Summary:

- Cord cutting will continue to be a headwind for CMCSA, which it will help mitigate with price.

- Peacock and its MVNO businesses represent growth opportunities.

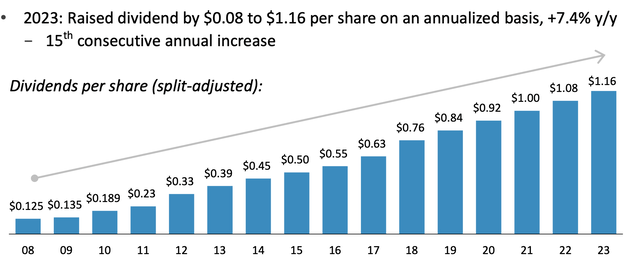

- The company generates a ton of cash, and will continue to grow its dividend.

Justin Sullivan/Getty Images News

Comcast (NASDAQ:CMCSA) is a solid stock to own for its abundant free cash flow and nice, steadily growing dividend.

Company Profile

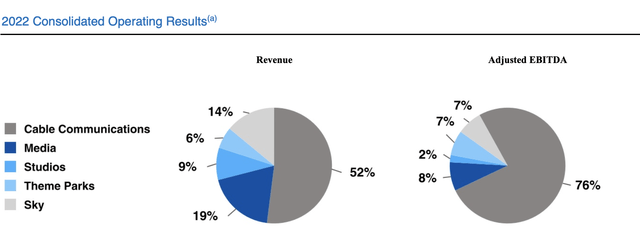

CMSCA is a media and cable company. Its Cable Communications segment, which accounted for about 52% of revenue in 2022, consists of broadband, video, voice, wireless, and home security services solid in the U.S. under the Xfinity brand.

At the end of 2022, the company has nearly 30 million broadband customers and over 15.5 million video customers. It also had nearly 8 million voice customers and over 5 million wireless lines. Its wireless service is only offered as part of a bundle and uses mobile virtual network operator (MVNO) rights over Verizon’s (VZ) wireless network.

The company’s NBCUniversal business consists of television and streaming platforms, as well as NBCUniversal’s film and television studio production and distribution operations. Its popular cable networks include USA, E!, Syfy, Bravo, MSNBC, and CNBC, among others, while it also owns NBC, Telemundo, and the streaming platform Peacock. Its film segment include Universal, Illumination, and DreamWorks Animation, among others.

The business also includes several theme parks located in Orlando, Florida; Hollywood, California; Osaka, Japan; and Beijing, China. Combined the three NBCUniversal segments represented 29% of CMCSA’s 2022 revenue.

CMCSA also owns Sky in Europe, which has both cable and entertainment businesses. The segment accounted for 19% of the company’s 2022 revenue. Its direct-to-home video service is offered through satellite and broadband in the United Kingdom, Italy, Germany, Ireland and Austria. It also offers broadband and voice services in the United Kingdom, Ireland and Italy. The company has a number of Sky-branded TV channels as well.

The company also owns the Philadelphia Flyers hockey team in the NHL and Wells Fargo Arena that they play in.

Opportunities and Risks

Cord cutting has long been a theme in the cable industry, as customers opt to get rid of cable in favor of streaming services. In fact, the CMSCA management has noted that cord cutting is still accelerating. As a result, CMCSA saw its video customers decline by 2 million users in 2022, while it also lost over 1.1 million voice customers. However, the company continues to push price, so while it lost -11% of its video customers, video revenue only fell -3.5%

Discussing price at a conference in December, CEO Jeffrey Shell said:

“So I’m still bullish that we’ll continue to see price increases. It’s just that cord cutting now is at a level where those price increases are not going to offset from a total amount. You’re still going to see declines in subscription revenue. We’ve kind of hit the top of the curve, right? And that’s going to be offset by, hopefully, subscription revenue on the streaming side.”

Of course, even as consumers cut the cord in favor of streaming, they still need broadband to access these streaming services. And on that end, CMSCA still controls the pipes to the house. As such, even though video and voice subs are on the decline, the company has actually been able to modestly grow its number of broadband subscribers. Together with price increases has helped drive revenue here.

The decline in cable subscribers can also impact the media business. Right now, the company’s own cable channels are on long-term distribution deals, so there is no impact on the carriage side of the business, but there could be in a few years when they come up for renewals. Advertising in linear television, however, has been weak, both due to advertisers cutting back due to uncertainty over the economy, as well as because of less linear TV viewership.

Areas where CMSCA does have growth drivers include its Peacock Streaming service, expanding its MVNO services, and theme parks. Peacock now has about 20 million subs doing $2 billion in revenue, after adding 10 million paid subs last year. Much of the company’s content spend is going towards Peacock, so it’s still a money-losing business. However, after an initial land grab among new streaming services, the industry has become more rational and is now focused on profitable growth.

CMCSA, meanwhile, has also been nicely growing its wireless sub with its MVNO business. Its sub base is only 9% penetrated, so there is room to continue to add more subscribers. It’s also an asset light business, so there isn’t a lot of capital to build it out.

Discussing the MVNO business at a Morgan Stanley conference in March, President Michael Cavanagh said:

“[We’re] very confident [that] MVNO is working for us, right? It’s capital light. Verizon’s advances in their product and network come to us at the same time it gets to them. Everybody talked about owners’ economics and the like, but without getting into the details of the actual agreement, we’re happy with it. And I see we do also have the ability to offload where it makes sense for us. So Charter and ourselves are testing a way on whether that would make sense. But I mean, you think about some of these numbers. 80% of the data traffic on Xfinity Mobile is over WiFi. Another interesting stat is 60% of the traffic that goes off network is in 3% of our geographic footprint. And we also own already spectrum that covers 80% of our footprint. So there’s a path there if that becomes feasible. We’re going to test away at that. But remember, the scale and growth pace that Charter and us together are generating creates pretty good dynamics for wanting to be served by the wireless industry, right? So I think there’ll also be advances as time passes and just the dynamics of these MVNO relationships.”

When looking at CMCSA, though, the main story is about cash flow and capital allocation. The company generated $12.6 billion in free cash flow last year. It bought back $13 billion in stock and paid out $4.7 billion in dividends. The company has now risen its dividend for 15 consecutive years. Its leverage is 2.4x.

Outside of cord cutting and an advertising slowdown, the biggest risk to CMSCA would be technological advances that could cost effectively compete with its broadband network. Fixed wireless has some potential but has limitations, while telco fiber is another competitor. I still think CMCSA’s broadband is the best solution, but AT&T (T) is offering both these other solutions to try to take share.

Valuation

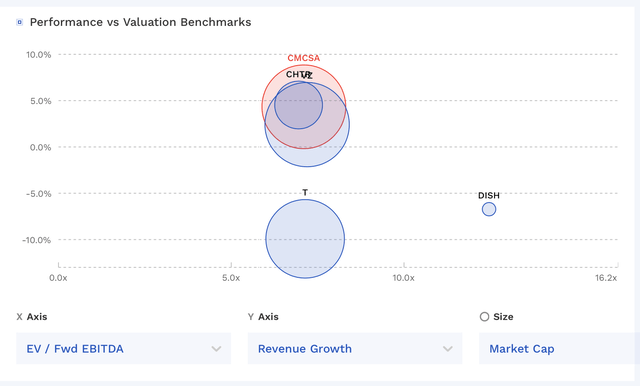

CMCSA stock currently trades around 7x the 2023 consensus EBITDA of $36.1 billion and 6.8x the 2024 consensus of $38 billion.

It trades at a forward PE of 10.5x the 2023 consensus of $3.64.

It’s projected to grow revenue by drop -1% this year and grow nearly 3% in 2024.

The wireless and cable companies generally trade in a similar range outside of Dish (DISH), which is likely valued differently due to its spectrum holdings.

CMCSA Valuation Vs Peers (FinBox)

Conclusion

While trading at a very similar multiple to its cable and wireless peers, I like CMCSA due to its large media assets. NBCUniversal is a valuable property, as content libraries are still very valuation. While the distribution model is changing, content is as important as ever. Owning the broadband pipes to the home is also advantageous.

I think for investors that like a growing dividend, CMSCA is good choice. The valuation is now at an attractive level, and while there are headwinds, it’s been managing them well and the company throws off a ton of cash.

While I wouldn’t expect huge gains, CMCSA is a nice steady stock to own.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.