Summary:

- CMCSA is currently a very attractive opportunity for investors, with a dirt-cheap valuation.

- Management is aggressively returning capital to shareholders through dividends and share buybacks.

- It maintains solid operating fundamentals, and has expansion opportunities through its hybrid fiber buildout.

Cindy Ord

The current bear market has produced a number of bargains, and in some ways, value investors may feel like a kid in a candy store. While the recent market rally has reversed some of the losses, it’s important to keep in mind that many stocks are still trading well off their prices just a year ago.

This brings me to Comcast (NASDAQ:CMCSA), which remains very cheap, especially considering the quality of its asset base and steady revenue stream from broadband subscribers. This article highlights why CMCSA remains deep bargain for value seekers, so let’s get started.

Why CMCSA?

Comcast is a global media and technology company that provides broadband and streaming services to 57 million customers across the U.S. and Europe. Its broadband, wireless, and video services include Xfinity, Comcast Business and Sky Brands, and its media empire includes Universal, Sky Studios, NBC, Telemundo, and Peacock streaming.

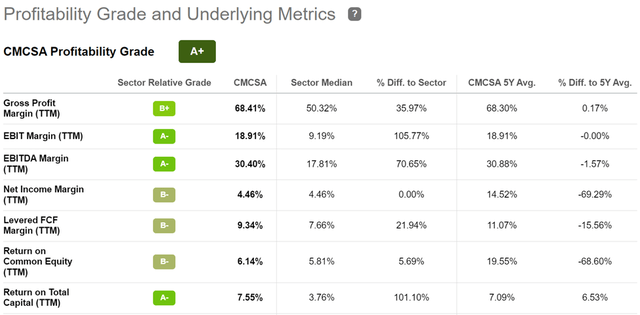

Comcast has a moat-worthy collection of assets, not least of which is its internet broadband footprint that reaches just over half (51%) of American households. CMCSA’s wide presence results in an economy of scale, because once the network is up and running, adding one additional customer results little to no incremental capital costs. As shown below, CMCSA carries an overall A+ grade for profitability, driven by a strong EBITDA margin of 30% that sits well above the 18% sector median.

CMCSA Profitability (Seeking Alpha)

Meanwhile, investors can take comfort in knowing that broadband subscriber growth is not as bad as the market made it seem in recent months, with Comcast adding 14K new broadband customers during the third quarter, up from zero in the prior quarter. Notably, management still expects to post a net loss in broadband subscribers for the full year, but that can be attributed to the impact of Hurricane Ian that wreaked havoc in parts of Florida last month.

Notwithstanding the slow growth in broadband customers, CMCSA is seeing strong traction in its consumer wireless plans, with net additions of 333,000, its best quarterly result on record. Plus, Peacock paid subscribers rose by 70% on a year-to-date basis, surpassing 15 million, and NBCUniversal adjusted EBITDA rose by 25% to $1.7 billion.

Moreover, consolidated adjusted EBITDA for the enterprise increased by 5.9% to $9.5 billion, and CMCSA continues to be a cash flow machine, generating $3.4 billion worth of free cash flow. Apparently, management thinks that the stock is too cheap, as it completed $3.5 billion worth of share repurchases last quarter, and that’s on top of $1.2 billion in dividends paid.

Looking forward, Comcast has a big opportunity ahead to expand hybrid fiber offerings (through DOCSIS 4.0) to more homes across the U.S. Management believes this is the right approach (versus full fiber) as it is less disruptive to neighborhood installations, thereby requiring less capital expenditures. This is supported by management’s comments this month during the recent technology and internet conference:

The reason why we don’t feel that we need to over build ourselves with fiber is because we believe that we’re able to deliver the same services meeting multiple gigabit symmetrical services with highly reliable service relied on the brilliant network that I described earlier and do that everywhere to each and every one of our 60 plus million homes without needing to dig up streets and without leading to dig up your front lawn and without more installation with your labor telco technicians in house and be able to do that everywhere and that’s why we believe that the DOCSIS evolution is the right one for us.

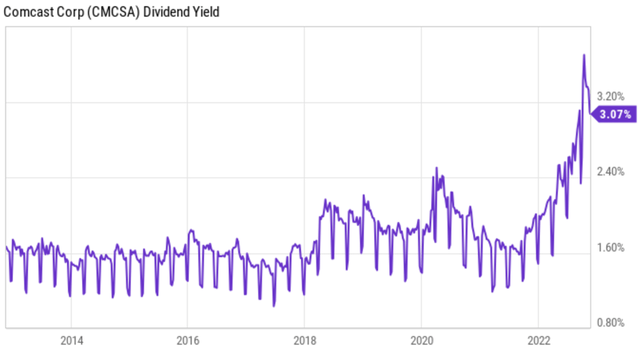

Meanwhile, CMCSA maintains a conservative managed A- rated balance sheet, and pays a very well-covered 3.1% dividend yield with a low 29% payout ratio. The dividend also comes with a robust 12% 5-year CAGR, and as shown below, sits at one of its highest levels over the past decade.

CMCSA Dividend Yield (YCharts)

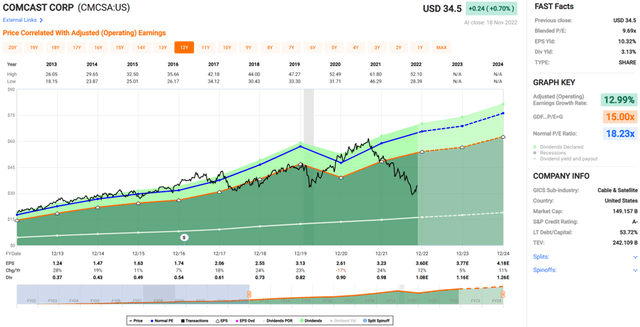

Turning to valuation, CMCSA remains dirt cheap at the current price of $34.50 with a forward PE of just 9.5, sitting far below its normal PE of 18.2 over the past decade. Analysts have a consensus Buy rating on the stock with an average price target of $41.85. CMCSA has the potential for very strong returns with simply a reversion to mean valuation, and that’s not even including earnings accretion through aggressive share buybacks on top of the dividend.

Investor Takeaway

CMCSA is currently a very attractive opportunity for investors, with a dirt-cheap valuation, strong free cash flow generation, robust dividend payments and the potential for accretion through aggressive capital returns to shareholders.

Furthermore, it has seen growth in its wireless plans and Peacock paid subscribers, with a steady broadband customer base and expansion of its hybrid fiber network. In summary, CMCSA’s fundamentals look very appealing at the current price and investors should consider taking advantage of its attractive valuation for potentially strong total returns over the long run.

Disclosure: I/we have a beneficial long position in the shares of CMCSA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!