Summary:

- Comcast is undervalued by over 30%, yet it lacks exposure to emerging industries, as all its businesses operate in saturated and highly competitive markets.

- The company’s financial performance over the last decade has been decent, but its capital allocation and debt levels raise concerns about future growth potential.

- Apart from presenting low growth prospects, the stock also lacks value, as its forward dividend yield is significantly below the current yields of U.S. Treasuries.

Sundry Photography

Investment thesis

I do not like to use a “zombie company” term for Comcast (NASDAQ:CMCSA). The company has vibrant history, and it can even be called iconic. Its profitability is still stellar and recent earnings show that there is still some potential to expand left.

On the other hand, the business mostly consists of units operating either in highly competitive or highly saturated industries. Wall Street analysts do not expect any real growth in revenue for the next decade, and this projection looks fair due to the company’s absence in any thriving industries. Capital allocation approach of the past decade also looks questionable as high leverage for new projects did not help to create more value for shareholders. The stock is more than 30% undervalued, but I consider it fair given stagnating financial metrics and no exposure to emerging industries. All in all, I assign CMCSA a “Hold” rating.

Company information

Comcast is one of the largest cable and telecommunications company in the United States. The company’s offerings include television, high-speed internet, and telephone services.

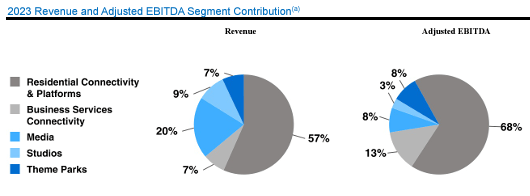

The company’s fiscal year ends on December 31. Residential Connectivity & Platforms segment is the largest revenue and EBITDA contributor to the company’s consolidated P&L. This segment’s offerings include residential broadband, video revenue, advertising. For more detailed information regarding each segment readers can refer to the latest 10-K report.

Comcast’s latest 10-K report

Financials

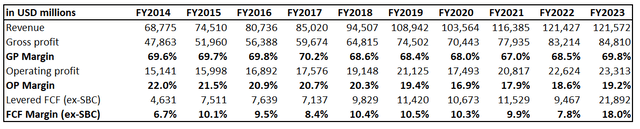

Comcast’s financial performance over the last decade has been solid with a 6.5% revenue CAGR and stable gross margins. On the other hand, the operating margin shrank by the end of the decade below 20%. The FCF margin has been consistently positive, ranging between high single-digits and low double-digits.

Author’s calculations

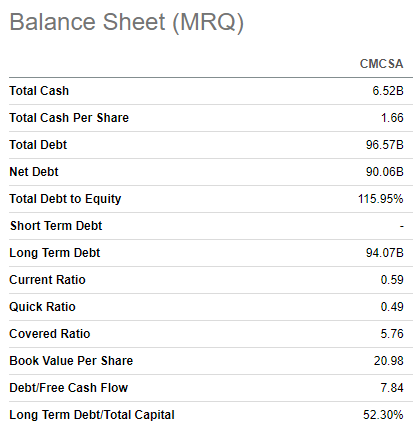

Capital allocation looks questionable. Debt levels are high and liquidity ratios are quite low. High debt level is not a problem itself, but when we look at it with the context of stagnating operating profitability, there are questions about the necessity of this high leverage to finance new projects. On the other hand, the current debt level is much lower compared to five years ago, which is a positive trend. Moreover, CMCSA blended rather aggressive deleveraging with solid dividend growth. Though, the stock’s forward 3.24% dividend yield is still lower than 10-year Treasuries yields by around one percentage point.

Seeking Alpha

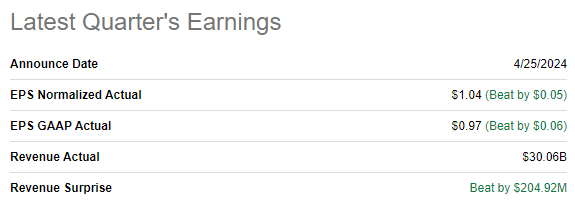

The latest quarterly earnings were released on April 25, when the company delivered positive revenue and EPS surprises. Revenue growth was quite modest with a 1.24% YoY increase. The adjusted EPS expanded from $0.92 to $1.04 YoY. The good news is that the EPS expansion was partially achieved with the operating leverage as key profitability metrics showed modest expansion.

Seeking Alpha

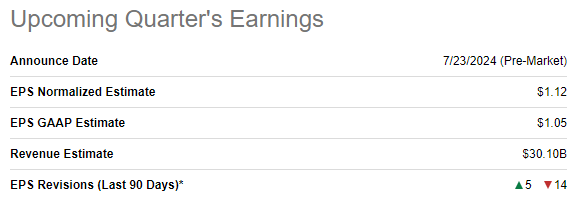

The upcoming earnings release is scheduled for July 23. The Q2 revenue is expected by consensus to be $30.10 billion, which will mean a slight YoY decrease. The adjusted EPS is expected to follow the top line with a one cent YoY decrease. Wall Street’s sentiment around the upcoming earnings release is quite weak because there were fourteen EPS estimates downgrades over the last 90 days.

Seeking Alpha

Long-term revenue and EPS consensus estimates are not very promising. Revenue is expected to grow approximately in line with inflation, while the EPS is expected to slight outpace revenue growth. It is difficult to agree here with EPS projections because due to the long-term inflationary effect on costs it will be almost impossible to drive profitability expansion without top line growth.

The entertainment industry has changed significantly over the last ten or fifteen years. Younger generations prefer streaming video services like Netflix (NFLX), Disney + (DIS), YouTube (GOOGL), Apple TV (AAPL) and dozens of other players. Video consumption increasingly shifts to these services, making traditional cable television less relevant in modern world. And this is a global trend, not only confronted in the U.S.

In addition to intense competition from formidable players in video streaming, Comcast also faces amplified competition from telecom providers and satellite broadcast firms. Telecom operators are actively marketing high-speed internet, digital phone services, which are usually bundled into quite appealing offerings for customers.

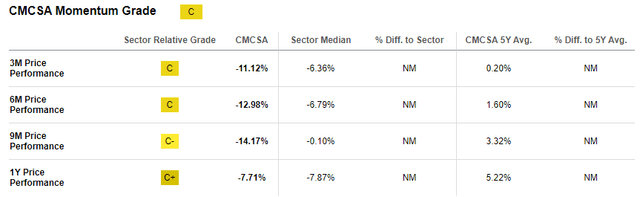

The sentiment around CMCSA looks weak and the stock has been falling over the last several months despite the broader market rallying. As one of the greats said, the stock market is a voting machine over the short-term. That said, CMCSA’s share price might continue stagnating until the market’s sentiment improves. While tech giants continue beating their all-time highs in 2024, it is difficult to say when investors will pay attention to value stocks like CMCSA.

Seeking Alpha

Valuation

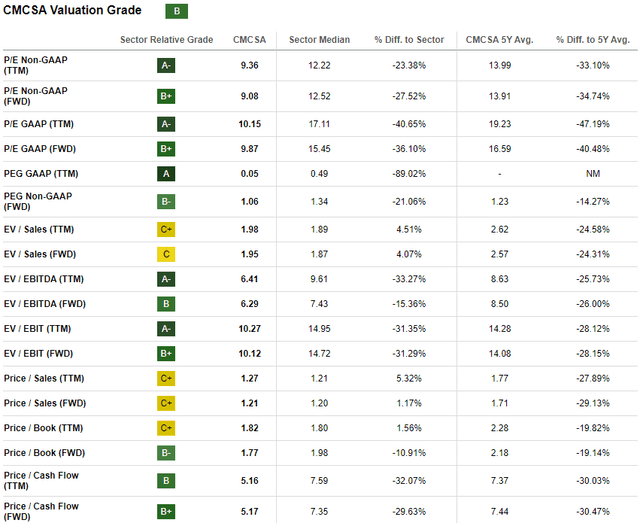

The stock declined by 6% over the last twelve months and the YTD performance is also disappointing with a 10% decline. The stock currently trades closer to the lower end of the last 52 weeks’ range. Comcast’s valuation ratios look very attractive both compared to the sector median and historical averages. That said, the stock is undervalued from the perspective of ratios.

Seeking Alpha

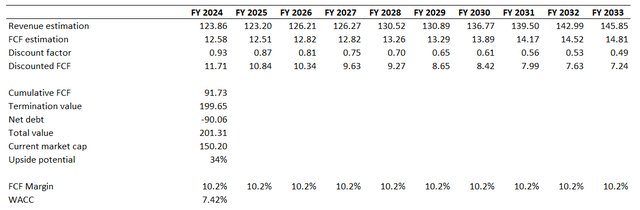

To determine the upside potential, I am simulating the discounted cash flow [DCF] model. I use a 7.42% WACC recommended by Gurufocus. Consensus projects revenue to deliver around 2% CAGR over the next decade, which looks applicable for my DCF model. Since revenue is expected to compound in line with inflation, I do not expect the FCF margin to show notable improvements. Therefore, I use a flat 10.2% FCF ex-SBC margin, which is the past decade’s average.

Author’s calculations

According to my DCF simulation, the fair value of the business is $201 billion. This is 34% higher than the current market cap and such an upside might look attractive for some investors. However, I think that the discount is fair given the fact that the company’s revenue and profits are expected to be almost flat on a nominal basis, and the current dividend yield is still notably below the risk-free rate.

Risks to my cautious thesis

Shifts in the market sentiment are difficult to forecast. Some unfavorable news like the Fed unexpectedly deciding to introduce few more rate cuts due to the strong stance of the U.S. economy might cause a selloff in growth stocks. This can lead to a notable rotation of investors’ capital to stocks like CMCSA due to their attractive valuation and solid dividend growth. In this case my cautious thesis will not age well.

Comcast’s business boasts various segments, and the company has a lot of assets. This means that the company has a huge room for restructuring, divesting, and investing. For example, Disney’s stock (DIS) also suffered a lot of pain before Bob Iger returned and started executing his transformation plan. Despite DIS still trading below pre-pandemic levels, it is difficult to deny that the stock became much more interesting to investors after Bob Iger started the turnaround and it even showed periods with notable rallies. For companies with diversified assets and segments there is always a possibility for restructuring and creating new synergies.

Bottom line

To conclude, CMCSA is a “Hold”. A notable discount to the share price looks fair given no exposure to notable secular growth drivers. On the contrary, most of Comcast’s businesses operate in highly saturated markets where there is almost no room for growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.