Summary:

- Comcast’s shares have gained 20% in the past year due to strong free cash flow generation and capital returns.

- The company’s capital returns are supported by its cash flow generation and have strengthened its balance sheet.

- Comcast’s connectivity and platforms unit is experiencing slow growth, but its wireless business has been successful and provides room for further growth.

- Subtracting our NBCUniversal and Hulu reveals a discounted valuation for its legacy cable and broadband unit.

Justin Sullivan

Shares of Comcast (NASDAQ:CMCSA) have been a solid performer over the past year, gaining about 20% as the company’s strong free cash flow generation and capital returns have more than made up for lackluster results and its core cable and broadband unit. Even after this run, given my sum of the parts analysis, I see ongoing upside and would remain long shares.

Seeking Alpha

In the company’s third quarter, CMCSA earned $1.08, up 13% from last year even with revenue up just 1% to $30.1 billion. Adjusted net income rose 6% to $4.5 billion, but thanks to its ongoing buyback, its share count is down by 5.4% from last year, accounting for nearly half of the EPS gains. So far this year, Comcast has completed $7.8 billion of buybacks, including $3.5 billion last quarter. On top of this, its dividend returns about $4.7 billion of cash to shareholders. These capital returns have been critical to the company’s performance.

Importantly, these capital returns are supported by Comcast’s cash flow generation. Comcast had $4 billion of free cash flow in the third quarter, bringing it to $11.5 billion of free cash flow this year. The total is $13 billion excluding working capital movements. These capital returns are entirely funded out of cash. In fact, even with its capital returns, over the past five years, CMCSA has reduced net debt by $20 billion to $88 billion, reducing net debt to EBITDA from 3.3x to 2.3x. Its average maturity is 17 years with an average rate of 3.6%. All but 3% of its debt is fixed rate. This activity has strengthened its balance sheet and left CMCSA extremely well-positioned for a period of higher interest rates.

Comcast operates two primary units. Its traditional cable, broadband, and wireless business (called Connectivity and Platforms) accounts for 65% of revenue and 83% of EBITDA with NBCUniversal the remainder. Alongside this, Comcast of course has a stake in Hulu. While this has generated substantial press coverage, I actually do not think it is likely to be that material of a driver of CMCSA’s share price. I think the best way to value Comcast is to look at its discrete units and derive a holistic valuation.

In connectivity and platforms, revenue rose by 0.2% to $20.3 billion last quarter while EBITDA rose by 2.6% to $8.2 billion thanks to a 100bp expansion in margins to 40.6%. Growth is extremely slow, but CMCSA is pushing price hard to maximize the value of each sale. Within residential, revenue was up 7.5% thanks to a 4% increase in broadband and 16% increase in wireless. CMCSA’s resale wireless business, where it essentially rents space on wireless networks from the likes of Verizon (VZ) and AT&T (T), and bundles this with its existing wirelines offerings has been quite successful. Last quarter, it added 249k lines, and 10% of broadband customers now have wireless. That provides substantial scope for further growth.

More disappointingly, domestic residential customers declined by 39,000 with a 17,000 drop in broadband. Given the centrality of internet to daily life, I would like to see broadband stable or even growing slightly. Despite the drop in customers, revenue is rising as broadband pricing rose by 4%. Domestic video fell by 490k, a modest improvement from last year’s 561k. Video revenue fell by 4.5% even with customers down by 12.7%, again thanks to pricing. Programming expense fell by just 0.1%.

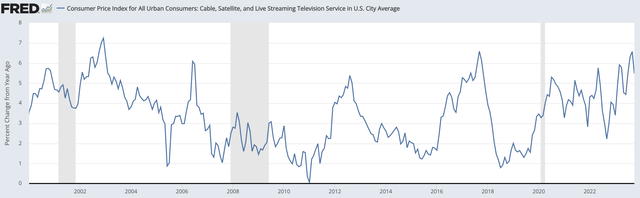

Comcast is essentially trying to push the pricing lever as hard as possible to protect revenue and EBITDA. The challenge becomes whether these pricing increases are leading to faster subscriber losses. Balancing this is difficult, and there is likely to be a discounted valuation for this business, given the concern that pricing cannot continue to offset customer losses, though at some point programming costs may finally come under more pressure.

In fact, cable inflation is actually running about as high as it has in the past 25 years. It is not usual to see a business that is steadily losing customers raise prices at an elevated rate. The industry is making the decision that cord-cutters will keep cutting, even if prices are a little cheaper. As such, they are trying to get every dollar possible out of those customers (many being sports fans) who are dedicated to keeping linear television. Just given the dynamics here, I do think pricing momentum is likely to slow.

St. Louis Federal Reserve

On the brighter side, business customers rose by 5,000. Business saw 5% revenue growth and 3.6% EBITDA growth. Comcast’s cable and broadband business is highly cash flow generative, but there is no topline growth. The debate is over whether it can sustain these margins and be a low-growth EBITDA business, or do we eventually see pricing erosion, making this a slowly melting ice cube, which will impact the fair multiple on its earnings. We will discuss this further below.

Content revenue rose by 1% to $10.6 billion, but EBITDA gained 10%. The theme parks are doing extremely well, with revenue jumping 17% as its Beijing park hit a record. As with Disney (DIS), the parks have proven to be a fantastic business. Studio revenue fell by nearly a quarter as last year it had Jurassic World. Quarterly earnings from this business are volatile, but Universal has had a solid year with films like Megan and Five Nights at Freddy’s. Next year, it will also be distributing an Apple Films release, Argylle. These are all consistent with the company’s relative budget restraint. For the year, studio’s EBITDA should be about $1.2 billion. Media revenue was flat at $6 billion, but EBTIDA gained 6%. Linear networks are struggling, but Peacock’s revenue rose 64% to $830 million.

Finally, at some point over the next year, Comcast will receive proceeds from its 33% stake in Hulu. It is guaranteed to receive a minimum $8.6 billion based on the minimum $27.5 billion valuation, less its outstanding equity contributions. The process is somewhat unusual. Morgan Stanley (MS) and JPMorgan (JPM) will each value it. If their valuations are within 10%, an average is used. If they are further apart, a third bank will be assigned to value Hulu. That valuation and the valuation it is closest to will be averaged. Based on Netflix’s (NFLX) valuation, CMCSA’s stake would be worth $13 billion. That is likely to be above what Hulu is valued at, given Netflix’s dominant industry position. I would view $9-11 billion as the likeliest outcome.

Hulu is being carried at $5.2 billion, and there is a $5.2 billion collateralized term loan against it, due at the earliest of March 2024 or the receipt of payment for its Hulu stake. This is aside from CMCSA’s stand-alone $88 billion of net debt. So after taxes on its gain above carrying value and paying off this debt, Hulu is likely to net CMCSA $4-6 billion. That variance is just about 1% of the company’s market value. Obviously, the higher the price the better, but this will only move CMCSA’s share price modestly.

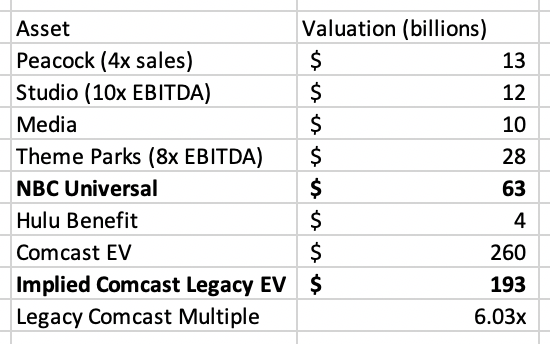

Given all of this, I first value all of CMCSA’s non-cable units to determine what the market is valuing the core business at.

First, I value Peacock at 4x its Q3 revenue run rate. This is a 20% discount to where Netflix trades, recognizing its much smaller size. That still yields a $13 billion valuation. Given its strong mix of franchises and steady performance, I value the studio at 10x EBITDA. Parks are more capital-intensive and subject to economic cyclicity, resulting in an 8x multiple. The linear networks are more difficult. They still generate over $3 billion in EBITDA, but there is tremendous pessimism over their future. As noted above, video subscribers are down double digits. There were reports Disney received a $10 billion bid for its linear assets. I assigned the same value here, which may be conservative, and is just 3x EBITDA. While one can quibble over each unit, the overall value of $63 billion for NBCUniversal is reasonable, in my view.

my own calculation

If we add to this a net $4 billion after the term loan for Hulu, there is $67 billion of value. Given its $260 billion enterprise value, with $32 billion in EBITDA, CMCSA’s connectivity unit is being valued at 6x EBITDA, a fairly depressed multiple.

Over the past year, Verizon (VZ) has generated $48 billion of EBITDA. It has a ~$305 billion EV, for an EV/EBITDA multiple of 6.4x. That would imply $10 billion of further value for CMCSA or 6% upside to shares. I actually view CMCSA’s business as somewhat superior to Verizon’s, as its wireless unit is adding competition to VZ. Broadband also tends to have fewer competitors, though in the very long term, it could face more competition from wireless providers.

Charter (CHTR) has $21.2 billion of EBITDA with $164 billion of enterprise value for a 7.7x multiple. At that multiple, CMCSA would be worth 32% more than where it currently trades. Of the two major cable companies, Comcast clearly looks more attractive.

Comcast overall has a 9% free cash flow yield with about $4.30 in go-forward earnings power, aided in part by continued share count reduction. Those high-level metrics alone strike me as attractive. Drilling deeper, even if EBITDA is just flat at the connectivity unit, CMCSA is a compelling opportunity with that unit at 6x EBITDA.

While I do not see shares rising a full third, I would prefer CMCSA to CHTR. Given its record of debt reduction and business diversification, I view it attractive to VZ at these levels. I see shares rising to about $50, or 7x EBITDA in its connectivity unit, closing half of the valuation gap with CHTR over the next year. With a 2.7% yield and 5% share count reduction per year, CMCSA is attractive for long-term value investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.