Summary:

- Comcast is a consistent dividend payer with underperforming stock due to cable TV uncertainty.

- Strong free cash flow and financial strength support dividend growth, especially as Peacock scales and losses decrease.

- CMCSA’s wireless business is growing, with the potential for increased margins as infrastructure expands and the customer base grows.

BCFC/iStock via Getty Images

Executive Summary

Comcast (NASDAQ:CMCSA) is a stable and entrenched enterprise that has managed to increase dividend payouts every year for more than a decade.

However, this stock has underperformed as of late due to the growing fears about the future of the cable TV business, a cord cutting is accelerating.

While we do believe that cable Video profits will decline, the streaming losses will also narrow, enabling Comcast to maintain profitability.

Comcast could indeed manage to grow earnings per share due to the aggressive stock buybacks at the depressed price.

On top of this, the retained earnings are invested in additional growth initiatives which will also produce incremental profits.

Comcast currently trades at an adjusted 12% free cash flow and 3.2% dividend yields. There is plenty of headroom to maintain and grow the dividend, however the longer-term earnings growth potential is uncertain.

Dividend Safety

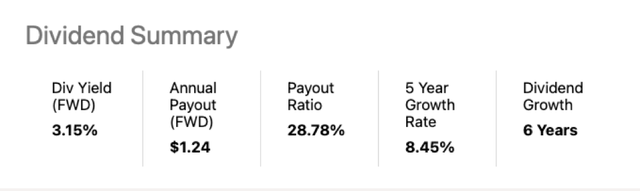

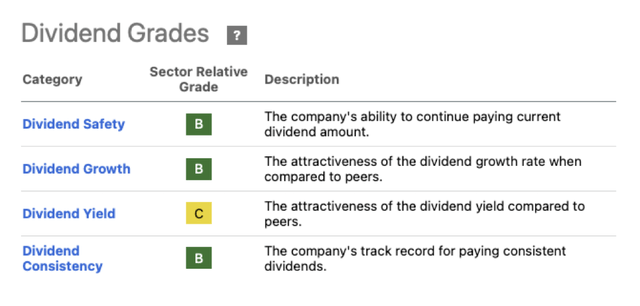

Comcast is currently offering a forward dividend yield of 3.2%, while only paying out ~30% of earnings. The remainder of earnings is reinvested back into the business and also used for buybacks, helping to grow earnings and dividends per share.

Had the stock been bought at the current dividend yield, long-term holders would have realised a Total Shareholder Return of over 10% per annum over the last 5 years. Unfortunately, Comcast’s stock price has declined over those last 5 years, with investors barely breaking even when dividends are included.

With the low payout ratio, a strong balance sheet and plentiful free cash flow, Comcast is well-positioned to continue increasing the dividend at a rapid pace. Seeking Alpha quants have awarded the company a “B” grade for dividend safety and growth.

A Free Cash Flow Machine

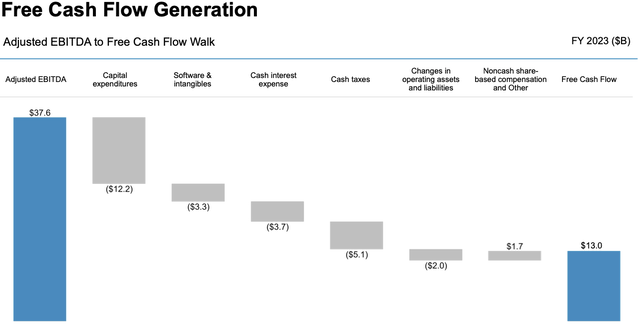

During the last financial year, Comcast generated $13 billion of free cash flow, equivalent to an 8.6% yield. The actual underlying free cash flow is significantly greater, though.

Comcast has disclosed that during 2023 Peacock incurred $2.8 billion in losses. If the latter losses were excluded, adjusted EBITDA would have increased to $40.4 billion and Free Cash Flow as high as ~15 billion.

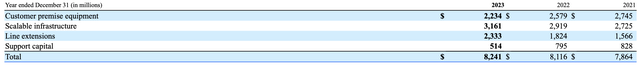

Comcast is also a capital-intensive business, and Capital Expenditure is the single biggest outlet of cash. Out of the $12 billion spent on equipment, infrastructure and buildings, some of the budget was allocated to replace outdated assets, while the balance was invested in growth.

When estimating free cash flows of businesses in mature industries, it is common to separate out maintenance and growth capex. The maintenance is the portion needed to maintain an ongoing level of business activity and profits. When estimating the cash that could be distributed to equity holders, growth investment is excluded, as this helps to get a sense of the current value of the business.

Comcast does not disclose the exact growth/maintenance split of the $12 billion capex budget. Considering that business invests in theme parks and network infrastructure, industries where assets do not become obsolete fast, we can assume that a considerable share of this capex is spent for growth.

Comcast discloses that during 2023 it has spent $2.3 billion on Line extensions, we can use this as a low-ball estimate of the growth capex. Scalable infrastructure also includes growth capex for the deployment of wireless gateways, but exact numbers are not provided.

This $2.3 could be added back when estimating FCF, which would increase to $17.3 billion, or a ~12% yield on the current market cap.

It would appear that Comcast is generating more than $17.3 billion of underlying Free Cash Flow, and possibly more. Considering that Comcast spent only $4.8 billion on dividends last year, there is considerable headroom for the business to maintain the dividend even in a very adverse environment.

Wireless Business Growth

Comcast is also growing its mobile business. The company utilises the network of Verizon (VZ) to provide nationwide coverage but is also building out its own 5G infrastructure in population centres. Over time, the margins of the wireless business should increase as new subscribers are signed up and a larger proportion of data flows through its own infrastructure.

Domestic Wireless has been one of the main revenue growth drivers of the group. The company now has 7.2 million wireless customers in the U.S. with a penetration rate of ~20% of domestic residential customer relationships. In the second quarter of 2024, Comcast reported a 20% year-over-year growth in wireless customer lines.

Comcast is growing wireless by offering its broadband customers attractive prices for data plans that include access to the extensive public Wi-Fi network of Xfinity. The company has started offering unlimited data for as low as $25 per month when four lines are purchased.

However, increased revenue is helping Comcast leverage their network investments and could potentially reduce customer churn. Data usage is one of the most important factors in determining the fees that Xfinity has to pay Verizon. Comcast will therefore try to make sure its customers will consume as much data through its own wireless infrastructure, such as Wi-Fi hotspots or the new 5G cells being rolled out.

The hotspots and cells will be plugged into Comcast’s network and will help increase the revenues earned from this fixed capital investment. Wireless profit margins might not be significant now, but they could grow significantly as the business scales and can increasingly utilise existing Xfinity infrastructure.

Cable TV Decline

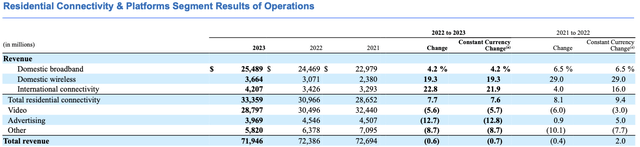

During the latest quarter, Comcast reported that domestic Video revenues have declined by 8% as subscriber numbers declined by ~13% over last year. The cord-cutting seems to have accelerated as streaming offerings keep improving.

Within the next two years, even flagship ESPN will start streaming DTC, and major sports rights holders are already offering attractive sports bundles. Live premium sport has been the last remaining lynchpin of the cable TV bundles, as sport moves to streaming, cord-cutting could accelerate even further.

This is an issue for Comcast, as the Video business still delivers about $10 billion of gross profit (revenue-programming cost) to Comcast. Loss of such a cash flow source would be painful. So far, the impact of subscriber losses has been mitigated as Comcast has been increasing prices and negotiating reduced programming costs.

|

FY2021 |

FY2022 |

FY2023 |

CAGR % |

|

|

Video revenue |

32,440 |

30,496 |

28,797 |

|

|

Programming cost |

20,542 |

18,500 |

18,067 |

|

|

Video gross profit |

11,898 |

11,996 |

10,730 |

-5.0% |

Comcast financial reports, our estimates

However, if subscriber losses accelerate it will become increasingly difficult to pass on price increases at a higher rate, especially as more alternatives are available through the DTC channel. The development of streaming offerings and bundles not only encourages cord-cutting but also limits the pricing power of cable companies.

We are not optimistic about the future of the cable TV business. The overall adjusted EBITDA of Comcast has been ~$38 billion, a loss of $10 billion in profits would be significant; however, it would not be lethal for the business. In theory, Comcast could maintain the current dividend even if the Video business disappeared overnight.

Peacock To Break Even

Comcast has launched a streaming service of its own to take advantage of the rising opportunities in DTC streaming. The industry has proven to be challenging and Peacock, the streaming service of Comcast, is still loss-making.

Most of the streaming platform operators, especially the smaller ones, struggle with high customer churn rates, and it remains to be seen if they can turn profits in this new industry. The largest players like Disney (DIS) might scrape together a competitive bundle and thrive, but Peacock is likely to struggle.

During FY2023, Comcast reported that Peacock incurred $2.8 billion in losses. This was seen as the peak loss year as the service has now exceeded 30 million subscribers and the expanded revenue base will help offset the aggressive content spending. Peacock has also announced it will be raising prices.

All of these factors will help Comcast to mitigate streaming losses this year and potentially break even over the next couple of years. The streaming industry, in general, has been focused on profitability improvement and many players are moving towards breaking even.

Peacock could also merge their streaming assets with another player to achieve better economics. Comcast is highly likely to experience an earnings uplift when the streaming business is fixed.

The $2.8 billion would go a long way in compensating for the Cable TV profit reduction as cord-cutting accelerates.

Putting It All Together

Cable TV profits are very likely to continue declining, however declining DTC streaming losses will help offset most of the negatives initially.

Comcast is highly likely to maintain its strong cash flow generation over the next 2-3 years, which will help it to continue paying out an increasing dividend and buy back the stock.

From a longer-term perspective, though, it’s not clear where the growth will come from. The wireless business does hold some potential, but it is still small and margins are tiny as third-party infrastructure is primarily utilised. Comcast could make it work eventually, but significant uncertainty still exists.

This uncertainty about future growth prospects and the future of cable TV will continue to linger and put pressure on the valuation multiples of the company. Comcast is a cash-generative business and is already trading at low valuation multiples, we therefore do not see a case for short-selling the stock.

However, we will Hold out from buying the stock as we do not see significant earnings growth prospects ahead. We would also like to observe how cable TV profits develop.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.