Summary:

- In this article, I discuss the possibility of Amazon paying a dividend.

- Amazon is focused on optimizing its cash flows which could lead to a dividend in the future.

- The company has grown at a rapid pace which has caused it to take on more debt.

- Although it is considered a growth company, I like to give investors a new perspective on the possibility of a company paying a dividend to shareholders.

4kodiak

Introduction

I recently wrote an article on the beloved EV maker Tesla (TSLA) earlier this month titled, “When There’s A Dividend, Count Me In.” It’s obvious stocks like Apple (AAPL) and Tesla are loved by investors and are some of the most well-known brands globally. You can’t go anywhere in the world without seeing their products. These companies are behemoths in comparison to others trading on the stock market. Both have large market caps and are cash flow machines.

Another company that comes to mind is Amazon (NASDAQ:AMZN). Like AAPL, they currently have a market cap over a trillion dollars. So saying the company is massive is quite the understatement. I used to joke with my friends and tell them Amazon and Tesla’s CEO’s are both going to run the world in a few years. It sure seems like that is what’s happening.

In my TSLA article I addressed the possibility of the company paying a dividend in the future. Many readers mentioned how it was a growth company and the dividend is not a priority. Many prefer the company to not pay a dividend. And that’s ok. I just wanted to give a different perspective on the them. After all it was briefly mentioned by their CEO. I just felt compelled to share my thoughts.

And again I’m doing that with AMZN. I understand there are plenty of tech stocks or other sectors that pay dividends. In fact I own some. But that doesn’t mean that dividends are not in the future for stocks like AMZN or TSLA. But to pay a dividend, one must have the cash flow to do so. Let’s jump into the article to see if a dividend may be in the company’s future.

Amazon The Massive Retailer

AMZN needs no introduction. Most of us know who they are and what they do. We see their vehicles in our neighborhoods delivering packages every day. Some of us may even work for them or sell our products on their website. I’m very familiar with them as I am an Amazon Prime member and have been for years. I’m actually watching Thursday Night Football right now on Amazon Prime. The company is a multinational tech company that focuses on E-commerce, cloud computing, online advertising, digital streaming, and artificial intelligence.

I actually almost worked for the company earlier this year. A recruiter reached out to me on LinkedIn, saw my military background, and offered me a position leading a team of maintenance technicians for their robotics department. The company has warehouses all over and a few here in San Diego. The job paid well and I was excited for the position but they were looking for someone who could start immediately. It was unfortunate as I was looking forward to the opportunity of working for a massive company like AMZN. But with my retirement later this year the opportunity passed.

It was apparent that the company is continuing its growth phase with optimizing their warehouse & fulfillment centers all over the world with new technology, and this is only going to continue in the future. In 2022 And I understand a growing business takes capital to fund its growth. But eventually that growth will slow down over time and just maybe then the company will consider paying a dividend to its shareholders.

Amazon’s Recent Acquisitions

Amazon’s biggest acquisition to date is when they acquired Whole Foods in 2017 for $13.7 billion transcending the brand to touch every aspect of daily life. And what better way to do that than with food. We all spend money on it every day because we have to. We can’t survive without it. And with people trying to live healthier, longer lives it was a no-brainer.

They acquired the robotaxi company, ZOOX, in 2020 for their transport technology for ride-hailing and logistics (delivery) services. This was so the brand could continue its expansion of autonomous delivery. In 2022, AMZN finalized a deal with Metro-Goldwyn-Mayer better known as MGM for $8.5 billion adding film & TV shows to their Amazon Prime content library. Many shareholders are huge fans of the company because of their long-term growth aspects. And the ones who decide to invest in companies like Amazon prefer growth over dividends. And while I understand that, I’m just providing a different perspective.

Can Amazon Support Paying A Dividend?

When companies are experiencing a ton of growth, especially at a fast pace, they normally don’t retain a lot of cash. TSLA’s CEO Elon Musk mentioned that he was surprised that his company was cash flow positive as it is very capital intensive currently. Big businesses needs big bucks to grow and that growth should also increase their earnings over time. So large companies such as Amazon or TSLA are always contenders of paying dividends.

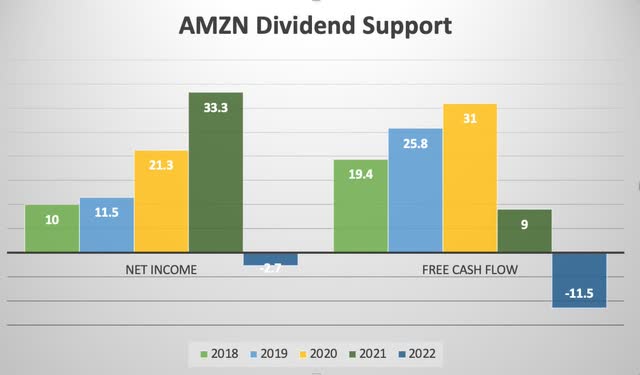

No one knows what the future holds but it’s probably a good chance they won’t, as they continue to focus on growth. Below is a look at Amazon’s net income and free cash flow the last 5 years. I purposely picked the last 5 years because Whole Foods & MGM are their two most expensive acquisitions to date. To be able to pay a dividend a company has to have the cash flow to support it.

Author creation

As you can see they experienced a loss in both net income and free cash flow last year. This was due to large acquisitions in One Medical & iRobot announced in 2022. AMZN acquired One Medical in July for a reported $3.9 billion and iRobot a month later in an all-cash deal worth $1.7 billion. If a company can support it, sometimes they’ll fund acquisitions with cash on hand, but most of the time they are funded with debt. One impressive thing about TSLA is that although they are a CAPEX intensive business, they’ve managed to keep their debt low amidst their stellar growth in recent years. Let’s take a look at AMZN’s debt.

Debt

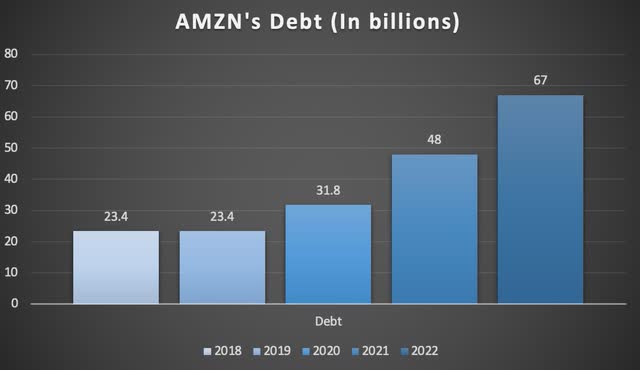

Something that comes along with growth is an increased debt load. Since 2018 Amazon’s debt has tripled going from $23.4 billion to $67 billion in 2022. As an investor everyone loves a fast-growing business like TSLA, AAPL, or AMZN. But what happens when that growth slows and you’re left with so much debt? When business have cult-like followings, I feel like the fundamentals are overlooked. Don’t get me wrong I think Amazon is a well-run business and they will be just fine in the future but that doesn’t mean they won’t face risks, especially with large amounts of debt.

We tend to think about the good but never the bad. How do my company fundamentals look? How have they progressed or digressed over the last year(s)? This is something to keep in the back of your mind when investing. Capital appreciation is great but long-standing businesses that have been around for decades or centuries even have done so with great fundamentals.

Author creation

Risk Factors

Like management previously mentioned the company faced several risks with its inventory due to supply chain disruptions but these have eased. And if we enter a recession, AMZN could possibly suffer a blow to its Prime memberships, as consumer spending tends to soften during economic uncertainty. With interest rates expected to rise further and inflation still lingering, this will most likely weigh on consumer confidence temporarily.

Then there’s the ongoing debacle with the FTC. The Federal Trade Commission plans to file an antitrust lawsuit against them later this month. This is expected to focus on their business practices and the suit is recommending the company make structural changes. As mentioned earlier the company has been growing at a rapid pace, and when this happens, you’re bound to have a couple of lawsuits or many for that matter.

From the looks of it the FTC thinks the company is too big and the changes may include breaking up the E-commerce giant. This is similar to what Kroger (KR) and Albertsons (ACI) have been dealing with for months now. The commission is simply worried that the deal will create a monopoly, leaving no room for competition. This has forced the companies to divest some of their stores in order for the deal to go through. Something similar could be in the future for Amazon if the FTC has their way. If so the stock’s price could suffer in the short term.

Future Improvements In Cash Flows & CAPEX

The company announced improvements to their working capital to free cash flow in Q2. This was difficult the last several years due to COVID as the company held higher weeks of inventory due to supply chain disruptions. But as this eases, the company is improving inventory efficiency, which has resulted in improved working capital. Furthermore, the company remains focused on optimizing cash flows moving forward.

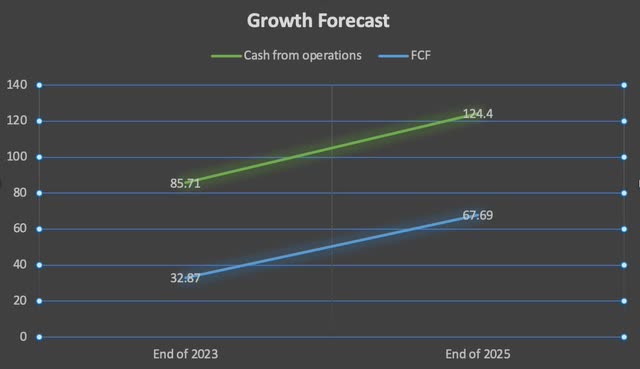

AMZN investor presentation

During Q2 earnings the company stated they expected capital expenditures of roughly $50 billion for the year, 18% less than the prior year of $59 billion. The company has been growing rapidly over the last few years with acquisitions of One Medical, ZOOX, MGM, Whole Foods, and several others. And while this will likely continue, maybe there is hope for a dividend in the future as CAPEX slows down. But who knows what may or may not happen. But this will only happen if they can continue to improve their cash flows and pay down debt.

In Q2 AMZN saw positive FCF of $7.9 billion compared to a loss of $3.3 billion in Q1. Their net income also doubled in the same quarter to $6.7 billion from $3.1 billion prior. Additionally, they had their 5th consecutive quarter of positive operating cash flow growing 74% from $35.5 billion to $61.8 billion year-over-year. So the company is definitely focusing on improving cash flows as promised and so far they are on the right track. But for a business as large as they are, this could be up and down over the next several quarters. Both cash from operations and free cash flow are expected to grow to $124 billion and roughly $68 billion by end of 2025. Since Amazon is already in television & media with MGM and Prime, movie theater companies could be attractive acquisitions for the future.

Author creation

Valuation

At the time of writing the stock is trading slightly below its 52-week high of $145. With an average 1-yr price target of $168 it does offer some upside from the current price but with a P/E ratio of 114x, I don’t think it’s a buy here. With September and October historically being the lowest months for stocks and the expected lawsuit from the FTC later this month, this could drive the stock price lower in the near future.

Since the beginning of the year their price has appreciated almost 70% from roughly $85 to its current price of $144.72. So it may be due for a correction soon. Investors looking to start a position should keep a close eye on the company’s pending lawsuit with the FTC. Depending on the outcome, it could have a major effect on the business going forward and push the stock lower in the near-term.

Conclusion

Like I previously mentioned, I understand AMZN is a growth company but that doesn’t mean dividends are not in its future. And although the company has been cash flow negative, management stated that optimizing cash flow is a huge priority for the company going forward. If they can achieve stable, positive cash flows and manage their debt load in the coming years, this could be something Amazon entertains. As seen in 2022, I wouldn’t be surprised at another stock split with a dividend down the line. With a pending lawsuit and economic uncertainty, I’m giving AMZN a hold for now to see what comes of the FTC lawsuit.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.