Summary:

- COVID was an existential crisis for Carnival, and one it is only just beginning to recover from.

- The balance sheet is precarious: gross debt of $34bn compares to $5.5bn of pre-pandemic EBITDA, with $5.7bn in committed ship purchases still to pay.

- That said, trends are improving – occupancy is getting better, and so is ship availability. Cruise credits are being utilized, and their elimination will boost future revenue.

- Pricing trends and booking volumes paint to a much stronger 2023, aided by the relaxation of COVID measures.

- That said, there is a tightrope walk to perform given covenants and tail risks. We prefer the 20% bonds with better downside protection.

SeregaSibTravel

It will come as no surprise to anyone that all of the cruise companies have had a dire few years. I remember covering cruise companies pre-COVID, and discussions were always on supply/demand dynamics. The name of the game was figuring out how expected passenger growth would compare to the rate of new ships in the pipeline. Slim percentage swings either way would feed into margin assumptions in coming years, and analysts would read the tea leaves to decide whether there would be a marginal supply deficit or surplus.

In hindsight, those were easy and predictable days. The effective collapse of the industry has seen Carnival (NYSE:CCL) lose about as much in net profit in the last two years as they made in the prior 10. Yet, they live. Impressively, we haven’t seen too much real distress. And recovery is now evident. It seems we are reaching the light at the end of the tunnel.

The obvious questions are: How do we profit from this, and is there enough runway to get to that light?

Permanent scarring

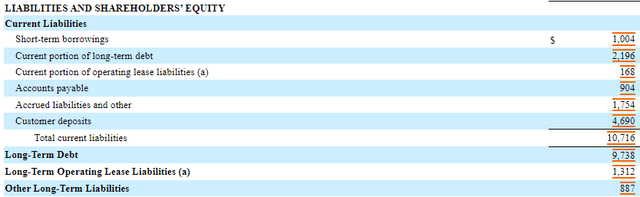

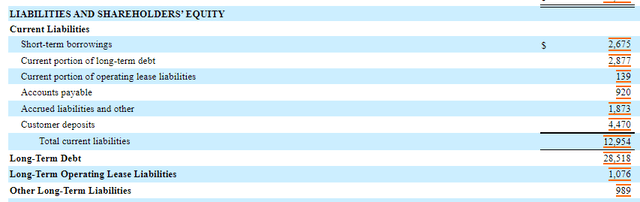

It is not quite as easy as assuming that cruises will recover to pre-COVID and all will be well in the world. The problem, in Carnival’s case, is that their balance sheet is shot to pieces. Cruise companies were always levered – appropriately so, given the capital intensity of the industry. But let’s compare the liability side of the balance sheet pre-COVID (first image below) vs. how it stands today:

You can see there’s $2.2bn more in current liabilities and almost $19bn more in long-term debt. That’s a terrifying number for a business that did ~$5.5bn of peak EBITDA in the good times. For equity holders, there is your visible and significant impairment.

Worse yet, it’s not a given that this new capital structure is even sustainable. Carnival’s unsecured bonds are trading at a yield-to-maturity of over 20%, implying a highly elevated risk of default in the coming few years. If everything goes well – e.g., if the economy does not crash, if COVID does not have another phase, and if global geopolitics don’t degrade to the extent where folks are hesitant to travel – they’ll probably make it through.

That’s a lot of ifs, though.

Recent trading

Let’s flip to the positives: recent forward indicators. Two things stood out for me in the recent earnings call from late September. Both are exceptionally positive:

Pricing for our 2023 book business is currently at considerably higher levels than 2019, adjusting for FCCs.

…we have already seen a very meaningful improvement in booking volumes. We are now running considerably higher than 2019 levels.

I don’t want to oversimplify the business, but frankly these are the only two variables you really need to care about. It’s a fixed-cost business. If you carry more passengers, and those passengers are paying higher rates, you will make more money.

Only a few days ago, we also got Royal Caribbean’s (RCL) take on dynamics. This is an even better insight into how things are developing:

…when those protocols fell off, we immediately saw a significant increase in the volume of bookings. And that volume continued to — just continued and has accelerated.

The successful return of our business to full operations in the accelerating demand environment positions as well to deliver on our expectations of record yields, and record adjusted EBITDA in 2023.

In short – things are hot. There is clearly a significant element of pent-up demand in the system as consumers respond to the removal of COVID measures.

Even without that “catch-up” effect, there’s a strong argument to be very bullish on demand in the medium term. Cruising was growing in the mid-single digits pre-COVID, driven by demographic and other factors. Those underlying drivers likely haven’t been altered by COVID, so in a normal environment, the market might be surprised at just what a new baseline level of demand is.

How to play it?

Let’s say you buy the positive cruise story and want exposure. How do you play it? Well, given the relative valuation of the equity and the unsecured bonds – which yield 20% to maturity, in the 2026 case – we should at least consider an investment in the bonds.

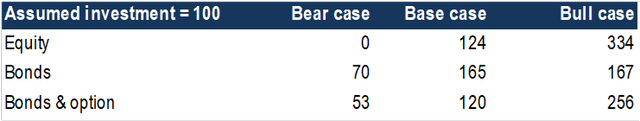

In these sort of situations, I like to construct little payoff comparisons, which might look something like the below:

Potential structures

- Straight investment in the equity

- Purchase of 2026 unsecured bonds

- Purchase of bonds and simultaneous investment in the $20 2025 call option for more upside

Trade timeframe

- Until early 2025 – likely long enough to figure out what post-COVID “normal” looks like

Bear case

There is debt restructuring, equity is wiped out, and unsecured bonds take a haircut.

Base case

Carnival gets back to ~$6bn of EBITDA, above the $5.5bn pre-COVID figure. The market gives Carnival a 7x EV/EBITDA multiple; somewhat lower than the ~8.5x EV/EBITDA historic average, but we are in a lower valuation and higher rate environment than 2018, so we should not be too ambitious. This would equate to $11.12/share.

Bull case

Strong cruise demand and excellent pricing trends drive EBITDA up to $7bn, substantially above pre-COVID levels. The earnings growth rate drives a repricing to the top of Carnival’s historic range, at 10x EV/EBITDA. This would equate to $33.40/share.

Notes

I’ve assumed that in the base case, the bond finishes trading at 100. In the bull case, I’ve assumed 102. These are terminal YTMs of 7.6% and 6%, respectively. In the bear case, clearly I’ve assumed recovery of 70 cents on the dollar for the unsecured debt. Unless it is truly disastrous, given the asset backing here, that seems reasonable.

If I plug the above parameters into a spreadsheet, I get a payoff matrix that looks like the below image:

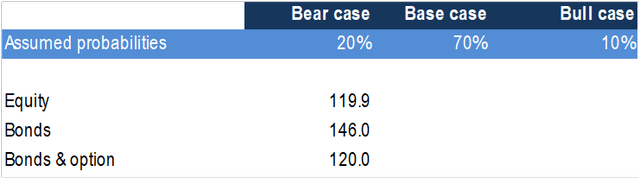

If we then make some assumptions about the likely probabilities of each scenario, we can come up with expected returns for each of the contemplated trades:

You can see that under my assumptions – where I am a little worried about a negative shock pushing the company into a restructuring scenario, and not that optimistic about a really bullish outcome – I have a strong preference for the bonds.

You might have a different view. If I tweak the numbers and give a bigger chance to the bull case, I should prefer the equity. That might be your position. You might think I’m being a little too pessimistic in perceiving a 20% chance of a debt restructuring scenario.

Conclusion

I have a soft spot for the cruise businesses, but Carnival of 2022 isn’t my usual stock setup. Both the balance sheet and the likely cashflows are too uncertain for me to be happy being an equity investor.

If you are, though, I recommend you take a look at your objectives and your risk appetite, and consider the other exposures to the company. Perhaps you’ll find the 20% yielding bonds are plenty juicy enough for you, without taking the full downside risk.

In any case, the exercise will sharpen your thinking and make you consider where the medium opportunity really is.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.