Summary:

- Not all of the tech is in a bubble: Meta Platforms continue to look compelling.

- The most recent quarter saw the company post 22.1% YoY revenue growth and a 50.4% GAAP operating margin in Family of Apps.

- The stock looks cheap here, but the current valuation is already inclusive of Reality Labs’ losses, making up over 30% of net income.

- Meta Platforms continues to look like a top pick in a choppy market.

Anna Moneymaker/Getty Images News

I am growing increasingly convinced that Meta Platforms (NASDAQ:META) is undisputedly the top pick among mega-cap tech. The company might not be growing the fastest or trading at the lowest valuation, but may very well be the dark horse in the generative AI race. Looking under the hood shows that the stock might be even cheaper than it looks when adjusting for Reality Labs losses. I expect the stock to re-rate higher over the long term as the market shows greater appreciation to not only the growing network effects of Facebook and Instagram, but also the growing dominance in online advertising afforded by the company’s heavy investment in artificial intelligence. I reiterate my strong buy rating on the stock.

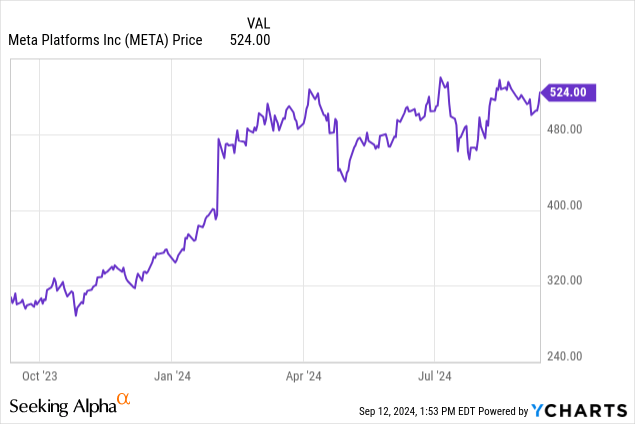

META Stock Price

I last covered META in May, where I stood by the stock in spite of Wall Street’s then-skepticism surrounding the company’s aggressive investment in CapEx spending, which had sent the stock plunging after first quarter results. The stock has jumped nearly double-digits since then.

With markets near all-time highs, it can be tempting to disregard META as just another over-crowded trade, but to me, it looks more like a diamond in broad daylight.

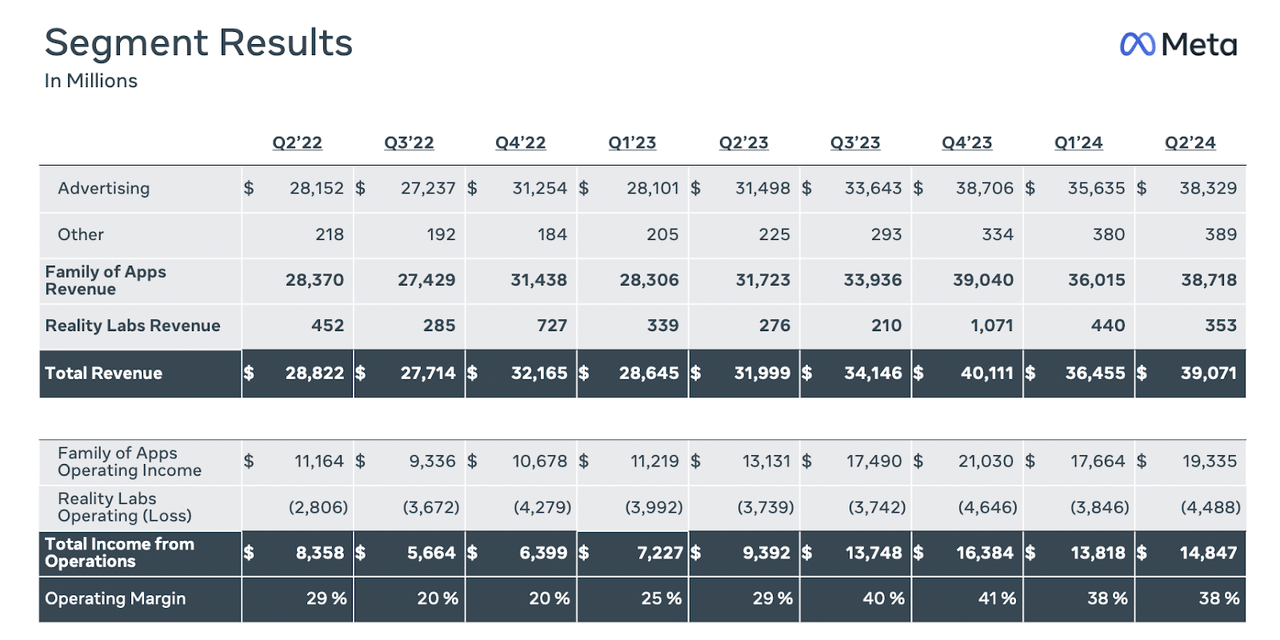

META Stock Key Metrics

META’s second quarter results confirmed the new reality: this is a company that has found a balance between above-market revenue growth and committed profitability gains. META saw revenues grow 22.1% YoY to $39.1 billion, exceeding the high end of the guidance range of between $36.5 billion and $39 billion. The Family of Apps (‘FoA’) business notably generated a 50.4% GAAP operating margin, up from 41.6% a year prior. Inclusive of $4.5 billion in Reality Labs’ operating losses, the company posted a 38% consolidated operating margin. In spite of the heavy investment in the metaverse, the company remains one of the most profitable companies in the tech sector and the market overall.

2024 Q2 Presentation

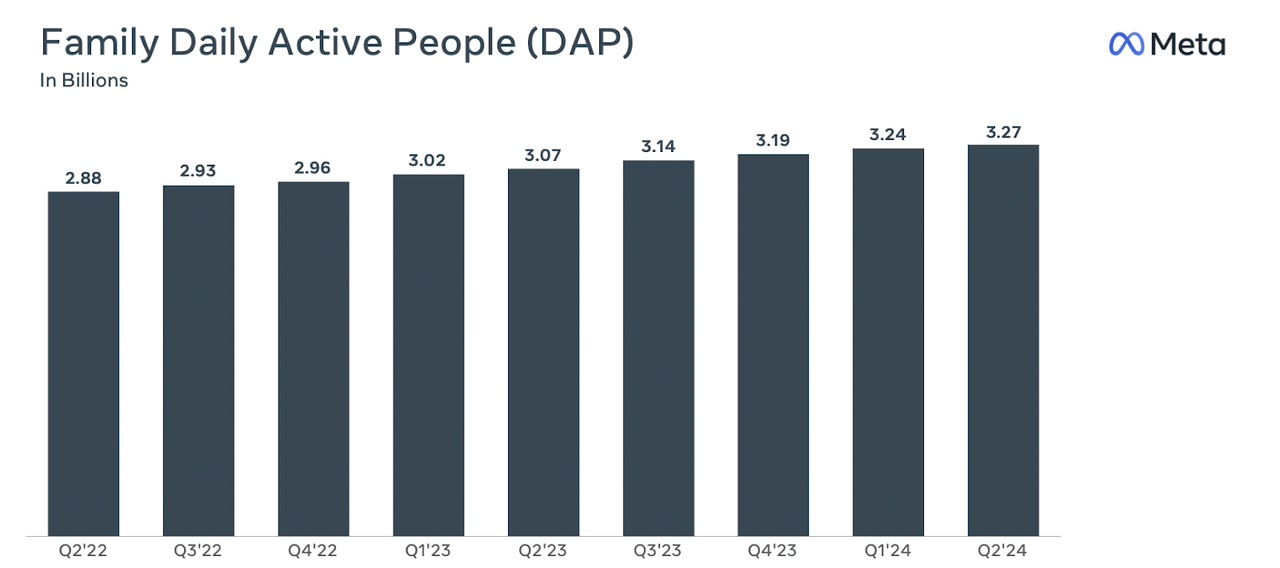

META saw its daily active people number tick slightly higher at 3.27 billion. With Facebook having crossed its 20th anniversary this year, investors should focus less on the modest user growth and more on the company’s ability to continue building upon its vast social networks even at this large scale.

2024 Q2 Presentation

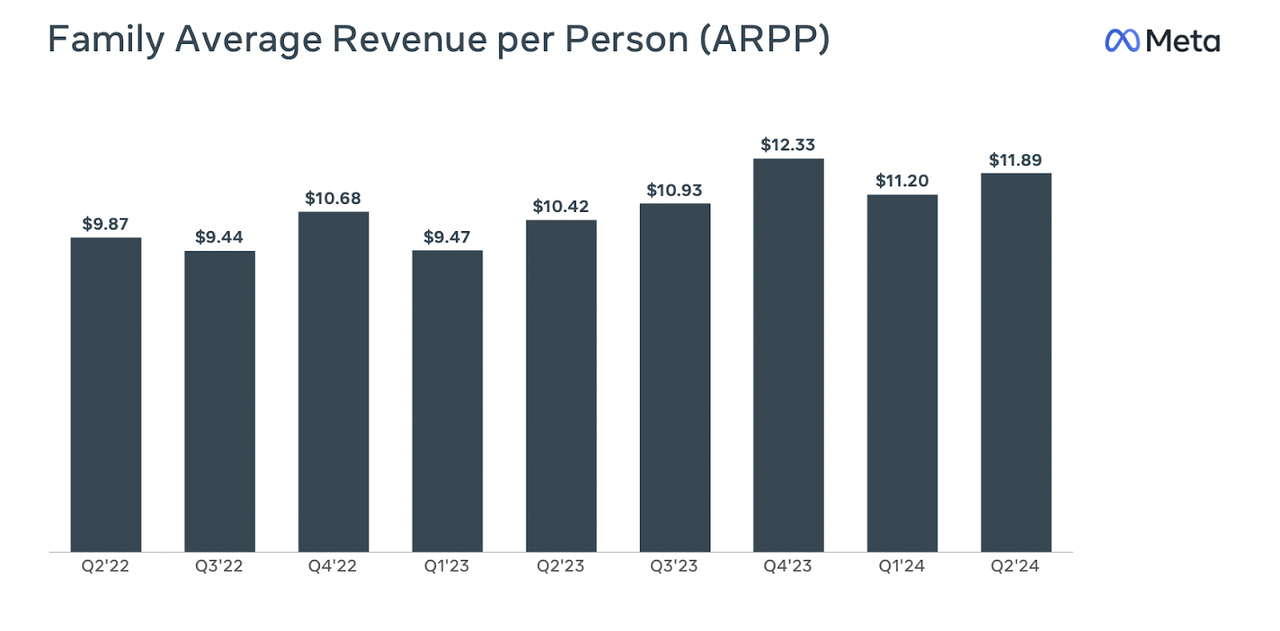

Instead, the bulk of revenue growth was driven by gains in average revenue per person, which grew 14.1% YoY.

2024 Q2 Presentation

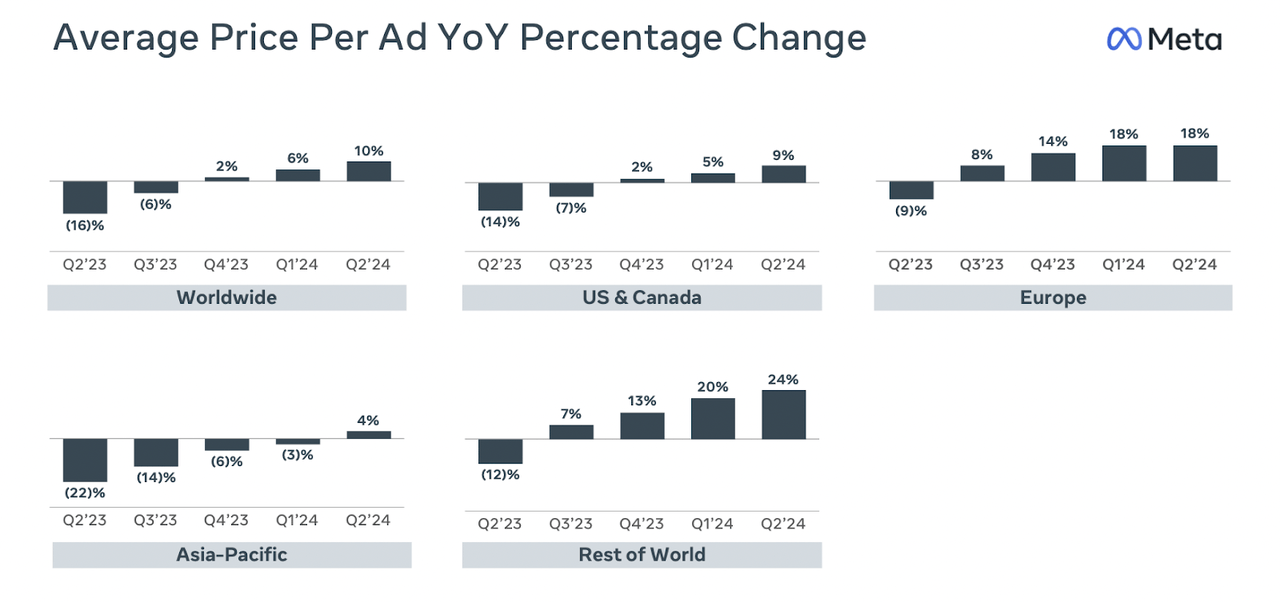

The company has impressively been able to sustain 10% YoY growth in ad impressions delivered, as well as a 10% jump in price per ad. As seen in the numbers, the company’s efforts to use artificial intelligence to power its content feeds makes it one of the biggest AI winners – despite the stock seemingly often being left out from discussions of top AI stocks.

2024 Q2 Presentation

META ended the quarter with $58 billion of cash versus $18.4 billion of debt, representing a bulletproof net cash balance sheet. The strong balance sheet and profit margins allowed the company to repurchase $6.3 billion in stock and pay out $1.3 billion in dividends, which was still lower than the $10.9 billion in free cash flow.

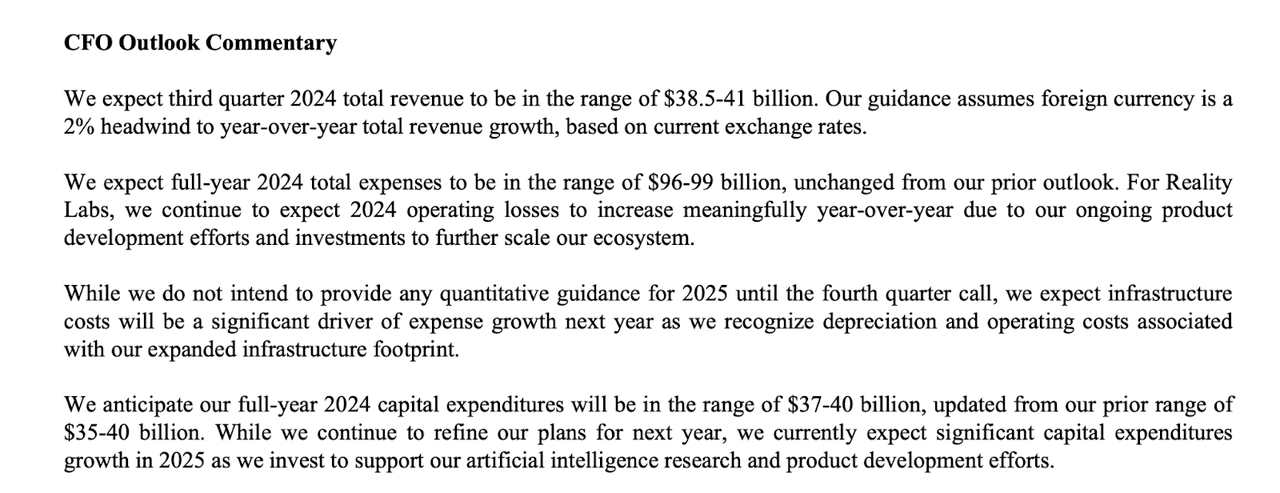

Looking ahead, management has guided for the third quarter to see up to $41 billion in revenue, implying growth of 20% YoY at the high end. That is an impressive guide given that the third quarter of 2023 was widely viewed to see comparables get much tougher as the company had seen growth slowdown mightily in 2022. Management raised the low end of 2024 CapEx from $35 billion to $37 billion and continued to outline expectations for even higher investments in 2025.

2024 Q2 Press Release

It took some time, but I think that Wall Street is becoming increasingly comfortable with the idea that META is a real artificial intelligence play. On the conference call, management outlined expectations for a future in which advertisers can just provide a “business objective and a budget” and they will be able to do the rest for them. I have already been impressed by the work that this company has done to use AI to power their content feed generation, but it is possible that even I have not been optimistic enough. Just 2 to 3 years ago, the market was concerned about META’s long-term relevancy, as the platform appeared to be challenged by both competition (TikTok) as well as technological constraints (data privacy changes by Apple). The company’s heavy investment in artificial intelligence to power their content feed generation has clearly helped it overcome these obstacles, but also creates a new paradigm: the strongest social network of the future might be dependent not only on the network itself but also the technology backing it. Social media has historically had the “fad risk” – whereas in the past I might have been concerned about hearing younger generations say that “TikTok is cooler,” I am now of the view that META’s superior technological advances are a moat in itself. As META works towards making it even easier for advertisers to advertise on the platform, we reach this positive feedback loop in which META appears to be the platform that will earn the greatest resources to invest in technological innovation, as well as having the top-tier talent and willingness to make such investments. META is beginning to look very much like Amazon (AMZN) looks in e-commerce through its heavy logistics investment.

But it doesn’t stop there – management is not just patting themselves on the back and declaring success on their AI investments. Management has explicitly noted that generative AI is not yet a meaningful driver of revenue, but that they expect a “solid return” over the long term. This is a situation in which the company has already reaped great benefits from their AI investments but continues to invest aggressively to become a future leader in generative AI – be it through chatbots or the uncertain future.

Is META Stock A Buy, Sell, or Hold?

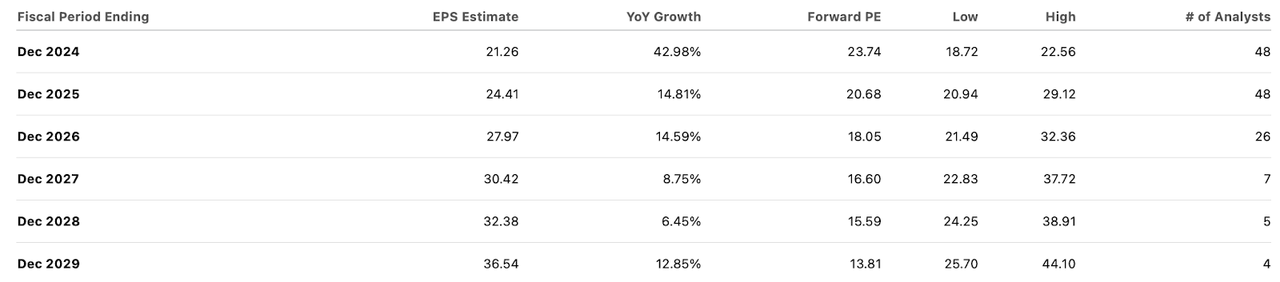

As of recent prices, META was trading at just around 24x earnings.

Seeking Alpha

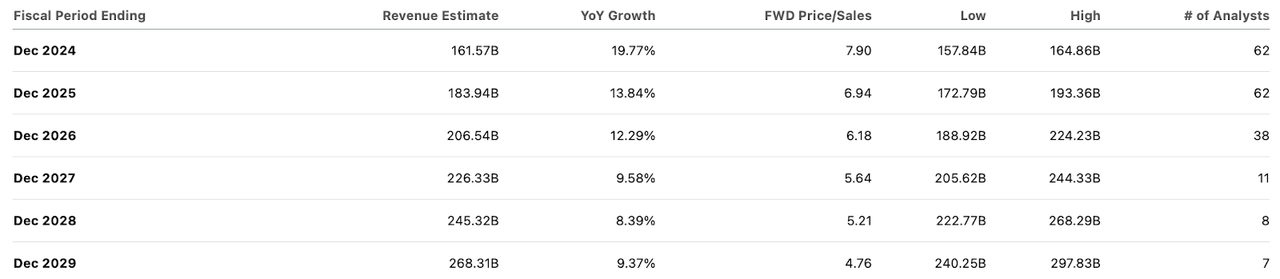

That valuation looks more than reasonable considering consensus estimates for just around double-digit top-line growth moving forward.

Seeking Alpha

I am of the view that META deserves to trade at a 30x earnings multiple, similar to Apple (AAPL) but representing some discount due to the relatively faster growth. That valuation would be justified by the strong net cash balance sheet and dominant market position. But the stock looks quite cheap even without this assumption.

The Reality Labs segment holds back earnings by around 30%. If one values META on a P/E basis, this would be assigning a negative value to that segment. Yet as a new owner of the Meta Ray-Ban Smart Glasses, I am of the view that the market may be drastically underestimating this segment, which has seemingly been often dismissed as just a money-losing pet project. If we instead value the segment at $0, then the stock may be offering at least 30% potential upside to a 24x earnings multiple.

But there may be even more to be optimistic about here. As mentioned earlier, the FoA business has an enviable 50% GAAP operating margin. I see these margins moving higher. If META can execute against its ambitions to allow fully automated ad generation, then it may benefit from both increasing advertising demand as well as higher potential for cost discipline. META stock looks very attractive here with 30% multiple expansion potential on top of 15% annual shareholder return potential (between revenue growth and the earnings yield and, importantly, inclusive of Reality Labs’ losses).

META Stock Risks

TikTok competitive risks have not been taken seriously for quite some time, but may re-emerge in the future. As witnessed in 2022, META has exposure to the macro environment – its secular growth story has matured to the point that secular growth might not always be enough to offset a macro slowdown. I expect the company to remain one of the most profitable companies of any sector even in a market downturn (or perhaps, especially in a market downturn), but the stock may nevertheless experience volatility. It is possible that consensus estimates prove too optimistic – the company, after all, is operating at a $160 billion revenue run-rate. It is possible that regulators enact laws that damage the business, perhaps aiming to reduce screen-time for minors. That might be the most underappreciated risk – META might end up being “the new tobacco.”

META Stock Conclusion

META looks like a definitive winner in the generative AI arms race. The company has already reaped the benefits of AI in its content feed generation, which has helped it to use technological advances to fend off competition. Investors might be concerned about a potential AI bubble, but META stock looks attractively priced for what it is today, while offering compelling upside if the company can continue executing against a generative AI future. Investors might also be underestimating the potential for the Reality Labs segment, which might end up becoming more than just a cash drain on the business. I reiterate my strong buy rating for the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, AMZN, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!