Summary:

- Comcast’s decision to spin off cable networks like MSNBC and CNBC aims to free up cash but may invite more competition, making shares a sell.

- Despite the spinoff, Comcast’s core business faces slow revenue growth, high debt, and threats from competitors like Starlink, impacting future profitability.

- The spinoff could diminish the value of Peacock, as key content will be lost, hurting streaming revenues and growth potential.

- Comcast’s net debt to EBITDA ratio is at risk of increasing, further straining resources needed to compete in the evolving media landscape.

- I believe shares are a sell.

RiverNorthPhotography

Co-Authored By Noah Cox and Brock Heilig.

Investment Thesis

Comcast (NASDAQ:CMCSA) shares are down roughly 1% YTD as of the close yesterday (trailing the market), on the back of the company’s core business undergoing a fundamental shift.

Comcast has made the painful decision to spin out some of their cable stations. With this, they have a series of key spin-out decisions ahead of them. While I think these decisions are a strong attempt to get the company back on the right track, I don’t think it will be enough to turn around the legacy cable giant.

Comcast spinning off cable networks like MSNBC and CNBC is the right move and will likely free up more cash for the cable company to either pay down debt or use for strategic acquisition. But, in the long run, I actually think this move invites more competition as new stand-alone media will likely mean another streaming service.

With this, I think shares are a sell.

Background

On Tuesday, CNBC confirmed that Comcast is spinning off key cable network channels like CNBC and MSNBC. On the cable giant’s recent earnings call, Comcast announced that it was considering this move, and now the plan to spin off is official.

Despite spinning these cable networks off into another company, Comcast is planning to hang onto NBCUniversal (NBCU) operations NBC and Peacock. These help support Comcast’s streaming service, Peacock.

Some of the stations that Comcast is spinning out have been experiencing low ratings, especially over the last few years (post Trump’s first term). This can be attributed to a couple of trends.

First, less political news is being consumed by everyday Americans. For those of you who live in the US, you’ll know that the last 6 months have been wall to wall political coverage and political ads. Many Americans are sick of watching political news and have found that this is the main type of content that major news stations now cover.

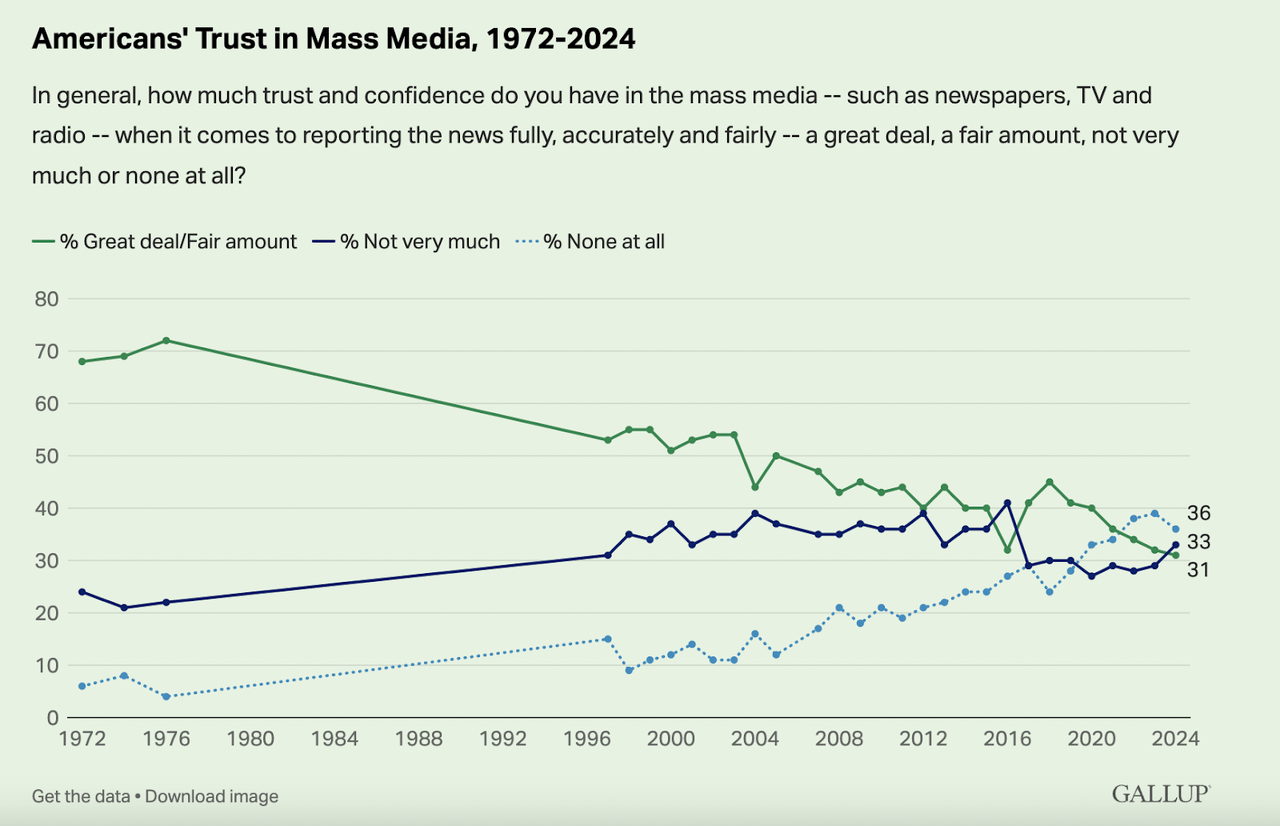

And secondly, many of these cable channels appear out of touch for millions of Americans, with the average American shifting their media consumption to podcasts, social media, and other online sources. Trust in these news outlets is at a multi-decade low.

American Trust In Mass Media (Gallup)

While some of the stations Comcast is spinning out have nothing to do with the news, Americans are simply watching less cable TV than they were before.

Mark Lazarus, the chairman of NBCU, discussed how the spinoff could help all parties involved.

As a standalone company with these outstanding assets, we will be better positioned to serve our audiences and drive shareholder returns in this incredibly dynamic media environment across news, sports and entertainment…We see a real opportunity to invest and build additional scale and I’m excited about the growth opportunities this transition will unlock. Our financial strength will also provide capacity for an attractive capital return policy while allowing for investment in the growth of these businesses.

Despite Lazarus’ optimism, I am not on the same page. Other analysts share my concerns.

In our opinion, a standalone spinoff of the cable network business makes little financial sense and could be motivated by a desire to overcome regulatory hurdles for potentially larger deals in cable, analysts at Barclays said in their immediate reaction to the news.

Spinoff Doesn’t Solve Core Problems

While the spinoff may help Comcast free up working capital, this is far from a risk-free move. On one hand, this spinoff would likely result in these channels creating their own streaming service either as part of a stand-alone company that they create, or as a part of another streaming company that buys these channels.

The big issue for Comcast here, though, is that the core business of cable and internet is in a tough position. I’ll dive deeper into these numbers later on, but forward revenue growth for the company is expected to be less than 1% year-over-year for the next year.

Because Comcast’s revenue is currently growing at such a slow pace, the cable company will likely struggle to innovate their internet offerings in this era of cord cutting.

New solutions like Starlink are a real threat to traditional cable companies, as more consumers use Starlink as a way to get internet access in their homes. Starlink recently passed over 4 million customers. With fewer Americans watching cable, customers keep Comcast for the internet service. This may not last forever.

This poses a huge problem for Comcast because Starlink can provide high-speed internet at just about any location in the entire world. Consumer satisfaction with cable companies is notoriously low as well. Comcast’s core business could be disrupted just as they spin off their media arm.

Valuation

For Comcast, the biggest issue is that their remaining business, which is now centered around internet, cable, and their streaming service, is becoming increasingly commoditized. At the same time, the company has a huge amount of debt on its balance sheet.

In total, Comcast has a total of $101.364 billion in debt. This debt will be a heavy burden on the cable giant if Starlink starts to bite into their cable business. With their media channels also off, Comcast also risks competition biting into their Peacock streaming on the other side.

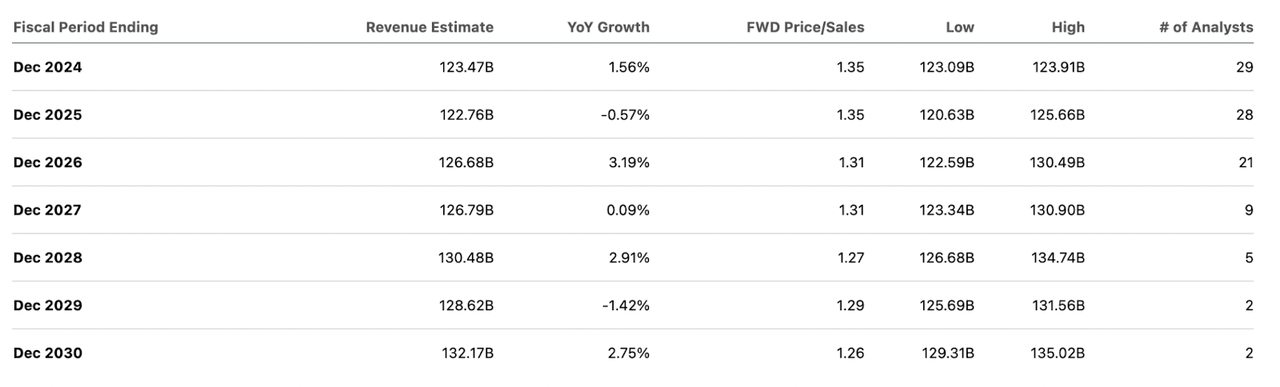

If we look over the next 6 years (ending December 2030) we can see that Comcast’s revenue is really set to stagnate. In many cases, revenue is either declining or will likely fall short of beating inflation.

Forward Revenue Estimates (Seeking Alpha)

As a company that is priced like a slow growth utility, this would be fine if their core business was not under threat. Unfortunately, for Comcast, that’s not the case here.

On the valuation front, Comcast is trading at a price-to-earnings ratio of 10.29, which is 23.39% lower than the sector median of 13.44. While this is rated as a B+ by Seeking Alpha, I actually think shares should trade at a lower P/E to show the disruption risk they face to both their traditional cable service and their Peacock streaming service.

Couple this with a $100 billion+ debt load, and I think investors need to pay close attention to the risk that debt could start to become a major burden for the company. Currently, the company’s net debt sits at $92.55 billion and the firm’s TTM EBITDA comes in at $37.286 billion. Generally speaking, companies with a net debt to EBITDA ratio of under 3 are safe. For Comcast, we are on the higher end of ‘safe’ at 2.48. This assumes that Comcast’s EBITDA holds up. Keep in mind that cable usage in the US is declining and their stagnating media business is getting spun out. I don’t see how, over the long run, their net debt to EBITDA ratio stays under 3 unless the company deleverages. Even then, the focus on deleveraging will take resources away from competing against Starlink’s new way for customers to get internet, and makes it harder for Peacock to invest to compete against other streaming services.

I think the company should be trading at a forward P/E of 8.00. If we saw the P/E drop to 8, it would represent 22.25% downside for shares of the company.

Bull Thesis

The biggest bull thesis for Comcast lies in getting Peacock revenue to grow. Since the launch of the streaming service, the company has been able to grow their revenue base substantially. As of the end of September, Peacock reported a subscriber base of 36 million customers and a quarterly revenue number of $1.5 billion.

The big problem for Comcast, however, is that many of their key Peacock consumers buy the streaming service for access to channels like “USA Network, CNBC, MSNBC, Oxygen, E!, SYFY, and Golf Channel” that are going to be leaving the company once the spinoff is complete. This will likely hurt streaming revenues.

Specifically, my assumption is that many of these key consumers fall under the MSNBC and CNBC franchises. So, in a lot of ways, Comcast is spitting out some of their most valuable television networks, which is diminishing the value of Peacock, one of the main growth stories for the company.

Takeaway

While Comcast has been well known for decades as a nationwide provider of cable and media content, the telecommunications giant is being left behind in the modern landscape of internet and streaming.

Non-traditional sources of media are increasingly becoming a key way millions of Americans get their news, while streaming is increasingly becoming the go-to way Americans watch their favorite shows. Although Comcast’s streaming service Peacock is performing well, I believe it’s going to be held back by the slate of content it’ll lose once this spinout is complete.

Comcast is in a very tough position by deciding to execute this spinoff. While I think it’s likely necessary for the cable company to try to focus on their core business (remaining cable revenues and their streaming service), I don’t think the company’s in a very good position. Their net debt to EBITDA is reasonable for now, but EBITDA is declining (just as recent as this last quarter).

Comcast faces threats on the cable side and internet services side from services Starlink. And on the streaming side of things, these channels that will be spun off will likely create an additional competitor they have to compete with in the streaming space.

I think it’s a lose-lose regardless.

With this, I believe shares are a sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.