Summary:

- Comcast shares have underperformed due to streaming wars and box office struggles, down 11% in 2024.

- Despite challenges, Comcast remains a value buy with low earnings multiple, high yield, and expected earnings growth.

- Analysts project a 2% EPS increase this year with potential for $5 EPS by 2026, making Comcast a compelling value idea.

- I outline key price levels to monitor ahead of earnings due out in July.

RiverNorthPhotography/iStock Unreleased via Getty Images

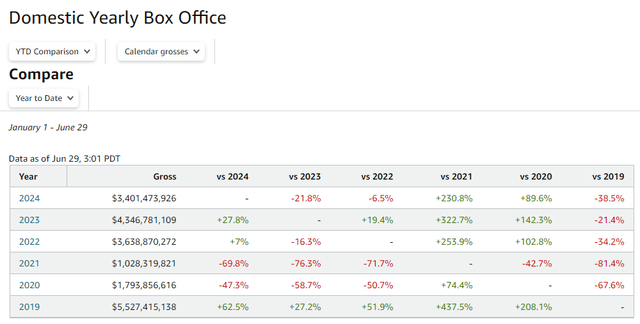

It has been a challenging backdrop for traditional media companies in 2024. With ongoing streaming wars in the at-home entertainment space and very soft ticket sales at the box office, shares of Comcast (NASDAQ:CMCSA) have sharply underperformed both the Communications Services sector and the broader S&P 500 so far this year. The $154 billion market cap stock is down 11% through the first half – CMCSA was even down in 12 straight sessions during June. Is too much negativity baked in, though?

I have a buy rating on Comcast. I see the company as a value today given its low earnings multiple, high yield, and the expectation for earnings growth to increase in the coming quarters.

Box Office Blues in 2024

According to Bank of America Global Research, Comcast is one of the largest US providers of cable services, with over 32mn broadband subscribers and nearly 14 million video subscribers. Comcast also owns NBCU, which includes the NBC TV Networks, Telemundo, MSNBC, USA, SyFy, Bravo, E!, CNBC, the Peacock streaming service, Universal Films, and Universal Theme Parks. In addition to these assets, Comcast owns Sky.

Back in April, Comcast reported a solid set of quarterly numbers. Q1 non-GAAP EPS of $1.04 beat the Wall Street consensus estimate of $0.99 while sales of $30.1 billion, up 1.2% from a year earlier, was a $190 million beat. Shares rose initially after the numbers were released, but sellers took hold the following session, with CMCSA finishing down 5.8% despite continuing a streak of bottom-line beats dating back to 2019. Within the report, Comcast’s Connectivity & Platforms Adjusted EBITDA rose 1.5% to $8.2 billion in Q1 while its adjusted EBITDA margin inched up 30 basis points to 40.5%.

Declines in its broadband subscriptions cast a cloud over the quarter as market saturation fears persist. Moreover, competition only seems to be growing in the entertainment industry, but Comcast has recently introduced a pre-paid broadband service with the goal of offsetting broader negative trends. Sometimes overlooked, the firm’s theme park segment posted weak profits in the first quarter, partly due to adverse currency moves.

Amid these headwinds, however, Comcast boasts a healthy balance sheet and consistently high free cash flow per share, which I see as compelling features from a value investor’s standpoint. Operationally, the company is in a decent position with respect to its low-churn customer base, high average revenue per user (ARPU), and some growth in its commercial business. Key risks include internet subscriber losses, high capex costs, lower growth in its higher-margin segments around data and enterprise, and a stronger USD.

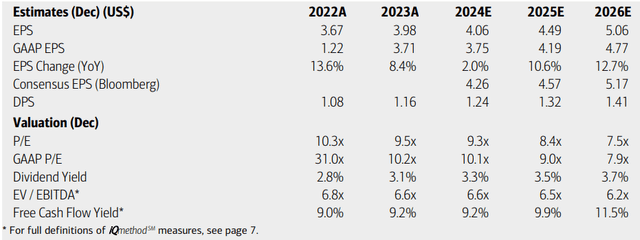

On earnings, analysts at BofA see operating EPS rising just 2% this year, with an earnings acceleration in the out year through 2026. The current Seeking Alpha consensus estimate calls for a 6% non-GAAP EPS rise this year and next, with potentially $5 of EPS by 2026. Sales growth is weak, though, at just 2% this year and fractionally negative in the out year.

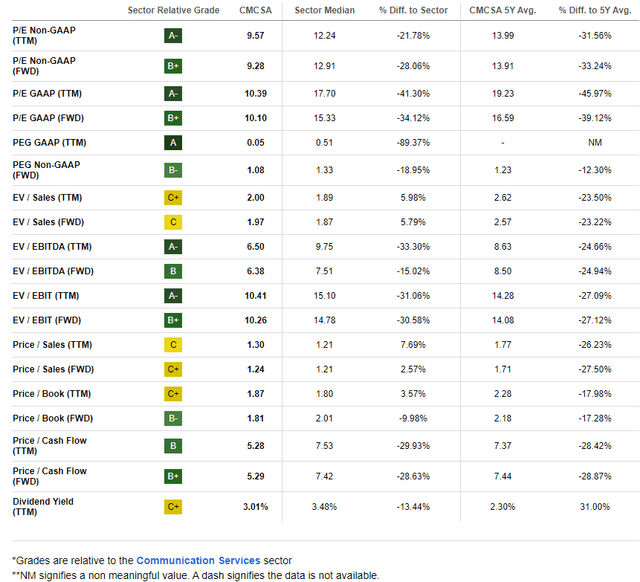

Dividends, meanwhile, are projected to increase at about a 3% annualized rate in the coming quarters while the stock’s P/E drifts possibly into the high-single-digits before the higher earnings growth period begins. With an EV/EBITDA ratio less than half that of the S&P 500, there is a solid value case with CMCSA. That assertion is augmented by a free cash flow yield that’s currently about 9%.

Comcast: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

If we assume $4.30 of operating EPS over the next 12 months, about where the consensus is today, and apply the stock’s 5-year average earnings multiple of 13.9x, then shares should trade near $60. I believe that valuation assumption is about on point considering the earnings trajectory ahead.

It would be a different story if the firm continued its 2% EPS rate of increase. Even if we apply a low 10x multiple on $5 of CY 2026 EPS, then we are still talking about a $50 stock.

CMCSA: Compelling Valuation Metrics

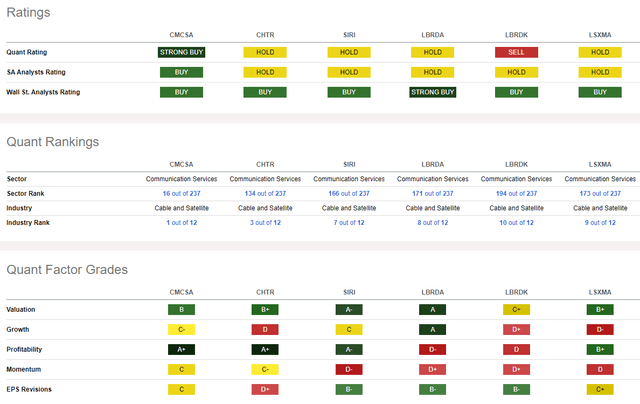

Compared to its peers, CMCSA sports a solid B valuation grade given its robust profitability metrics. And while the recent growth path has been rocky amid macro and industry challenges, the earnings story could inflect positive very soon.

Still, the sell side is a bit of negative on Comcast, evidenced by a high of 15 downward EPS revisions in the past 90 days compared with just 9 upgrades. Share-price momentum is another sore spot, but I will highlight key support on the chart as we begin the second half of 2024.

Competitor Analysis

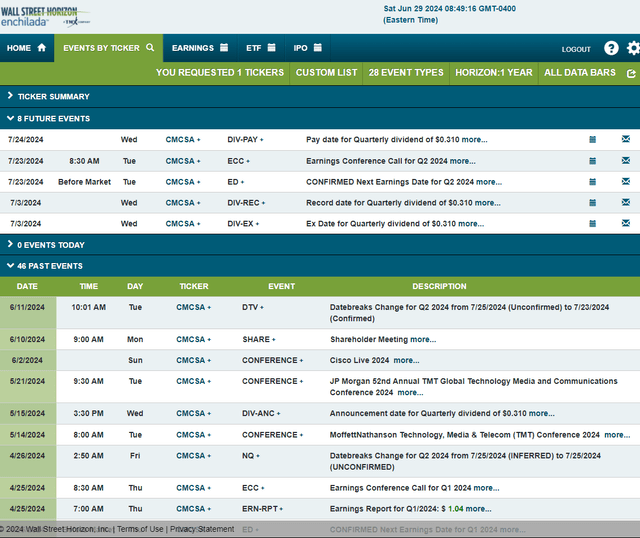

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q2 2024 earnings date of Tuesday, July 23 BMO with a conference call immediately after the numbers cross the wires. You can listen live here.

Shares trade ex a $0.31 dividend on Wednesday this week and the firm has several movie releases this month. Comcast Universal’s Despicable Me 4 opens ahead of the July 4th holiday.

Corporate Event Calendar

The Technical Take

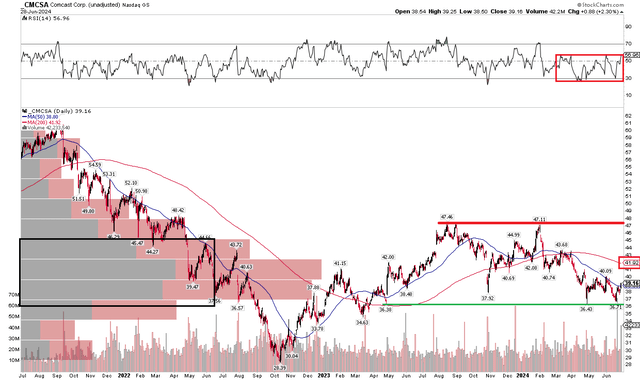

With a compelling valuation and an earnings date in the offing, CMCSA remains mired in a trading range over the past year-plus. The stock is trending lower in a nearer-term view going back to February, too. Notice in the chart below that shares have important support in the mid-$30s, while the $47 to $48 range is resistance. With a negatively sloped long-term 200-day moving average and soft RSI momentum trends, the bears have their grip on the primary trend.

Also, take a look at the volume by price indicator on the left side of the graph – there is a high amount of shares traded in the current zone, which will make it tough on the bulls to bring CMCSA through resistance. For now, a long play with a stop under the 2024 low could work, but this is not an attractive technical situation as it stands.

Comcast: 200dma Turns Down, Key Support Near $36

The Bottom Line

Despite a chart that is less than stellar, Comcast’s valuation is the star of the show. With a high yield, impressive free cash flow, and earnings growth on tap, I see shares significantly undervalued today.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.