Summary:

- Despite Palantir’s recent explosive growth, I maintain a “Sell” rating due to its extreme overvaluation and reliance on sentiment-driven stock price increases.

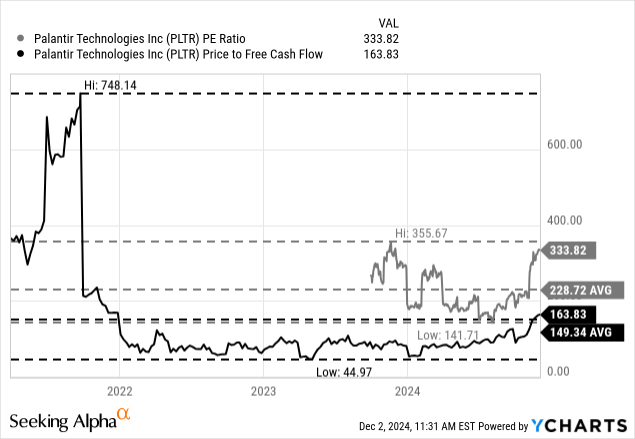

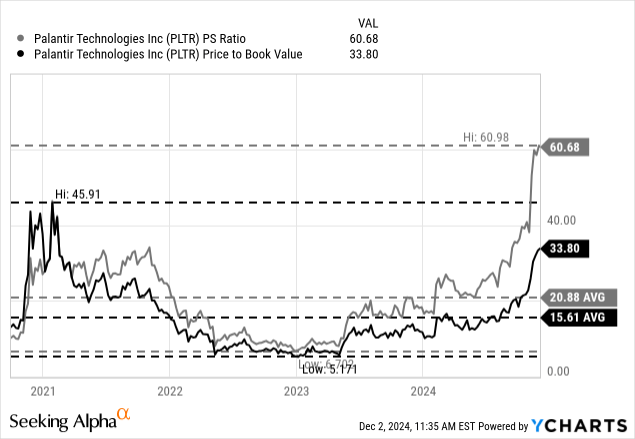

- The stock’s current valuation multiples, such as 333 times earnings and 60 times sales, are unsustainable and not justified by fundamentals.

- Palantir’s impressive quarterly results and growth rates are overshadowed by the unrealistic expectations for future free cash flow growth and ongoing share dilution.

- Investors should be cautious of the feedback loops and irrational exuberance driving Palantir’s stock price, which could lead to significant losses.

anyaberkut

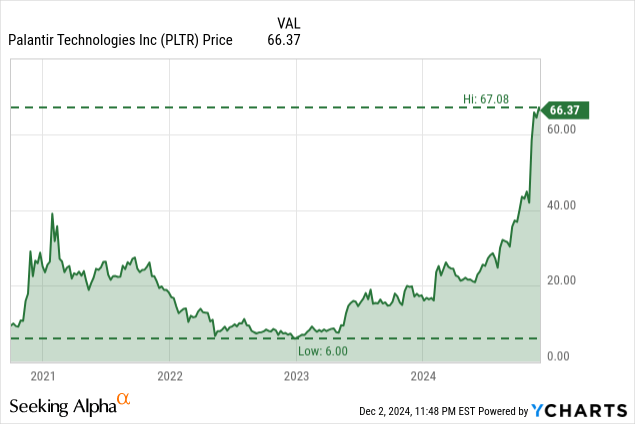

I know, I have been consistently wrong about Palantir Technologies Inc. (NASDAQ:PLTR) – at least when looking at the stock price in the last few quarters. My previous articles were all around more or less in the same direction: Palantir has growth potential and the chaotic and unstable world we are probably headed for in the next few years (or maybe the next decade) seems like a great business environment especially for Palantir’s government business. And while acknowledging the growth potential, I didn’t see the stock price justified and especially in my last article – which was published in mid-September 2024 – I rated the stock as a “Sell” (a rating I use very seldom).

And like the market was mocking me, the stock exploded in value since then. Since my last article, Palantir has gained 80% in value in less than three months and since my article published at the end of May 2024, the stock has gained even 210% in value.

In my last article, I argued that Palantir trading for 200 times earnings is too much, and we will see that the stock is now trading for a much higher valuation multiple. There doesn’t seem to be much to say about Palantir I haven’t said before, but of course, I will argue once again why I still believe that Palantir is in no way fairly valued and certainly not a “Buy”. Additionally, we will look at the last quarterly results. And I will talk about psychology and sentiment – important topics in investing, and Palantir seems to be a very good example right now.

The Stock and Its Sentiment

Let’s start with a question: How can an 80% stock price increase in less than three months be justified? If we believe in efficient market theory and assume that always right and correctly reflecting the available information, we must assume that expected free cash flow in the years to come is now considered to be 80% higher. This is raising several questions: What did suddenly change? And when thinking about it, several explanations are possible: Trump being elected might create an extremely chaotic and unstable world, leading to high demand for Palantir’s products. Or Palantir will close much more high-value contracts from the new administration in the United States and other countries will also increase their military spending.

Wisdom of Crowds? Efficient Markets?

In my opinion, these explanations are rather nonsense – and by the way, I don’t believe in the efficient market hypothesis. I believe that “the market” sometimes has more knowledge than individual investors and there is a “wisdom of the crowd” – but it has severe limitations. And while the market can discount information quickly and while it is sometimes possible to know about major events from the trading data of gold or equities much faster than by reading news outlets or being on social media, the market can be really wrong on several occasions.

We also have tendencies of herding in the market, we see irrational exuberance or panic – in all these occasions the market is usually wrong. And in this scenario, two other explanations are possible: Either the stock was undervalued before, and now the stock price approached its fair, intrinsic value again after it was trading way too low before. Or the stock price is now trading on euphoria and speculation. Overall, these are the only three explanations possible

Not only do I not believe in the efficient market hypothesis, but I am also a firm believer in sentiment driving the stock market in the short-to-mid-term and fundamentals driving market performance in the long run.

Feedback Loops

Another problem is that the market generates feedback loops on its way to extreme overvaluation as well as extremely undervaluation. In a phase of stock prices constantly increasing for one single stock (in this case Palantir) the increasing price has an impact on sentiment. When we can look back at the last six months and see price increases of 200%, we usually get a bullish sentiment and the fear of missing out is created – driving even more investors into the stock.

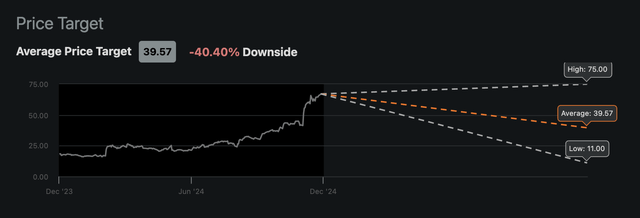

And not only are investors influenced by the rising stock price. Analysts are also influenced by the stock price and with a stock like Palantir continue to climb higher analysts are also raising targets. In my opinion, we can clearly see that analysts are often following the stock price development. The stock sets the sentiment, and analysts follow that sentiment.

Palantir: Share Price and Targets (Seeking Alpha)

But analysts’ opinions are read again by investors and with analysts constantly raising price targets, they are contributing to the bullish sentiment again.

Palantir: Price Targets (Seeking Alpha)

Additionally, there is another issue. When Palantir is trading for almost $70, and you are the analyst with a price target of $11 (see chart above) you almost seem like an idiot or if you called Palantir already overvalued when it was trading for about $21 (like I did in May 2024). In my opinion, there is a huge pressure to adjust price targets in some way to the stock price performance, and it takes a lot of guts and self-confidence to stick to your guns and, for example, keep the $11 price target for Palantir.

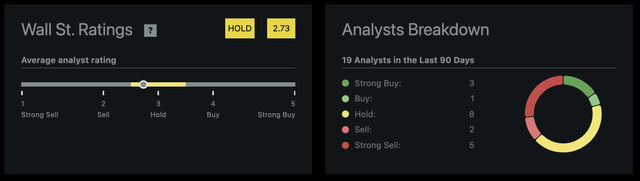

Palantir Ratings (Seeking Alpha)

Despite adjusting price targets over time, analysts are rather neutral at this point and rather rate the stock as a “Hold” with only a minority of Wall Street analysts being bullish or very bullish. And it is not just Wall Street analysts, Seeking Alpha analysts are also not bullish about Palantir.

The Strategy Of Stepping To The Sidelines

And although I think I know how the stock market works – the stock price is driven by momentum or sentiment in the short-to-midterm – I don’t want to make investment decisions based on sentiment. Just knowing that sentiment is driving stock prices and that prices can reach extremes (being either way too expensive or way too cheap) is not enough to make trading decisions based on this knowledge.

When investing based on fundamentals instead, it means we must step to the sidelines when we reach the state of irrational exuberance. Nevertheless, there are still two scenarios possible:

- Assessment is wrong: Of course, it is possible that my assessment was just wrong and fundamentals were better than estimates and a company was able to grow at a high pace for a much longer time than estimated. In such cases, the company is usually growing into its high valuation and the irrational exuberance is not resolved by the stock price collapsing but by the business growing with a high pace and at some point catching up with the stock price (which is growing slower than the business, but still growing).

- Assessment is correct: The stock is overpriced and at some point it will collapse and people usually lose a lot of money. In the last few years we can find countless examples like GameStop Corp. (GME), Beyond Meat, Inc. (BYND), Zoom Communications Inc. (ZM), and ARK Innovation ETF (ARKK). About 9 months ago, I created a chart to show how all these stocks collapsed in value and how investors lost huge amounts of money. And a company like Zoom will most likely survive, but those investors that bought Zoom for $500 and more probably won’t get their investments back in the next one or two decades.

And therefore, the investment strategy of stepping to the sidelines once the state of irrational exuberance is reached will mean that I might miss out on some of the great growth stories that are making investors rich (an example is Amazon.com, Inc. (AMZN)). But it also means that I will miss those stocks that ruin investors and make people lose almost everything. And while picking winners is certainly a part of investing, preserving capital and avoiding those stocks that destroy almost 100% of capital is also important.

Quarterly Results

And Palantir is at least growing with a very high pace, making it also a possibility that my assessment of Palantir being a “Sell” is wrong.

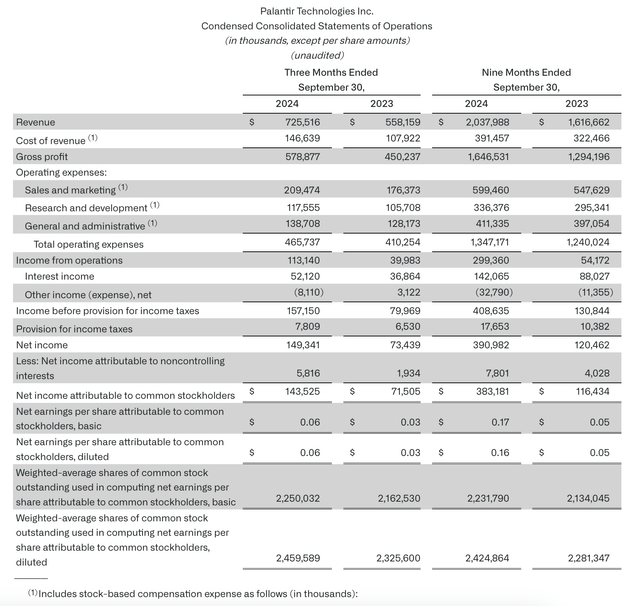

About a month ago, on November 4, 2024, Palantir reported third quarter results for fiscal 2024 and Palantir reported high growth rates once again. Revenue increased from $558.2 million in Q3/23 to $725.5 million in Q3/24 – resulting in 30.0% year-over-year growth. Income from operations increased from $40.0 million in the same quarter last year to $113.1 million this quarter – resulting in 183% year-over-year growth. And finally, diluted earnings per share doubled from $0.03 in Q3/23 to $0.06 in Q3/24.

Palantir Q3/24 Earnings Release

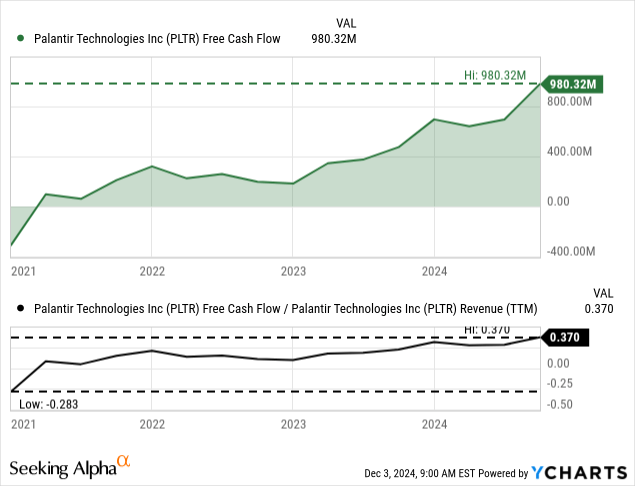

We can also look at adjusted free cash flow, which increased from $140.8 million in the same quarter last year to $434.5 million in this quarter – resulting in 209% year-over-year growth. Adjusted free cash flow margin also jumped from 25% in the same quarter last year to 60% in this quarter.

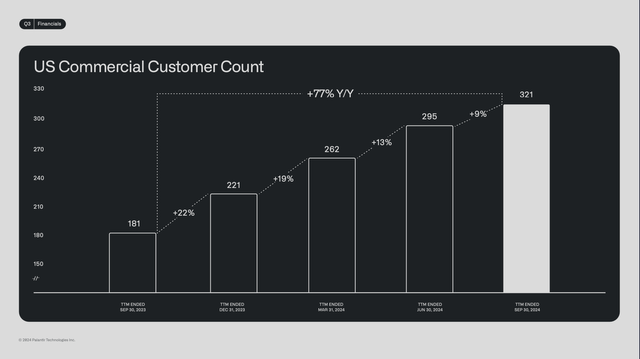

When looking at the segment results, U.S. revenue increased 44% year-over-year and while U.S. government revenue increased 40% to $320 million (which is certainly a high growth rate), U.S. commercial revenue grew 54% to $179 million. U.S. Commercial customer count also increased 77% year-over-year from 181 in the same quarter last year to 321 this quarter.

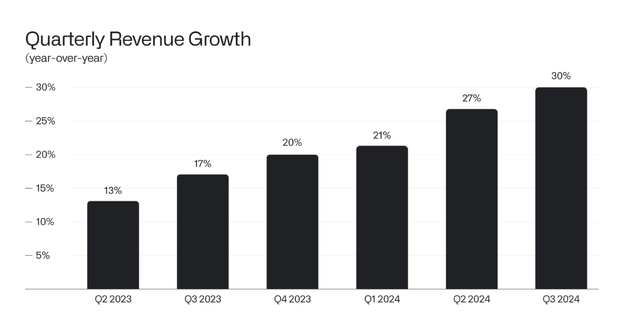

It is not enough to just look at one single quarter. When looking at longer timeframes, we see a very positive picture for Palantir with accelerating top line growth. This is now the fifth quarter with higher growth rates in a row.

Palantir Q3/24 Shareholder Letter

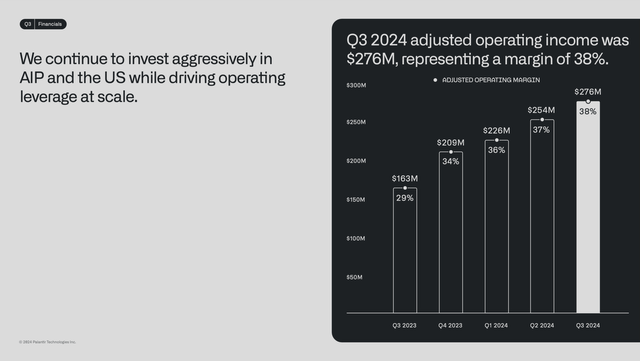

And aside from revenue growth accelerating, Palantir is also improving its profitability, with adjusted operating margins constantly improving in the last few quarters. In Q3/24, the company reported an operating margin of 38% – compared to 29% one year earlier.

And Alex Karp is still extremely optimistic in his shareholder letter about the long-lasting potential for growth of Palantir:

This is still only the beginning.

The growth of our business is accelerating, and our financial performance is exceeding expectations as we meet an unwavering demand for the most advanced artificial intelligence technologies from our U.S. government and commercial customers.

The world is in the midst of a U.S.-driven AI revolution that is reshaping industries and economies, and we are at the center of it.

There are probably very few people actually having doubts that AI is here to stay and that we are at the very beginning of a long development. But in the late 1990s we were also at the beginning of a fundamental shift and long development towards the world getting connected – but we still have companies from back then, which were not able in the 25 years since then to reach previous stock prices again. In my article Remembering The Dotcom Bubble from June 2021 I talked about four companies which are still struggling and two counterexamples – Microsoft and Amazon – that managed to thrive. But in case of Cisco and Intel almost nobody had any doubts in 2000 that these companies had a great future ahead of them and almost everybody was convinced they were a great investment. And when ignoring the current struggles of Intel, both companies certainly performed solid in the last 25 years – but the stock prices were so detached from reality, making both stocks horrible investments over the last 25 years. By the way: We should not ignore the survivorship bias and always remember that these are only the companies that survived – countless other stocks from back then collapsed completely.

Intrinsic Value Calculation

And at this point we must come back to an intrinsic value calculation at this point to show how high the expectations are and at what impressive rate Palantir must deliver in the years to come to be fairly valued right now. And I would not solely look at simple valuation multiples, but in this case, the number are so high that any discussion if these metrics are reasonable, is mood.

At the time of writing, Palantir is trading for 333 times earnings and for 164 times free cash flow, and the number of companies where a triple-digit valuation multiple was justified is very limited. And while free cash flow and earnings per share are often fluctuating heavily, the P/E ratio and P/FCF could be distorted by temporarily low earnings. This is not the case for Palantir, but we can also look at the price-sales ratio, which is much more stable.

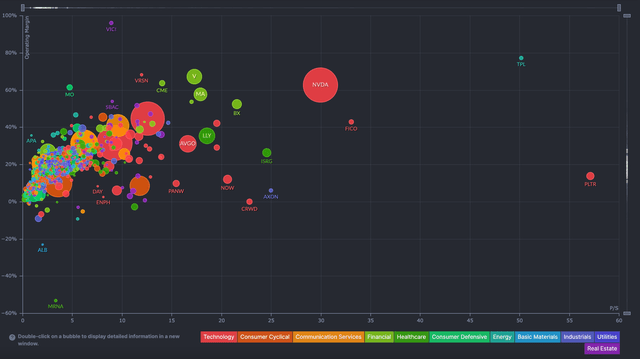

Right now, Palantir is trading for 60 times of sales – the highest metric in the entire S&P 500. And at the time I check, only two other companies were trading above a P/S ratio of 30. When displaying the entire S&P 500 in a chart and the x-axis showing the P/S ratio, we see Palantir being quite lonely on the right. And I am certain that many will now argue with the high profitability and margins improving and therefore included the operating margin on the y-axis: Palantir’s operating margin is solid, but I am not impressive and there is no reason for the absurd valuation multiples.

S&P 500 by operating margin and P/S ratio (FINVIZ.com)

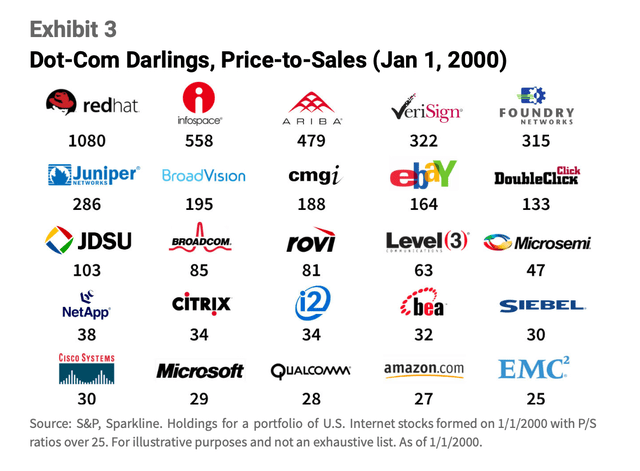

If we would display the same chart for the P/FCF ratio, there would be 9 companies (out of 503) more to the right than Palantir. When comparing Palantir with its price-sales ratio of 60 to the Dotcom darlings with extreme P/S ratios, the stock is fitting quite well.

Palantir is well ahead of companies like Cisco, Microsoft, Qualcomm and Amazon which were all trading for lower P/S ratio. Of course, there were companies with much higher P/S ratios (and we can also find these companies today) but simply not being the stock with the worst P/S ratio – or P/E ratio – does not make something a good investment. We are comparing here to the worst of the worst – companies that either completely collapsed or where investors had to wait 10, 15 or 20 years before seeing any return on investment.

We could say that enough is being said at this point, and we can come to the conclusion that Palantir is overvalued. But let’s look at the situation from another point of view and once again use a discount cash flow calculation to determine an intrinsic value. We start with the following assumptions in a first calculation:

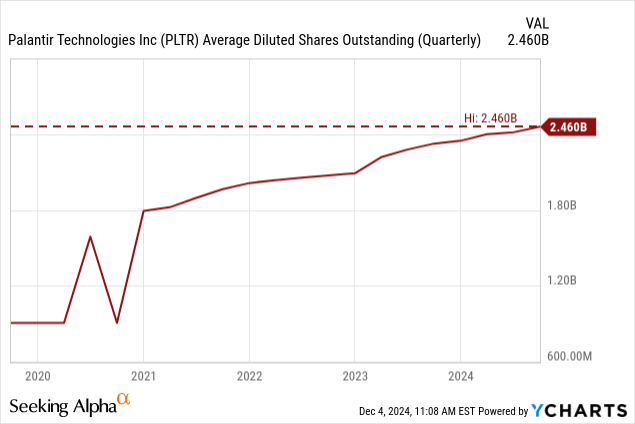

- 10% discount rate and the last reported number of outstanding shares (2,460 million)

- As basis in our calculation, we assume $1,000 million in free cash flow (slightly above the TTM number and slightly below guidance)

- In ten years from now, we calculate with 6% growth till perpetuity

When calculating with these assumptions, Palantir must grow its free cash flow about 34% annually for the next ten years in order to be fairly valued. And as Palantir is only profitable for a few quarters, we have very limited data to compare the growth rates to. In the last five years, Palantir grew its revenue with a CAGR of 30.17% and free cash flow grew with a CAGR of 47% in the last three years. Hence, we could make the case that 34% annual growth for free cash flow might be possible.

But we are not done. I mentioned in several articles in the past that Palantir has diluted the number of outstanding shares, and in the last quarter that dilution continued. In the last twelve months, Palantir increased the number of outstanding shares by 5.8%. And when assuming that the dilution will continue, Palantir has to offset the dilution as well and free cash flow has to grow about 40% annually in the next ten years to be fairly valued.

Above I calculated with a growth rate of 6% till perpetuity, and we certainly can make the case for Palantir being able to grow at a high pace for a long time. However, we can also follow CFI’s advice and not calculate with a terminal rate higher than 4%. When also considering the ongoing dilution, Palantir must now grow its free cash flow about 46% annually for the next ten years to be fairly valued.

Usually, a business has different ways to grow its bottom line. Aside from growing its revenue, it can also improve its margins. And while Palantir is improving its adjusted operating margin (see section above), it is already reporting a free cash flow margin of 37.0% which is very high and Palantir already found its place among the most successful companies in the word. To be honest, I don’t see much room for margin improvement here, meaning the growth has to come almost entirely from top line growth.

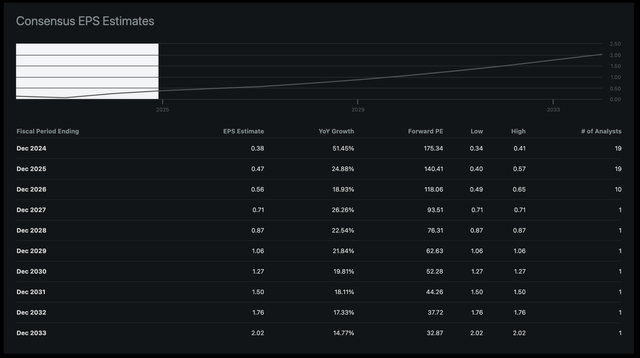

Palantir: Consensus EPS Estimates (Seeking Alpha)

It is also worth mentioning that analysts are expecting Palantir to grow its bottom line “only” with a CAGR of 23% in the next ten years.

And one final – and extremely important – point. All these calculations were made with a 10% discount rate, meaning an investor will receive about 10% annual return on his or her investment in the years to come. Palantir will grow 46% every year in the next ten years, but the stock – if the stock price would increase linear – would gain only 10% in value. On the basis of a current stock price around $70, the stock would be worth $77 at the end of 2025, $84.70 at the end of 2026 and about $113 at the end of 2029. I don’t know if this is the stock performance the typical Palantir investor is assumed, or if dreams are rather of a stock price close to $500 in a few years from now.

Conclusion

I have written above that analysts tend to adjust their ratings or price target when the stock moves higher. And we can adjust the price targets (or intrinsic value) for Palantir a little bit – as the stock is certainly growing at a fast pace. But the stock is not getting closer to its intrinsic value or more reasonably valued. Instead, it is moving more and more away from its intrinsic value and the downside risk is increasing for those buying now.

In case of Palantir, I can only put a “Sell” rating on the stock once again – and in my opinion, we are close to a “Strong Sell” rating. The only fact speaking for Palantir is that the fundamentals are really supporting and can make us rather bullish about a stock.

And I can personally feel the pressure to update my rating at least to a “Hold” not to look like an idiot who didn’t get Palantir. Don’t get me wrong – I certainly make mistakes and oversee trends. But in case of Palantir, I am still convinced that the stock is extremely overvalued.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.