Summary:

- This is my personal review of Comcast Universal’s Super Nintendo Land at Universal Hollywood and Super Mario Bros. Film.

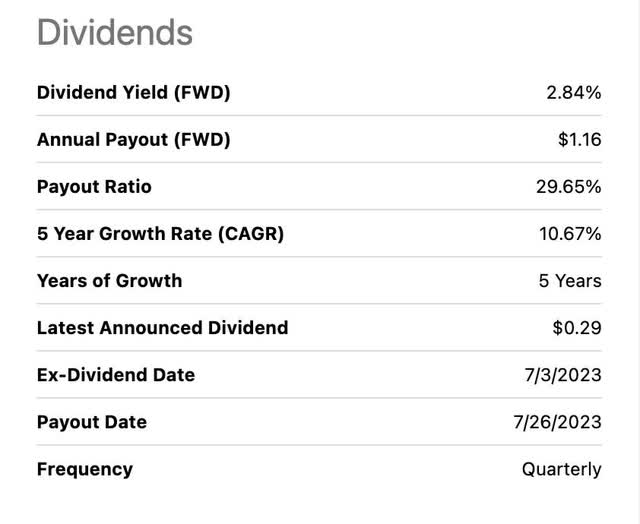

- Comcast pays a nice, well-covered dividend with healthy payout ratios of earnings and free cash flow.

- The stock trades below intrinsic value on two of my price target models.

- Comcast may have a Star Wars-type franchise burgeoning going forward.

Rodin Eckenroth/Getty Images Entertainment

Headline

Comcast (NASDAQ:CMCSA), is still a buy and back on my list of best ideas after some others have gotten away from me to the upside. I recently did an article on the company before the release of The Super Mario Bros. movie. I predicted the release of that movie coinciding with the opening of Super Nintendo Land at Universal Hollywood would probably produce a Billion dollar revenue hit. Sequel news is coming soon according to Mario voice actor Chris Pratt. The film has now gone on to gross more than $1.3 Billion and becomes one of the top 20-grossing films of all time.

Why is the film important? I mean films gross a Billion or more quite frequently, especially with inflation and nearly $20 movie tickets. The importance is, this is a new franchise. Yes, Super Mario and Nintendo (OTCPK:NTDOY) have been around since the early 80s but never has a film been produced that was so close to mimicking the game itself. With another park and Super Nintendo land opening in Orlando in 2025 as part of the new Epic Universe Theme park, they’re just getting started.

This is a very hard company to comp. Professional analysts would say they are in the same segment as Charter Communications Inc. (CHTR). I say they’re trying to compete with Disney (DIS) as part of their expansion going forward. The stock is slowly developing from cable/internet services into a similar business model as Disney with streaming and parks split almost down the middle revenue-wise. They have the streaming business with NBC ownership to match. If the hard line cable services stay relevant, more icing on the cake.

The chart

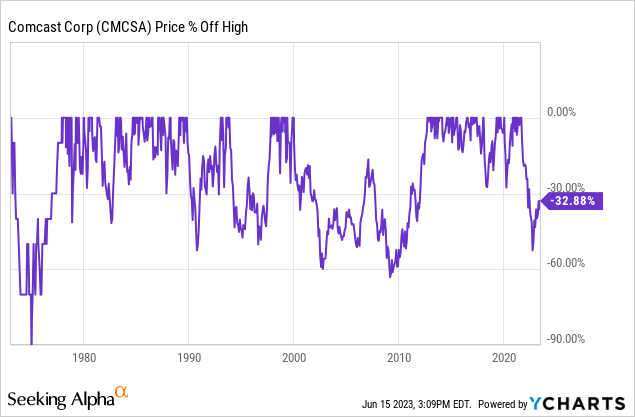

The stock is still hovering near 52-week lows since I last wrote about Comcast Corporation. It’s surprising, with many buy articles that have come out since. I see professional analysts on Wall St. all slapping buys on it as well. What gives? I say it’s an opportunity to get in before the resonance of the new theme-park addition, Nintendo toy sales, and Super Mario movie dough gets counted by the end of the year.

What they do

From the 10K:

We are a global media and technology company with three primary businesses: Comcast Cable, NBCUniversal and Sky. We were incorporated under the laws of Pennsylvania in December 2001. Through our predecessors, we have developed, managed and operated cable systems since 1963. Through transactions in 2011 and 2013, we acquired NBCUniversal, and in 2018, we acquired Sky. We present our operations in five reportable business segments: (1) Comcast Cable in one reportable business segment, referred to as Cable Communications; (2) NBCUniversal in three reportable business segments: Media, Studios and Theme Parks (collectively, the “NBCUniversal segments”); and (3) Sky in one reportable business segment.

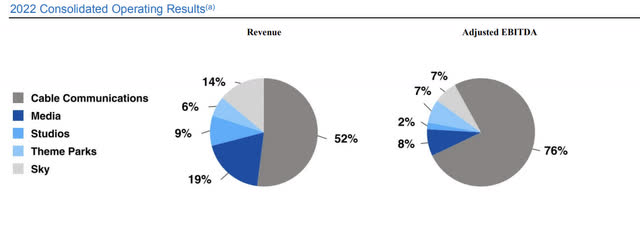

So we can see why Comcast is normally compared to Charter, with 76% of adjusted EBITDA coming from the cable communications side, this is already a profitable workhorse. Cable is only represented as 52% of revenue, however. Media, studios, and theme-parks make up 34%. This is the segment that can be enhanced by new profitable franchises similar to what Disney did with the addition of Marvel and Lucas Films with the Star Wars Franchise.

The one issue compared to what Disney did is they are not taking the franchise whole, nor do I believe that it would be possible as Nintendo itself is a $50 Billion market cap company. The licensing arrangement will always make the deal less profitable than the wholly-owned franchises Disney purchased, but it also turns Comcast into Disney’s first formidable foe. With the Harry Potter franchise petering out, and the Minions and Fast and the Furious getting long in the tooth, the injection of the Nintendo Franchise was just the shot in the arm they needed.

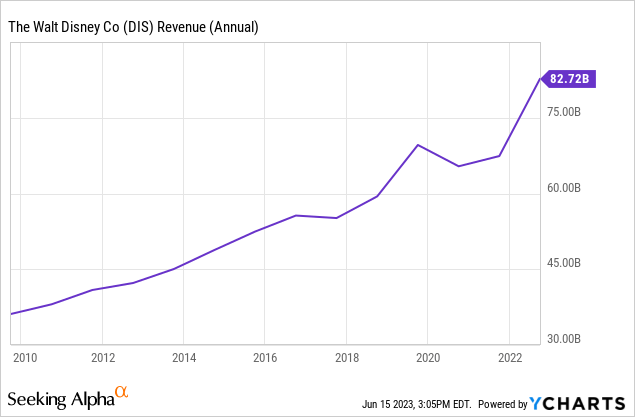

Disney and Star Wars bump

Two major events in Franchise acquisitions for Disney on this timeline:

- 2009, The Walt Disney Company acquired Marvel Entertainment for US$4 billion.

- Disney acquired Lucasfilm, the production company founded by Lucas, on October 30, 2012, for a reported $4.05 billion.

The effect of the Star Wars/Lucas Film addition is more pronounced on this revenue chart than we can incorporate for Marvel. The first Star Wars Film under the Disney parent, The Force Awakens, came in 2015. The new trilogy continued through 2019. The theme-park-related portion opened in 2019, right before Covid hit. This was also the time Disney + debuted with Star Wars again a big catalyst for generating revenue in the Disney “DMED” segment.

Super Nintendo Land

I hope I’m the first analyst to give an in-person review of the Super Nintendo Theme Park. First things first, the tickets. We had to purchase both a standard entrance pass and an extra $20 early Super Nintendo Land pass to assure that we’d get in. We arrived at 8 am, ugh. Here are some highlights from a recent article I did on JAKKS Pacific (JAKK):

- We had to get an early pass to get in, an extra $20 for that pass. The lines were still packed at 8 am before the actual 9 am opening of Universal.

- 60-70% of the crowd were decked out in Super Nintendo and Super Mario attire, hats, and accessories, the full nine yards.

- The shops at Universal Studios have now all been tuned into quasi-Super Nintendo shops outside of the Harry Potter shop. The shops inside the actual Super Nintendo World are exclusively Super Nintendo based.

- Nintendo-based toys had the highest customer-facing exposure of any toys or accessories in the entire park by far.

- Purchasing on that day appeared to be very high volume on an eyeball test basis. This was a weekday, not a weekend.

- There are vending machines that dispense point-accumulating bracelets that sync with the Super Nintendo app. Virtually every child’s parents were purchasing these Super Mario-themed bracelets at $20 a pop.

Even though we were there early, the Super Nintendo area became cramped fast. There was only one ride, an augmented reality Mario Kart ride with several other interactive games that required children to buy the $20 aforementioned bracelets. The world itself is stunning, have a gander:

my own photo (my own photo from Super Nintendo Land)

Mind you this was a weekday. Not a holiday either. The land itself seemed far smaller than the Star Wars park at Disney. With only one ride versus two for the Star Wars land at Disney, I would also assume this setup is lower cost to operate. The trickle-down effect of all the toy and merchandise buying should increase revenue for both Comcast and Nintendo. This is more of a Nintendo museum than theme-park, but something totally new and anticipated by multiple generations of Americans.

Super Mario Movie

Now for the film. Yes, I am a dad [not just an immature grown-up], and yes I have now seen this movie three times. Here are my observations:

- The film stays true to the most recent games released on Nintendo Switch. Some parts of the film are meant to emulate the game to a tee.

- It incorporated aspects of both the immersive world game and the Mario Kart game.

- Nintendo creator Shigeru Miyamoto was a co-producer and had a lot of creative control over the production.

Seeing the film all the way through to the credits revealed a lot of Japanese designers credited with the production and animation work in conjunction with Illumination Universal. The attention to detail was amazing. As someone who grew up with the franchise, the film paid it homage.

Universal is doing an excellent job handling fans with satin gloves. As long as Miyamoto is happy with the results, Nintendo should continue to allow Universal to have licensing rights and capitalize on this going forward.

Valuation model

I’m going to look at this company on a couple of different metrics, one versus an adjusted EBITDA per share Graham Number model from the Intelligent Investor and the other an owner earnings model laid out in The Warren Buffett Way:

With the Graham formula being the SQRT of 22.5 X [EPS] X [Book Value], our inputs would be $19.72 Book Value, and our forward EPS equivalent to analyst average estimates of $3.67 a share, data courtesy of Seeking Alpha. Therefore SQRT 22.5 X ($3.67) X ($19.72)= $40.35, trading right at fair value.

Reconfiguring it to get a high end based on EBITDA, we have $36.750 Billion in EBITDA TTM and 4.18 Billion shares outstanding. This would give us an EBITDA per share of $8.8. A reconstituted formula of SQRT 22.5 X($8.8) X (19.72)= $62.48 a share. This is an improvement since my last article with earnings and book value increasing and share count decreasing.

From an owner earnings target price perspective, we have the following inputs:

All data courtesy Seeking Alpha, all numbers in millions:

- TTM Net Income $5,655

- Plus Depreciation and Amortization $14,050

- Minus CAPEX $11,704

- Equals Owner Earnings of $8,001

- Discounted at 10 Year Treasury risk free rate 6/15/23 3.72% = $215,080 fair market cap.

- Divided by shares outstanding 4,168 = $51.60

- Discounted at 2 Year Treasury risk free rate 6/15/23 4.65%= $172,064 fair market cap

- Divided by shares outstanding 4168= $41.28

- Blended average = $46.44

Wall St. Price Targets

Interestingly, my price targets based on the modified Graham number at the high end and the long/short RFR owner earnings models are pretty close to these ranges. As Joel Greenblatt pointed out in his book You Can Be A Stock Market Genius, media companies invariably trade on cash flow or EBITDA versus GAAP.

The reason for this is the large amounts of depreciation on equipment and amortization of intangible assets/intellectual property. You can see the non-cash expense being very high in this instance at $14 Billion plus. The non-cash expenses outstrip the depreciation and amortization. A very positive indicator. This was also outlined in the Cap Cities/ABC case studies when Warren Buffett helped arrange the acquisition of ABC. The large non-cash expenses ongoing compared to smaller capex were part of the appeal in the deal.

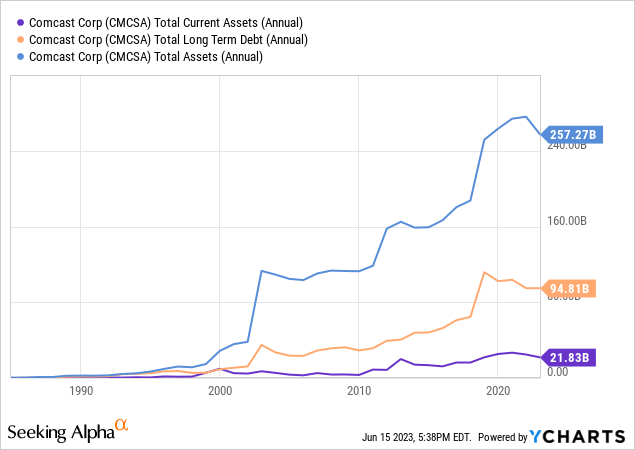

Balance sheet trends

Current assets have remained about flat, long term debt has trended downwards recent. Total liabilities TTM are at $176 Billion. This gives Comcast a healthy net-worth of $81 Billion.

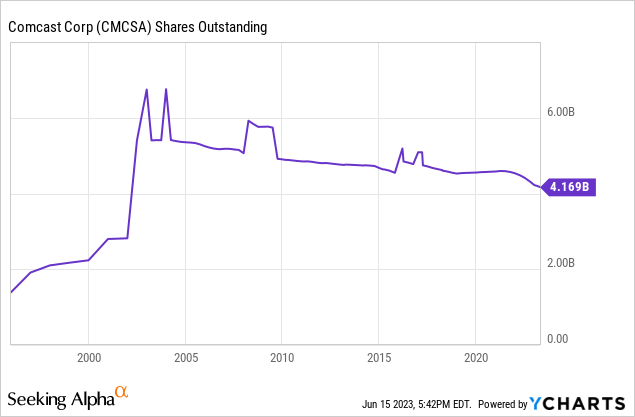

Nice steady downward trajectory in shares outstanding. Improving earnings per share metrics for owners along the way. I support more buybacks while under intrinsic value.

The dividend and free cash flow

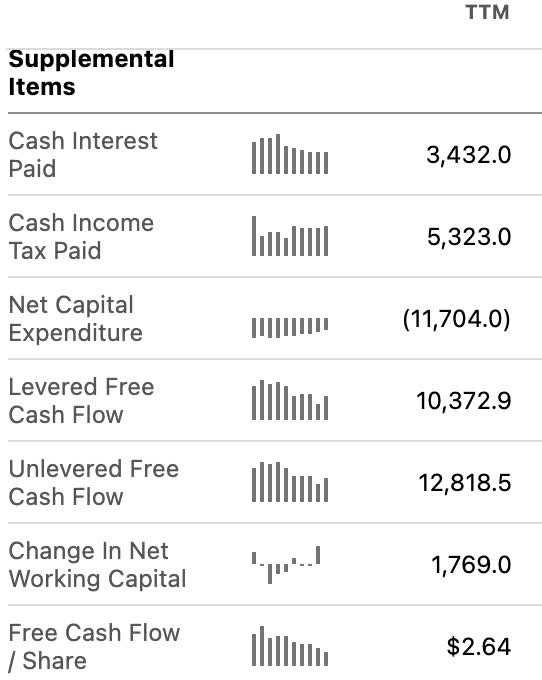

Nice yield, low payout ratio. The 5-year growth rate above 10% should continue. Let’s take a look at the free cash flow per share compared to the FWD annual payout:

seeking alpha

At $2.64 in free cash flow/share and a dividend of $1.16 FWD, that’s a free cash flow payout of 43%. Again, healthy coverage for a nice growing dividend.

Catalysts

I predict a nice bump to the top line with all the new Super Mario and Super Nintendo products floating around the ether. If we get some positive revisions to the upside, this should start to gravitate toward intrinsic value.

Risks

One of the biggest bear cases to the fixed internet segment is 5G and wireless direct-to-home internet access. How big of a threat it is has yet to be seen but it is looming. With Comcast Corporation deriving a big portion of its revenue and EBITDA based on the cable internet business, it seems wise that so much is being spent now expanding its parks and entertainment business. Streaming will remain a difficult margin business, but the margins should improve for everyone if data streaming and storage costs deflate as more capacity comes online. Netflix (NFLX) is a testament to the possibility of improving streaming margins.

Conclusion

I like this play quite a bit. I had taken it off my list for a while, but I am going to start allocating capital again. I am doubly inspired after seeing both the new theme-park addition and the film with my own eyes. I believe Comcast may have a new Star Wars-esque franchise on its hands and it is being handled very well at the outset. The stock is a buy and I’ll set a conservative price target at my mid-number of $51.6 a share.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMCSA, DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.