Summary:

- I am downgrading Comcast Corporation stock to a hold rating due to negative sentiment, declining revenues, and customer losses, despite stable GAAP margins and adjusted EBITDA growth.

- Comcast’s significant debt, lack of top-line growth, and customer attrition in broadband and business segments are major concerns impacting its stock performance.

- The company’s streaming platform Peacock shows decent revenue growth but remains unprofitable, further weighing on Comcast’s overall outlook.

- While Comcast’s fundamentals are strong, poor customer service and increasing debt hinder its potential to outperform the broader market.

RiverNorthPhotography

Introduction

My thoughts on Comcast Corporation (NASDAQ:CMCSA) recently changed, mainly because of the sentiment surrounding the company. I will outline the reasons I think this negative sentiment will lead to underperformance, and therefore, I believe there could be better places to park your money for now. I am downgrading to a hold rating until the sentiment improves.

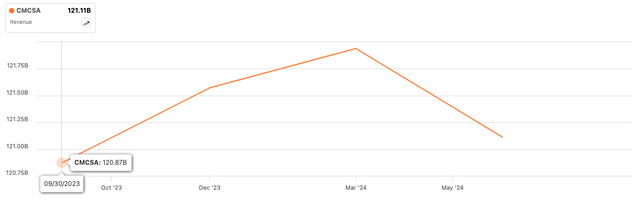

Briefly on Performance

Starting from the top, the company’s revenues since Q1 of this year have started to decline. It’s not that big of a deal, to be honest. The latest quarter saw -2.7% growth due to some weaknesses, primarily in the company’s Platforms, Studios, and Theme Parks Segment. The comparison was tough when looking at the Studios segment because of the hit movie The Super Mario Bros., which generated over $1.3B at the box office.

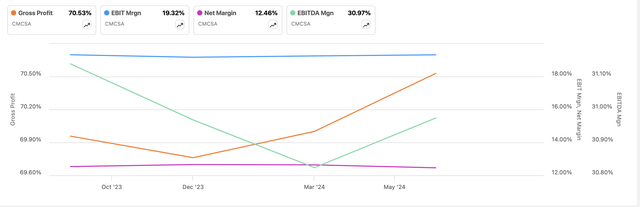

In terms of margins (GAAP), the company seems to keep this relatively stable over time, which isn’t a bad thing. These are pretty healthy margins. However, a metric the management likes to focus on, adjusted EBITDA, has increased quite a bit across the board. Connectivity & Platforms saw an increase of 1.6%, Business Services Connectivity 4.4%, and Media saw an increase of 9%. I’m not a fan of using EBITDA, let alone adjusted EBITDA. However, I must mention it since that is what the company chooses to focus on.

In terms of the company’s financial position, as of Q2 ’24, CMCSA had around $6B in cash and equivalents against a mountain of debt of over $90B, or three-quarters of its total market cap. That alone will deter many people from investing in a company that they may perceive as risky because these people tend to avoid any unnecessary risks associated with overleveraging.

But is it truly worrisome? The company pays out around $1B in interest expenses every quarter, so around $4B a year. That is a lot. However, the company also makes around $6B to $7B in operating income every quarter, so as of the six months ended June 30th, the company’s interest coverage ratio stood at around 6x. Many analysts believe a ratio of 2x is healthy, while I tend to lean towards 5x just to be more conservative. Either way, the company doesn’t seem to be overleveraged, so the debt isn’t a problem on paper. In many people’s heads, it may seem like that amount of debt is too risky. The company would certainly benefit from tackling this debt head-on instead of adding to it as it did in the last two quarters, but so far, it’s not an issue to me.

Overall, a lackluster performance so far this year. The company’s revenues aren’t growing, but at least GAAP margins are stable, and on an adjusted basis, these are performing quite well for a company of this size, I suppose.

Comments on the Outlook

So, how come the company’s share price hasn’t fared very well in 2024? I think the biggest reasons are the huge amount of debt and the lack of top-line growth, as well as the loss of customers. Let’s look at these things. First up, customers.

Domestic broadband and business customers seem to continue to decline this past quarter, as they did in Q1 as well. It appears that the company is losing market share across the board, except for domestic wireless lines, which saw a 20% y/y increase. The losses in customers were offset by revenue growth across the board, driven by strong ARPU growth, so it was not all bad. The healthy growth of wireless is excellent to see. People seem to be opting for the wireless plan. It usually comes a bit cheaper and at a worse performance, but many won’t care about that as long as streaming works fine and does not need an exceptional connection for things like gaming.

The growth in domestic wireless is still respectable; however, it has been declining for a while now, which is not a good sign. The company’s competition recently came out and said that by 2028, they expect to see 12M customers. That means T-Mobile US, Inc. (TMUS) expects around 15% CAGR from 2025 to 2028, which so far still is below what CMCSA was able to achieve. However, it is just one of the competitors in the market, and in light of plenty of customers of CMCSA recommending switching away from them because the customer service is appalling, the company may lose more market share going forward.

Next is the lack of revenue growth. Analysts do not see much growth at all over the coming years. They are not very positive the company is going to achieve something better. If the company continues to lose customers from the broadband segment, and wireless will start to slow down while cable-cutting continues, what is left for it to do to improve top-line growth? I don’t think Peacock, although it shows decent revenue growth every quarter, will be enough to push the top line to new levels. Y/y, the streaming platform grew its subscriber base by 38%, while it remained essentially flat sequentially. So, that is already not great if it cannot grow sequentially.

The streaming business is very competitive, and many established players in this segment are already profitable, while Peacock is still nowhere near. The company only reports an improvement in adjusted EBITDA because, while the platform made $2.1B in revenues in the past six months, total costs and expenses for the same period came in at $3.1B. $200m higher than the first six months of the year prior. There are a lot of other streaming platforms that people prefer, so it will be a waiting game with Peacock to see if it will eventually turn a profit or be sold off to some other company.

Lastly, the company’s debt pile. As I mentioned earlier, I don’t think it’s too worrisome. The company seems to have locked in quite a decent interest rate on all of it, around 4%. So, if the company could work on reducing it, people will start to pay attention to it more, as the risk will be perceived as lower. It is quite a lot of debt, and to add another $2B in the past six months doesn’t look good in front of potential investors. It just shows that the management isn’t worried about the debt pile that’s just sitting there and taking $4B every year out of the company, which could have been used for many other things. Things that could help rejuvenate its top-line growth.

Closing Comments

For those reasons, above, I feel the company will continue to underperform the overall broader market. Therefore, I am downgrading it to a hold. I would like to see how the company’s main revenue segments perform going forward, and whether the bleed in customers stops, or will it continue to lose market share to the competitors.

Fundamentally, Comcast Corporation’s numbers are very good, but I just don’t think it is enough to push it up when many investors are just not in love with the company itself. A company that has been known to have terrible customer service, a massive pile of debt, a loss-making streaming platform that hardly differentiates itself from competitors, and losing market share to rival network companies.

I’m sure the company’s time will come, but for now, I don’t think it will outperform the market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.