Summary:

- Comcast Corporation investors have defied the pessimistic prognostications since late last year. I also urged investors to buy its October 2022 massive capitulation.

- CMCSA has significantly outperformed the market since then, as my Buy thesis has played out accordingly. While CMCSA is no longer that cheap, its valuation is still reasonable.

- Comcast’s wide-moat and well-diversified business model has best-in-class “A+” profitability. As such, it’s well-primed to navigate structural TV headwinds.

- The competitive threat from the wireless operators has also subsided, impeded by headwinds from high interest rates and disadvantages against Comcast’s integrated broadband market leadership.

- I argue why investors who missed last year’s lows aren’t late to add exposure, although the risk/reward is much less attractive now.

Justin Sullivan

Investors in Comcast Corporation (NASDAQ:CMCSA), who capitalized on its collapse late last year, have benefited from its fantastic recovery, significantly outperforming the market.

I last updated CMCSA in October 2022, highlighting why the “panic frenzy” that sent weak holders into a capitulation was a golden opportunity. I assessed that Comcast’s fundamentals remain solidly intact, even as the market broadly de-rated it. As such, I was confident that CMCSA was well-positioned to recover at the levels then.

As such, CMCSA has delivered more than 50% in total return since my October 2022 article. The recovery is spectacular for a stock not usually associated with growth. Seeking Alpha Quant’s “C-” growth metric corroborates my assessment, suggesting investors pushed it far too low last year, resulting in the mean-reversion thesis panning out very well.

With CMCSA buyers regaining control of its long-term moving averages, it’s opportune for me to analyze whether the current levels are still timely for Comcast investors who missed last year’s lows to add further.

Wide moat Comcast delivered a robust second-quarter or FQ2 earnings release, demonstrating why the market is justified in forming CMCSA’s 2022 lows and ongoing uptrend bias.

The company’s well-diversified and profitable business model is built on its success in its integrated broadband (connectivity & platform) and content & entertainment segments. Both are highly profitable businesses. Notably, Comcast’s connectivity business reported a segment-adjusted EBITDA margin of 41% in Q2. In addition, Comcast’s content & experiences segment (which includes its TV, streaming, and theme parks business) registered an adjusted EBITDA of more than 20%, underpinned by media and theme parks.

Therefore, I assessed that the market remains confident in the company’s wide moat business model, built on best-in-class profitability, and assigned an “A+” profitability grade by Seeking Alpha Quant. Furthermore, competitive headwinds attributed to the wireless telcos have subsided. Impeded by the high-interest rate headwinds and sustainable market leadership by the leading broadband players like Comcast, fixed wireless operators could find it increasingly challenging to pose a significant threat against Comcast.

Analysts’ estimates suggest Comcast’s operating leverage is expected to improve further, underpinning the extent of its remarkable recovery. Accordingly, Comcast is estimated to deliver an adjusted EPS CAGR of 8.1% from FY22-25. Its robust free cash flow or FCF margin is also expected to improve further, reaching 12.6% by FY25 from 10.4% last year.

Therefore, I believe investors who bought aggressively into its October 2022 lows were confident about Comcast’s execution, as the company has not disappointed in the first half of 2023.

Notwithstanding my optimism, we must assess whether CMCSA’s valuation and price action are still supportive to underpin a bullish thesis or move to the sidelines.

Accordingly, CMCSA last traded at an EBITDA multiple of 7.5x, below its 10Y average of 8.4x. However, it’s in line with its peers’ median of 7.5x (according to S&P Cap IQ data), suggesting the valuation dislocation is no longer apparent after its sharp recovery.

Therefore, I assessed that investors are pricing in a discount against its TV media business as it faces a secular decline. Despite that, Comcast’s well-diversified profitability anchors suggest it is positioned to navigate these structural headwinds. Moreover, the potential sale of Hulu to Disney (DIS) could underpin a more robust capital return to investors, driving shareholder value further.

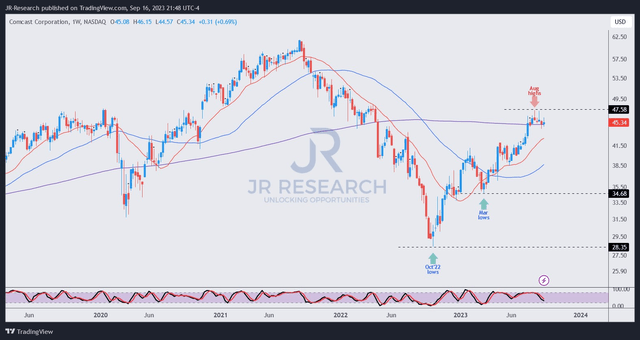

CMCSA price chart (weekly) (TradingView)

CMCSA remains in a well-defined medium-term uptrend, suggesting robust momentum. Seeking Alpha Quant’s “A” momentum grade corroborates my assessment. However, it’s also critical to understand that momentum swings could occur quickly, resulting in significant volatility unless the price action is still constructive.

I gleaned selling pressure at the $47.5 level, suggesting dip buyers likely took profit and cut exposure. Therefore, downside volatility could take CMCSA down further to the low $40s zone before more robust dip-buying support could be ascertained.

Notwithstanding my near-term caution, I’m confident there aren’t any clear sell signals on CMCSA despite the recent profit-taking levels. Moreover, CMCSA has recovered its long-term support levels, suggesting further upside is anticipated.

Bolstered by a reasonable valuation, the market is likely still pricing in a discount against Comcast’s structural headwinds. As such, I assessed that investors who missed buying its lows last year can still consider adding exposure, although the risk/reward profile is much less attractive.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!