Summary:

- There are several reasons why Costco is a superior business than Walmart.

- Some of these reasons are: (1) Footprint Growth, (2) Return on Capital, and (3) the trend toward urbanization.

- Earnings-wise, Costco far outperformed Walmart on every level. Much of Walmart’s price return came from a change in the valuation.

- Both companies seem to be overvalued at the moment.

heywoody/iStock via Getty Images

Introduction

Pretty close to exactly one year ago, I wrote my first article on Costco Wholesale (NASDAQ:COST), which was very well received. To this day, I think that article called “Costco Wholesale: A Union For Consumers” is one of the best pieces I have written on this platform. COST delivered a total return of 47% since then, easily outperforming the S&P 500’s 24% (to be fair, a good chunk of that return came from multiple expansion).

In the peer group comparison of last year’s article, I compared COST to Walmart (NYSE:WMT) and Target (NYSE:TGT). In this article, I want to compare WMT and COST again, but this time on a much broader basis. I will look at several trends/metrics/reasons that make for a clear winner in my opinion.

Short Business Overview

I think I can keep this short since most of you will be familiar with Walmart and Costco.

Costco operates membership warehouses in the US, Canada, Puerto Rico, Mexico, Japan, UK, Korea, Taiwan, Australia, Spain, France, China, Sweden, New Zealand and Iceland. Out of the 861 warehouses at the end of FY23, 591 are located in the US. The US is still by far Costco’s largest market. Costco operates with a membership model. Customers can sign up for an Executive membership (priced at $120 per year) or a Gold Star membership (priced at $60 per year). To make up for the higher price, the Executive membership gives the holder a 2% annual reward (calculated for pre-tax purchases). I will refer you to my initial article for further details regarding Costco’s business model.

Walmart operates as an omni-channel retailer, serving customers through retail stores and eCommerce. Walmart reports results for three segments:(1) Walmart U.S., (2) Walmart International, and (3) Sam’s Club. The first two segments are basically the same and are only divided for regional purposes.

Walmart U.S. consists of the Walmart shopping centers (“Walmart” and “Walmart Neighborhood Market”), walmart.com, and Walmart+. It contributed 69% of FY23 revenue and is by far Walmart’s largest segment. Internationally, Walmart operates in 19 countries outside of the U.S.: Canada, Chile, China, several countries in Africa, India, Mexico and some countries in Central America. Walmart International contributed 17% of FY23 sales.

Sam’s Club operates a membership-only warehouse model in the U.S. and Puerto Rico, just like Costco. It contributed 14% of FY23 sales. The membership fees are a bit cheaper than for Costco, $110 for a Plus Membership and $50 for a Club Membership. Sam’s Club has seen great sales growth in the past two years. Sales grew from $63.9 billion in FY21 to $73.9 billion in FY22 and then to $84.3 billion in FY23. Here is what Walmart had to say about the Sam’s Club business in the most recent 10-K filing:

Sam’s Club operates with a lower gross profit rate and lower operating expenses as a percentage of net sales than our other segments.

Walmart – FY23 10-K Filing Item 1. Business

We can already see here that Walmart is trying to reproduce Costco’s success by using the same business model to grow its business.

Reason #1 – Footprint Growth

I want to start with a discussion of what I call Footprint growth. Footprint growth refers to the organic addition of new stores/warehouses or square feet of retail space. I discussed this topic extensively in a recent article on Starbucks. Optimally, we want our companies to be able to grow their footprint consistently to expand operations. Here is a table showing the store count for Costco and Walmart:

| Year | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Costco | 686 | 715 | 741 | 762 | 782 | 795 | 815 | 838 | 861 |

| Walmart | 11,528 | 11,695 | 11,718 | 11,361 | 11,501 | 11,443 | 10,593 | 10,623 | 10,509 |

Source: Company reports – Compiled by Author

The 2023 number shows Costco’s store count at the end of August and Walmart’s store count at the end of October. Costco currently has 25.5% more while Walmart has 8.8% fewer stores than in 2015. On a CAGR basis, Costco grew its store count at a CAGR of 2.88% since 2015 while Walmart’s store count declined at a rate of -1.12% per year.

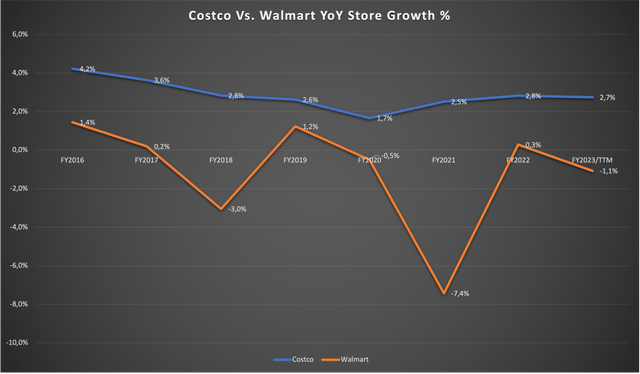

In the case that you are more affine to charts, here is a chart showing you what this looks like in YoY growth rates:

Costco Vs. Walmart – YoY Store Growth (Company reports – Compiled by Author)

The fact that Walmart had to reduce its store count is a bad sign because sales growth for retailers like Costco and Walmart is a combination of (1) same-store sales growth and (2) store count growth. If one is zero or negative, you will have to rely on only one of the two growth drivers which doesn’t bode well for investors.

The addition of retail square feet paints a similar picture (million Sq Ft):

| Year | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Costco | 98.7 | 103.2 | 107.3 | 110.7 | 113.9 | 116.1 | 118.9 | 122.5 | 126.3 |

| Walmart | 1,149 | 1,164 | 1,158 | 1,129 | 1,129 | 1,121 | 1,060 | 1,056 | 1,050 |

The numbers are pretty much similar (which was to be expected). In conclusion, Costco was able to grow its footprint organically while Walmart wasn’t. This gives Costco a clear advantage over Walmart in terms of growth.

Reason #2 – Return on Capital

In all of my articles, I spent some time talking about the importance of high returns on capital. I personally always use my formula for Return on Capital Employed (ROCE) but you can use any kind of formula. You could also use Return on Invested Capital (ROIC), it doesn’t matter that much because the message will always be the same. If a company wants to create value for shareholders, it needs to consistently make returns on capital above its cost of capital. If it does, it creates value. If it doesn’t, it destroys value. Additionally, high returns on capital are usually a sign of a wide moat, something we as investors should look out for.

For this comparison, I will use ROCE. My version of ROCE is Operating Profit divided by Capital Employed, where Capital Employed = Long-term Liabilities + Shareholders’ equity – net cash if there is any.

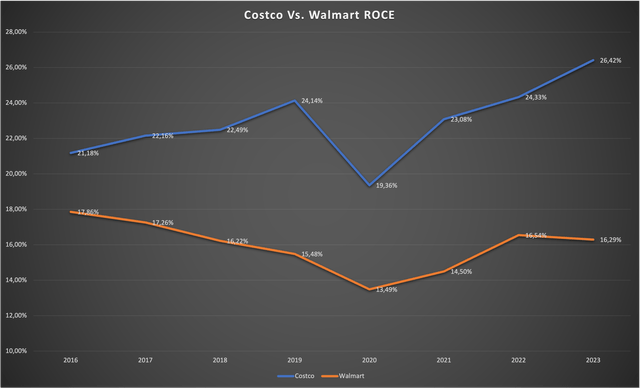

Here is a chart showing both companies ROCE since 2016:

Costco Vs. Walmart – ROCE since 2016 (Calculated by Author using company reports)

For the trailing twelve months, ROCE is 29.35% for Costco and 16.95% for Walmart. I need to add that the operating profit numbers for Walmart are Adjusted or Non-GAAP while Costco only uses GAAP numbers. So Costco’s ROCE has stayed above 20% except for 2020 due to the pandemic while Walmart’s ROCE hovered around 15%. Additionally, Costco’s ROCE is in a longer-term upward trend while Walmart’s ROCE isn’t.

So what does this tell us? Costco currently generates 29 Cents of profit for every dollar it reinvests back into the business. Walmart on the other hand only generates 16 Cents for the same reinvested dollar. Assuming both companies would reinvest 100% of profits (which they don’t) Costco would far outpace Walmart in terms of growth, ultimately justifying a much higher price tag (I will come back to this later). Coupled with reason #1 regarding footprint growth, it seems very likely that Costco has much more runway for organic reinvestment than Walmart does. Costco’s growth runway (footprint growth) looks better and reinvestments are made at a much better reinvestment yield than at Walmart.

Reason #3 – The Debt Situation

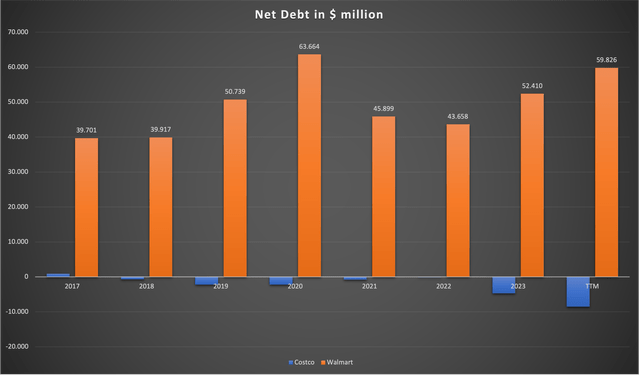

I want to start with by showing a chart showing both companies’ net debt position since 2017:

Costco Vs. Walmart – Net Debt since 2017 (S&P Capital IQ)

Except for 2017 (net debt of $880 million), Costco has been net cash positive every single year. Walmart on the other hand has quite a large amount of net debt. Just to be clear: I don’t think that Walmart’s debt position poses an existential threat. I think it is quite manageable with FY23 net interest cost of just a bit above $1.5 billion.

We should also look at it relative to Walmart’s earnings power. Adjusted EBIT stands at $26.2 billion for the TTM, so the net debt to EBIT is around 2.3x which seems reasonable. It is a factor to consider though while it is no problem at all for Costco.

Reason #4 – Trend to Urbanisation

This is something that is very often overlooked in my opinion. In my prior article, I wrote the following:

So what are the factors that decide how profitable a Costco store can be? The store needs to be located in an area that is populated as dense as possible because the profitability of a Costco store is mainly derived from the number of memberships for that store.

Source: Prior Costco article

I continued to show that Costco cherry-picks the best locations to open new stores. In my example, these were Seoul and the greater Tokyo area. The costs for running a warehouse/store are fixed costs. So the most important driver for a store’s stand-alone profitability is what I call “Traffic”. In the case of Costco, “Traffic” can be seen as the number of memberships for each store.

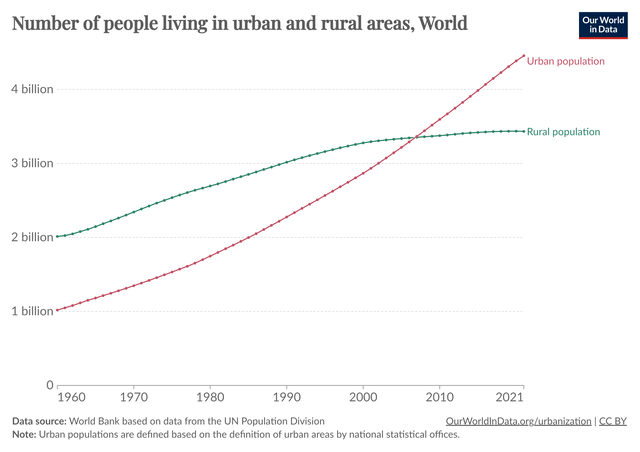

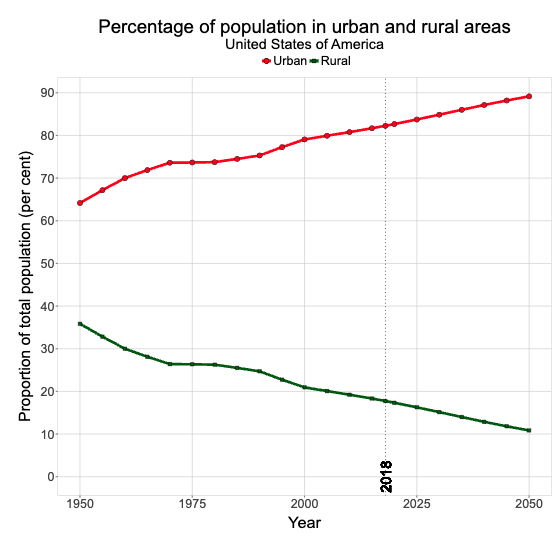

Now what would happen if Costco didn’t have 861 but 8,000 stores? They would need to place their warehouses in places that are not as attractive as dense-populated areas like Seoul or Tokyo. Luckily for Costco, the global trend goes toward further urbanization and denser-populated cities. Here is a chart showing the urbanization trend since 1960:

Urban Vs. Rural Areas (ourworldindata.org – Date source: UN Population Division)

So let’s take this over to the real world. Let’s say Costco operates 50 stores in major cities in the US. All of these cities have a dense population structure. Meanwhile, Walmart has 500 stores throughout the US, some in major cities, some in smaller cities, and some in rural areas. What will happen if people relocate from rural areas/smaller cities to major cities (=urbanization)? Costco’s stores and Walmart’s stores in the major cities will benefit because they will get more potential customers while the fixed costs for running the store remain unchanged, making the store in itself more profitable/attractive. Walmart’s stores in the smaller cities/rural areas on the other hand will suffer for the same reason. Customers move away and the fixed costs for the store remain unchanged, ultimately making these stores less profitable/attractive. So in conclusion, Walmart has much less to gain and much more to lose from this trend because the number of stores is so much higher than for Costco.

Here is another chart showing the percentage of the population in urban vs. rural areas with a forecast until 2050:

U.S. % Population in urban and rural areas (population.un.org)

In conclusion, urbanization will be a tailwind for Costco’s whole business while it will only be a tailwind for parts of Walmart’s business and a tailwind to other parts of Walmart’s business.

Reason #5 – Growth Rates

This one is pretty straightforward and is pretty much the result (expressed as financial numbers) of some of my earlier points (footprint growth, return on capital, urbanization). I will just let the numbers speak for themselves. Here is a table showing Costco’s and Walmart’s numbers for the most important financial metrics since 2016 (in $billion):

| Year | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR |

| Costco Revenue | 118.7 | 129.0 | 141.6 | 152.7 | 166.8 | 195.9 | 226.9 | 242.3 | 10.73% |

| Walmart Revenue | 482.1 | 485.9 | 500.3 | 514.4 | 524.0 | 559.1 | 572.7 | 611.3 | 3.45% |

|

Costco EBIT |

3.7 | 4.1 | 4.5 | 4.7 | 5.4 | 6.7 | 7.8 | 8.1 | 11.99% |

| Walmart EBIT | 24.1 | 22.8 | 20.4 | 21.9 | 21.4 | 23.2 | 26.0 | 24.6 | 0.29% |

| Costco Net Earnings | 2.4 | 2.7 | 3.1 | 3.6 | 4.0 | 5.0 | 5.8 | 6.3 | 15.11% |

| Walmart Net Earnings | 14.8 | 13.4 | 13.3 | 14.5 | 14.1 | 15.6 | 18.1 | 17.2 | 2.20% |

Source: Company reports – compiled by Author

Note that Walmart’s numbers are already on an adjusted basis. We can see that Costco far outpaced Walmart in any kind of earnings metric. Even the dividend CAGR stands at 12.4% (Costco) vs. 1.93% for Walmart. And this is while operating in the same sector.

To make it clearer: Walmart delivered a share price return of around 116% from the end of FY16 to the end of FY23. In this timeframe, the earnings multiple expanded by 58% from a P/E of 14.5 in 2016 to 22.9 in 2023. Earnings growth only attributed 37% to Walmart’s share price performance.

Now let’s do the same for Costco: Costco’s share price return amounted to 236% from FY16 to FY23. The multiple “only” expanded by 26.3%. So for Costco, earnings growth attributed 166% to the share price performance.

In conclusion, Costco outperformed Walmart on every level over the past few years. I think that this comes down to the reasons I described earlier.

Reason #6 – Value Proposition and Target Audience

For my last reason, I want to update the back of the napkin calculation regarding the value proposition difference between Costco and Walmart that I used in my prior article. I will show you what I call the “actual economic costs” for consumers shopping at Costco or Walmart.

The calculation is pretty simple for Walmart. The “actual economic cost” to the consumer is expressed by the net margin that is left as a profit for Walmart. I will use the average of the last three years, in this case, a 2.92% net margin for Walmart.

Due to the membership model, this is a bit tricky for Costco. So Costco generated $242,290 million in revenue in FY23. $4,580 million were membership fees so I will deduct them for now. This leaves us with $237,710 million in revenue through actual sales. According to Costco’s latest 10-K, sales to Executive Members were 72.8% or $173,053 million. This leaves $64,657 million in sales to non-Executive Members. Since we know that there were 32.3 million Executive Memberships (according to the 10-K), an average Executive Member spends $5,473 per year at Costco. A non-Executive Member only spends $1,671 per year. Now we need to know how much rewards Executive Members get for their sales (it is 2% pre-tax with some items being excluded from the reward system). According to the 10-K, FY23 rewards were $2,576 million of 1.47% of sales to Executive Members. So the actual reward cashback was 1.47% on average. Now we can put all of this information together (numbers in $):

| Executive Membership Yearly Spent | Costco | Walmart |

| Purchases | 5,437 | 5,437 |

| x Net Margin 3-Y average | 1.94% | 2.92% |

| = Company net profit before annual reward | 106 | 159 |

| Less: 1.47% Annual Reward on purchases | -80 | 0 |

| = actual company profit | 26 | 159 |

| Add: Membership fee cost | 120 | 0 |

| = Total cost to the consumer | 146 | 159 |

So assuming $5,437 spent per year, the total cost to the consumer is lower at Costco. This is only true for Executive Memberships though. Non-Executive Memberships don’t profit from the Costco business model because they are not spending enough and they don’t get the annual reward on their purchases. This means that the Costco model benefits higher-spending households, a customer group that is much more resilient to economic downturns.

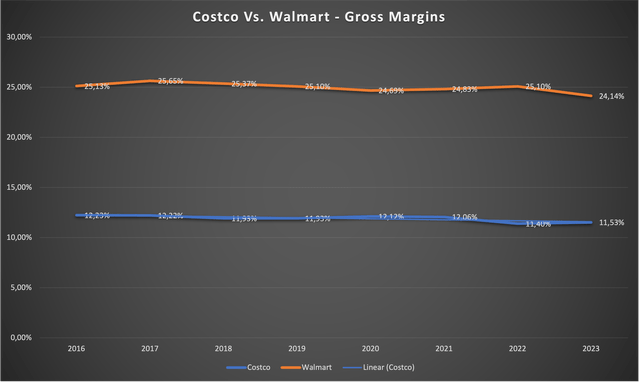

The above calculations don’t even factor in that Costco sells its products at a much lower gross margin, making it very likely that purchases at Costco are better priced to begin with. For reference, here is a chart showing both companies’ gross margins since 2016 (I adjusted Costco’s number to factor out the membership model):

Costco Vs. Walmart – Gross Margins (Company reports – compiled by Author)

Valuation

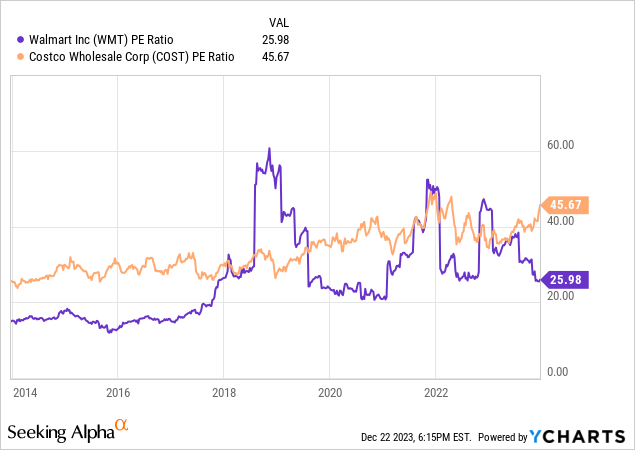

After all of this, I would argue that Costco deserves a higher multiple than Walmart. The market agrees, as can be seen in the following chart:

Here we can see that the market has a decade-long history of valuing Costco at a premium to Walmart, probably due to all the reasons I stated throughout this article. Please note that the big spikes in Walmart’s PE are due to one-time events that are adjusted for in Walmart’s reported earnings (like Opioid legal charges). If we smooth the PE spikes for Walmart out, both companies seem to be overvalued if we were to value them on a historic multiple basis.

I don’t think that this is the right way to do it though. Let me start by saying that I think long-term returns will always be the sum of (a) the Free Cash Flow Yield (FCF Yield) and (b) the future growth rate. For the FCF Yield, we need to normalize the FCF because due to the retail business model, FCF is quite volatile. For Walmart, FCF of the last eight years was 112% of net income. For Costco, it was only 84%. If I were to use these numbers, the FCF would be 1.85% for Costco and 4.69% for Walmart. So Walmart is trading at a much lower FCF Yield. The fact that Walmart’s cash conversion is so much higher (112% vs. 84%) is a good sign and a bad sign at the same time. It is good because Walmart seems to earn lots of cash that it can use to pay down debt, repurchase shares, or pay out dividends. It is bad because it looks like Walmart doesn’t know what to do with that cash (it seems to lack reinvestment opportunities, remember what I wrote earlier?).

So what do we do with all this information? We could use a reverse DCF calculation. I would argue this is the best way to tackle the valuation question.

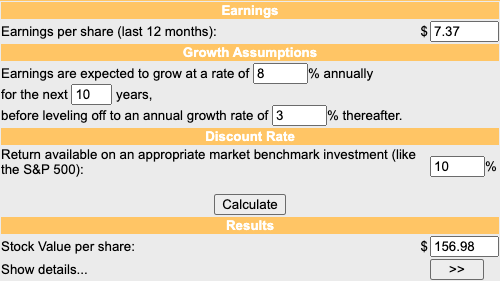

Let’s start with Walmart. I said that the normalized FCF Yield seems to be 4.69%. With the stock price sitting at $156.65, this would mean that FCF per share is around $7.37. As I have shown earlier, Walmart only grew earnings with a CAGR of 2.2% since FY16. It had two good years in FY21/FY22 due to the pandemic and has been back to struggling with earnings growth since FY23. I will just assume a terminal growth rate of 3% and a discount rate of 10%. Here is the result:

Walmart DCF (moneychimp.com)

To be fairly valued, Walmart would need to grow earnings with a CAGR of 8% over the next 10 years. I think that in light of past growth rates and everything I highlighted in this article, this seems very unlikely to me. In conclusion, I think that Walmart is overvalued at the current price.

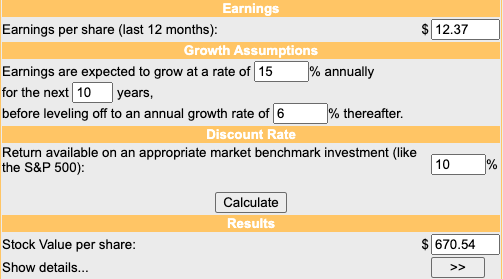

As for Costco, earnings growth over the past few years was in the mid-double digits but this was due to margin expansion. I think that over the longer term, we should focus on the revenue growth which came in at a CAGR of 10.7% since FY16. Costco aims for 3% store count growth well into the future, in line with what it achieved in the past. Coupled with decent same-store sales growth in the range of GDP growth (2-3%), longer-term growth rates should be in the range of 6%. For all the reasons I highlighted in this article, I think Costco is one of the best and most predictable businesses you can find. If you read some of my prior works, you may remember that I usually assign perpetual growth rates in line with a company’s moat and the strength of the business model. For Costco, I think 6% perpetual growth is reasonable (I usually assign 2-3% in line with inflation to lower quality/ROCE companies and 4-6% for higher quality/ROCE companies). The normalized FCF per share for Costco should be around $12.37 per share. Performing the same DCF calculation leads me to the following result:

Costco DCF (moneychimp.com)

Costco currently trades at $671.74 per share and would need to grow earnings at a CAGR of 15% over the next decade with 6% thereafter. This seems to be very unlikely, even when I think that Costco is an outstanding business. In conclusion, I think that Costco is also overvalued at the moment.

Risks

Since I will rate Walmart a sell, I will limit the risks section to my sell thesis on Walmart. I mainly see two risks to my sell thesis: (1) A venture into other business segments and (2) the growth prospects of Sam’s Club.

(1) On December 1, 2023, this SA news article fired some speculations that Walmart might be interested in buying Humana (HUM), a leading Medicare Advantage health insurance company. Now I don’t know if that is true and if it would make sense but that is beside the point. The point is that Walmart is operating in a low-margin, high-volume business and seems to generate a lot of cash without knowing what to do with it. They could pay down debt but they somehow don’t. A big chunk of the FCF goes toward dividends and share repurchases. At current price levels, both don’t generate that much value to shareholders. But what could happen is that Walmart starts to venture into other areas, similar to what CVS Health (CVS) has been doing in the past few years. This would make sense since Walmart already has “the foot on the ground”, meaning that they already have lots of customer relationships and stores/warehouses where they can meet consumers. If Walmart successfully ventures into other, higher-margin businesses, this could reignite the company’s growth. Walmart has all the tools it needs to make this happen.

(2) Sam’s Club contributed 14% of FY23 sales and has been growing sales in the low double-digits. Once Sam’s Club starts contributing more revenue to consolidated sales, consolidated sales growth will naturally accelerate (given that Sam’s Club can keep up the growth rates). Sam’s Club operates similarly to Costco and I highlighted throughout this article why I think that Costco’s business model is one of the best in the world. I think that Sam’s Club could be valued in the range that Costco is valued, maybe a bit lower because Costco is also valued based on its culture, something I have highlighted in my prior article on Costco. Sam’s Club’s revenue was $84 billion in FY23. Let’s just assume Sam’s Club’s FY24 revenue could be something like $92 billion. Costco is currently valued at 1.22x sales. So Sam’s Club could easily be worth $92 billion or 22% of Walmart’s market cap. Sam’s Club could be a big growth driver for Walmart in the future and lead to an acceleration of Walmart’s revenue and earnings growth.

Conclusion

Throughout this article, I highlighted why I think that Costco is superior to Walmart in nearly every way (excluding valuation). Costco has been able to grow its footprint (expressed by store count and retail square feet) consistently over the last decade while Walmart’s store count and retail square feet declined over the same timeframe. Costco generates a much higher return on capital, indicating that has a wider moat. Walmart should face long-term headwinds from the trend toward urbanization, something that is a tailwind for Costco due to the warehouse business model that profits from dense-populated areas.

All of these points have led to severe outperformance from Costco regarding earnings metrics like revenue, operating profit, and net earnings. While Walmart only managed to grow in the low single digits since FY16, Costco has been able to grow in the low double digits. Costco operates on way lower gross margins than Walmart, indicating that the pricing is superior. Additionally, the membership model focuses on higher-spending households, a customer group that is much more resilient to economic downturns.

The only problem is valuation. Both companies seem to be overvalued at their respective share prices. I will rate Walmart a sell because I think that is a lower-quality business due to all the reasons I made throughout this article.

Regarding Costco, I wrote the following in my initial article:

Despite the assumed overvaluation, I rate Costco a buy for long-term investors. The quality of the business model, the predictable growth prospects and the assumed long-term total return potential of 13% more than offset paying up for such a quality company.

While there are cases where I will give a buy rating despite overvaluation (and Costco being a stock where this would normally be the case), this isn’t one of them anymore. I will have to lower my rating on Costco to “hold” for now. I think the recent announcement of the special dividend ($15 per share, to be paid in January) has led to an irrational surge in the share price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of COST, HUM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.