Summary:

- Costco and Microsoft are below recent highs and have triggered a buy-on-weakness signal in the Model Portfolio.

- Portfolio managers are expected to buy these stocks on weakness due to positive Fund and Implied Return indicators.

- Traders may wait for the buy signal in the Confirm column before buying.

anouchka

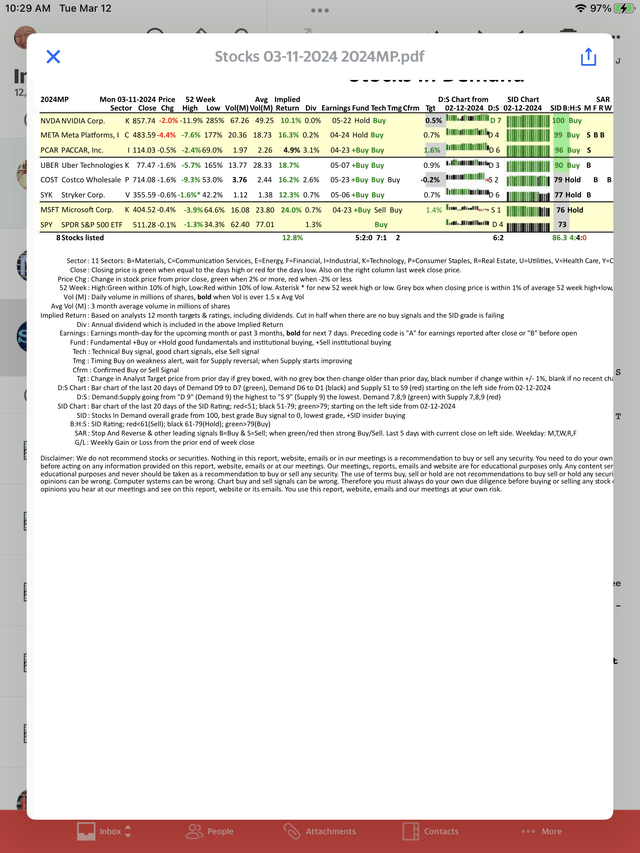

Costco Wholesale Corporation (COST) and Microsoft Corporation (NASDAQ:MSFT) are not selling at a 15% discount, but they are below their recent highs, are in our Model Portfolio, and have triggered our buy-on-weakness signal shown in the Timing, Tmg, column on the report below. All of the stocks shown on the report below are in our 2024MP Model Portfolio. The SPDR® S&P 500 ETF Trust (SPY) is not in the Model portfolio, but we do have the option of putting the $30,000 in cash in the SPY. This is a $100,000 portfolio with $10,000 in each stock. We are waiting for a pullback in the market to add stocks.

When our Tmg buy-on-weakness signal is triggered, we expect to see portfolio managers come in to buy on weakness. If they do, then they will trigger our buy signal in the Confirm, Cfrm, column. If they don’t come in to buy, then we will probably drop the stock from our portfolio when it starts underperforming the Index.

As you can see on our report below, COST is selling at a 9.3% discount to its 52-week high and MSFT is at a 3.9% discount. Why do we expect portfolio managers to come in and buy these stocks on weakness? The “+Buy” in our Fund column on the report below tells us the portfolio managers are probably still adding this stock to their existing positions.

In addition, our Implied Return column shows our computer calculating 24% for MSFT and 16% for COST. We think that should attract additional buying on weakness by the portfolio managers. Also, that should help these stocks to continue to outperform the Index.

Should you go out and buy these stocks today? Portfolio managers have to buy on weakness, but I don’t. I can wait until red supply, shown on the 20-day chart below, starts improving. Traders will probably wait for the buy signal in the Cfrm column to join the portfolio managers in buying. They can tell when Supply turns to Demand because it is shown in the D:S column. You can see the Supply reading for COST is S2 where 9 would be the worst reading. MSFT is at S1 and to switch to Demand, it has to go to D1 where D9 is the highest Demand rating. MSFT is almost there, trying to go from S1 to D1.

Another indicator we watch is in the Target, Tgt, column that indicates whether analysts are raising or dropping targets. You can see that they are raising targets for MSFT which is what we like to see. This indicator is negative for COST and maybe that is why there is Supply showing.

Of course we like to do our due diligence by checking to see what Seeking Alpha Quant ratings are showing and what SA analysts are saying about MSFT. The SA analysts have a consensus Buy, while the Quant ratings have a Hold. The Quant ratings are good for Momentum, Revisions, Profitability and Growth, but a poor grade for Valuation.

COST has a Hold rating for both the SA analysts and the Quant rating. It has good ratings for Momentum, Profitability and Revisions, but a weak Growth rating and a poor Valuation score. We don’t like that combination, so we will be interested to see how low COST goes and at what price it triggers our Confirmed Buy signal, indicating to us that the selling is done. Then we will see if it is still an Outperformer. If not, then we will delete it from the portfolio.

Here is our daily portfolio report we send out, showing all the signals and their day to day changes. We cut down on portfolio turnover by allowing stocks that have our SID buy signal or even if it drops to a hold. We can identify whether it will bounce back to a Buy signal. Our two week free trial will show you how all our signals change each day telling us to hold or dump any stock.

Our 2024MP Model Portfolio with COST. & MSFT showing buy-on-weakness signals in the Tmg column (Daily Index Beaters )

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MSFT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: We are not investment advisers and we never recommend stocks or securities. Nothing on this website, in our reports and emails or in our meetings is a recommendation to buy or sell any security. Options are especially risky and most options expire worthless. You need to do your own due diligence and consult with a professional financial advisor before acting on any information provided on this website or at our meetings. Our meetings and website are for educational purposes only. Any content sent to you is sent out as any newspaper or newsletter, is for educational purposes and never should be taken as a recommendation to buy or sell any security. The use of terms buy, sell or hold are not recommendations to buy sell or hold any security. They are used here strictly for educational purposes. Analysts price targets are educated guesses and can be wrong. Computer systems like ours, using analyst targets therefore can be wrong. Chart buy and sell signals can be wrong and are used by our system which can then be wrong. Therefore you must always do your own due diligence before buying or selling any stock discussed here. Past results may never be repeated again and are no indication of how well our SID score Buy signal will do in the future. We assume no liability for erroneous data or opinions you hear at our meetings and see on this website or its emails and reports. You use this website and our meetings at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

To completely understand our fundamental and technical approach to stock selections, we suggest you read “Successful Stock Signals” by Thomas K. Lloyd, available wherever books are sold.