Summary:

- Comcast’s Q1 earnings beat expectations, with non-GAAP EPS of $1.04 and revenue of $30.1 billion.

- The company saw growth in broadband revenue, wireless subscribers, and revenue from its streaming service, Peacock.

- Despite the positive results, Comcast’s stock price fell due to concerns about declining cable subscribers and an adjusted EBITDA loss for Peacock.

Justin Horrocks/E+ via Getty Images

Comcast (NASDAQ:CMCSA) provided Q1 earnings this week. Despite beating on the top and bottom line, the share price fell 6% in one day, resulting in the lowest close since April 26, 2023.

The stock is now down over 10% this month and has fallen nearly 14% in 2024.

Bears have long pointed to the rapid decline in the cable and media businesses as an inexorable headwind that will derail the company. Furthermore, some point to developments highlighted in this quarter’s results as proof that management’s growth initiatives are failing to mitigate the loss in cable subscribers.

However, I contend that there are multiple positives to be found in this earnings season, as well as in overall trends.

Q1 Earnings

Comcast reported Q1 2024 results on the 25th of April.

Non-GAAP EPS of $1.04 beat analysts’ estimates by $0.05 and was up from the comparable quarter by $0.12.

Revenue of $30.1 billion beat consensus by $300 million and increased by $400 million from Q1 of 2023.

Free cash flow for the quarter was up nearly 20%, to $4.5 billion.

Average revenue per user (ARPU) for broadband increased by over 4%, resulting in mid-single digit growth in residential broadband revenue to over $6.5 billion.

Residential connectivity revenue increased by 7%, with 4% growth in domestic broadband, 13% growth in domestic wireless and 19% growth in international connectivity.

Business services connectivity revenue grew 5%.

However, revenue for total connectivity in platforms was flat at $20.3 billion.

The number of wireless subscribers increased by 21%, to 6.9 million customers, and wireless revenue was up 13%.

The company reported robust growth from Peacock, with revenue surging by 54% to $1.1 billion year over year and subscribers hitting 34 million, a 55% increase.

Why The Stock Plummeted

Yes, Comcast beat on the top and bottom line; however, revenue only increased by roughly 1% year over year, and net income grew by less than 1%.

Plus, the company reported an adjusted EBITDA loss of $639 million for Peacock. Add to that a 65,000 loss in domestic broadband customers and 487,000 domestic video customers for the quarter.

While a large drop in video subs was expected, that doesn’t diminish the headwind it creates. And management has long pointed to domestic broadband as a growth engine that can counter the cable losses.

What Many Bears Are Missing

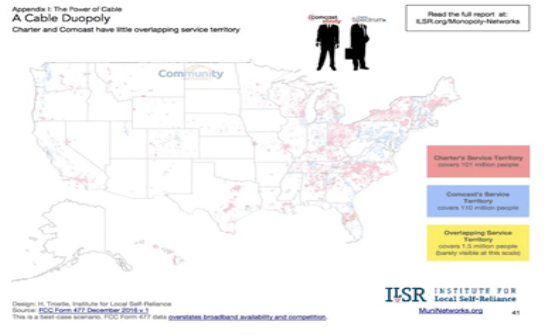

Comcast and Charter (CHTR) are a duopoly that serve 200 million people in the US, with less than 1% of those having access to the services of both companies.

Comcast is also the only broadband provider to thirty million customers in the United States.

ILSR

According to the Institute For Local Self-Reliance, this duopoly results in Comcast and Charter having “an absolute monopoly” over 47 million people. Furthermore, unless they opt for a much slower and less reliable provider, 33 million people in the US have no option besides Comcast or Charter.

A report released by Ookla early this year rated Comcast’s Xfinity as the fastest broadband service. Recent tests of internet speeds also showed downloads are more than two-and-a-half times faster for broadband as opposed to wireless, and broadband upload speeds versus wireless are even greater.

This is of particular importance for video gamers who have a strong preference for the fastest service provider.

Over 85% of Comcast’s customers receive 100 megabits/second service. In contrast, the three major telecom providers’ speeds rarely top 20 megabits/second.

In order to compete against Comcast, AT&T (T), T-Mobile (TMUS), and Verizon (VZ) would have to invest enormous capex to upgrade their systems. Considering that each of those companies have heavy debt loads, I would argue that that is an unlikely scenario.

Furthermore, Comcast is currently investing in DOCSIS 4.0. to upgrade its broadband offerings. DOCSIS 4.0 provides downstream capacity of 10 Gbps but boosts upstream capacity to 6 Gbps. That represents a major improvement over DOCSIS 3.1, which provides a maximum downstream capacity of 10 Gbps and a maximum upstream capacity of 1-2 Gbps.

Comcast expects DOCSIS 4.0 to be available to 50 million customers by the end of 2025. DOCSIS 4.0 should serve to not only keep competitors at bay while also driving ARPU growth.

Debt, Dividend, And Valuation

Comcast’s credit is rated A- with a stable outlook. The weighted average cost of the company’s debt is 3.6%, and the average life of Comcast’s debt is 16 years.

CMCSA has a yield of 3.08%, a payout ratio a bit above 29%, and a 5-year dividend growth rate of 8.63%, indicating the dividend is safe and likely to grow for the foreseeable future.

The stock trades for $37.92 a share. Analysts’ average one year price target is$49.94. CMCSA is rated as a strong buy by 12 analysts, 4 rate the stock as a buy, and the remainder have a hold rating.

CMCSA has a forward P/E of 10.23x, well below the stock’s average P/E over the last 5 years of 14.23x.

The current 5-year PEG of 0.66x is also well below the 5-year average PEG of 1.24x for CMCSA.

The company repurchased $13 billion of its stock in 2022, $11 billion in 2023, and $2.4 billion this quarter. Share buybacks reduced Comcast’s share count by nearly 6% in FY 2024 and by over 15% since 2021.

Is CMCSA A Buy, Sell, Or Hold?

I’ll readily admit that the loss of cable subs is a major headwind. Additionally, while the Peacock streaming service may (may) provide an additional revenue stream, that is far from a foregone conclusion. In the meantime, Peacock is a money eating machine.

I’ll add that I can’t see broadband providing much growth. That being said, I believe Comcasts has a very solid moat in that arena, one that is likely to prevail for the foreseeable future.

Now let me provide reasons why I am adding to my position in CMCSA.

Since 2018, Comcast’s adjusted EPS is up over 50% while free cash flow per share has increased by nearly 25%.

Comcast reported $4.5 billion in free cash flow this quarter, up from $3.8 billion a year ago. The company’s robust FCF has been put to good use: since 2021, stock buybacks have lowered the share count by over 15%.

Management has emphasized that Hulu proceeds will be used to accelerate the share repurchase program.

With net debt at 2.3 times EBITDA, Comcast has a firm financial foundation.

In FY 2023, Comcast posted a record-breaking year in theme parks, with $3.3 billion in adjusted EBITDA, up 25%, and a 19% surge in revenue.

Comcast’s new park, Universal Epic Universe, is scheduled to open in Orlando in 2025..

Comcast had the #1 studio by worldwide box office in 2023, with The Super Mario Brothers, Fast X, and Oppenheimer among three of the top-five movies for the year.

As noted above, CMCSA is the #1 broadband provider in the U.S., as well as the #2 broadband provider in the U.K.

SKY, which provides broadband and wireless services in the U.K. and broadband service in Italy, reported a 23% increase in revenue in 2023.

Last but far from least, I view the stock as trading at a valuation that provides a significant margin of safety.

Weighing all of these factors, I rate CMCSA as a BUY.

I have a moderate sized position in the stock which I added to following the earnings report.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMCSA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have no formal training in investing. All articles are my personal perspective on a given prospective investment and should not be considered as investment advice. Due diligence should be exercised and readers should engage in additional research and analysis before making their own investment decision. All relevant risks are not covered in this article. Although I endeavor to provide accurate data, there is a possibility that I inadvertently relay inaccurate or outdated information. Readers should consider their own unique investment profile and consider seeking advice from an investment professional before making an investment decision.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.