Summary:

- While Comcast’s revenue is better mixed than it used to be, 76% of EBITDA still comes from Cable Communications, a blessing and a curse.

- The company is (wrongly) focused on Peacock, which has led to accumulated losses of over $5 billion and an additional $3 billion of EBITDA losses projected for 2023.

- Despite its attractive valuation and strong cash generation, concerns over management’s focus and strategy lead to a ‘Hold’ rating for Comcast.

Cindy Ord

The Businesses of Comcast

If you still think of Comcast (NASDAQ:CMCSA) as just a cable TV provider which is being threatened by “cord cutters” and tech-savvy millennials, it’s time for an updated perspective. Comcast’s revenue comes from 3 broad segments (which I’ll cover in more detail below):

- Cable Communications

- NBCUniversal

- Sky

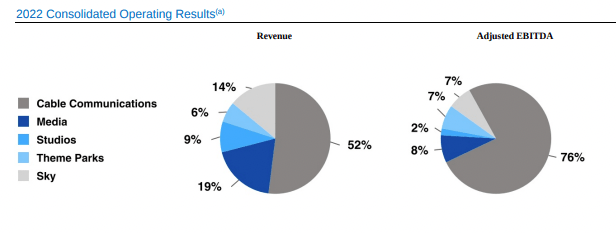

2022 Annual Report

These 3 segments generated ~$121.4 billion in revenue in FY22. As you can see in the image below, revenue is moderately split across these 3 segments. EBITDA, however, is still highly concentrated in Comcast’s legacy business. This is both a problem and an opportunity.

1. Cable Communications

Cable Communications is Comcast’s broadband, video, voice, wireless, and other services offered to individual customers and businesses through the Xfinity brand. This segment was responsible for ~95% of revenue in 2010 (~$35.8 billion of ~$37.9 billion). In FY22, Cable Communications generated ~$66.3 billion in revenue, just ~52% of total revenue.

While the revenue mix is better diversified now than it was 15 years ago, a significant portion of Comcast’s value remains in its legacy products (which still make up > 75% of EBITDA). I understand management wanting to diversify, but the company’s best opportunities lie in this segment. Unfortunately for shareholders, management’s focus is elsewhere (more on this below).

2. NBCUniversal (NBCU)

NBCU is where the vast majority of management’s and investors’ attention has been in recent years. NBCU itself divided into 3 sub-segments:

- Media – Television broadcast networks like NBC and Telemundo and its streaming platform Peacock.

- Studios – Film and television studio production and distribution (primarily licensing).

- Theme Parks – Universal theme parks in Orlando, Hollywood, Osaka, and Beijing.

(That combination looks remarkably similar to Disney’s, which I find noteworthy.) In FY22, NBCU generated ~$39.2 billion in revenue (up 14.2% YoY), ~34% of total revenue. Despite making up more than a third of revenue, this division brought in just ~17% of EBITDA. The revenue and EBITDA split looks like:

- Media revenue increased 2.7% YoY to $23.4 billion and EBITDA decreased 29.7% YoY to $3.2 billion.

- Studios revenue increased 23% YoY to $11.6 billion and EBITDA increased 6.6% to $942 million.

- Theme Parks revenue increased 49.3% YoY to $7.5 billion and EBITDA more than doubled to $2.7 billion.

As a potential investor, I’m generally happy with this segment, though I believe there is nothing but accumulated losses ahead for Peacock. Unfortunately for current investors, management is all too happy to accumulate those losses as fast as possible.

3. Sky

Sky is a European entertainment company offering video, broadband, voice, wireless phone services, and the Sky News and Sky Sports networks. Revenue decreased 11.5% YoY in FY22 to $17.9 billion, while EBITDA increased 7% YoY to $2.5 billion.

The Problem with Comcast

Comcast needs a market to focus on. From my perspective, management’s current “strategy” seems aimless. Based on business performance, marketing spend, and recent earnings calls, the team has all but announced they have no idea where future growth will come from (besides Peacock, which I’ll address further below).

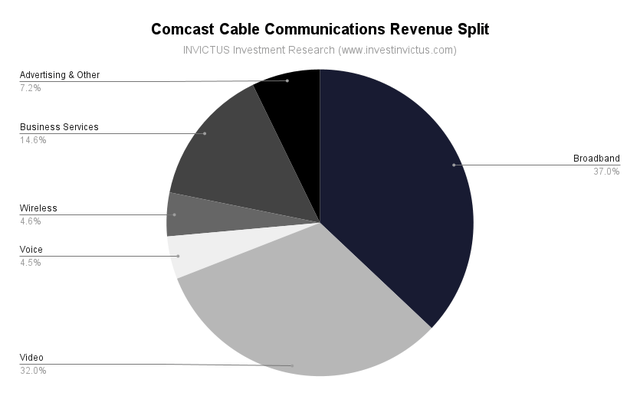

As highlighted above, Cable Communications is generating ~76% of the company’s EBITDA. The revenue split in this segment looks like this:

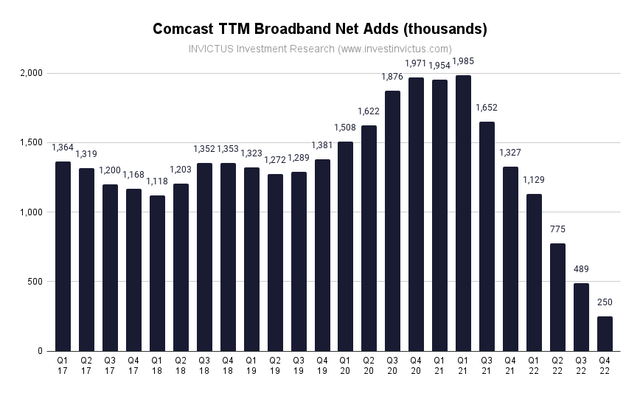

As I look at the above, 3 areas stand out to me: Broadband, Wireless, and Business Services. (Video and Voice are dying industries, and while they’re still generating meaningful revenue, I think management is right in not pursuing large investments in these areas.) Of the remaining 3, Broadband represents the biggest source of revenue, though net adds are decreasing at a worrisome rate:

In Q1 2023, Comcast reported just 5,000 net adds in Broadband, an annualized pace of 20,000. At this rate, net adds in Broadband will be negative by the end of 2023. Yes, Wireless is picking up some of the slack, but Wireless’s current growth and size is leaving plenty of room for competitors like Charter Communications (CHTR) to steal market share. Put another way, customers are not switching from Comcast’s Broadband to Wireless segments at a 1:1 ratio.

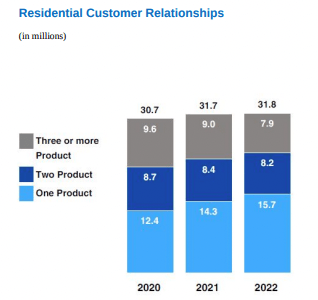

I’m not surprised, given Comcast’s poor customer reviews and user experience. While Comcast used to operate as an oligopoly, the future looks increasingly competitive, and it has a lot of damage to undo if it wants to retain customers and have them choose Comcast over its competitors. The current trend is anything but favorable as customers continue to exit the Comcast ecosystem:

2022 Annual Report

Comcast management doesn’t seem to be overly concerned about growing Broadband or Wireless, with Comcast President Mike Cavanagh saying on the Q1 call:

While we had some success towards the end of the first quarter with a couple of offers targeting the lower end of the market, the broadband environment remains highly competitive… Our view remains that 2023 will be a challenging period to add subs. Our outlook for growth and our strategy has been consistent: we will compete aggressively, but in a financially disciplined way. While we expect to return to growth in broadband subscribers over time, during this interim period, as well as over the longer term, we will focus on protecting and growing broadband ARPU.” – Mike Cavanagh, President

Couple that with declining Marketing & Promo expenses and Comcast’s lack of intention in this segment becomes even more apparent. Yes, a case can be made for it trying to grow profitably, but if it had a clear channel for acquiring connectivity customers and turning them into sustainable revenue I believe the investments would be made. For instance, Charter Communications CEO Chris Winfrey said this on Charter’s Q1 call:

Ultimately, we’re focused on everything a customer would want us to do – investing in the network to offer even faster speeds, providing seamless connectivity products not available elsewhere, then bringing that same seamless connectivity to markets that have never had broadband before, and delivering better customer service… while helping save customers significant money… Our intent is to grow, to continue down the path we’re on…” – Chris Winfrey, CEO

As a potential investor, the difference in how Comcast’s management talked about the same opportunity is troubling. Comcast is acting passively and doesn’t seem sure of its path forward. Charter does. It’s also worth mentioning: Comcast’s balance sheet is stronger than Charter’s and is generating double the free cash flow.

The only area where Comcast seems committed is with Peacock. Unfortunately for shareholders, this bet has accumulated losses of over $5 billion. The company is projecting an additional $3 billion of EBITDA losses in 2023 alone. As those numbers indicate, management is currently hellbent on trying to compete in streaming.

As is the case with all of the struggling streamers, Peacock needs to get much larger (and much better) to have any chance at competing in global DTC streaming. I do not think this is a war Comcast should fight. In my opinion, Netflix (NFLX) and maybe Disney (DIS) and Apple (AAPL) are the only companies with any chance at having their own profitable streaming platforms. It’s becoming extremely clear consumers are unwilling to pay for more than a few streaming services. Those that don’t make the cut (as I expect will be the case for Peacock) should go back to licensing. I believe, directly in opposition to management, Comcast should be giving up on Peacock today. Instead, management seems focused on building an empire to rival Disney’s, not maximizing per share value.

Valuation

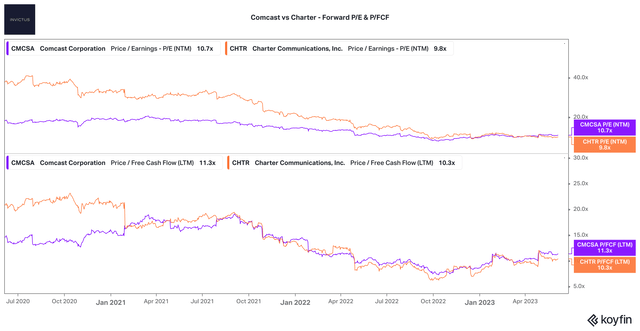

For now, the underlying business itself is doing just fine. In FY22, Adjusted EPS rose 12.7% YoY to $3.64 and Adjusted EBITDA reached $36.5 billion (up 5% YoY). Free Cash Flow also reached $12.6 billion, or $2.80 per share. Based on these numbers alone, I’ll admit Comcast looks quite cheap:

You’ll find similar metrics for Charter Communications. Both companies are trading at significant discounts to the market, despite strong EPS and FCF numbers. Here’s how Comcast is trading relative to Charter:

I’ll admit, I like Comcast quite a bit at these prices. Its opportunity in the connectivity industry is hard to ignore, and I don’t think it’s too far off from finding robust growth in this area. Unfortunately, its focus (and money) is elsewhere, and I can’t overlook my disappointment in its management team, despite its exceptional valuation. At these prices, most of the risk is priced in, but I’m far from convinced Comcast is ready to walk back up the plank, turn the rudder, and stop its self-inflicted slow bleed. Per my investment philosophy, I have to pass until Comcast shows it’s a truly high-quality business.

Conclusion

While I’m tempted to mark Comcast as ‘Sell’, I find that imprudent given its valuation and substantial businesses. While I am not sure where the growth will come from, the reality is Comcast generated ~$26.3 billion in cash from operations in FY22, giving it plenty of ammunition. Plus, Xfinity alone serves more than 30 million residences and over 2 million businesses. It has the reach.

For now, I’m giving Comcast a ‘Hold’ rating and acknowledge it has plenty of room to surprise to the upside. The question is if management decides to throw out Disney’s playbook and create its own – hopefully one focused on shareholder returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.