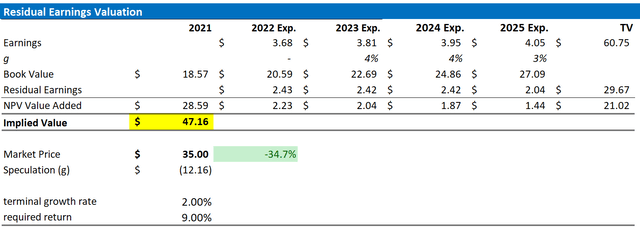

To derive an estimate of a company’s fair implied valuation, I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

With regard to my Comcast stock valuation model, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on CMCSA’s cost of equity at 9%.

- For the terminal growth rate after 2025, I apply 2%, which is conservative in my opinion.

Given these assumptions, I calculate a base-case target price for CMCSA of about $47.16/share.

Analyst Consensus EPS; Author’s Calculations

My base-case target price does not calculate a lot of upside. But investors should also consider the risk-reward profile. To test various assumptions of CMCSA’s cost of equity and terminal growth rate, I have constructed a sensitivity table.

Analyst Consenus EPS; Author’s Calculations

Risks

As I see it, there has been no major risk-updated since I have last covered Comcast stock. Thus, I would like to highlight what I have written before:

First, in a rising interest rate environment, investors are worried about Comcast’s debt position. As of Q2 2022, Comcast recorded total debt of $98.7 billion, against cash and short-term investments of only $6.8 billion. Accordingly, Comcast’s $91.9 billion of net debt could be exposed to higher interest payment costs. If rates were to stay elevated for a longer period of time, Comcast would need to roll debt at much less favorable interest rate conditions. But investors should consider that even if Comcast’s cost of debt were to jump to 10% (about $9 billion of interest payments, versus $4.13 billion TTM), the company would not at all be in difficulty.

Update on financial position: as of Q3 2022, Comcast recorded total debt of $97.6 billion, against cash and short-term investments of only $5.7 billion:

Secondly, Comcast suffered from the broad sector selloff in the media space – as The Walt Disney Company (DIS) lost about 35% YTD, Netflix, Inc. (NFLX) 59%, Warner Bros. Discovery, Inc. (WBD) 51% and Paramount Global (PARA) 38%. Investors became increasingly worried that competition in entertainment will eventually erode profitability, as content investments surged and global subscriber potential for streaming services suddenly hit a limit, with Netflix posting disappointing subscriber growth.

But investors should consider that Comcast is a diversified media company with strong exposure to multiple verticals, including streaming, news, cable television, film studios, theme parks, and sports. Fretting that Comcast’s portfolio has a dim future is, in my opinion, as unreasonable as believing that streaming attracts unlimited potential. Markets simply have a tendency to overreact. And now they are clearly reacting too much on the downside for the media industry.

Conclusion

Comcast’s Q3 results were better than expected – as the company topped analyst consensus with regards to both revenues and EPS. But somehow investors are still reluctant to invest in the media giant – currently pricing CMCSA at a 30% EV/EBIT discount to the sector median.

While CMCSA stock continues to trade cheaply, shareholders are rewarded handsomely: in Q3 alone, in fact, the company returned a combined $4.7 billion, $1.2 billion in form of dividend payments and $3.5 billion in form of share repurchases (more than 12.5% yield annualized).

Personally, I believe Comcast Corporation stock should be fairly valued at approximately $47.16/share.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: not financial advise