Summary:

- Comcast Corporation is a hidden giant in the media industry, with a strong focus on managing cord cutting and building its power verticals.

- The company is upselling broadband, Internet, and wireless users to its streaming services, which is a low-cost strategy compared to massive promotional spend.

- Comcast’s parks and entertainment segment is expanding, with the opening of Epic Universal next year and a focus on fresh intellectual property.

Cindy Ord/Getty Images Entertainment

Above: Legacy NBC reached 100m households.

- Comcast Corporation (NASDAQ:CMCSA) has good balance between businesses, managing cord cutting well, building on parks and cross marketing broadband customers working.

- Upselling broadband, internet and wireless users is low hanging fruit compared with massive promotional spend alone.

- Parks and entertainment expanding with fresh IP going forward. Epic Universal will open next year.

Premise of this guidance: Because of ongoing cord cutting among other issues, I see Mr. Market misjudging (IMHO only) the shares of Comcast as part of the streaming woes extant In fact, the company is a media outlier that is undervalued. What counts is this, how is it meeting that cord cutting challenge and building its power verticals? Better than most is my response, lots better. It is something of a hidden giant.

When you take a good hard look at what it really is relative to so-called peers, you see Comcast set apart from essentially content companies which have used tech advances to distribute their output. Comcast, stripped of the multitude of pretenses that populate analysis of the streamers, is a different animal. It is really a tech company built on pipelines as much as anything else.

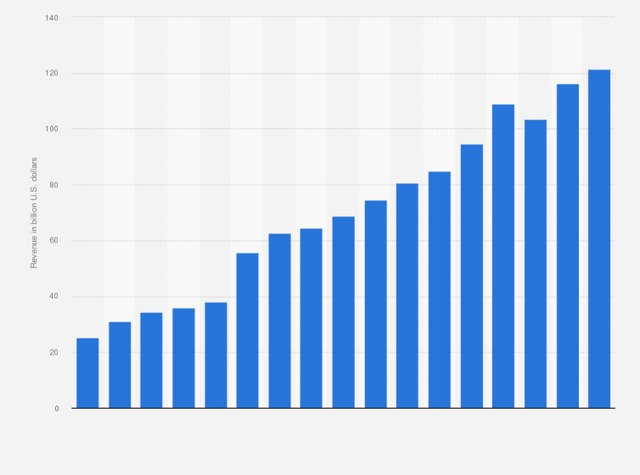

The distribution of its $120b (ttm) in revenue by segment tells the opening tale. Compare it to Disney (DIS) for context:

Above: A steady rise since last year appears to have eluded notice of many investors still mesmerized by straight streamers.

Comcast

Cable/broadband: 54.6%

Media: 19.31%

SKY (Intl) 14.8%

Studios: 9.6%

Parks: 6.2%

Eliminations: -(5.2%)

Corporate: 0.7%

Disney

Linear Networks: 32%

Direct to consumer: 24%

Content sales & lic: 7%

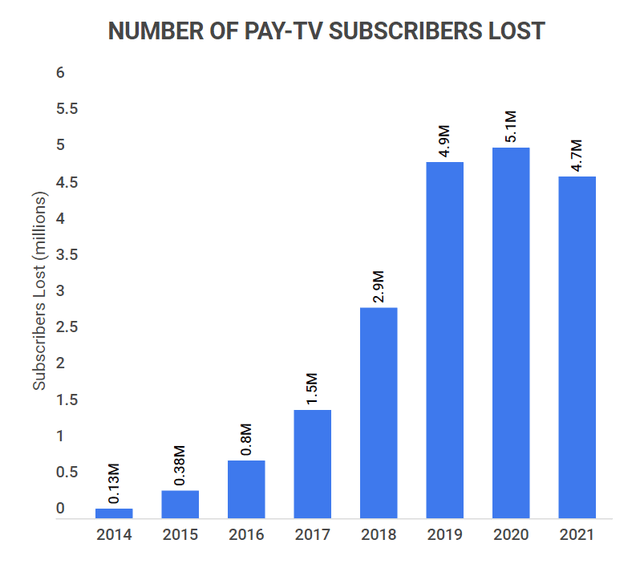

Parks 26%

The market is rewarding Disney’s ~$86b (ttm) in revenue segments roughly double the price of Comcast stock. Both companies are challenged by cord cutting, but Comcast is far more exposed to it than Disney. Over 47.6m cable customers have already cut the cord. That translates to 54.6% of the nation that will be without cable by end of this year. That’s what Mr. Market sees and is partly why the stock seems dead pooled at its trading range.

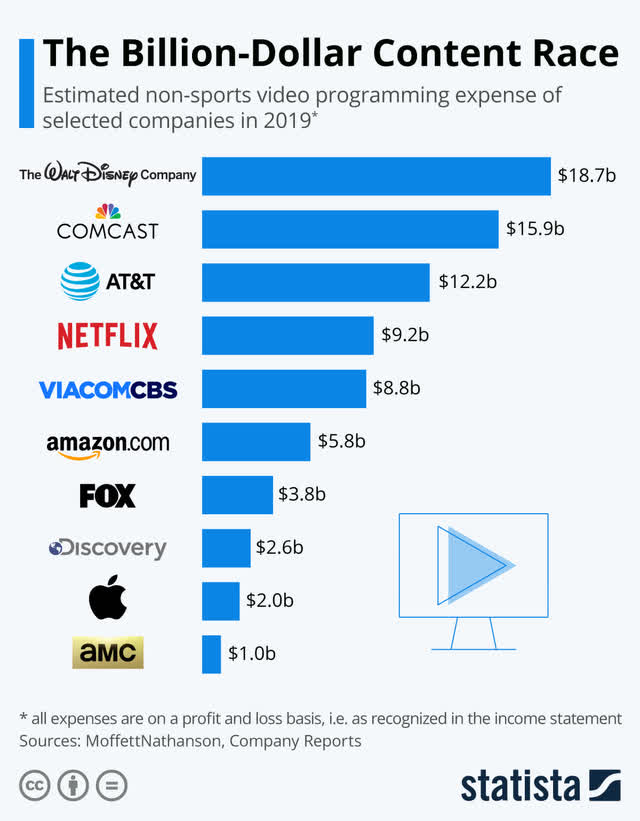

It tells the tale of greater conviction among investors in the value of content production with all its current ills,–i.e., Disney vs. Comcast, which is basically a pipeline provider which has annealed growing IP content to its existing universe. However Comcast is aggressively moving to use its existing broadband base as marketing targets to convert to streaming, or upgrade their internet speeds, or use its new, and very neat Voice search technology to continue to provide reasons for their existing customers to stay put by adding to services.

Above: Overall revenue growth continues despite cord cutting.

In this we see parallel marketing moves to that of DraftKings (DKNG) and FanDuel (OTCPK:PDYPY) right after the Supreme Court ruled favorably on sports betting in 2018. They immediately reached for the lowest hanging fruit with marketing programs aimed at converting their daily fantasy sports businesses to sports betting accounts.

The platforms used quick, efficient, low cost marketing that bore immediate results. Only after they rolled up that potential did they embark on the wild promotional spend that followed, having then to go head to head with all competitors fighting for market share as more states legalized. The lesson here is this: Comcast has its version of low hanging fruit in terms of its cable customers. The costs of converting that base to Peacock and upgrading speeds for internet customers plays out the same way: with its huge existing customer base it can build its streaming presence at an average lower cost.

Above: Cord cutting continues to rise unabated but Comcast is focused on using its immense footprint in broadband to upsell existing customers.

The statistics are gruesome of course. Comcast’s cable is down to ~33m subscribers(across its cable, internet and wireless customers) losing 12.5% this year as cord cutting continues apace. The losses also means that its subscribers have lost access to the Peacock streaming vertical—yet, Peacock acquired 2m new subscribers YTD.

It now has 24m subscribers, but due to its diverse cash flow from its pipeline businesses, does not have to chase subscribers with the insane promotional deals or evolution to ad supported pricing of others. While ad supported pricing as a remedy for the growing floodtides of red ink that bedevil all streamers (including Peacock) is entirely understandable, it clearly is an act of desperation.

Above: Pre-covid Comcast was among the leaders in content development but it was not nearly as visible to Mr. Market who focused on others.

It goes against the very premise upon which streaming was born: You choose what you want to watch, when you want to watch it without the necessity to endure endless ad blather inserted into your shows. So wave bye bye to cable and broadcast advertising.

Tech wizardry permits great content to reach wider audiences—that’s what counts today

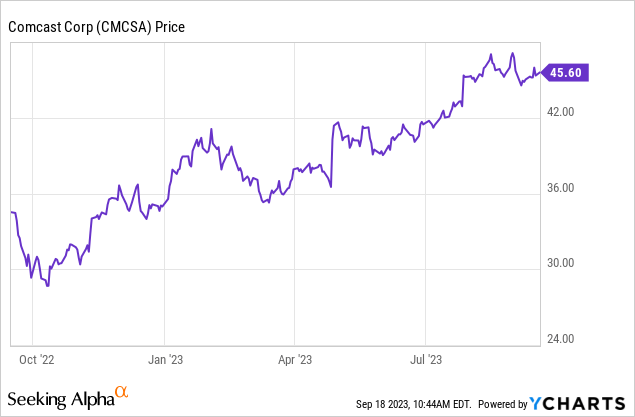

Comcast is run by operators who bring superior tech savvy to the massive challenges it faces. I believe Comcast is doing that better than most and for that reason believe its price at writing of $45.19 is undervalued. Its Voice Search I could be a game breaker value. Investing sets its DCF value at $54.15 a share bearing a potential upside of 17%.

google

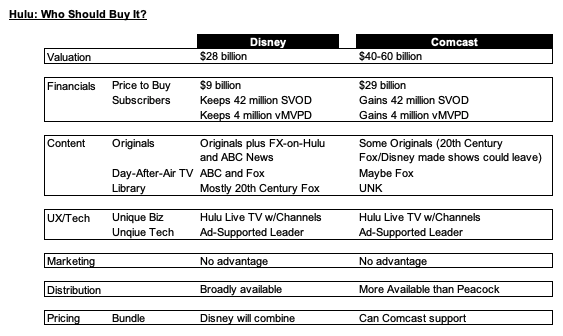

Above: Persistent questions about who will buy out whom in the Hulu partnership. Valuation is problematical now but a deal might happen yet if Disney gets into a general sell off of assets ahead.

Our calculations run a bit higher because we believe Comcast has its arms around the 600lb gorilla problem—cord cutting—than the market appears to believe. Working forward from the company’s positive 2Q23 results we are setting a PT of $61.25 by 1Q24. Plus that given the scale of its overall operations all firing at a modest growth yet consistent rate, we think $45 is a solid entry point now.

Our rationale: These guys are serious, lunch pail tech operators with accumulated savvy that can deal with cord cutting and at the same time build it’s streaming toward profitability before many believe it can. It’s not near, but nor is anyone else per se. But the construct of logic—believe it or not—seems to us to present a strong bull case here. Here content is prince—the money ball move is converting its broadband nation to its other pipelines in wi-fi, streaming and even theme Parks.

Content

Comcast has its shares of major IP like Nintendo, Jurasic Park, Minions, etc. that it markets through its 5 Parks, streaming and

NBCUniversal shows, it has viable footprints into NBC sports as well with gold plated deals for Sunday Night Football, among many sports content shows. Overall, dying business or not, the NBC network reaches 100 U.S. households every day. Its NBC news feed ranks with other networks. And here’s the irony we see forming in the years ahead: The essential weakness of streaming TV among its many strengths is that it is becoming more and more like network television in terms of its core business model.

Look at what is forming among all streamers now: Moving to two tier pricing. In other words, the rescue they see for churn and the mass of me-too content, is to move to an ad supported and free business model. Take a closer look. An “ad supported” streaming service is merely a modern version of broadcast TV as we know it. Even though viewers of broadcast don’t pay monthly, the fact is that the age- old compact between viewer and broadcaster is the same. It is this:

We the broadcasters provide you with free programming in exchange for your tolerance of an ever more bloated time eating set of commercials interrupting the flow of your favorite shows We assume that somewhere in the mass of a show’s audience, there are enough viewers who at one point or another, be influenced to buy a given product or service. Corporations buy audiences, customers are assumed to be among them in enough numbers to make ads efficient.

The old John Wanamaker quote fits here. The great retailer of yore was once asked if advertising works. He replied, “One half of my advertising works, the other half wasted. I only wish I knew which half was working.”

Now think of an ad supported streaming show. It may start out with a few 30 second spots sprinkled here and there but you have to be utterly clueless if you don’t realize that in time, streamers will load an ever rising tide of commercial time into each program. In the end, watching your favorite show on a streaming service will be no different than watching old broadcast media. Except for one thing: In this compact you will not only be asked to pay attention to ads but also to pay at the end of the month for watching a programming format no different than what you saw on NBC, ABC, CBS or Fox.

Parks: Orlando was soft in 2Q, international strong, overall the planned additions like EPIC Universe coming next year promise to build that segment at a faster clip because like its Nintendo park it feeds off far more recent IP than the average Disney palette. We think this segment will become cash flow positive at a fairly faster pace against the overall park entertainment sector in general.

Conclusion

For all its size and massive footprint, it seems to me that Comcast has become something of an orphan since the original run-up of the streaming madness since 2020. It has lacked center stage visibility among investors. It performance now is looking at a forward P/E of 11.9X vs. US cable industry’s 12.5X. It shows an operating cash flow of $27.25b, a levered FCF if $11.17b. Its hefty interest expense of $3.9b supports a heavy levered debt of $90b, nearly double that of Disney. Yet it has a dividend yield of 2.5%–no great shakes. On many grounds one would be disinclined to open a position on the shares despite its relative undervaluation on a DCF basis.

But looking a bit deeper as to how Comcast is meeting its challenges, expanding its IP and Parks portfolio and using the immense cash flow of its broadband and wireless businesses to convert customers to its streaming and IP one can see how it may well be a value buy going forward.

Other than Disney, stocks in the media/communications sector are all selling at low double digits prices and represent buys that bring with it a given amount of downside risk. Yet Comcast is digging away at initiatives to staunch cord cutting by converting its huge broadband base to upgraded service, cross marketing hand held wireless and building its IP by expansion of its Parks business. Its ROE is 6.93 vs. Disney’s at 2.3%. To us that is one small signal that the product/service mix of Comcast relative to Disney makes it a good value buy in uncertain times.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

For in-depth and deep dive research on the casino and gmaing sector, subscribe to The House Edge. New: Free excerpts from our book in progress “The Smartest ever Guide to Gaming Stocks” – free to existing members and new subscribers.