Summary:

- Consumer weakness has become more apparent recently, with the Fed preparing to start cutting rates and McKinsey research revealing that consumers are trading down.

- This trend has been hurting fast-food stocks like McDonald’s, and Starbucks is not immune to it.

- The company faces major short-term headwinds, but it also has the opportunity to turn this into a recovery story in partnership with Elliott Management.

- We need more fundamental proof that this recovery is happening, as I cannot see any other catalyst for the stock. Therefore, SBUX receives a “Hold” rating.

garett_mosher

Introduction

I have been wanting to cover Starbucks (NASDAQ:SBUX) for a long time. I have been following key developments and earnings calls for the last few quarters, and I have to say that I haven’t seen much that excited me. Investors seem to agree, as the stock price has declined nearly 40% since its high in July 2021.

The company announced its Q3 2024 earnings yesterday. Although there are clear issues with the business, the path to recovery seems open. There is an activist investor involved who is having “constructive conversations” with the management.

The short-term outlook is tough, but there is potential in the medium term for sales and margins to recover. The company seems to be venturing into delivery-only kitchens in the US, which, if they receive significant investment, could drive profitability higher.

The outlook is too mixed to make a confident conclusion. The stock appears cheap, but it is tough to identify a catalyst that would make the market buy this name. Therefore, I believe the best course of action is inaction for Starbucks, and we should wait until we get further confirmation of the recovery story. We do not need to catch a potential falling knife.

That is why SBUX receives a “Hold” rating.

Business Description

Starbucks doesn’t require a detailed business description. I am fairly confident that you have had a drink from Starbucks at some point in your life. It sells coffee products. However, some people would say it sells an experience and that is what sets it apart from other coffee shops.

The company calls itself a “roaster, marketer, and retailer of specialty coffee”. It has more than 39,000 stores around the world and is currently the largest coffee brand.

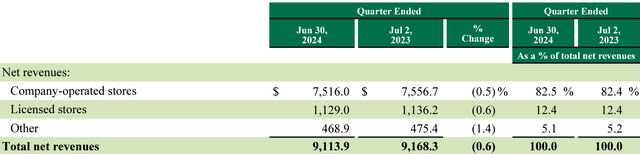

These stores are either operated directly by the company or licensed to others. In Q3 2024, 52% of stores were company-operated and 48% were licensed. However, revenue from company-operated stores accounted for 82% of total revenue in FY23. Additionally, the company states that licensed stores have a lower gross margin. So, there is a significant difference between these two types of stores.

Like many big chains, customers choose Starbucks because they enjoy the experience, and they know what to expect. Coffee is the same regardless of which Starbucks you go to. Therefore, Starbucks benefits not only from its established brand but also from its size. That is why one of the key operating metrics the company talks about is new store openings.

Finally, being a coffee business, Starbucks can sometimes be affected by price fluctuations in commodity markets. However, its size allows it to negotiate the price of quality coffee it buys outside of the commodity market. This way, the company ensures a consistent supply of high-quality coffee and establishes price stability.

Consumer Exposure Remains Risky, But Recovery Is On The Way

I have been talking about the fact that the US consumers are struggling. One way of seeing this is by observing what the Fed is doing. They have the highest-quality economic data. Powell has indicated that the Fed will not cut rates until the economy slows down and inflation is under control. Currently, a significant majority of investors expect the Fed to start cutting rates in September, which implies the economy has slowed down.

We are also observing that the pandemic savings are spent, real wage growth has not been keeping up with inflation, the consumer confidence index is declining, the delinquency rate on consumer loans is up, and the personal saving rate is at its lowest since 2017.

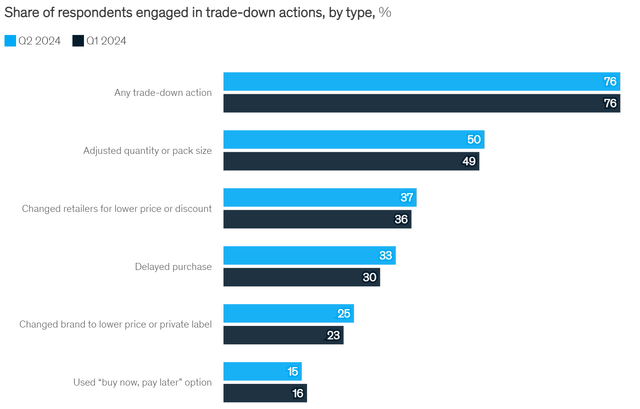

Although these metrics seem unrelated, they are crucial for Starbucks’ business. They indicate consumer weakness. According to a study conducted by McKinsey, consumers are now trading down. They do so by adjusting the quantity, changing retailers for a lower price, delaying purchases, and changing brands for a lower price.

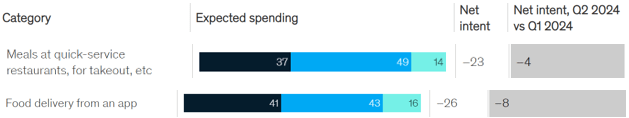

McKinsey also specifically studies what spending the US consumer intends to cut. Net intent (a function of respondents intending to spend more vs less) declined for food delivery from an app, meals at quick-service restaurants, takeout, etc.

McKinsey

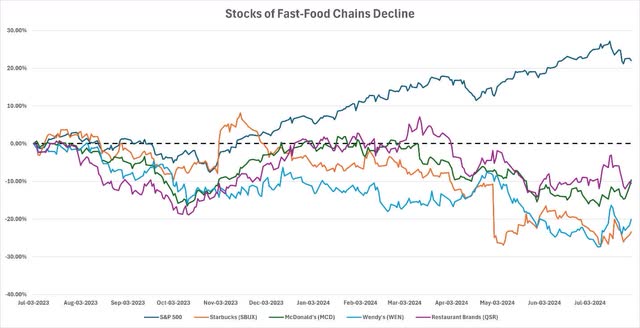

This has been the main reason we have seen stocks of fast-food restaurants like McDonald’s (MCD), Wendy’s (WEN), and Restaurant Brands (QSR) decline significantly. Starbucks joins this list.

There are cheaper alternatives to Starbucks. People can make it at home or go to another coffee shop. It seems difficult for this picture to improve before we see stronger consumers. That is why the metrics mentioned above defining the strength of the US consumer are crucial to track.

Long-Term Drivers Are Intact

Although the company is struggling in the short-term, medium- to long-term drivers appear strong. There are three important trends regarding coffee demand.

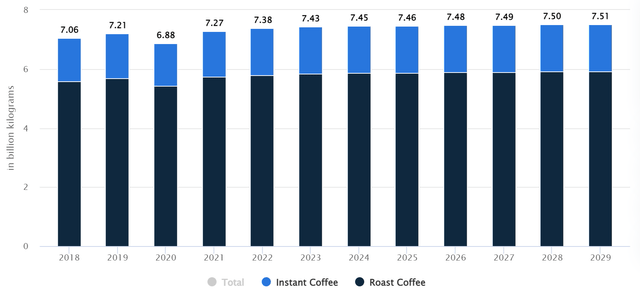

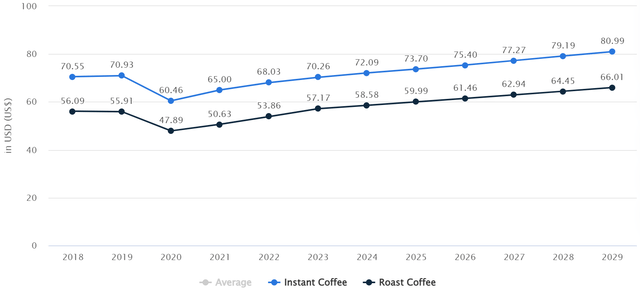

Firstly, the demand for coffee is incredibly stable. The volume produced and bought worldwide has been above 7 billion kilograms since 2018, with the exception of 2020, and it is expected to remain above that level going forward.

In the meantime, the price of coffee increases significantly. Analysts believe it will continue to increase.

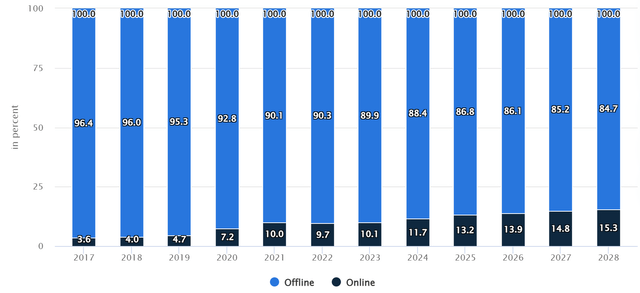

Finally, as more sales are made online, the profitability of retailers and producers rises. In the case of Starbucks, they don’t need to rent or employ as many people when they operate delivery-only kitchens.

As a dominant player in the industry, Starbucks benefits from favorable shifts in demand, price, and sales channels.

In addition, management has confirmed that Elliott Management became a shareholder of the company. If they manage to guide the company through short-term headwinds, this could be the catalyst the market has been waiting for.

Valuation

We will examine the price-to-earnings (“P/E”) multiples the stock trades at to understand if the stock is undervalued or overvalued. The two ways of observing it is by comparing the current multiple to the sector median and by comparing it to the company’s own historical multiples.

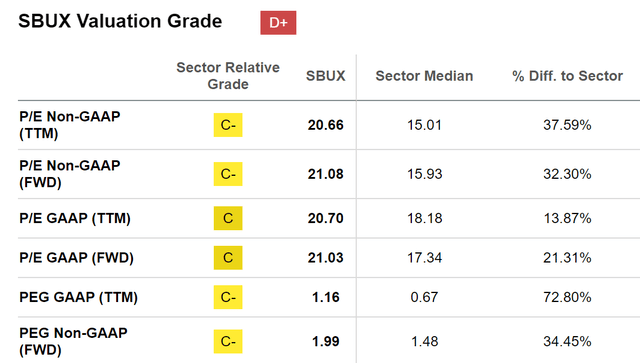

Seeking Alpha’s valuation grades are quite helpful for this. Based on a combination of multiples, Starbucks gets a valuation grade of D+ from Seeking Alpha, implying that the stock is not undervalued.

What I care more about Starbucks is P/E multiples. It seems like Starbucks is trading at a premium compared to the sector median. Being the largest player in the industry, this could be understood.

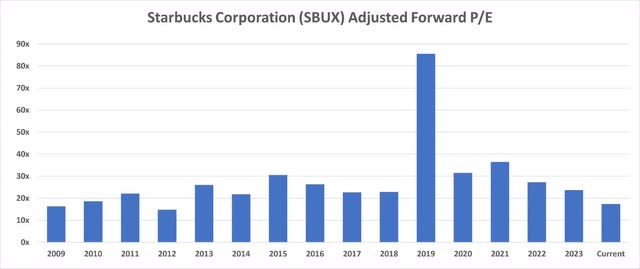

Additionally, a look at historical multiples for the company shows that the stock is trading at a slight discount compared to historical averages.

I believe this is fair. The company faces headwinds it must navigate, and I can understand the market being less optimistic about the future of the business compared to historical levels.

I believe this valuation may provide an opportunity to invest in the company, but the lack of a foreseeable catalyst makes me hesitant for now.

Conclusion

The largest coffee retailer in the world faces short-term headwinds that have pressured the stock. Although the long-term drivers are intact, the US consumer remains weak. This affects Starbucks as well as other fast-food chains.

Even if interest rates start to decline, it will not suddenly lead to a change in consumer sentiment. I expect that we will see them continue to trade down for an extended period of time. This means consumers are buying less from Starbucks.

Although the stock appears undervalued, the market’s concerns seem justified. The company has an opportunity to work with Elliott Management and reignite the business, achieving higher sales and margins. However, we need to see the fundamentals improve to believe in that story. Otherwise, it would be pure speculation.

As a result, Starbucks receives a “Hold” rating due to the lack of a catalyst and continued short-term pressures. It is best to stay away for now and track fundamental improvements to see if it becomes investable.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.