Summary:

- Comcast is a Communication Services’ giant with a stretched valuation and low growth rates.

- The company operates in Connectivity & Platforms and Content & Experiences, with the former forming the majority of revenues.

- CMCSA has strong performance in the past year, but it is expected to experience multiple contraction.

Justin Sullivan

Investment Thesis

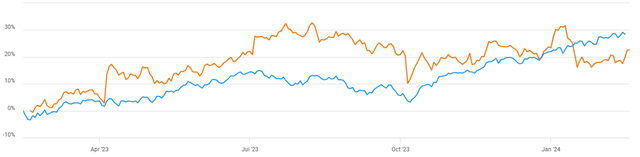

A Communication Services’ giant that can’t sustain its current valuation. 1-year performance has been strong with Comcast Corporation (NASDAQ:CMCSA) rallying 22.5% against the S&P 500 (SPX) that returned 28% over the same period. But I think this relatively strong performance is behind the company and the current valuation feels stretched. I think the end of the Affordable Connectivity Program and the recent loss in customers will hinder broadband revenue growth going forward and the current valuation feels lofty.

Seeking Alpha

Background

CMCSA is a global media company that reaches viewers worldwide. They deliver a whole reach of media services such as broadband, video and voice services under the Xfinity, Comcast Business and Sky brands. They operate two forms of business:

- Connectivity & Platforms

- Content & Experiences

In Connectivity & Platforms they have 52 million customers paying $100+ per month on average and in Content & Experiences advertisers can reach 230 million US adults every month. Connectivity & Platforms formed 65% of revenues and Content & Experiences form the remaining 35%. Breaking down Connectivity & Platforms further we can see that Residential Connectivity and Video form that largest shares of revenues in this segment. With highlights including that they are the #1 broadband provider in the US, #2 in the UK and house 75 million devices on their global technology platform.

In Content & Experiences Media forms 55% of revenues followed by Studios at 25% and Theme Parks at 19%. However, the Theme Parks business contributes the largest portion to adjusted EBITDA.

Financials

CMCSA has grown revenues 5.17% CAGR over the last 5-years. This ranks well compared to the industry and relative to the sector isn’t bad either. Throughout the period of 2013 to 2017 the company grew pretty much organically at a rate 6.8%, then during 2018 the company acquired Sky Broadband for $39 billion. This bolstered sales above $90 billion, but then lockdowns hit and visitor attractions shut, so the company’s portfolio of theme parks were forced to close. This contributed to a -5% contraction in sales over 2020, but the company has since recovered.

In 2023 the company posted flat growth on the prior year. This was driven by -1.3% decline in Residential Connectivity & Platform. Offset by growth of 5.7% in Content & Experiences. Breaking down each category further, for Connectivity & Platform I can see that Broadband and Internet remain strong offset by large declines in Advertising. And for Content & Experiences, I can see that the robust growth was mainly driven by a 12% increase in Theme Parks.

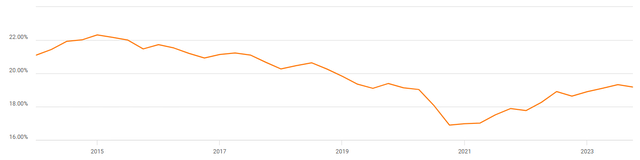

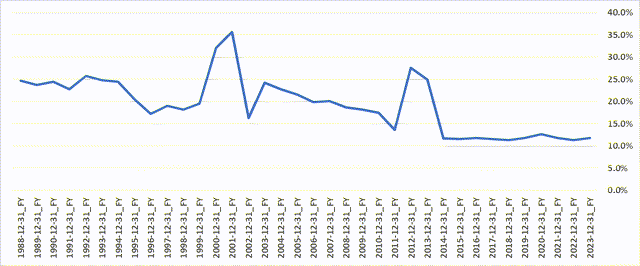

Moving on to profitability, the Cable & Satellite industry is a profitable one, with median EBIT Margins over 19%. But for CMCSA margins contracted -200 basis points between December 2014 and 2019. Then with COVID lockdowns, sales reduced and margins contracted by another -250 basis points in 2020. With the recovery in revenues, CMCSA margins have also recovered, expanding 230 basis points but still remain marginally under 2019 levels. This margin progress continued into 2023 despite the flat sales growth, EBIT Margins expanded 55 basis points on the prior year.

EBIT Margin (Seeking Alpha)

Net Debt to Sales stands at 74% with a cash balance of $6.2 billion. The company has $2.1 billion to pay in 2024 and then $6.3 billion in 2025, but with average free cash flow of over $14 billion they are in a fine position to service these principals.

Outlook

While broadband revenue remained strong in December, 3-months earlier it was reported that CMCSA lost 18,000 customers in the third quarter. This was below the FactSet estimate that expected a gain of 3,600 customers. The reason for the dip in customers was due to increased pressures from the likes of Verizon (VZ) and T-Mobile (TMUS), that offer lower cost alternatives. Despite the fall in customers CMCSA still managed to increase Adjusted EBITDA Margins by 120 basis points in the Residential Connectivity and Platforms category.

To defend against the competition CMCSA announced they are raising speeds across their broadband network at no extra cost to customers. The increase in speeds comes at a time when there are doubts that the Affordable Connectivity Program will be renewed by congress. This is a program with 23 million subscribers that provides discounts of up to $30 a month for eligible families, allowing them better access to broadband. This could be the reason for the loss of customers in October, as families reevaluate their budgets and look for lower cost alternatives amidst the program being scrapped.

With the potential end of the Affordable Connectivity Program driving customers to lower cost alternatives, I don’t think the outlook on broadband at CMSA is too bright. It looks like instead of offering a promotional incentive the company as opted to increase speeds in an attempt to lure prospective customers and keep existing ones. This outlook aligns with analyst estimates that has forward guidance way below historic growth rates.

The industry is facing headwinds with a median forward growth rate of just 0.75% against a median 5-year CAGR of 9%. CMCSA precisely align with the industry median but this is a substantial decline on their historic growth.

Valuation

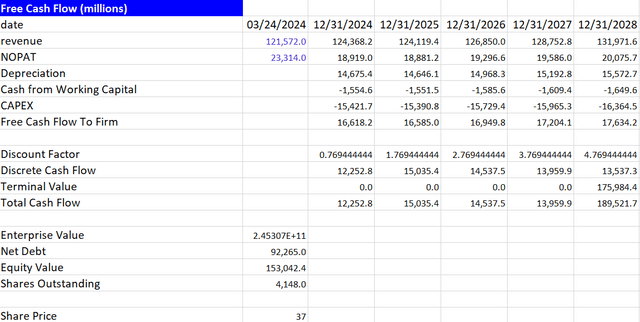

Source: Author’s Calculations

The important question to answer here, is what P/FCF multiple to use in my valuation. First I began by finding the median post COVID, that came to just under 14x. Then I looked into analysts’ revisions and noticed that the average growth rate over the next 3-years was 1.44%, which made me consider a multiple closer to 12x-12x. Coupled with EBIT Margins of 20% (the long run average) produces a share price target in the range of $34 to $37 and a downside of -14% on the top end.

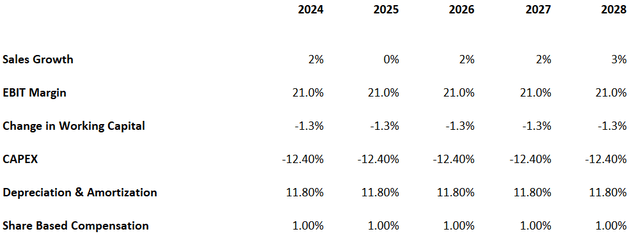

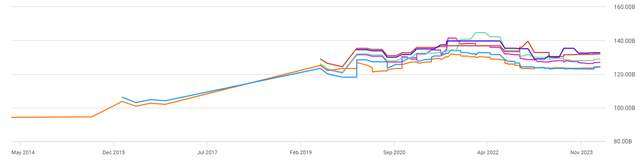

Source: Author’s Calculations

When modelling the Working Capital, I have a -1.25% incremental decline which is the 9-year median change in Working Capital. And as for CAPEX, this has been stable as a percent of revenues for 9 years so I have this level running into perpetuity.

CAPEX as percent of Sales (Source: Author’s Calculations)

Risks

The main risk here is the trend in revisions. Revenue revisions peaked in spring 2022 and have since declined and found a new floor. Over the last 3 months, analysts have marginally moved up their 2024, 2025 and 2026 revenue forecasts, but I still believe at the current valuation they would need to increase substantially more to move this share price. If estimates moved up something like 100 basis points I would change my outlook to a Buy recommendation as these growth rates would be worthy of a 15x multiple.

Revenue Revisions (Seeking Alpha)

Conclusion

Comcast lost 34,000 customers in the 3-months to December about half what it was expected to lose, but this was on top of a massive loss in the 3-months to October. The competition on the company is growing and customers are looking for cheaper alternatives with the potential end of the Affordable Connectivity Program. The valuation feels punchy, and at current forward growth rates I don’t think there is much upside in the share price. So I am initiating a Hold on Comcast stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.